-

Scandic Trust Group strengthens sales network with First Idea Consultant

Scandic Trust Group strengthens sales network with First Idea Consultant

-

No end to Sudan fighting despite RSF paramilitaries backing truce plan

-

US officials, NGOs cry foul as Washington snubs UN rights review

US officials, NGOs cry foul as Washington snubs UN rights review

-

Injured teen medal hope Tabanelli risks missing home Winter Olympics

-

Bellingham, Foden recalled to England squad for World Cup qualifiers

Bellingham, Foden recalled to England squad for World Cup qualifiers

-

Tanzania rights group condemns 'reprisal killings' of civilians

-

Slot urges patience as Isak returns to training with Liverpool

Slot urges patience as Isak returns to training with Liverpool

-

Rees-Zammit set for Wales return with bench role against Argentina

-

China's new aircraft carrier enters service in key move to modernise fleet

China's new aircraft carrier enters service in key move to modernise fleet

-

Operation Cloudburst: Dutch train for 'water bomb' floods

-

Leaders turn up the heat on fossil fuels at Amazon climate summit

Leaders turn up the heat on fossil fuels at Amazon climate summit

-

US travel woes mount as govt shutdown prompts flight cuts

-

North Korea fires unidentified ballistic missile: Seoul military

North Korea fires unidentified ballistic missile: Seoul military

-

West Bank's ancient olive tree a 'symbol of Palestinian endurance'

