-

Malaysia tycoon pleads guilty in Singapore to abetting obstruction of justice

Malaysia tycoon pleads guilty in Singapore to abetting obstruction of justice

-

England face searching Ashes questions after India series thriller

-

Zverev to meet Khachanov in ATP Toronto semi-finals

Zverev to meet Khachanov in ATP Toronto semi-finals

-

Swiss 'Mountain Tinder' sparks high-altitude attraction

-

Hong Kong hit by flooding after flurry of rainstorm warnings

Hong Kong hit by flooding after flurry of rainstorm warnings

-

Asian markets track Wall St rally on Fed rate cut bets

-

Gaza war deepens Israel's divides

Gaza war deepens Israel's divides

-

Beijing lifts rain alert after evacuating over 80,000

-

Decision time as plastic pollution treaty talks begin

Decision time as plastic pollution treaty talks begin

-

Zverev ignores fan distraction to advance to ATP Toronto semis

-

Remains of 32 people found in Mexico's Guanajuato state

Remains of 32 people found in Mexico's Guanajuato state

-

Trump tariffs don't spare his fans in EU

-

Brazil judge puts ex-president Bolsonaro under house arrest

Brazil judge puts ex-president Bolsonaro under house arrest

-

With six months to go, Winter Games organisers say they'll be ready

-

Rybakina to face teen Mboko in WTA Canadian Open semis

Rybakina to face teen Mboko in WTA Canadian Open semis

-

Australia to buy 11 advanced warships from Japan

-

Five years after Beirut port blast, Lebanese demand justice

Five years after Beirut port blast, Lebanese demand justice

-

Stella Rimington, first woman to lead UK's MI5 dies at 90

-

Trump admin to reinstall Confederate statue toppled by protesters

Trump admin to reinstall Confederate statue toppled by protesters

-

Rybakina advances to WTA Canadian Open semis

-

Brazilian judge places ex-president Bolsonaro under house arrest

Brazilian judge places ex-president Bolsonaro under house arrest

-

Brazil judge places ex-president Bolsonaro under house arrest

-

NGOs caught between juntas and jihadists in turbulent Sahel

NGOs caught between juntas and jihadists in turbulent Sahel

-

NBA Spurs agree to four-year extension with Fox: reports

-

Stocks mostly rebound on US interest rate cut bets

Stocks mostly rebound on US interest rate cut bets

-

Boeing defense workers launch strike over contract dispute

-

Grand Canyon fire rages, one month on

Grand Canyon fire rages, one month on

-

Djokovic withdraws from ATP Cincinnati Masters

-

Brazil's Paixao promises 'big things' at Marseille unveiling

Brazil's Paixao promises 'big things' at Marseille unveiling

-

Shubman Gill: India's elegant captain

-

Trump says to name new labor statistics chief this week

Trump says to name new labor statistics chief this week

-

England v India: Three talking points

-

Exceptional Nordic heatwave stumps tourists seeking shade

Exceptional Nordic heatwave stumps tourists seeking shade

-

'Musical cocoon': Polish mountain town hosts Chopin fest

-

A 'Thinker' drowns in plastic garbage as UN treaty talks open

A 'Thinker' drowns in plastic garbage as UN treaty talks open

-

India's Siraj 'woke up believing' ahead of Test heroics

-

Israeli PM says to brief army on Gaza war plan

Israeli PM says to brief army on Gaza war plan

-

Frustrated Stokes refuses to blame Brook for England collapse

-

Moscow awaits 'important' Trump envoy visit before sanctions deadline

Moscow awaits 'important' Trump envoy visit before sanctions deadline

-

Schick extends Bayer Leverkusen contract until 2030

-

Tesla approves $29 bn in shares to Musk as court case rumbles on

Tesla approves $29 bn in shares to Musk as court case rumbles on

-

Stocks rebound on US rate cut bets

-

Swiss eye 'more attractive' offer for Trump after tariff shock

Swiss eye 'more attractive' offer for Trump after tariff shock

-

Trump says will name new economics data official this week

-

Three things we learned from the Hungarian Grand Prix

Three things we learned from the Hungarian Grand Prix

-

Lions hooker Sheehan banned over Lynagh incident

