-

'Science refugees': French university welcomes first US researchers

'Science refugees': French university welcomes first US researchers

-

Eala makes history as first Filipina to reach WTA Tour final

-

Gaza rescuers say 62 killed by Israeli forces

Gaza rescuers say 62 killed by Israeli forces

-

Capes, tailcoats and cravats: Dior gets its teeth into Dracula chic

-

England chief Key confident 'pure talent' Archer can pick up Test career

England chief Key confident 'pure talent' Archer can pick up Test career

-

US stocks hit record on US-China trade progress

-

Kriel 'excited' to skipper Boks after Kolisi withdrawal

Kriel 'excited' to skipper Boks after Kolisi withdrawal

-

Bielle-Biarrey set for Top 14 final return after 'spectacular change'

-

US Fed's preferred inflation gauge picks up as tariff effects loom

US Fed's preferred inflation gauge picks up as tariff effects loom

-

Sri Lanka spinners leave Bangladesh on verge of crushing defeat

-

Swiatek sweeps past Paolini into first grass-court final in Germany

Swiatek sweeps past Paolini into first grass-court final in Germany

-

Russell tops opening practice in Austria

-

MSF slams US-backed Gaza aid scheme as 'slaughter masquerading' as aid

MSF slams US-backed Gaza aid scheme as 'slaughter masquerading' as aid

-

Lorde kicks off Glastonbury festival with surprise set

-

Alex Marquez dismisses helping brother Marc's title bid

Alex Marquez dismisses helping brother Marc's title bid

-

Son of Norway princess suspected of three rapes

-

Alive but weakened, Iran's Khamenei faces new challenges

Alive but weakened, Iran's Khamenei faces new challenges

-

Heatwave across the Med sparks health and fire warnings

-

UAE name powerful team to support Pogacar in Tour de France

UAE name powerful team to support Pogacar in Tour de France

-

Stocks rise as US-China reach trade deal framework

-

Alcaraz starts Wimbledon defence against Fognini

Alcaraz starts Wimbledon defence against Fognini

-

Spain makes Booking.com scrap 4,000 tourist rental ads

-

One of Hong Kong's last opposition parties says it will disband

One of Hong Kong's last opposition parties says it will disband

-

UK govt climbs down on welfare cuts in latest U-turn

-

Kusal Mendis steers Sri Lanka to commanding lead over Bangladesh

Kusal Mendis steers Sri Lanka to commanding lead over Bangladesh

-

Anderson teases Dior debut with Mbappe, Basquiat and Marie Antoinette

-

Global tensions rattle COP30 build-up but 'failure not an option'

Global tensions rattle COP30 build-up but 'failure not an option'

