-

At least 25 killed at Pakistan's weekend pro-Iran protests

At least 25 killed at Pakistan's weekend pro-Iran protests

-

Energy prices soar, stock markets slide on Iran war fallout

-

'No indication' Iran nuclear installations hit: IAEA

'No indication' Iran nuclear installations hit: IAEA

-

Showdown looms between Tesla and German union

-

Israel vows intensified attacks: latest developments in US-Iran war

Israel vows intensified attacks: latest developments in US-Iran war

-

France arrests activists blocking ship over alleged Russia uranium links

-

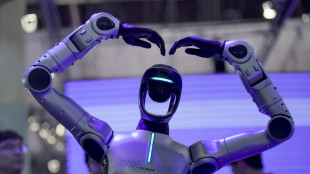

Tech sovereignty and AI networks set to dominate mobile meet

Tech sovereignty and AI networks set to dominate mobile meet

-

Indian police clash with pro-Khamenei protesters in Kashmir

-

Israel targets Hezbollah, Iran: latest developments in US-Iran war

Israel targets Hezbollah, Iran: latest developments in US-Iran war

-

Canada and India strike agreements on rare earth, uranium

-

Crude, gas prices soar and stocks drop after US strikes on Iran

Crude, gas prices soar and stocks drop after US strikes on Iran

-

A rough guide to F1 rule changes for 2026

-

At least 25 killed at Pakistan's pro-Iran weekend protests

At least 25 killed at Pakistan's pro-Iran weekend protests

-

Israel kills 31 in Lebanon, vows to expand strikes after Hezbollah fire

-

Myanmar grants amnesty to over 7,000 convicted of 'terrorist group' support

Myanmar grants amnesty to over 7,000 convicted of 'terrorist group' support

-

Riyadh's King Fahd stadium to host 2027 Asian Cup final

-

'Superman Sanju' toast of India after T20 World Cup heroics

'Superman Sanju' toast of India after T20 World Cup heroics

-

Travel chaos, but F1 season-opener in Australia 'ready to go'

-

Lunar New Year heartache for Chinese team at Women's Asian Cup

Lunar New Year heartache for Chinese team at Women's Asian Cup

-

El Nino may return in 2026 and make planet even hotter

-

Somaliland's Israel deal could put Berbera port at risk

Somaliland's Israel deal could put Berbera port at risk

-

Texas primaries launch midterm battle with Trump agenda at stake

-

How a Syrian refugee chef met Britain's King Charles

How a Syrian refugee chef met Britain's King Charles

-

Bangladesh tackle gender barriers to reach Women's Asian Cup

-

Iran war spreads across region as Israel strikes Hezbollah

Iran war spreads across region as Israel strikes Hezbollah

-

Argentina's Milei says wants US 'strategic alliance' to be state policy

-

'Sinners' wins top prize at Screen Actors Guild awards

'Sinners' wins top prize at Screen Actors Guild awards

-

New rules, same old suspects as F1 revs up for 2026 season

-

World Cup tickets: Huge demand and sky-high prices

World Cup tickets: Huge demand and sky-high prices

-

List of key Actor Award winners

-

Trump hunkers down after Iran strikes

Trump hunkers down after Iran strikes

-

China's leaders gather for key strategy session as challenges grow

-

UK toughens asylum rules to discourage migration

UK toughens asylum rules to discourage migration

-

Israel hits Lebanon after Hezbollah fire, expanding Iran war

-

CBS in turmoil as US media feels pressure under Trump

CBS in turmoil as US media feels pressure under Trump

-

Messi bags double as Miami battle back to down Orlando

-

Greenland is 'open for business' -- kind of, says business leader

Greenland is 'open for business' -- kind of, says business leader

-

Canada's Carney to mend rift, boost trade as he meets India's Modi

-

Crude soars, stocks drop after US strikes on Iran

Crude soars, stocks drop after US strikes on Iran

-

Iran war spreads across region as US, Israel suffer losses

-

Miriam Margolyes tackles aging in Oscar-nominated short

Miriam Margolyes tackles aging in Oscar-nominated short

-

Recognition, not competition, for Oscar-nominated foreign filmmakers

-

Israel, Hezbollah trade fire: latest developments in Iran war

Israel, Hezbollah trade fire: latest developments in Iran war

-

Israel strikes Tehran: latest developments in Iran war

-

Trump vows to avenge first US deaths as Iran war intensifies

Trump vows to avenge first US deaths as Iran war intensifies

-

Lowry collapses late again, Echavarria snatches victory in Cognizant Classic

-

Aubameyang strikes twice as Marseille edge Lyon in Ligue 1

Aubameyang strikes twice as Marseille edge Lyon in Ligue 1

-

Infantino says players who cover mouths when speaking could be sent off

-

Bolsonaro son rallies the right as thousands protest Brazil government

Bolsonaro son rallies the right as thousands protest Brazil government

-

Juve stay in Champions League hunt with last-gasp Roma draw

Finance’s Role in Economic Ruin

The finance industry, often hailed as the backbone of modern economies, has a darker side that increasingly threatens global stability. Since the 2008 financial crisis, triggered by reckless speculation in mortgage-backed securities, the sector’s unchecked growth has sown seeds of destruction. In the United States alone, the financial sector’s share of GDP rose from 2.8% in 1950 to 8.4% by 2020, yet it produced no tangible goods, instead profiting from debt and risk. Critics argue this shift diverts capital from productive industries like manufacturing—down from 27% to 11% of US GDP over the same period to speculative bubbles.

The 2023 collapse of Silicon Valley Bank, fuelled by over-leveraged bets on tech stocks, cost $20 billion in bailouts and sparked a domino effect across European markets. In the UK, the 2022 mini-budget crisis, exacerbated by hedge fund short-selling of gilts, pushed borrowing costs to record highs. Economist Ann Pettifor warns, “Finance thrives on instability it creates”. With global debt at $305 trillion—three times world GDP—experts fear the industry’s pursuit of profit through complex derivatives and high-frequency trading could precipitate another crash. Is finance an engine of growth or a wrecking ball?

UK politics: Outlook for 2026

United Kingdom vs Immigration

Trump's threats to Colombia

COSTCO profits from Fees

AI bust: Layoffs & Rent surge

Trap laid, Ukraine walked in

BRICS-Dollar challenge

Saudi shift shakes Israel

Al-Qaida’s growing ambitions

Argentina's radical Shift

Hidden Cartel crisis in USA