-

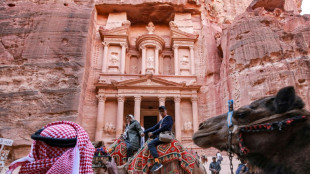

Jordan sees tourism slump over Gaza war

Jordan sees tourism slump over Gaza war

-

China's Baidu to deploy robotaxis on rideshare app Lyft

-

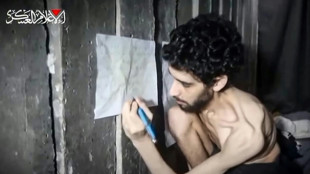

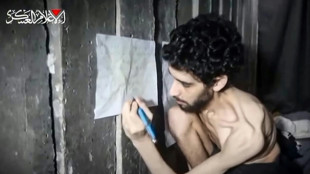

Israel wants world attention on hostages held in Gaza

Israel wants world attention on hostages held in Gaza

-

Pacific algae invade Algeria beaches, pushing humans and fish away

| SCU | 0% | 12.72 | $ | |

| RBGPF | 0% | 74.94 | $ | |

| CMSD | 1.18% | 23.63 | $ | |

| JRI | 0.76% | 13.2 | $ | |

| BCC | -0.77% | 82.71 | $ | |

| BCE | -1.12% | 23.31 | $ | |

| CMSC | 0.87% | 23.07 | $ | |

| NGG | 1.14% | 72.65 | $ | |

| SCS | 38.6% | 16.58 | $ | |

| RIO | 0.58% | 60 | $ | |

| RELX | 0.73% | 51.97 | $ | |

| RYCEF | 2.14% | 14.5 | $ | |

| BTI | 2.16% | 55.55 | $ | |

| GSK | 0.32% | 37.68 | $ | |

| AZN | 0.86% | 74.59 | $ | |

| VOD | 0.72% | 11.04 | $ | |

| BP | 2.28% | 32.49 | $ |

Asian markets track Wall St rally on Fed rate cut bets

Stock markets rose Tuesday as investors grow increasingly confident the Federal Reserve will cut interest rates next month, despite concerns about the US economy and Donald Trump's tariffs.

The gains tracked a rally on Wall Street, where traders rediscovered their mojo following Friday's sell-off that was fuelled by news that fewer-than-expected American jobs were created in July, while the previous two months' figures were revised down sharply.

The reading raised concerns the world's biggest economy was in worse shape than expected, though it also fanned bets the Fed will slash in September, with markets pricing the chance of a 25-basis-point reduction at about 95 percent, according to Bloomberg.

There is also talk that bank officials could go for twice as much as that.

"The narrative flipped fast: soft jobs equals soft Fed, and soft Fed equals risk-on," said Stephen Innes at SPI Asset Management.

But he warned that "if cuts are coming because the labour market is slipping from 'cooling' to 'cracking', then we're skating closer to the edge than we care to admit".

He added: "That dichotomy -- between rate cuts as stimulus and rate cuts as warning flare -- is now front and center.

"If the Fed moves proactively to shield markets from the tariff storm and weak labour, the equity rally has legs. But if policymakers are reacting to a sharper downturn that is in full swing, the runway shortens quickly."

In early trade, Tokyo, Hong Kong, Shanghai, Sydney, Seoul, Singapore, Taipei, Manila and Jakarta were all in the green.

However, while there is a broad expectation that the Fed will cut rates, Lazard chief market strategist Ronald Temple remained sceptical.

"I continue to believe the Fed will not reduce rates at all this year given rising inflation caused by tariffs and a relatively stable unemployment rate," he wrote.

"I would align with the majority of the FOMC members who believe it is more appropriate to hold policy constant until there is greater clarity in terms of the effects of tariffs and stricter immigration enforcement on inflation and employment."

Traders were keeping an eye on trade talks between Washington and dozens of its trade partners after Trump imposed tariffs of between 10 and 41 percent on them.

Among those to strike a deal is India, which Trump on Monday threatened to hit with "substantially" higher rates over its purchases of Russian oil.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 0.6 percent at 40,544.99 (break)

Hong Kong - Hang Seng Index: UP 0.1 percent at 24,747.97

Shanghai - Composite: UP 0.5 percent at 3,600.02

Dollar/yen: UP at 147.11 yen from 147.08 yen on Monday

Euro/dollar: DOWN at $1.1562 from $1.1573

Pound/dollar: UP at $1.3287 from $1.3285

Euro/pound: DOWN at 87.01 pence from 87.11 pence

West Texas Intermediate: DOWN 0.1 percent at $66.24 per barrel

Brent North Sea Crude: DOWN 0.1 percent at $68.70 per barrel

New York - Dow: UP 1.3 percent at 44,173.64 (close)

London - FTSE 100: UP 0.7 percent at 9,128.30 (close)

N.Shalabi--SF-PST