-

Thousands protest in Greece over 13-hour workday plans

Thousands protest in Greece over 13-hour workday plans

-

Indigenous protest urges end to Colombia border violence

-

Torrential downpours kill nine in Ukraine's Odesa

Torrential downpours kill nine in Ukraine's Odesa

-

Australia ease to six-wicket win in first New Zealand T20

-

France's Monfils announces retirement at end of 2026

France's Monfils announces retirement at end of 2026

-

'Normal' Sinner thrashes Tien in Beijing for 21st title

-

Survivor pulled from Indonesia school collapse as parents await news

Survivor pulled from Indonesia school collapse as parents await news

-

Tennis schedule under renewed scrutiny as injuries, criticism mount

-

New player load guidelines hailed as 'landmark moment' for rugby

New player load guidelines hailed as 'landmark moment' for rugby

-

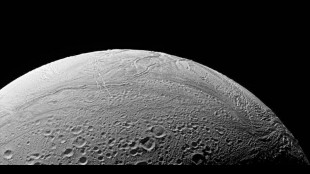

More ingredients for life discovered in ocean on Saturn moon

-

Germany's Oktoberfest closed by bomb threat

Germany's Oktoberfest closed by bomb threat

-

Spanish court opens 550-mn-euro Meta data protection trial

-

Jonathan Anderson to bring new twist to Dior women with Paris debut

Jonathan Anderson to bring new twist to Dior women with Paris debut

-

Gold hits record, Wall St futures drop as US shutdown begins

-

Sinner thrashes Tien to win China Open for 21st title

Sinner thrashes Tien to win China Open for 21st title

-

Philippines quake toll rises to 69 as injured overwhelm hospitals

-

Swiss glaciers shrank by a quarter in past decade: study

Swiss glaciers shrank by a quarter in past decade: study

-

Indonesia's MotoGP project leaves evicted villagers in limbo

-

'The Summer I Turned Pretty' sells more Paris romantic escapism

'The Summer I Turned Pretty' sells more Paris romantic escapism

-

Australia's Lyon tells England that no spinner would be Ashes error

-

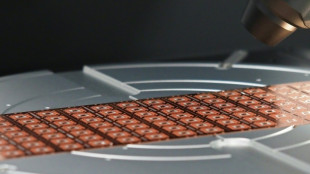

Taiwan says 'will not agree' to making 50% of its chips in US

Taiwan says 'will not agree' to making 50% of its chips in US

-

Verstappen's late-season surge faces steamy Singapore examination

-

Ohtani erupts as Dodgers down Reds, Red Sox stun Yankees in MLB playoffs

Ohtani erupts as Dodgers down Reds, Red Sox stun Yankees in MLB playoffs

-

Gold hits record, Wall St futures drop as US heads for shutdown

-

General strike in Greece over 13-hour workday plans

General strike in Greece over 13-hour workday plans

-

Georgia risks political turmoil over weekend vote

-

US government enters shutdown as Congress fails to reach funding deal

US government enters shutdown as Congress fails to reach funding deal

-

Spanish court to start hearing media case against Meta

-

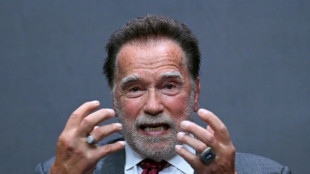

Pope, Schwarzenegger to rally Catholics to 'terminate' climate change

Pope, Schwarzenegger to rally Catholics to 'terminate' climate change

-

FBI director gave New Zealand officials illegal firearms: police

-

Gisele Pelicot back in French court for appeal trial 'ordeal'

Gisele Pelicot back in French court for appeal trial 'ordeal'

-

EU leaders plot defence boost in shadow of Denmark drones

-

Wallabies' most-capped player James Slipper announces retirement

Wallabies' most-capped player James Slipper announces retirement

-

India ready to rev up chipmaking, industry pioneer says

-

Australian Rules axes 'centre bounce' after 130 years

Australian Rules axes 'centre bounce' after 130 years

-

Rangers searching for Europa League respite, Villa visit Feyenoord

-

Crystal Palace soaring under Glasner ahead of European bow

Crystal Palace soaring under Glasner ahead of European bow

-

Asian stocks mixed, Wall St futures drop as US heads for shutdown

-

Suarez double in vain as Chicago sink Miami to clinch playoff berth

Suarez double in vain as Chicago sink Miami to clinch playoff berth

-

England's 'outsiders' aim to break trophy drought at Women's Cricket World Cup

-

Indigenous survivors recount past horrors at Canada residential school

Indigenous survivors recount past horrors at Canada residential school

-

Hitmaker Max Martin back with Taylor Swift for 'Showgirl'