-

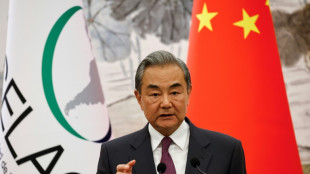

China's top diplomat to visit EU, Germany, France next week

-

Manager Van Nistelrooy leaves relegated Leicester

Manager Van Nistelrooy leaves relegated Leicester

-

Eel-eating Japan opposes EU call for more protection

-

Messi's PSG reunion, Real Madrid face Juventus in Club World Cup last 16

Messi's PSG reunion, Real Madrid face Juventus in Club World Cup last 16

-

China confirms trade deal framework reached with United States

-

Dollar holds losses on rate cut bets, trade hope boosts stocks

Dollar holds losses on rate cut bets, trade hope boosts stocks

-

India accused of illegal deportations targeting Muslims

-

Australia and Lions yet to resolve tour sticking point

Australia and Lions yet to resolve tour sticking point

-

Green bonds offer hope, and risk, in Africa's climate fight

-

Game 'reloots' African artefacts from Western museums

Game 'reloots' African artefacts from Western museums

-

Renters struggle to survive in Portugal housing crisis

-

Western Japan sees earliest end to rainy season on record

Western Japan sees earliest end to rainy season on record

-

Ketamine 'epidemic' among UK youth raises alarm

-

'Shocking' COP30 lodging costs heap pressure on Brazil

'Shocking' COP30 lodging costs heap pressure on Brazil

-

India investigates 'unnatural' death of five tigers

-

Anderson teases Dior debut with Mbappe, Basquiet and Marie Antoinette

Anderson teases Dior debut with Mbappe, Basquiet and Marie Antoinette

-

Bangladesh pushes solar to tackle energy woes

-

Wallabies veteran White relishing 'unreal' Lions opportunity

Wallabies veteran White relishing 'unreal' Lions opportunity

-

Hong Kong's dragnet widens 5 years after national security law

-

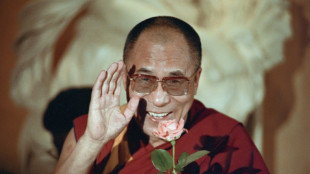

Tibetans face up to uncertain future as Dalai Lama turns 90

Tibetans face up to uncertain future as Dalai Lama turns 90

-

'Simple monk': the Dalai Lama, in his translator's words

-

Man City crush Juventus, Real Madrid reach Club World Cup last 16

Man City crush Juventus, Real Madrid reach Club World Cup last 16

-

Stocks climb, dollar holds on trade hopes and rate bets

Stocks rise as US-China reach trade deal framework

European stocks rose Friday as the United States and China moved closer to a trade deal and as hopes of a further delay to reciprocal tariffs were boosted.

With the Israel-Iran ceasefire holding, investors turned attention back to the wider economy and the US president's trade war.

"The key theme for markets in the next week and a half will be US trade agreements," ahead of the July 9 deadline ending reciprocal tariff reprieves, said Kathleen Brooks, research director at trading group XTB.

President Donald Trump on Thursday said the United States had signed a deal relating to trade with China, without providing further details.

China said Friday that Washington would lift "restrictive measures", while Beijing would "review and approve" items under export controls.

Adding to positive market sentiment, US Treasury Secretary Scott Bessent said a "revenge tax" on foreign-owned companies would be dropped from Trump's tax bill as he signalled a forthcoming agreement with G7 nations to exempt US firms from certain taxes.

European stock markets rose Friday, with the Paris CAC 40 leading the way around midday, boosted by a rise in luxury stocks.

Traders brushed off data showing that inflation edged up in France and Spain in June, even as it added to speculation that the European Central Bank may pause its interest rate-cut cycle.

Investor also awaited the release of the US Federal Reserve's preferred inflation measure for May due Friday.

In Asia, Tokyo rallied more than one percent to break 40,000 points for the first time since January, while Hong Kong and Shanghai equities closed lower.

Separately on Thursday, the White House indicated that Washington could extend a July deadline when steeper tariffs affecting dozens of economies are due to kick in.

The president imposed a 10-percent tariff on goods from nearly every country at start of April, but he put off higher rates on dozens of nations to allow for talks.

- Weaker dollar -

The dollar held around three-year lows Friday as traders ramp up bets on US interest rate cuts, especially after Trump hinted at replacing Fed chief Jerome Powell.

The prospect of lower borrowing costs sent the Dollar Index, which compares the greenback to a basket of major currencies, to its lowest level since March 2022.

Weak economic data on Thursday -- showing that the world's top economy contracted more than previous estimate in the first quarter and softer cosumer spending -- further fuelled rate cut expectations.

All three main equity indices on Wall Street rallied Thursday, with the Nasdaq hitting a record high and the S&P 500 within a whisker of a new closing peak.

In company news, shares in Chinese smartphone maker Xiaomi jumped more than three percent to a record high in Hong Kong as it enjoyed strong early orders for its YU7 sport utility vehicle, its second foray into the competitive electric vehicle market.

- Key figures at around 1040 GMT -

London - FTSE 100: UP 0.5 percent at 8,781.49 points

Paris - CAC 40: UP 1.3 percent at 7,654.06

Frankfurt - DAX: UP 0.7 percent at 23,806.46

Tokyo - Nikkei 225: UP 1.4 percent at 40,150.79 (close)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 24,284.15 (close)

Shanghai - Composite: DOWN 0.7 percent at 3,424.23 (close)

New York - Dow: UP 0.9 percent at 43,386.84 (close)

Euro/dollar: UP at $1.1704 from $1.1701 on Thursday

Pound/dollar: DOWN at $1.3724 from $1.3725

Dollar/yen: UP at 144.59 yen from 144.44 yen

Euro/pound: UP at 85.29 pence from 85.22 pence

West Texas Intermediate: UP 0.7 percent at $65.70 per barrel

Brent North Sea Crude: UP 0.6 percent at $67.07 per barrel

O.Salim--SF-PST