-

Scandic Trust Group strengthens sales network with First Idea Consultant

Scandic Trust Group strengthens sales network with First Idea Consultant

-

No end to Sudan fighting despite RSF paramilitaries backing truce plan

-

US officials, NGOs cry foul as Washington snubs UN rights review

US officials, NGOs cry foul as Washington snubs UN rights review

-

Injured teen medal hope Tabanelli risks missing home Winter Olympics

-

Bellingham, Foden recalled to England squad for World Cup qualifiers

Bellingham, Foden recalled to England squad for World Cup qualifiers

-

Tanzania rights group condemns 'reprisal killings' of civilians

-

Slot urges patience as Isak returns to training with Liverpool

Slot urges patience as Isak returns to training with Liverpool

-

Rees-Zammit set for Wales return with bench role against Argentina

-

China's new aircraft carrier enters service in key move to modernise fleet

China's new aircraft carrier enters service in key move to modernise fleet

-

Operation Cloudburst: Dutch train for 'water bomb' floods

-

Leaders turn up the heat on fossil fuels at Amazon climate summit

Leaders turn up the heat on fossil fuels at Amazon climate summit

-

US travel woes mount as govt shutdown prompts flight cuts

-

North Korea fires unidentified ballistic missile: Seoul military

North Korea fires unidentified ballistic missile: Seoul military

-

West Bank's ancient olive tree a 'symbol of Palestinian endurance'

