-

Marseille hoping to prove title credentials after win over PSG

Marseille hoping to prove title credentials after win over PSG

-

Germany must move quicker on reforms, say experts

-

PSG star Hakimi says at 'peace' despite rape allegation

PSG star Hakimi says at 'peace' despite rape allegation

-

India spin great Ashwin joins Australia's BBL in first

-

France's ex-president Sarkozy convicted in Libya trial

France's ex-president Sarkozy convicted in Libya trial

-

Dutch lead charge on electric inland vessels

-

Red-hot Kane on record course with Bremen in his sights

Red-hot Kane on record course with Bremen in his sights

-

Vietnam jails dozens in $3.8 bn online gambling and crypto case

-

England unchanged for Women's Rugby World Cup final against Canada

England unchanged for Women's Rugby World Cup final against Canada

-

Swiss central bank keeps zero-rate as tariffs take their toll

-

Denmark says 'professional actor' behind drone flights over airports

Denmark says 'professional actor' behind drone flights over airports

-

Marquez looking to crown comeback with MotoGP title in Japan

-

Markets slide as traders prepare for key US data

Markets slide as traders prepare for key US data

-

Colombia's top drug cartel in decline, may lay down arms: negotiator

-

Snoop Dogg 'in love' with Australian Rules football

Snoop Dogg 'in love' with Australian Rules football

-

Former NBA star Harrell axed by Adelaide 36ers over drugs

-

Townsend pulls out of Beijing following 'crazy' Chinese food post

Townsend pulls out of Beijing following 'crazy' Chinese food post

-

Under promise, over deliver? China unveils new climate goals

-

South China cleans up after powerful Typhoon Ragasa

South China cleans up after powerful Typhoon Ragasa

-

'Morgue is full': how Kenyan starvation cult kept killing

-

Nickel mining threatens Indonesia coral haven, NGOs warn

Nickel mining threatens Indonesia coral haven, NGOs warn

-

Drones fly over multiple Danish airports

-

Raleigh reaches 60 homers as Mariners clinch first division title since 2001

Raleigh reaches 60 homers as Mariners clinch first division title since 2001

-

Savea leads 'stung' All Blacks, Wallaby Slipper to hit 150 Test milestone

-

Morocco High Atlas whistle language strives for survival

Morocco High Atlas whistle language strives for survival

-

Glimmering sea of solar as China expands desert installation

-

France's Sarkozy set to learn fate in Libya case

France's Sarkozy set to learn fate in Libya case

-

Clean-up underway in southern China after Typhoon Ragasa sweeps through

-

Apple asks EU to scrap landmark digital competition law

Apple asks EU to scrap landmark digital competition law

-

Asian markets slide as traders prepare for key US data

-

Return of millions of Afghans fuels terror potential

Return of millions of Afghans fuels terror potential

-

Savea to lead 'stung' All Blacks as Robertson makes four changes

-

'Shut your mouth': Low-paid women still waiting for their #MeToo

'Shut your mouth': Low-paid women still waiting for their #MeToo

-

Famed 'sponge cities' Chinese architect dead in Brazil plane crash

-

Palestinian leader to address UN as peace push gathers steam

Palestinian leader to address UN as peace push gathers steam

-

Canada's Indigenous wary of mining push in rich 'Ring of Fire'

-

Trump visit adds to intensity as Ryder Cup looms

Trump visit adds to intensity as Ryder Cup looms

-

Savea to lead All Blacks as four changes made to face Wallabies

-

Kimmel scores decade-high ratings amid Trump fight: Disney

Kimmel scores decade-high ratings amid Trump fight: Disney

-

Trump trolls Biden with White House 'autopen' portrait

-

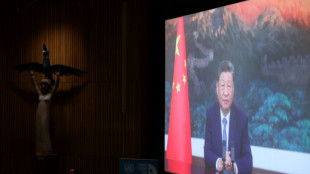

Low bar, high hopes: China unveils new climate goals

Low bar, high hopes: China unveils new climate goals

-

Under-fire Brazil Senate scraps immunity bid

-

Donald and Bradley tout respect, trade jabs at Ryder Cup opening ceremony

Donald and Bradley tout respect, trade jabs at Ryder Cup opening ceremony

-

Escalatorgate: Trump demands probe into UN 'triple sabotage'

