-

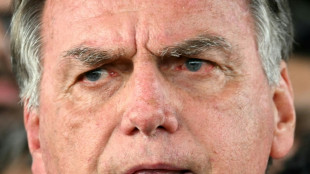

Brazil judge places ex-president Bolsonaro under house arrest

Brazil judge places ex-president Bolsonaro under house arrest

-

NGOs caught between juntas and jihadists in turbulent Sahel

-

NBA Spurs agree to four-year extension with Fox: reports

NBA Spurs agree to four-year extension with Fox: reports

-

Stocks mostly rebound on US interest rate cut bets

-

Boeing defense workers launch strike over contract dispute

Boeing defense workers launch strike over contract dispute

-

Grand Canyon fire rages, one month on

-

Djokovic withdraws from ATP Cincinnati Masters

Djokovic withdraws from ATP Cincinnati Masters

-

Brazil's Paixao promises 'big things' at Marseille unveiling

-

Shubman Gill: India's elegant captain

Shubman Gill: India's elegant captain

-

Trump says to name new labor statistics chief this week

-

England v India: Three talking points

England v India: Three talking points

-

Exceptional Nordic heatwave stumps tourists seeking shade

-

'Musical cocoon': Polish mountain town hosts Chopin fest

'Musical cocoon': Polish mountain town hosts Chopin fest

-

A 'Thinker' drowns in plastic garbage as UN treaty talks open

-

India's Siraj 'woke up believing' ahead of Test heroics

India's Siraj 'woke up believing' ahead of Test heroics

-

Israeli PM says to brief army on Gaza war plan

-

Frustrated Stokes refuses to blame Brook for England collapse

Frustrated Stokes refuses to blame Brook for England collapse

-

Moscow awaits 'important' Trump envoy visit before sanctions deadline

-

Schick extends Bayer Leverkusen contract until 2030

Schick extends Bayer Leverkusen contract until 2030

-

Tesla approves $29 bn in shares to Musk as court case rumbles on

-

Stocks rebound on US rate cut bets

Stocks rebound on US rate cut bets

-

Swiss eye 'more attractive' offer for Trump after tariff shock

-

Trump says will name new economics data official this week

Trump says will name new economics data official this week

-

Three things we learned from the Hungarian Grand Prix

-

Lions hooker Sheehan banned over Lynagh incident

Lions hooker Sheehan banned over Lynagh incident

-

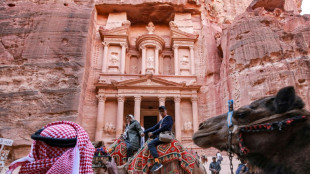

Jordan sees tourism slump over Gaza war

-

China's Baidu to deploy robotaxis on rideshare app Lyft

China's Baidu to deploy robotaxis on rideshare app Lyft

-

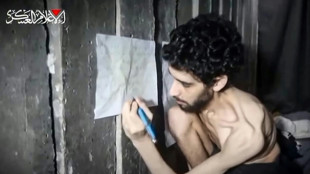

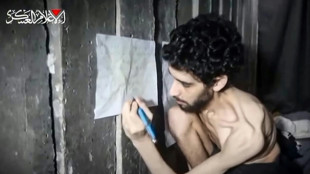

Israel wants world attention on hostages held in Gaza

-

Pacific algae invade Algeria beaches, pushing humans and fish away

Pacific algae invade Algeria beaches, pushing humans and fish away

-

Siraj stars as India beat England by six runs in fifth-Test thriller

-

Stocks mostly rise as traders boost US rate cut bets

Stocks mostly rise as traders boost US rate cut bets

-

S.Africa eyes new markets after US tariffs: president

-

Trump envoy's visit will be 'important', Moscow says

Trump envoy's visit will be 'important', Moscow says

-

BP makes largest oil, gas discovery in 25 years off Brazil

-

South Korea removing loudspeakers on border with North

South Korea removing loudspeakers on border with North

-

Italy fines fast-fashion giant Shein for 'green' claims

-

Shares in UK banks jump after car loan court ruling

Shares in UK banks jump after car loan court ruling

-

Beijing issues new storm warning after deadly floods

-

Most markets rise as traders US data boosts rate cut bets

Most markets rise as traders US data boosts rate cut bets

-

17 heat records broken in Japan

-

Most markets rise as traders weigh tariffs, US jobs

Most markets rise as traders weigh tariffs, US jobs

-

Tycoon who brought F1 to Singapore pleads guilty in graft case

-

Australian police charge Chinese national with 'foreign interference'

Australian police charge Chinese national with 'foreign interference'

