-

Tens of thousands of Afghans displaced by Pakistan conflict

Tens of thousands of Afghans displaced by Pakistan conflict

-

Unbeaten South Africa face 'fresh start' in semi-final: Markram

-

Iran steps up attacks on Mideast economy in response to US-Israeli strikes

Iran steps up attacks on Mideast economy in response to US-Israeli strikes

-

'We back ourselves': Underdogs New Zealand eye T20 World Cup final

-

UK cuts 2026 growth forecast, flags Iran war risk

UK cuts 2026 growth forecast, flags Iran war risk

-

Guardiola says Premier League teams must adapt to set-piece threat

-

Will Iran take part in the 2026 World Cup?

Will Iran take part in the 2026 World Cup?

-

Afghans escape from Iranian cities to get home

-

'Peaky Blinders' stars hit Brum red carpet for movie premiere

'Peaky Blinders' stars hit Brum red carpet for movie premiere

-

Brazil's Flamengo sack coach Filipe Luis despite 8-0 win

-

England 'not fearing anything' against India, says Curran

England 'not fearing anything' against India, says Curran

-

Global markets turmoil intensifies on Iran war

-

Iran targets Mideast energy industry and US missions

Iran targets Mideast energy industry and US missions

-

Rahm accuses DP World Tour of 'extorting players' with LIV deal

-

Thousands of Afghans displaced by Pakistan conflict

Thousands of Afghans displaced by Pakistan conflict

-

China, North Korea make winning starts at Women's Asian Cup

-

EU asylum applications down but Iran concerns mount

EU asylum applications down but Iran concerns mount

-

Rahm accuses DP World Tour of 'exorting players' with LIV deal

-

Drones hit US embassy as vengeful Iran targets Mideast cities

Drones hit US embassy as vengeful Iran targets Mideast cities

-

Mideast war exposes fragile oil, gas dependency

-

How the T20 World Cup semi-finalists shape up

How the T20 World Cup semi-finalists shape up

-

Oil extends gains and stocks dive as Middle East war spreads

-

Warming El Nino may return later this year: UN

Warming El Nino may return later this year: UN

-

Trump says US-UK relationship 'not like it used to be'

-

Eight years on, trial begins in Argentina submarine implosion

Eight years on, trial begins in Argentina submarine implosion

-

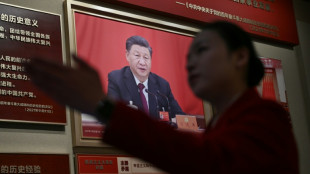

Beijing votes out three generals from political advisory body

-

Oil extends gains and stocks dive as Iran conflict spreads

Oil extends gains and stocks dive as Iran conflict spreads

-

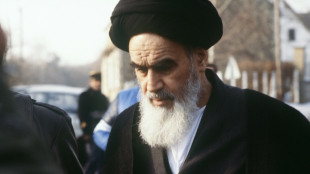

The French village where Ayatollah Khomeini fomented Iran's revolution

-

South Africa, India eye T20 World Cup rematch as semi-finals begin

South Africa, India eye T20 World Cup rematch as semi-finals begin

-

Trump hosts Germany's Merz for talks eclipsed by Mideast war

-

Second-hand phones surf rising green consumer wave

Second-hand phones surf rising green consumer wave

-

Pakistanis at remote border describe scramble to leave Iran

-

China votes to oust three generals from political advisory body

China votes to oust three generals from political advisory body

-

Murray scores 45 as Nuggets hold off Jazz

-

Five things about the 2026 F1 season

Five things about the 2026 F1 season

-

Scrum-half Gibson-Park: Ireland's 'petit general'

-

Geopolitical storm leaves isolated Greenlanders hanging by a telecoms thread

Geopolitical storm leaves isolated Greenlanders hanging by a telecoms thread

-

Myong hat-trick as North Korea cruise at Women's Asian Cup

-

AI disinformation turns Nepal polls into 'digital battleground'

AI disinformation turns Nepal polls into 'digital battleground'

-

New Israel, Iran attacks across region: Latest developments in Middle East war

-

China's overstretched healthcare looks to AI boom

China's overstretched healthcare looks to AI boom

-

Oil extends gains and stocks drop as Iran conflict spreads

-

Rituals of resilience: how Afghan women stay sane in their 'cage'

Rituals of resilience: how Afghan women stay sane in their 'cage'

-

Strait of Hormuz impasse squeezes world shipping

-

Fresh Israel, Iran attacks across region: Latest developments in Middle East war

Fresh Israel, Iran attacks across region: Latest developments in Middle East war

-

Oscar-nominated Iranian doc offers different vision of leadership

-

Oscar-nominated docs take on hot-button US social issues

Oscar-nominated docs take on hot-button US social issues

-

'I couldn't breathe': The dark side of Bolivia's silver boom

-

Trump warns of longer Iran war as Riyadh, Beirut hit

Trump warns of longer Iran war as Riyadh, Beirut hit

-

Underground party scene: Israelis celebrate Purim in air raid shelters

Finance’s Role in Economic Ruin

The finance industry, often hailed as the backbone of modern economies, has a darker side that increasingly threatens global stability. Since the 2008 financial crisis, triggered by reckless speculation in mortgage-backed securities, the sector’s unchecked growth has sown seeds of destruction. In the United States alone, the financial sector’s share of GDP rose from 2.8% in 1950 to 8.4% by 2020, yet it produced no tangible goods, instead profiting from debt and risk. Critics argue this shift diverts capital from productive industries like manufacturing—down from 27% to 11% of US GDP over the same period to speculative bubbles.

The 2023 collapse of Silicon Valley Bank, fuelled by over-leveraged bets on tech stocks, cost $20 billion in bailouts and sparked a domino effect across European markets. In the UK, the 2022 mini-budget crisis, exacerbated by hedge fund short-selling of gilts, pushed borrowing costs to record highs. Economist Ann Pettifor warns, “Finance thrives on instability it creates”. With global debt at $305 trillion—three times world GDP—experts fear the industry’s pursuit of profit through complex derivatives and high-frequency trading could precipitate another crash. Is finance an engine of growth or a wrecking ball?

Europe: Is Bulgaria "hostage" to a Schengen debate?

EU: Netherlands causes headaches in Brussels

Israel in the fight against the terror scum of Hamas

Italy: Storm Ciarán brings disastrous record rainfall

What remains of the EU leader's visit to Kiev?

Gaza: Hamas terrorists responsible for expulsion

Vice-Chancellor Habeck: Empty words without action?

Israel: More bodies, weeks after Hamas terror attack

Israel politician threatens russian terror state on Russian TV

EU: No agreement on 10-year extension for glyphosate

Ukraine: When will the world stand up to Russian terror?