-

'Showgirl' conquers showbusiness: Taylor Swift releases 12th album on Friday

'Showgirl' conquers showbusiness: Taylor Swift releases 12th album on Friday

-

Former Wallabies coach Cheika joins Sydney Roosters

-

South Korea posts record semiconductor exports in September

South Korea posts record semiconductor exports in September

-

Strong quake in central Philippines kills 26 as search ongoing

-

Rugby World Cup draw set for December 3

Rugby World Cup draw set for December 3

-

Strong quake in central Philippines kills 19 as search ongoing

-

US on brink of govt shutdown as last-ditch vote fails

US on brink of govt shutdown as last-ditch vote fails

-

Chelsea memories don't 'feed' Mourinho after return ends in defeat

Gold hits record, Wall St futures drop as US shutdown begins

Gold hit a record high and Wall Street futures fell with the dollar Wednesday as the US government shut down after lawmakers failed to reach a funding deal, though most Asian and European markets edged up.

The prospect of services in the United States being closed overshadowed optimism the Federal Reserve will cut interest rates again.

Democrats and Republicans remain at loggerheads on funding the government beyond Tuesday -- the end of the fiscal year -- with both sides blaming each other.

Senate Republicans tried to rubber-stamp a House-passed temporary funding patch, but could not get the handful of Democratic votes required to send it to President Donald Trump to sign off.

Democrats want to see hundreds of billions of dollars in healthcare spending for low-income households restored, which the Trump administration is likely to eliminate.

The closure will see non-essential operations halted, leaving hundreds of thousands of civil servants temporarily unpaid, and many social safety net benefit payments potentially disrupted.

Trump threatened to punish Democrats during any stoppage by targeting progressive priorities and forcing mass public sector job cuts.

"So we'd be laying off a lot of people that are going to be very affected," he said.

"And they're Democrats, they're going to be Democrats," the president told an event at the White House, adding that he would use the pause to "get rid of a lot of things we didn't want, and they'd be Democrat things".

Republican House Speaker Mike Johnson wrote on X that "Democrats have officially voted to CLOSE the government".

Democratic leaders Chuck Schumer and Hakeem Jeffries said in a joint statement their party remained "ready to find a bipartisan path forward to reopen the government in a way that lowers costs and addresses the Republican healthcare crisis".

While most shutdowns end after a short period with little effect on markets, investors remain concerned, particularly as it could prevent the release Friday of the key non-farm payrolls report -- a crucial guide for the Fed on rate decisions.

Still, Pepperstone's Michael Brown wrote: "I remain strongly of the view that (investors) should continue to look through the political noise as, in the grand scheme of things, the expiration of federal funding doesn't make especially much difference.

"Chiefly, this is because we all know that, sooner or later, a deal will be cut, the government will re-open, and any economic data that was delayed... will be released in due course."

Safe-haven gold hit a new peak of $3,875.53 on worries about the shutdown as well as a weaker dollar and bets on lower borrowing costs.

Futures on all three main indexes in New York were in the red -- with the Dow coming off a record.

However, Asian equities held up, with Singapore, Seoul, Wellington, Taipei, Manila, Mumbai, Bangkok and Jakarta all in positive territory along with London.

Tokyo sank with Paris and Frankfurt while Sydney was barely moved.

Hong Kong and Shanghai were closed for holidays.

The dollar retreated against its peers owing to concerns caused by the shutdown.

India's rupee also made small inroads as the country's central bank decided against cutting interest rates, despite inflation remaining low, but the unit continued to hover around record lows against the greenback.

The South Asian currency has been hit by concerns over stalled trade talks with Trump that will soften painful tariffs, while Washington's strict immigration measures have added to worries.

The two sides remain in talks despite sharp disagreements over agricultural trade and New Delhi's purchases of Russian oil.

In company news, Australian mining titan BHP fell 2.5 percent following reports China had told steelmakers to temporarily stop buying seagoing, dollar-denominated cargoes from the firm, as part of a pricing dispute.

- Key figures at around 0715 GMT -

Tokyo - Nikkei 225: DOWN 0.9 percent at 44,550.85 (close)

London - FTSE 100: UP 0.2 percent at 9,366.15

Hong Kong - Hang Seng Index: Closed for a holiday

Shanghai - Composite: Closed for a holiday

Euro/dollar: UP at $1.1768 from $1.1739 on Tuesday

Pound/dollar: DOWN at $1.3468 from $1.3448

Dollar/yen: UP at 147.21 yen from 147.86 yen

Euro/pound: UP at 87.37 pence from 87.29 pence

West Texas Intermediate: UP 0.4 percent at $62.59 per barrel

Brent North Sea Crude: UP 0.4 percent at $66.28 per barrel

New York - Dow: UP 0.2 percent at 46,397.89 (close)

J.AbuHassan--SF-PST