-

Russia strikes power plant, kills four in Ukraine barrage

Russia strikes power plant, kills four in Ukraine barrage

-

France's Le Pen says had 'no sense' of any offence as appeal trial opens

-

JPMorgan Chase reports mixed results as Dimon defends Fed chief

JPMorgan Chase reports mixed results as Dimon defends Fed chief

-

Vingegaard targets first Giro while thirsting for third Tour title

-

US pushes forward trade enclave over Armenia

US pushes forward trade enclave over Armenia

-

Alpine release reserve driver Doohan ahead of F1 season

-

Toulouse's Ntamack out of crunch Champions Cup match against Sale

Toulouse's Ntamack out of crunch Champions Cup match against Sale

-

US takes aim at Muslim Brotherhood in Arab world

-

Gloucester sign Springbok World Cup-winner Kleyn

Gloucester sign Springbok World Cup-winner Kleyn

-

Trump tells Iranians 'help on its way' as crackdown toll soars

-

Iran threatens death penalty for 'rioters' as concern grows for protester

Iran threatens death penalty for 'rioters' as concern grows for protester

-

US ends protection for Somalis amid escalating migrant crackdown

-

Oil prices surge following Trump's Iran tariff threat

Oil prices surge following Trump's Iran tariff threat

-

Fashion student, bodybuilder, footballer: the victims of Iran's crackdown

-

Trump tells Iranians to 'keep protesting', says 'help on its way'

Trump tells Iranians to 'keep protesting', says 'help on its way'

