-

UN chief says world should not be intimidated by Israel

UN chief says world should not be intimidated by Israel

-

UN chief warns 1.5C warming goal at risk of 'collapsing'

-

Canada coach Rouet only has eyes for World Cup glory after dethroning New Zealand

Canada coach Rouet only has eyes for World Cup glory after dethroning New Zealand

-

Trump-backed panel sows doubt over Covid-19 shots

-

Germany World Cup winner Boateng announces retirement

Germany World Cup winner Boateng announces retirement

-

Canada end New Zealand's reign as world champions with superb semi win

-

Venezuela accuses US of waging 'undeclared war,' urges UN probe

Venezuela accuses US of waging 'undeclared war,' urges UN probe

-

US stocks end at records again as Trump and Xi talk

-

Bayeux Tapestry leaves museum for first time since 1983 before UK loan

Bayeux Tapestry leaves museum for first time since 1983 before UK loan

-

Canada end New Zealand's reign as world champions with superb semi-final win

-

Trump to welcome Turkey's Erdogan, sees end to warplane row

Trump to welcome Turkey's Erdogan, sees end to warplane row

-

Canada bars Irish rap band Kneecap from entering

-

Argentina's Milei says 'political panic' rattling markets

Argentina's Milei says 'political panic' rattling markets

-

Colombia slams 'excessive' US military buildup, warns against Venezuela intervention

-

India beat valiant Oman in Asia Cup T20

India beat valiant Oman in Asia Cup T20

-

International treaty protecting world's oceans to take effect

-

Porsche slows electric shift, prompting VW profit warning

Porsche slows electric shift, prompting VW profit warning

-

Venezuela accuses US of waging 'undeclared war'

-

Hamilton beaming after Ferrari 1-2 in Baku practice as McLaren struggle

Hamilton beaming after Ferrari 1-2 in Baku practice as McLaren struggle

-

Kenya's only breastmilk bank, lifeline for premature babies

-

Hard-working Paolini prolongs Italy's BJK Cup title defence

Hard-working Paolini prolongs Italy's BJK Cup title defence

-

Kenya's Sawe targets Berlin record to salute Kipchoge and Kiptum

-

Painting stripes on cows to lizards' pizza pick: Ig Nobel winners

Painting stripes on cows to lizards' pizza pick: Ig Nobel winners

-

England's Matthews ready for another 'battle' with France in World Cup semi-final