-

Torrential rain in Taiwan kills four over past week

-

Rwanda bees being wiped out by pesticides

Rwanda bees being wiped out by pesticides

-

Tourism boom sparks backlash in historic heart of Athens

-

Doctors fight vaccine mistrust as Romania hit by measles outbreak

Doctors fight vaccine mistrust as Romania hit by measles outbreak

-

Fritz fights through to reach ATP Toronto Masters quarters

-

Trump confirms US envoy Witkoff to travel to Russia in coming week

Trump confirms US envoy Witkoff to travel to Russia in coming week

-

Mighty Atom: how the A-bombs shaped Japanese arts

| CMSC | 0.87% | 23.07 | $ | |

| JRI | 0.76% | 13.2 | $ | |

| BCC | -0.77% | 82.71 | $ | |

| AZN | 0.86% | 74.59 | $ | |

| CMSD | 1.18% | 23.63 | $ | |

| SCU | 0% | 12.72 | $ | |

| GSK | 0.32% | 37.68 | $ | |

| RIO | 0.58% | 60 | $ | |

| RBGPF | 0.08% | 75 | $ | |

| NGG | 1.14% | 72.65 | $ | |

| BCE | -1.12% | 23.31 | $ | |

| SCS | 38.6% | 16.58 | $ | |

| RYCEF | 2.07% | 14.5 | $ | |

| RELX | 0.73% | 51.97 | $ | |

| BTI | 2.16% | 55.55 | $ | |

| VOD | 0.72% | 11.04 | $ | |

| BP | 2.28% | 32.49 | $ |

Stocks mostly rebound on US interest rate cut bets

Most stock markets bounced on Monday on hopes of US interest rate cuts after weak jobs figures raised concerns about the world's top economy.

The broad gains followed a Wall Street sell-off on Friday in reaction to the jobs data and news that dozens of countries would be hit with US tariffs ranging from 10 to 41 percent.

Major US indices spent the entire day in positive territory, with the broad-based S&P 500 finishing up 1.5 percent.

"Traders and investors have made a lot of money by deciding that tariffs won't matter, and they're not going to change that now," said Steve Sosnick of Interactive Brokers.

"I think the bias that most of them have now is 'Let's not think about tariffs as being a problem until they actually prove that they are.'"

European indices mostly started the week on the front foot, with Paris and Frankfurt both ending the day up more than one percent.

"Investors seem to be taking an optimistic view... betting on an increased likelihood of further monetary easing by the Fed after Friday's employment figures," said John Plassard, head of investment strategy at Cite Gestion Private Bank.

CME's FedWatch tool now has investors seeing a 94.1 percent chance of the Fed making a quarter-point cut in interest rates at the next meeting in September.

Plassard noted, however, that "uncertainty reigns" as US President Donald Trump's latest round of tariffs are set to take effect on Thursday.

Switzerland's stock market dropped around two percent at Monday's open, its first session as it returned from a holiday after a tough 39-percent US tariff rate was announced.

But the index later pared most of its losses on hopes the Swiss government, which announced it would make an improved offer to Washington, could negotiate a reduction in the levy, which is steeper than that imposed on the European Union and Britain.

London advanced, lifted by banking stocks after the sector was granted a reprieve from the worst of feared compensation claims over controversial car loans dating back to 2007.

Lloyds Banking Group jumped nine percent while Close Brothers, listed on the FTSE 250, soared more than 23 percent.

Asian investors started the week mixed, with Hong Kong and Shanghai advancing while Tokyo fell.

Stocks had struggled Friday as US jobs growth fell short of expectations in July, with revised data showing the weakest hiring since the Covid-19 pandemic -- fueling concerns that Trump's tariffs are starting to bite.

Trump responded to the data by firing the commissioner of labor statistics, accusing her of manipulating employment data for political reasons.

Markets reacted more favorably on Monday, as the hiring slowdown boosted hopes of Fed rate cuts to support the economy.

Elsewhere, oil prices fell more than two percent after a sharp output increase by eight OPEC+ countries, with markets anticipating abundant supply.

However, they later trimmed their losses after Trump threatened to hike tariffs on Indian goods further over its purchases of Russian oil.

- Key figures at around 2050 GMT -

New York - Dow: UP 1.3 percent at 44,173.64 (close)

New York - S&P 500: UP 1.5 percent at 6,329.94 (close)

New York - Nasdaq Composite: UP 2.0 percent at 21,053.58 (close)

London - FTSE 100: UP 0.7 percent at 9,128.30 (close)

Paris - CAC 40: UP 1.1 percent at 7,632.01 (close)

Frankfurt - DAX: UP 1.4 percent at 23,757.69 (close)

Tokyo - Nikkei 225: DOWN 1.3 percent at 40,290.70 (close)

Hong Kong - Hang Seng Index: UP 0.9 percent at 24,733.45 (close)

Shanghai - Composite: UP 0.9 percent at 3,583.31 (close)

Dollar/yen: DOWN at 147.08 yen from 147.40 yen on Friday

Euro/dollar: DOWN at $1.1573 from $1.1587

Pound/dollar: UP at $1.3285 from $1.3279

Euro/pound: DOWN at 87.11 pence from 87.25 pence

West Texas Intermediate: DOWN 1.6 percent at $66.29 per barrel

Brent North Sea Crude: DOWN 1.3 percent at $68.76 per barrel

burs-jmb/sst

P.Tamimi--SF-PST