-

Swiss court to hear landmark climate case against cement giant

Swiss court to hear landmark climate case against cement giant

-

Steelers beat Lions in 'chaos' as three NFL teams book playoffs

-

Knicks' Brunson scores 47, Bulls edge Hawks epic

Knicks' Brunson scores 47, Bulls edge Hawks epic

-

Global nuclear arms control under pressure in 2026

-

Five-wicket Duffy prompts West Indies collapse as NZ win series 2-0

Five-wicket Duffy prompts West Indies collapse as NZ win series 2-0

-

Asian markets rally with Wall St as rate hopes rise, AI fears ease

-

Jailed Malaysian ex-PM Najib loses bid for house arrest

Jailed Malaysian ex-PM Najib loses bid for house arrest

-

Banned film exposes Hong Kong's censorship trend, director says

-

Duffy, Patel force West Indies collapse as NZ close in on Test series win

Duffy, Patel force West Indies collapse as NZ close in on Test series win

-

Australian state pushes tough gun laws, 'terror symbols' ban after shooting

-

A night out on the town during Nigeria's 'Detty December'

A night out on the town during Nigeria's 'Detty December'

-

US in 'pursuit' of third oil tanker in Caribbean: official

-

CO2 soon to be buried under North Sea oil platform

CO2 soon to be buried under North Sea oil platform

-

Steelers edge Lions as Bears, 49ers reach playoffs

-

India's Bollywood counts costs as star fees squeeze profits

India's Bollywood counts costs as star fees squeeze profits

-

McCullum admits errors in Ashes preparations as England look to salvage pride

-

Pets, pedis and peppermints: When the diva is a donkey

Pets, pedis and peppermints: When the diva is a donkey

-

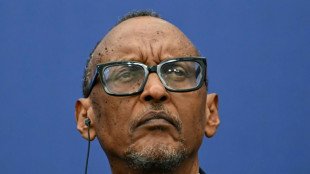

'A den of bandits': Rwanda closes thousands of evangelical churches

-

Southeast Asia bloc meets to press Thailand, Cambodia on truce

Southeast Asia bloc meets to press Thailand, Cambodia on truce

-

As US battles China on AI, some companies choose Chinese

-

AI resurrections of dead celebrities amuse and rankle

AI resurrections of dead celebrities amuse and rankle

-

Steelers receiver Metcalf strikes Lions fan

-

Morocco coach 'taking no risks' with Hakimi fitness

Morocco coach 'taking no risks' with Hakimi fitness

-

Gang members given hundreds-years-long sentences in El Salvador

-

Chargers, Bills edge closer to playoff berths

Chargers, Bills edge closer to playoff berths

-

US, Ukraine hail 'productive' Miami talks but no breakthrough

-

Gang members given hundred-years-long sentences in El Salvador

Gang members given hundred-years-long sentences in El Salvador

-

Hosts Morocco off to winning start at Africa Cup of Nations

-

No jacket required for Emery as Villa dream of title glory

No jacket required for Emery as Villa dream of title glory

-

Amorim fears United captain Fernandes will be out 'a while'