-

New Syria leader warns on Israel attacks on UN charm mission

New Syria leader warns on Israel attacks on UN charm mission

-

In first, China unveils specific emissions targets

-

Alvarez hat-trick helps Atletico edge Rayo thriller

Alvarez hat-trick helps Atletico edge Rayo thriller

-

Con job? Climate change is my job, says island nation leader

-

US stocks fall again while Alibaba gains on big AI push

US stocks fall again while Alibaba gains on big AI push

-

Forest denied winning European return by Antony, Roma down Nice

Markets slide as traders prepare for key US data

Stocks skidded Thursday as traders continue to pull back from the buying that has propelled markets to record highs in recent months, with upcoming US inflation and jobs data seen as likely to be the next catalysts for action.

Investors have been on a buying spree since shares hit deep lows in the wake of Donald Trump's April global tariff bombshell, with sentiment buoyed by trade agreements and signs that the Federal Reserve was about to resume its interest rate cut programme.

The US central bank -- citing a weak labour market and inflation that has not spiked -- last week announced its reduction, and forecast there could be two more this year.

However, while traders have been banking on a period of easing, some Fed officials, including boss Jerome Powell, are trying to take a more cautious approach, citing still-elevated inflation.

His remarks this week that stocks are "fairly highly valued" and that there was "no risk-free path" on rates has tempered the euphoria on trading floors.

The bank will be keeping watch on the release this week of its preferred gauge of inflation -- the personal consumption expenditure index -- and next week's non-farm payrolls report.

Tokyo held solidly in positive territory early Thursday, but most other markets trended lower.

Hong Kong dropped, with tech titan Alibaba in the red after Wednesday's gain of more than nine percent in reaction to its chief executive saying it planned to ramp up spending on artificial intelligence. Its US-listed stock piled on more than eight percent.

And China's biggest car exporter Chery Automobile rocketed more than at the start of its 13 percent on its trading debut in the city, having raised about US$1.2 billion in its initial public offering. It ended up 3.8 percent.

There were losses in Singapore, Wellington, Taipei, Manila, Mumbai and Jakarta, while Sydney and Bangkok edged up with Shanghai and Seoul barely moved.

London, Paris and Frankfurt fell.

The tepid day came after a second day of losses in Wall Street for all three main indexes.

While there appears to be some unease in recent days over the latest market rally.

"With major regions in easy fiscal mode, and with the Fed cutting against a backdrop of broadening and accelerating profits, it's not hard to argue for a boom in (earnings per share) and GDP growth," Bank of America analysts wrote.

"US (capital expenditure) and revisions are broadening beyond tech, sticky inflation could help sales and thus drive operating leverage. This is the higher probability 'tail' in 2026 than stagflation or recession, in our view."

And Pepperstone's Michael Brown added that "the bull case has been a solid one for quite some time now, with the S&P having gone over 100 days without a daily loss of at least two percent, and remains firmly intact, with the underlying economy resilient and earnings growth robust".

"Furthermore, the Fed's 'run it hot' approach, resulting in a looser policy stance, sooner than expected, tilts risks to the outlook to the upside."

- Key figures at around 0810 GMT -

Tokyo - Nikkei 225: UP 0.3 percent at 45,754.93 (close)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 26,484.68 (close)

Shanghai - Composite: FLAT at 3,853.30 (close)

London - FTSE 100: DOWN 0.2 percent at 9,232.69

Euro/dollar: DOWN at $1.1733 from $1.1737 on Wednesday

Pound/dollar: DOWN at $1.3438 from $1.3445

Dollar/yen: DOWN at 148.80 yen from 148.91 yen

Euro/pound: UP at 87.32 pence from 87.29 pence

West Texas Intermediate: DOWN 0.4 percent at $64.73 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $69.13 per barrel

New York - Dow: FLAT at 46,121.28 (close)

U.Shaheen--SF-PST