-

Israel targets Hezbollah, Iran: latest developments in US-Iran war

Israel targets Hezbollah, Iran: latest developments in US-Iran war

-

Canada and India strike agreements on rare earth, uranium

-

Crude, gas prices soar and stocks drop after US strikes on Iran

Crude, gas prices soar and stocks drop after US strikes on Iran

-

A rough guide to F1 rule changes for 2026

-

At least 25 killed at Pakistan's pro-Iran weekend protests

At least 25 killed at Pakistan's pro-Iran weekend protests

-

Israel kills 31 in Lebanon, vows to expand strikes after Hezbollah fire

-

Myanmar grants amnesty to over 7,000 convicted of 'terrorist group' support

Myanmar grants amnesty to over 7,000 convicted of 'terrorist group' support

-

Riyadh's King Fahd stadium to host 2027 Asian Cup final

-

'Superman Sanju' toast of India after T20 World Cup heroics

'Superman Sanju' toast of India after T20 World Cup heroics

-

Travel chaos, but F1 season-opener in Australia 'ready to go'

-

Lunar New Year heartache for Chinese team at Women's Asian Cup

Lunar New Year heartache for Chinese team at Women's Asian Cup

-

El Nino may return in 2026 and make planet even hotter

-

Somaliland's Israel deal could put Berbera port at risk

Somaliland's Israel deal could put Berbera port at risk

-

Texas primaries launch midterm battle with Trump agenda at stake

-

How a Syrian refugee chef met Britain's King Charles

How a Syrian refugee chef met Britain's King Charles

-

Bangladesh tackle gender barriers to reach Women's Asian Cup

-

Iran war spreads across region as Israel strikes Hezbollah

Iran war spreads across region as Israel strikes Hezbollah

-

Argentina's Milei says wants US 'strategic alliance' to be state policy

-

'Sinners' wins top prize at Screen Actors Guild awards

'Sinners' wins top prize at Screen Actors Guild awards

-

New rules, same old suspects as F1 revs up for 2026 season

-

World Cup tickets: Huge demand and sky-high prices

World Cup tickets: Huge demand and sky-high prices

-

List of key Actor Award winners

-

Trump hunkers down after Iran strikes

Trump hunkers down after Iran strikes

-

China's leaders gather for key strategy session as challenges grow

-

UK toughens asylum rules to discourage migration

UK toughens asylum rules to discourage migration

-

Israel hits Lebanon after Hezbollah fire, expanding Iran war

-

CBS in turmoil as US media feels pressure under Trump

CBS in turmoil as US media feels pressure under Trump

-

Messi bags double as Miami battle back to down Orlando

-

Greenland is 'open for business' -- kind of, says business leader

Greenland is 'open for business' -- kind of, says business leader

-

Canada's Carney to mend rift, boost trade as he meets India's Modi

-

Crude soars, stocks drop after US strikes on Iran

Crude soars, stocks drop after US strikes on Iran

-

Iran war spreads across region as US, Israel suffer losses

-

Miriam Margolyes tackles aging in Oscar-nominated short

Miriam Margolyes tackles aging in Oscar-nominated short

-

Recognition, not competition, for Oscar-nominated foreign filmmakers

-

Israel, Hezbollah trade fire: latest developments in Iran war

Israel, Hezbollah trade fire: latest developments in Iran war

-

Israel strikes Tehran: latest developments in Iran war

-

Trump vows to avenge first US deaths as Iran war intensifies

Trump vows to avenge first US deaths as Iran war intensifies

-

Lowry collapses late again, Echavarria snatches victory in Cognizant Classic

-

Aubameyang strikes twice as Marseille edge Lyon in Ligue 1

Aubameyang strikes twice as Marseille edge Lyon in Ligue 1

-

Infantino says players who cover mouths when speaking could be sent off

-

Bolsonaro son rallies the right as thousands protest Brazil government

Bolsonaro son rallies the right as thousands protest Brazil government

-

Juve stay in Champions League hunt with last-gasp Roma draw

-

Maersk suspends vessel transit through Strait of Hormuz

Maersk suspends vessel transit through Strait of Hormuz

-

France, Germany, UK ready to take 'defensive action' against Iran

-

Trump vows to avenge deaths of US troops: latest Iran developments

Trump vows to avenge deaths of US troops: latest Iran developments

-

Knicks halt Spurs' 11-game NBA winning streak

-

EU warns against long war, urges 'credible transition' in Iran

EU warns against long war, urges 'credible transition' in Iran

-

'Severe blow' dealt to Iran command centres: latest developments

-

Bored of peace? Trump keeps choosing war

Bored of peace? Trump keeps choosing war

-

Arteta embraces Arsenal's 'Set-Piece FC' label after corners sink Chelsea

Finance’s Role in Economic Ruin

The finance industry, often hailed as the backbone of modern economies, has a darker side that increasingly threatens global stability. Since the 2008 financial crisis, triggered by reckless speculation in mortgage-backed securities, the sector’s unchecked growth has sown seeds of destruction. In the United States alone, the financial sector’s share of GDP rose from 2.8% in 1950 to 8.4% by 2020, yet it produced no tangible goods, instead profiting from debt and risk. Critics argue this shift diverts capital from productive industries like manufacturing—down from 27% to 11% of US GDP over the same period to speculative bubbles.