-

Nigerian government frees 130 kidnapped Catholic schoolchildren

Nigerian government frees 130 kidnapped Catholic schoolchildren

-

Captain Kane helps undermanned Bayern go nine clear in Bundesliga

-

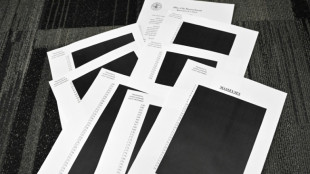

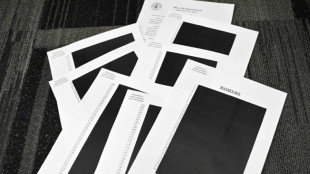

Trump administration denies cover-up over redacted Epstein files

Trump administration denies cover-up over redacted Epstein files

-

Captain Kane helps undermanned Bayern go nine clear

-

Rogers stars as Villa beat Man Utd to boost title bid

Rogers stars as Villa beat Man Utd to boost title bid

-

Barca strengthen Liga lead at Villarreal, Atletico go third

-

Third 'Avatar' film soars to top in N. American box office debut

Third 'Avatar' film soars to top in N. American box office debut

-

Third day of Ukraine settlement talks to begin in Miami

-

Barcelona's Raphinha, Yamal strike in Villarreal win

Barcelona's Raphinha, Yamal strike in Villarreal win

-

Macron, on UAE visit, announces new French aircraft carrier

-

Barca's Raphinha, Yamal strike in Villarreal win

Barca's Raphinha, Yamal strike in Villarreal win

-

Gunmen kill 9, wound 10 in South Africa bar attack

-

Allegations of new cover-up over Epstein files

Allegations of new cover-up over Epstein files

-

Atletico go third with comfortable win at Girona

-

Schwarz breaks World Cup duck with Alta Badia giant slalom victory

Schwarz breaks World Cup duck with Alta Badia giant slalom victory

-

Salah unaffected by Liverpool turmoil ahead of AFCON opener - Egypt coach

-

Goggia eases her pain with World Cup super-G win as Vonn takes third

Goggia eases her pain with World Cup super-G win as Vonn takes third

-

Goggia wins World Cup super-G as Vonn takes third

-

Cambodia says Thai border clashes displace over half a million

Cambodia says Thai border clashes displace over half a million

-

Kremlin denies three-way US-Ukraine-Russia talks in preparation

Asian markets rally with Wall St as rate hopes rise, AI fears ease

Asian markets rallied Monday and gold hit a record high as the latest round of US data boosted hopes for more interest rate cuts, while worries over AI spending also subsided.

Investors were back in the saddle for the final business days before Christmas, having had a minor wobble earlier in the month on concerns that the Federal Reserve would hold off easing monetary policy further in the early part of 2026.

Figures last week showing US unemployment hit a four-year high in November came as a report indicated the rise in consumer prices slowed more than expected.

That stoked bets on the Fed lowering borrowing costs early next year. Investors had pared their forecasts after the bank indicated it could take a pause on further cuts in its post-meeting statement earlier this month.

"This labour market softening and inflation moderation strengthened Federal Reserve easing expectations for 2026," wrote IG market analyst Fabien Yip.

However, she added that "the low inflation reading may prove temporary as shutdown-related data collection disruptions likely suppressed the figure, which could normalise higher once data gathering processes resume".

Asian tech firms led the gains Monday with South Korea's Samsung Electronics, Taiwan's TSMC and Japan's Renesas among the best performers.

Hong Kong, Shanghai, Sydney, Seoul, Singapore, Wellington, Taipei and Manila all enjoyed healthy advances.

Tokyo was the standout, piling on two percent thanks to a weaker yen.

Gold, which benefits from lower US interest rates, hit a fresh record above $4,388, while silver also struck a new peak.

The precious metals, which are go-to assets in times of crisis, also benefited from geopolitical worries as Washington steps up its oil blockade against Venezuela and after Ukraine hit a tanker from Russia's shadow fleet in the Mediterranean.

Stephen Innes at SPI Asset Management said: "Asian equity markets are stepping onto the floor with a constructive bias, taking their cue from Friday's solid rebound in US stocks and the growing belief that the final stretch of the year still belongs to the bulls."

The equity gains tracked a surge on Wall Street led by the Nasdaq as technology giants following a bumper earnings report from chip giant Micron Technology that reinvigorated the AI trade.

That came on top of news that Oracle will take a 15 percent stake in a TikTok joint venture that will allow the social media company to maintain operations in the United States.

The tech bounce came after a bout of selling fuelled by concerns that valuations had been stretched and questions were being asked about the vast sums invested in artificial intelligence that some warn could take time to see returns.

Forex traders are keeping tabs on Tokyo after Japan's top currency official said he was concerned about the yen's recent weakness, which came after the central bank hiked interest rates to a 30-year high on Friday.

"We're seeing one-directional, sudden moves especially after last week's monetary policy meeting, so I'm deeply concerned," Atsushi Mimura said Monday.

"We'd like to take appropriate responses against excessive moves."

The comments stoked speculation officials could intervene in currency markets to support the yen, which fell more than one percent against the dollar Friday after bank boss Kazuo Ueda chose not to signal more increases early in the new year.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 2.0 percent at 50,480.76 (break)

Hong Kong - Hang Seng Index: UP 0.2 percent at 25,728.31

Shanghai - Composite: UP 0.6 percent at 3,914.36

Dollar/yen: DOWN at 157.40 yen from 157.59 yen on Friday

Euro/dollar: DOWN at $1.1718 from $1.1719

Pound/dollar: UP at $1.3396 from $1.3386

Euro/pound: DOWN at 87.47 pence from 87.55 pence

West Texas Intermediate: UP 0.7 percent at $56.92 per barrel

Brent North Sea Crude: UP 0.7 percent at $60.91 per barrel

New York - Dow: UP 0.4 percent at 48,134.89 (close)

London - FTSE 100: UP 0.6 percent at 9,897.92 (close)

Y.Shaath--SF-PST