-

Italian Olympians 'insulted' by torch relay snub

-

Davos braces for Trump's 'America First' onslaught

Davos braces for Trump's 'America First' onslaught

-

How AI 'deepfakes' became Elon Musk's latest scandal

-

Albania's waste-choked rivers worsen deadly floods

Albania's waste-choked rivers worsen deadly floods

-

Cancelo rejoins Barca on loan from Al-Hilal

-

India hunts rampaging elephant that killed 20 people

India hunts rampaging elephant that killed 20 people

-

Nuuk, Copenhagen mull Greenland independence in Trump's shadow

-

WHO says sugary drinks, alcohol getting cheaper, should be taxed more

WHO says sugary drinks, alcohol getting cheaper, should be taxed more

-

Arteta urges Arsenal to learn from League Cup pain ahead of Chelsea semi

-

Davos elite, devotees of multilateralism, brace for Trump

Davos elite, devotees of multilateralism, brace for Trump

-

Spanish star Julio Iglesias accused of sexual assault by two ex-employees

-

Trump's Iran tariff threat pushes oil price higher

Trump's Iran tariff threat pushes oil price higher

-

US consumer inflation holds steady as affordability worries linger

-

Iran to press capital crime charges for 'rioters': prosecutors

Iran to press capital crime charges for 'rioters': prosecutors

-

Denmark, Greenland set for high-stake talks at White House

-

Iranian goes on trial in France ahead of possible prisoner swap

Iranian goes on trial in France ahead of possible prisoner swap

-

Cold winter and AI boom pushed US emissions increase in 2025

-

Hong Kong activist investor David Webb dies at 60

Hong Kong activist investor David Webb dies at 60

-

Try to be Mourinho and I'll fail: new Real Madrid coach Arbeloa

-

Vingegaard targets Giro d'Italia and Tour de France double

Vingegaard targets Giro d'Italia and Tour de France double

-

South Korean prosecutors demand death penalty for ex-leader Yoon

-

Iwobi hails Nigerian 'unity' with Super Eagles set for Morocco AFCON semi

Iwobi hails Nigerian 'unity' with Super Eagles set for Morocco AFCON semi

-

Le Pen appeal trial opens with French presidential bid at stake

-

Iran ex-empress urges security forces to join protesters

Iran ex-empress urges security forces to join protesters

-

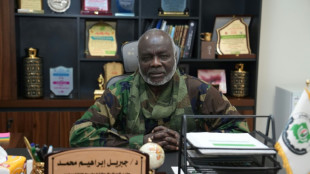

Sudan 'lost all sources of revenue' in the war: finance minister to AFP

-

Freezing rain hampers transport in Central Europe

Freezing rain hampers transport in Central Europe

-

Nuuk, Copenhagen cautiously mull Greenland independence

-

'Proving the boys wrong': Teenage racers picked for elite driver programme

'Proving the boys wrong': Teenage racers picked for elite driver programme

-

Mbappe absent from training as Arbeloa takes charge at Real Madrid

-

Iran worries push up oil price as world stocks diverge

Iran worries push up oil price as world stocks diverge

-

Volvo Cars pauses battery factory after fruitless partner search

-

Social media harms teens, watchdog warns, as France weighs ban

Social media harms teens, watchdog warns, as France weighs ban

-

Central bank chiefs voice 'full solidarity' with US Fed, Powell

-

Greece airspace shutdown exposes badly outdated systems

Greece airspace shutdown exposes badly outdated systems

-

France climate goals off track as emissions cuts slow again

JPMorgan Chase reports mixed results as Dimon defends Fed chief

JPMorgan Chase reported lower fourth-quarter profits Tuesday as CEO Jamie Dimon endorsed Federal Reserve independence and offered an upbeat reading on the US economy.

The giant US bank reported $13.0 billion in profits, down seven percent from the year-ago period following a $2.1 billion hit connected to the assumption of the Apple credit card, replacing Goldman Sachs.

While revenues rose seven percent to $45.8 billion, bank executives expressed disappointment at some line items, such as investment banking.

Shares of the bank were decisively lower at midday. Some analysts questioned a plan to lift capital spending by more than $9 billion, in part due to increased technology investment.

Dimon, who has struck a cautious tone in some recent quarters, characterized the United States outlook as "pretty positive," while also offering a strong defense of Federal Reserve Chair Jerome Powell, who is under investigation by President Donald Trump's Justice Department.

Powell has dismissed the DOJ probe into a Fed construction project as a pretext for Trump's criticism of US monetary policy decisions.

"While I don’t agree with everything the Fed has done, I do have enormous respect for Jay Powell," said Dimon, who predicted that any effort to weaken Fed independence would backfire and "probably increase (interest) rates over time."

Executives also took issue with a call by Trump last week to cap credit card interest at 10 percent. Trump said he is "calling for a one year cap" from January 20, according to a January 9 social media post.

"Actions like this will have the exact opposite consequence to what the administration wants in terms of helping consumers," said JPMorgan Chief Financial Officer Jeremy Barnum. "Instead Of lowering the price of credit, it will simply reduce the supply of credit."

Barnum said it was too early to quantify the impact because "there's just way too much uncertainty about the whole thing."

- Deal delay -

In terms of performance, the bank scored higher net interest income, a closely-watched benchmark measuring the difference between revenue from lending and outward-bound interest payments.

Expenses grew five percent, with the bank citing increases in front office employees, higher occupancy expense and other factors.

In its commercial and investment bank, JPMorgan benefited from increases in trading-related revenues in financial markets, but investment banking revenue and fees both fell.

Barnum said some of the weakness in investment banking was because some companies chose to push back deals into 2026. But "it's also true that I think our performance was not what we would have liked," he said.

The drop in earnings from the year-ago period was due to higher credit costs, with JPMorgan establishing a $2.2 billion reserve to cover the Apple credit card portfolio.

Dimon said "the US economy has remained resilient," adding that "while labor markets have softened, conditions do not appear to be worsening.

"Meanwhile, consumers continue to spend, and businesses generally remain healthy."

While Dimon said these conditions could persist, "as usual, we remain vigilant, and markets seem to underappreciate the potential hazards -- including from complex geopolitical conditions, the risk of sticky inflation and elevated asset price."

Shares of JPMorgan fell 3.5 percent in midday trading.

U.Shaheen--SF-PST