The 2023 collapse of Silicon Valley Bank, fuelled by over-leveraged bets on tech stocks, cost $20 billion in bailouts and sparked a domino effect across European markets. In the UK, the 2022 mini-budget crisis, exacerbated by hedge fund short-selling of gilts, pushed borrowing costs to record highs. Economist Ann Pettifor warns, “Finance thrives on instability it creates”. With global debt at $305 trillion—three times world GDP—experts fear the industry’s pursuit of profit through complex derivatives and high-frequency trading could precipitate another crash. Is finance an engine of growth or a wrecking ball?

Cuba's golden Goose dies

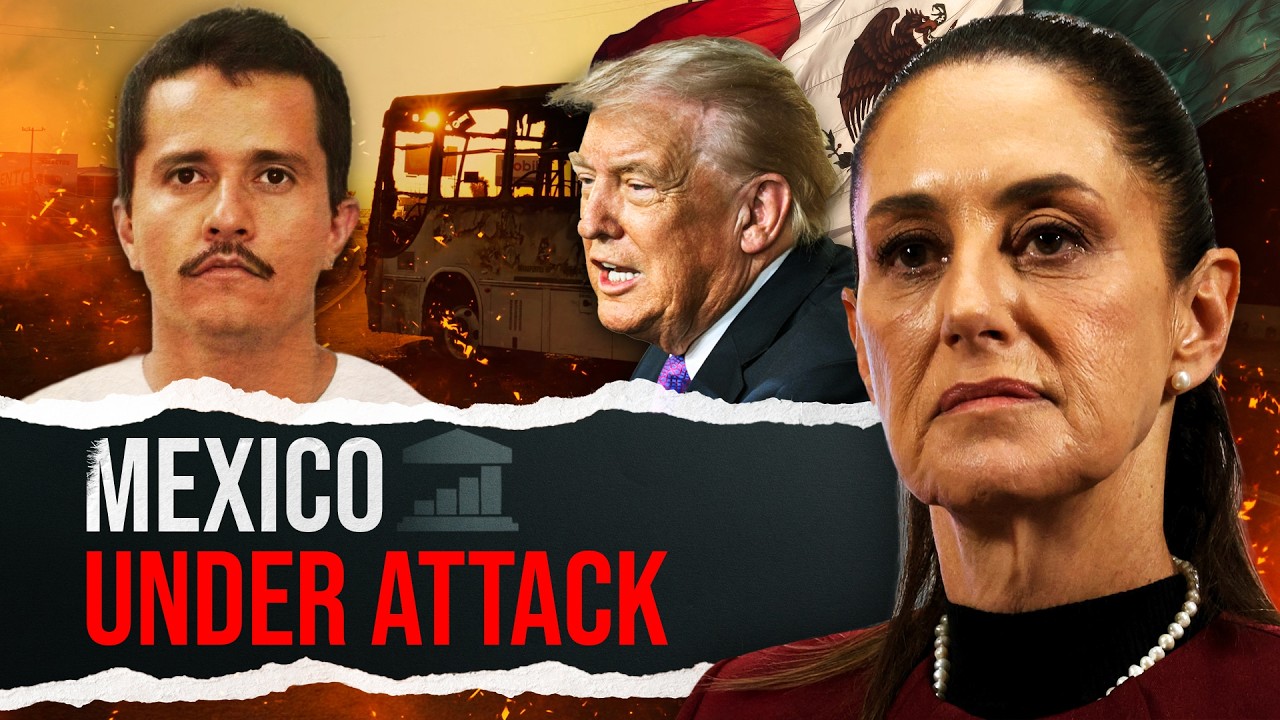

Mexico after El Mencho falls

Nicaragua on the brink?

Cuba: The Regime's last Card

Strike fears rise over Iran

U.S. Jobs stall, gdp slows

Japan’s right‑turn triumph

EU India deal gains unveiled

AI sparks Wall Street panic

India defies U.S. tariffs

EU misstep on mercosur Deal