-

Global tech tensions overshadow Web Summit's AI and robots

Global tech tensions overshadow Web Summit's AI and robots

-

Green shines as Suns thump Clippers 115-102

-

Japan to screen #MeToo film months after Oscar nomination

Japan to screen #MeToo film months after Oscar nomination

-

Erasmus relishing 'brutal' France re-match on Paris return

-

Rejuvenated Vlahovic taking the reins for Juve ahead of Turin derby

Rejuvenated Vlahovic taking the reins for Juve ahead of Turin derby

-

'Well-oiled' Leipzig humming along in Bayern's slipstream

-

Bangladesh cricket probes sexual harassment claims

Bangladesh cricket probes sexual harassment claims

-

NFL-best Broncos edge Raiders to win seventh in a row

-

Deadly Typhoon Kalmaegi ravages Vietnam, Philippines

Deadly Typhoon Kalmaegi ravages Vietnam, Philippines

-

Three killed in new US strike on alleged drug boat, toll at 70

-

Chinese microdrama creators turn to AI despite job loss concerns

Chinese microdrama creators turn to AI despite job loss concerns

-

Trump hails Central Asia's 'unbelievable potential' at summit

-

Kolya, the Ukrainian teen preparing for frontline battle

Kolya, the Ukrainian teen preparing for frontline battle

-

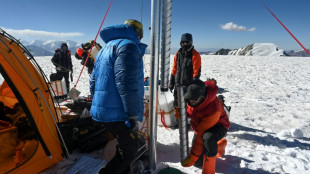

Big leap in quest to get to bottom of climate ice mystery

-

Markets drop as valuations and US jobs, rates spook investors

Markets drop as valuations and US jobs, rates spook investors

-

'Soap opera on cocaine': how vertical dramas flipped Hollywood

-

Under pressure? EU states on edge over migrant burden-sharing

Under pressure? EU states on edge over migrant burden-sharing

-

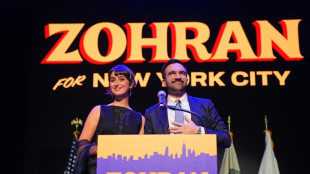

US influencers falsely associate Mamdani with extremist group

-

Hungary's Orban to meet Trump in face of Russia oil sanctions

Hungary's Orban to meet Trump in face of Russia oil sanctions

-

US facing travel chaos as flights cut due to govt shutdown

-

Liverpool and Man City renew rivalry as they try to narrow Arsenal gap

Liverpool and Man City renew rivalry as they try to narrow Arsenal gap

-

UK's Andrew asked to testify over Epstein as he formally loses titles

-

Local hero: 'DC sandwich guy' found not guilty of assaulting officer with sub

Local hero: 'DC sandwich guy' found not guilty of assaulting officer with sub

-

Dead famous: Paris puts heritage graves up for grabs

-

UK grandmother on Indonesia death row flies home

UK grandmother on Indonesia death row flies home

-

Former NFL star Brown extradited from Dubai to face trial in shooting - police

-

Chile presidential hopeful vows to expel 'criminal' migrants to El Salvador

Chile presidential hopeful vows to expel 'criminal' migrants to El Salvador

-

Trump event paused in Oval Office when guest faints

-

NFL Colts add Sauce to recipe while Patriots confront Baker

NFL Colts add Sauce to recipe while Patriots confront Baker

-

Home owned by Miami Heat coach Spoelstra damaged by fire

-

Tesla shareholders approve Musk's $1 trillion pay package

Tesla shareholders approve Musk's $1 trillion pay package

-

World leaders launch fund to save forests, get first $5 bn

-

Villa edge Maccabi Tel Aviv in fraught Europa League match

Villa edge Maccabi Tel Aviv in fraught Europa League match

-

Protests as Villa beat Maccabi Tel Aviv under tight security

-

US Supreme Court backs Trump admin's passport gender policy

US Supreme Court backs Trump admin's passport gender policy

-

Japan boss Jones backs Farrell to revive Ireland's fortunes

Investors walk fine line as Trump tariffs temper rate hopes

Asian investors trod warily Wednesday amid lingering uncertainty over Donald Trump's trade war, while another round of data indicated further weakness in the US economy but added interest rate cut speculation.

The US president's claim that Washington was "very close to a deal" to extend a China truce provided some optimism, though that was tempered by his warning of fresh levies on pharmaceuticals and chips.

After a strong start to the week sparked by hopes that painful jobs data will force the US Federal Reserve to lower rates next month, another batch of figures added fuel to the fire.

A closely watched index of services activity showed it had barely grown in July as companies contend with weaker hiring conditions and rising prices.

The news came after Friday's jobs data revealed far fewer US jobs were created than expected in May, June and July.

"Market pricing has moved aggressively in favour of a September rate cut by the Federal Reserve, after a weak July jobs report and ugly revisions to May and June signalled the US labour market may finally be cracking under the pressure of tariffs," said Neil Wilson at Saxo Markets.

"The data pushed the US closer to stagflationary territory," he said.

"So far, the market has held up and looked beyond the tariff risks, but we may at last be seeing the hard data finally catch up with the soft survey data."

But while bets on a rate cut in September have soared, he remained unsure that such a move was a certainty.

Stocks fluctuated through the morning.

Tokyo, Shanghai, Sydney, Wellington, Manila and Jakarta rose but Hong Kong, Singapore, Seoul and Taipei were in the red.

Confidence remains thin as Trump's tariff threats linger, with several countries -- including India and Switzerland -- still to hammer out deals before his delayed deadline Thursday, and agreed levies with others begin to kick in.

In his latest salvo, Trump told CNBC he was looking at hitting pharmaceuticals with tolls that eventually reach 250 percent, while semiconductors were also in the firing line.

He has said he will also hammer India over its purchases of Russian oil.

Still, Trump did strike a positive note on China, which is in talks with US officials to continue a truce agreed in May that saw the world's two largest economies pare down their eye-watering triple-digit tariffs.

Regarding Chinese President Xi Jinping, Trump told CNBC's "Squawk Box" that "I'll end up having a meeting before the end of the year, most likely, if we make a deal.

"If we don't make a deal, I'm not going to have a meeting. I mean, you know, what's the purpose of meeting if we're not going to make a deal?

"But we're getting very close to a deal."

He added that his relationship with Xi was "very good" and that "I think we'll make a good deal. It's not imperative, but I think we're going to make a good deal".

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 0.6 percent at 40,802.73 (break)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 24,844.94

Shanghai - Composite: UP 0.1 percent at 3,619.78

Euro/dollar: DOWN at $1.1570 from $1.1582 on Tuesday

Pound/dollar: UP at $1.3303 from $1.3294

Dollar/yen: UP at 147.61 yen from 147.55 yen

Euro/pound: DOWN at 86.97 pence from 87.01 pence

West Texas Intermediate: UP 0.5 percent at $65.46 per barrel

Brent North Sea Crude: UP 0.5 percent at $67.96 per barrel

New York - Dow: DOWN 0.1 percent at 44,111.74 (close)

London - FTSE 100: UP 0.2 percent at 9,142.73 (close)

C.Hamad--SF-PST