-

UK, Ireland announce new 'Troubles' legacy deal

UK, Ireland announce new 'Troubles' legacy deal

-

Estonia and allies denounce 'reckless' Russian air incursion

-

West Africans deported by US to Ghana sue over detention

West Africans deported by US to Ghana sue over detention

-

Independence of central banks tested by Trump attacks on US Fed

-

New Fed governor says was not told how to vote by Trump

New Fed governor says was not told how to vote by Trump

-

Trio of titles on a golden night for USA at world championships

-

Trump sees progress on TikTok, says will visit China

Trump sees progress on TikTok, says will visit China

-

Biathlete Fourcade awarded sixth Olympic gold 15 years later

-

IOC to again allow Russians under neutral flag at 2026 Winter Olympics

IOC to again allow Russians under neutral flag at 2026 Winter Olympics

-

Arsenal will learn from Lewis-Skelly's Haaland taunt: Arteta

-

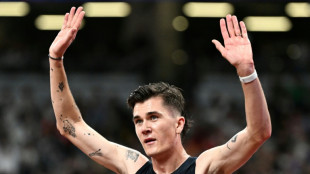

Lyles defies health issues to emulate Bolt's feat

Lyles defies health issues to emulate Bolt's feat

-

UN Security Council votes to reimpose Iran nuclear sanctions

-

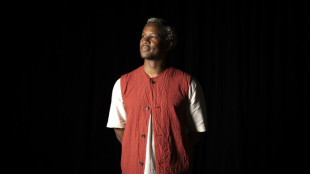

Fresh off Cannes win, Akinola Davies imagines the future of Nigerian film

Fresh off Cannes win, Akinola Davies imagines the future of Nigerian film

-

Elderly British couple released by Taliban arrive in Qatar

-

Bol retains world crown but laments McLaughlin-Levrone absence

Bol retains world crown but laments McLaughlin-Levrone absence

-

Amateur astronomers help track asteroid to French impact site

-

UK launches dark web portal to recruit foreign spies

UK launches dark web portal to recruit foreign spies

-

Roaring Lyles matches Bolt with fourth world 200m title

-

Ratcliffe visit not a Man Utd crisis meeting, says Amorim

Ratcliffe visit not a Man Utd crisis meeting, says Amorim

-

Hamilton tops practice in Ferrari 1-2 as McLaren struggle in Baku

-

Jefferson-Wooden emulates Fraser-Pryce with world sprint double

Jefferson-Wooden emulates Fraser-Pryce with world sprint double

-

Sweden offers $23 bn to finance

nuclear power construction

-

'Not myself' but defending champ Ingebrigtsen into 5,000m final

'Not myself' but defending champ Ingebrigtsen into 5,000m final

-

Spurs boss Frank will ignore league table until April

-

Stocks steady, dollar up as Trump and Xi talk

Stocks steady, dollar up as Trump and Xi talk

-

No letup in migrant crossings after UK-France 'one in one out' deal

US stocks end at records again as Trump and Xi talk

Stock markets steadied and the dollar mostly rose Friday at the end of a week marked by central bank decisions, as attention turned to a call between US President Donald Trump and his Chinese counterpart Xi Jinping.

Wall Street's three main indices finished the week at records for the second day in a row, extending a rally after the Federal Reserve cut interest rates on Wednesday for the first time in 2025.

"Traders are satisfied" with the Fed's decision, said FHN Financial's Chris Low.

The Fed on Wednesday lowered interest rates by 25 basis points and signaled it could cut two more times in 2025. The central bank explained its move as a response to weaker job data, adding that future decisions would depend on how the economy evolves.

But Jack Ablin of Cresset Capital Management noted that the rise in US Treasury yields represents a source of concern.

"I'm going to celebrate the equity records but the market is expensive and the 10-year yields is moving higher," Ablin said. "That's something we need to pay attention to."

Earlier, Europe's main indices ended the day little changed or slightly lower.

Markets greeted a phone call between US President Donald Trump and Chinese President Xi Jinping that included discussion on selling blockbuster app TikTok.

Shortly before European markets closed, Trump said he made progress in his call on a deal for the social networking platform TikTok, though he stopped short of announcing a deal.

"We made progress on many very important issues including Trade, Fentanyl, the need to bring the War between Russia and Ukraine to an end, and the approval of the TikTok Deal," Trump wrote on his Truth Social platform.

He has repeatedly put off a ban under a law designed to force TikTok's Chinese parent company ByteDance to sell its US operations for national security reasons.

The call came after high-level discussions between Washington and Beijing officials in Madrid, where they addressed trade ahead of a November tariff deadline.

Trump said Friday that he would meet Xi at an Asia-Pacific summit in South Korea in just over a month, and visit China himself next year.

Meanwhile, the British pound retreated after official data showed that UK government borrowing had reached its highest level since the Covid pandemic.

In Asia, Tokyo led losses among major indices on expectations that Japan's central bank would hike interest rates this year after leaving borrowing costs unchanged Friday.

Before the announcement, official data showed that inflation in Japan, the world's fourth-largest economy, slowed in August, with rice price increases easing following a spike that had rattled the country's government.

Among individual companies, Apple jumped 3.2 percent as the tech giant's launch of new iPhones was greeted with long lines at retail outlets, suggesting strong demand for the devices.

- Key figures at around 2030 GMT -

New York - Dow: UP 0.4 percent at 46,315.27 (close)

New York - S&P 500: UP 0.5 percent at 6,664.36 (close)

New York - Nasdaq Composite: UP 0.7 percent at 22,631.48 (close)

London - FTSE 100: DOWN 0.1 percent at 9,216.67 (close)

Paris - CAC 40: FLAT at 7,853.59 (close)

Frankfurt - DAX: DOWN 0.2 percent at 23,639.41 (close)

Tokyo - Nikkei 225: DOWN 0.6 percent at 45,045.81 (close)

Hong Kong - Hang Seng Index: FLAT at 26,545.10 (close)

Shanghai - Composite: DOWN 0.3 percent at 3,820.09 (close)

Euro/dollar: DOWN at $1.1745 from $1.1788 on Thursday

Pound/dollar: DOWN at $1.3472 from $1.3555

Dollar/yen: DOWN at 147.90 yen from 148.00 yen

Euro/pound: UP at 87.18 pence from 86.96 pence

Brent North Sea Crude: DOWN 1.1 percent at $66.68 per barrel

West Texas Intermediate: DOWN 1.4 percent at $62.68 per barrel

burs-jmb/des

H.Nasr--SF-PST