-

South China cleans up after powerful Typhoon Ragasa

South China cleans up after powerful Typhoon Ragasa

-

'Morgue is full': how Kenyan starvation cult kept killing

-

Nickel mining threatens Indonesia coral haven, NGOs warn

Nickel mining threatens Indonesia coral haven, NGOs warn

-

Drones fly over multiple Danish airports

-

Raleigh reaches 60 homers as Mariners clinch first division title since 2001

Raleigh reaches 60 homers as Mariners clinch first division title since 2001

-

Savea leads 'stung' All Blacks, Wallaby Slipper to hit 150 Test milestone

-

Morocco High Atlas whistle language strives for survival

Morocco High Atlas whistle language strives for survival

-

Glimmering sea of solar as China expands desert installation

-

France's Sarkozy set to learn fate in Libya case

France's Sarkozy set to learn fate in Libya case

-

Clean-up underway in southern China after Typhoon Ragasa sweeps through

-

Apple asks EU to scrap landmark digital competition law

Apple asks EU to scrap landmark digital competition law

-

Asian markets slide as traders prepare for key US data

-

Return of millions of Afghans fuels terror potential

Return of millions of Afghans fuels terror potential

-

Savea to lead 'stung' All Blacks as Robertson makes four changes

-

'Shut your mouth': Low-paid women still waiting for their #MeToo

'Shut your mouth': Low-paid women still waiting for their #MeToo

-

Famed 'sponge cities' Chinese architect dead in Brazil plane crash

-

Palestinian leader to address UN as peace push gathers steam

Palestinian leader to address UN as peace push gathers steam

-

Canada's Indigenous wary of mining push in rich 'Ring of Fire'

-

Trump visit adds to intensity as Ryder Cup looms

Trump visit adds to intensity as Ryder Cup looms

-

Savea to lead All Blacks as four changes made to face Wallabies

-

Kimmel scores decade-high ratings amid Trump fight: Disney

Kimmel scores decade-high ratings amid Trump fight: Disney

-

Trump trolls Biden with White House 'autopen' portrait

-

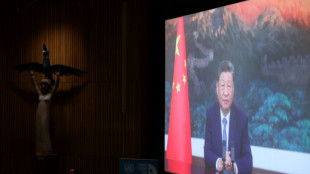

Low bar, high hopes: China unveils new climate goals

Low bar, high hopes: China unveils new climate goals

-

Under-fire Brazil Senate scraps immunity bid

-

Donald and Bradley tout respect, trade jabs at Ryder Cup opening ceremony

Donald and Bradley tout respect, trade jabs at Ryder Cup opening ceremony

-

Escalatorgate: Trump demands probe into UN 'triple sabotage'

-

New Syria leader warns on Israel attacks on UN charm mission

New Syria leader warns on Israel attacks on UN charm mission

-

In first, China unveils specific emissions targets

-

Alvarez hat-trick helps Atletico edge Rayo thriller

Alvarez hat-trick helps Atletico edge Rayo thriller

-

Con job? Climate change is my job, says island nation leader

-

US stocks fall again while Alibaba gains on big AI push

US stocks fall again while Alibaba gains on big AI push

-

Forest denied winning European return by Antony, Roma down Nice

-

Postecoglou's Forest held by Antony's Betis on European return

Postecoglou's Forest held by Antony's Betis on European return

-

Eze nets first goal as Arsenal join Man City in League Cup last 16

-

Guardians' Fry has facial fractures after taking fastball to face

Guardians' Fry has facial fractures after taking fastball to face

-

Giants to go with rookie QB Dart, bench NFL veteran Wilson

-

Police clashes mar rally for Uganda opposition leader Bobi Wine

Police clashes mar rally for Uganda opposition leader Bobi Wine

-

China unveils steady but restrained climate goals

-

Trump 'incredibly impatient' with Russia on Ukraine, VP Vance says

Trump 'incredibly impatient' with Russia on Ukraine, VP Vance says

-

France, US tell Iran still chance to avoid nuclear sanctions

-

Big news: Annual eating contest roars to life in Fat Bear Week

Big news: Annual eating contest roars to life in Fat Bear Week

-

In UN debut, new Syria leader warns on Israel but backs dialogue

-

Malawi's ex-president Mutharika returns to power in crushing vote win

Malawi's ex-president Mutharika returns to power in crushing vote win

-

Under-fire Brazil senators scrap immunity bid

-

Morikawa calls on US Ryder Cup fans 'to go crazy'

Morikawa calls on US Ryder Cup fans 'to go crazy'

-

India see off Bangladesh to book Asia Cup final spot

-

Rubio calls for Russia to stop the 'killing' in Ukraine

Rubio calls for Russia to stop the 'killing' in Ukraine

-

Macron tells Iran president only hours remain to avert nuclear sanctions

-

UN humanitarian chief slams impunity in face of Gaza 'horror'

UN humanitarian chief slams impunity in face of Gaza 'horror'

-

Danish PM apologises to victims of Greenland forced contraception

Asian markets slide as traders prepare for key US data

Stocks moved narrowly Thursday as traders continue to pull back from the buying that has propelled markets to record highs in recent months, with upcoming US inflation and jobs data seen as likely to be the next catalysts for action.

Investors have been on a buying spree since shares hit deep lows in the wake of Donald Trump's April global tariff bombshell, with sentiment buoyed by trade agreements and signs that the Federal Reserve was about to resume its interest rate cut programme.

The US central bank -- citing a weak labour market and inflation that has not spiked -- last week announced its reduction, and forecast there could be two more this year.

However, while traders have been banking on a period of easing, some Fed officials including boss Jerome Powell are trying to take a more cautious approach, citing still-elevated inflation.

His remarks this week that stocks are "fairly highly valued" and that there was "no risk-free path" on rates has tempered the euphoria on trading floors.

The bank will be keeping watch on the release this week of its preferred gauge of inflation -- the personal consumption expenditure index -- and next week's non-farm payrolls report.

Tokyo held solidly in positive territory early Thursday, but elsewhere flitted between gains and losses.

Hong Kong was flat, even as tech titan Alibaba jumped more than one percent to extend Wednesday's gain of more than nine percent after its chief executive said it planned to ramp up spending on artificial intelligence. Its US-listed stock piled on more than eight percent.

And China's biggest car exporter Chery Automobile rocketed more than 13 percent higher on its trading debut in the city, having raised about US$1.2 billion in its initial public offering.

There were also small losses in Shanghai, Sydney and Singapore while Taipei, Seoul and Manila were barely moved.

That came after a second day of losses in Wall Street for all three main indexes.

While there appears to be some unease in recent days over the latest market rally, economists at Bank of America were upbeat.

"With major regions in easy fiscal mode, and with the Fed cutting against a backdrop of broadening and accelerating profits, it's not hard to argue for a boom in (earnings per share) and GDP growth," they wrote.

"US (capital expenditure) and revisions are broadening beyond tech, sticky inflation could help sales and thus drive operating leverage. This is the higher probability 'tail' in 2026 than stagflation or recession, in our view."

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 0.2 percent at 45,719.71 (break)

Hong Kong - Hang Seng Index: FLAT at 26,525.03

Shanghai - Composite: DOWN 0.1 percent at 3,850.15

Euro/dollar: UP at $1.1745 from $1.1737 on Wednesday

Pound/dollar: UP at $1.3455 from $1.3445

Dollar/yen: DOWN at 148.74 yen from 148.91 yen

Euro/pound: UP at 87.30 pence from 87.29 pence

West Texas Intermediate: DOWN 0.4 percent at $64.73 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $69.09 per barrel

A.Suleiman--SF-PST