-

Global tech tensions overshadow Web Summit's AI and robots

Global tech tensions overshadow Web Summit's AI and robots

-

Green shines as Suns thump Clippers 115-102

-

Japan to screen #MeToo film months after Oscar nomination

Japan to screen #MeToo film months after Oscar nomination

-

Erasmus relishing 'brutal' France re-match on Paris return

-

Rejuvenated Vlahovic taking the reins for Juve ahead of Turin derby

Rejuvenated Vlahovic taking the reins for Juve ahead of Turin derby

-

'Well-oiled' Leipzig humming along in Bayern's slipstream

-

Bangladesh cricket probes sexual harassment claims

Bangladesh cricket probes sexual harassment claims

-

NFL-best Broncos edge Raiders to win seventh in a row

-

Deadly Typhoon Kalmaegi ravages Vietnam, Philippines

Deadly Typhoon Kalmaegi ravages Vietnam, Philippines

-

Three killed in new US strike on alleged drug boat, toll at 70

-

Chinese microdrama creators turn to AI despite job loss concerns

Chinese microdrama creators turn to AI despite job loss concerns

-

Trump hails Central Asia's 'unbelievable potential' at summit

-

Kolya, the Ukrainian teen preparing for frontline battle

Kolya, the Ukrainian teen preparing for frontline battle

-

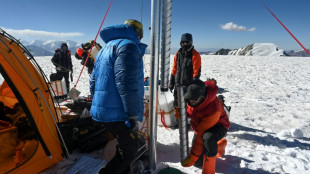

Big leap in quest to get to bottom of climate ice mystery

-

Markets drop as valuations and US jobs, rates spook investors

Markets drop as valuations and US jobs, rates spook investors

-

'Soap opera on cocaine': how vertical dramas flipped Hollywood

-

Under pressure? EU states on edge over migrant burden-sharing

Under pressure? EU states on edge over migrant burden-sharing

-

US influencers falsely associate Mamdani with extremist group

-

Hungary's Orban to meet Trump in face of Russia oil sanctions

Hungary's Orban to meet Trump in face of Russia oil sanctions

-

US facing travel chaos as flights cut due to govt shutdown

-

Liverpool and Man City renew rivalry as they try to narrow Arsenal gap

Liverpool and Man City renew rivalry as they try to narrow Arsenal gap

-

UK's Andrew asked to testify over Epstein as he formally loses titles

-

Local hero: 'DC sandwich guy' found not guilty of assaulting officer with sub

Local hero: 'DC sandwich guy' found not guilty of assaulting officer with sub

-

Dead famous: Paris puts heritage graves up for grabs

-

UK grandmother on Indonesia death row flies home

UK grandmother on Indonesia death row flies home

-

Former NFL star Brown extradited from Dubai to face trial in shooting - police

-

Chile presidential hopeful vows to expel 'criminal' migrants to El Salvador

Chile presidential hopeful vows to expel 'criminal' migrants to El Salvador

-

Trump event paused in Oval Office when guest faints

-

NFL Colts add Sauce to recipe while Patriots confront Baker

NFL Colts add Sauce to recipe while Patriots confront Baker

-

Home owned by Miami Heat coach Spoelstra damaged by fire

-

Tesla shareholders approve Musk's $1 trillion pay package

Tesla shareholders approve Musk's $1 trillion pay package

-

World leaders launch fund to save forests, get first $5 bn

-

Villa edge Maccabi Tel Aviv in fraught Europa League match

Villa edge Maccabi Tel Aviv in fraught Europa League match

-

Protests as Villa beat Maccabi Tel Aviv under tight security

-

US Supreme Court backs Trump admin's passport gender policy

US Supreme Court backs Trump admin's passport gender policy

-

Japan boss Jones backs Farrell to revive Ireland's fortunes

Oil giant BP surprises with better than expected earnings

Oil giant BP, which recently pivoted away from green energy, posted Tuesday better-than-expected quarterly earnings and announced a fresh review of costs.

The British group's return to profit in the second quarter contrasted with weaker results from energy rivals, as lower exceptional charges offset falling oil prices.

Profit after tax came in at $1.63 billion in the April-June period, compared with a net loss of $129 million in the second quarter of 2024, BP said in an earnings statement.

Stripping out exceptional items, underlying net profit was down nearly 15 percent.

"This has been another strong quarter for BP operationally and strategically," chief executive Murray Auchincloss said in the earnings statement.

BP on Monday said it made its biggest oil and gas discovery in 25 years off the coast of Brazil.

In February, BP launched a major pivot back to its more profitable oil and gas business, shelving its once industry-leading targets on reducing carbon emissions and slashing clean energy investment.

However, energy prices have come under pressure in recent months on concerns that US President Donald Trump's tariffs will hurt economic growth, while OPEC+ nations have produced more oil.

BP managed to post a profit for the second quarter thanks to impairments which were lower than one year earlier, along with a revaluation of assets -- notably in relation to liquefied natural gas (LNG) -- and divestments.

- Sector woes -

By contrast, US rivals ExxonMobil and Chevron, along with French group TotalEnergies, posted heavy falls to their net profits in the second quarter.

As did oil giant Saudi Aramco, which on Tuesday announced its 10th straight drop in quarterly profits as a slump in prices hit revenues.

The average price for Brent North Sea crude, the international benchmark, stood at $67.9 per barrel in the second quarter, down from $85 one year earlier.

British rival Shell still managed to post a slight increase to its profit after tax for the latest reporting period.

As for BP, Auchincloss said the company was launching "a further cost review and, whilst we will not compromise on safety, we are doing this with a view to being best in class in our industry".

Shares in BP gained 2.2 percent in London morning deals following its results and news of a fresh dividend and share buyback.

"A slick turnaround plan pumped up BP's second-quarter results," noted Derren Nathan, head of equity research at Hargreaves Lansdown.

"Despite lower oil and gas prices, it's managed to push underlying profits up by nearly $1 billion from the first quarter to $2.4 billion, well ahead of analyst forecasts."

Nathan added that "shareholders will be glad to see this matched with financial discipline".

BP already announced plans this year to cut cleaner energy investment by more than $5 billion annually and offload assets worth a total of $20 billion by 2027.

It recently agreed to sell its onshore wind energy business in the United States, while Shell has also scaled back its climate objectives.

BP last month named Albert Manifold as its new chairman, replacing Helge Lund, whose departure was announced amid the strategy reset.

The group's net profit plunged 70 percent in its first quarter, hit by weaker oil prices.

burs-bcp/ajb/lth

A.AlHaj--SF-PST