-

Son of Norway princess suspected of three rapes

Son of Norway princess suspected of three rapes

-

Alive but weakened, Iran's Khamenei faces new challenges

-

Heatwave across the Med sparks health and fire warnings

Heatwave across the Med sparks health and fire warnings

-

UAE name powerful team to support Pogacar in Tour de France

-

Stocks rise as US-China reach trade deal framework

Stocks rise as US-China reach trade deal framework

-

Alcaraz starts Wimbledon defence against Fognini

-

Spain makes Booking.com scrap 4,000 tourist rental ads

Spain makes Booking.com scrap 4,000 tourist rental ads

-

One of Hong Kong's last opposition parties says it will disband

-

UK govt climbs down on welfare cuts in latest U-turn

UK govt climbs down on welfare cuts in latest U-turn

-

Kusal Mendis steers Sri Lanka to commanding lead over Bangladesh

-

Anderson teases Dior debut with Mbappe, Basquiat and Marie Antoinette

Anderson teases Dior debut with Mbappe, Basquiat and Marie Antoinette

-

Global tensions rattle COP30 build-up but 'failure not an option'

-

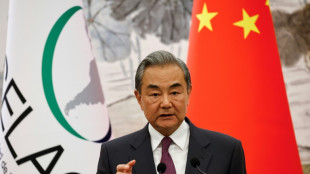

China's top diplomat to visit EU, Germany, France next week

China's top diplomat to visit EU, Germany, France next week

-

Manager Van Nistelrooy leaves relegated Leicester

-

Eel-eating Japan opposes EU call for more protection

Eel-eating Japan opposes EU call for more protection

-

Messi's PSG reunion, Real Madrid face Juventus in Club World Cup last 16

-

China confirms trade deal framework reached with United States

China confirms trade deal framework reached with United States

-

Dollar holds losses on rate cut bets, trade hope boosts stocks

-

India accused of illegal deportations targeting Muslims

India accused of illegal deportations targeting Muslims

-

Australia and Lions yet to resolve tour sticking point

-

Green bonds offer hope, and risk, in Africa's climate fight

Green bonds offer hope, and risk, in Africa's climate fight

-

Game 'reloots' African artefacts from Western museums

-

Renters struggle to survive in Portugal housing crisis

Renters struggle to survive in Portugal housing crisis

-

Western Japan sees earliest end to rainy season on record

-

Ketamine 'epidemic' among UK youth raises alarm

Ketamine 'epidemic' among UK youth raises alarm

-

'Shocking' COP30 lodging costs heap pressure on Brazil

-

India investigates 'unnatural' death of five tigers

India investigates 'unnatural' death of five tigers

-

Anderson teases Dior debut with Mbappe, Basquiet and Marie Antoinette

-

Bangladesh pushes solar to tackle energy woes

Bangladesh pushes solar to tackle energy woes

-

Wallabies veteran White relishing 'unreal' Lions opportunity

-

Hong Kong's dragnet widens 5 years after national security law

Hong Kong's dragnet widens 5 years after national security law

-

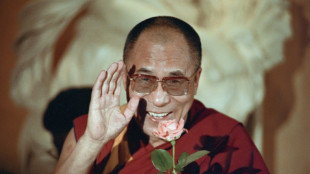

Tibetans face up to uncertain future as Dalai Lama turns 90

-

'Simple monk': the Dalai Lama, in his translator's words

'Simple monk': the Dalai Lama, in his translator's words

-

Man City crush Juventus, Real Madrid reach Club World Cup last 16

-

Stocks climb, dollar holds on trade hopes and rate bets

Stocks climb, dollar holds on trade hopes and rate bets

-

Bezos, Sanchez to say 'I do' in Venice

-

Vinicius stars as Real Madrid ease into Club World Cup last 16

Vinicius stars as Real Madrid ease into Club World Cup last 16

-

New-look Wimbledon prepares for life without line judges

-

Japan executes 'Twitter killer' who murdered nine

Japan executes 'Twitter killer' who murdered nine

-

UN conference seeks foreign aid rally as Trump cuts bite

-

Dying breed: Tunisian dog lovers push to save age-old desert hound

Dying breed: Tunisian dog lovers push to save age-old desert hound

-

Springboks launch 'really tough season' against Barbarians

-

Syria's wheat war: drought fuels food crisis for 16 million

Syria's wheat war: drought fuels food crisis for 16 million

-

Ex-All Black Kaino's Toulouse not expecting 'walkover' in Top 14 final

-

Rwanda, DRC to ink peace deal in US but questions remain

Rwanda, DRC to ink peace deal in US but questions remain

-

Combs defense team set to take the floor in trial's closing arguments

-

Fraser-Pryce eases through in Jamaica trials farewell

Fraser-Pryce eases through in Jamaica trials farewell

-

US Treasury signals G7 deal excluding US firms from some taxes

-

Combs created 'climate of fear' as head of criminal ring: prosecutors

Combs created 'climate of fear' as head of criminal ring: prosecutors

-

Chelsea's Fernandez flying ahead of Benfica reunion at Club World Cup

Dollar holds losses on rate cut bets, trade hope boosts stocks

The dollar held around three-year lows Friday as traders ramp up bets on US interest rate cuts, while most stock markets rose on hopes Donald Trump will further delay imposing tough tariffs.

With the Israel-Iran ceasefire holding for now, investors were able to turn their attention back to the economy and the US president's trade war.

Bets on a Federal Reserve rate cut jumped this week after Trump said he had candidates in mind to succeed boss Jerome Powell when he leaves next year, with reports saying he would make an announcement as early as September.

That was followed Thursday by data showing the world's top economy contracted more than previously estimated in the first quarter and consumer spending grew less than expected.

Traders are now fully expecting two rate cuts this year, while there was a pick-up in bets on a third, according to Bloomberg News.

Powell, who has faced pressure from Trump to move sooner, appeared to take a dovish turn in a deposition to lawmakers this week, while several other Fed officials have also hinted at a softer approach.

The prospect of lower borrowing costs sent the Dollar Index, which compares the greenback to a basket of major currencies, to its lowest level since March 2022.

And while it edged slightly higher Friday it remained under pressure, with the pound and euro at levels last seen in 2021 and the Taiwan dollar hitting its strongest point since April 2022.

"For the dollar to see a sustained counter-rally, I would argue we'd need US growth to pick up and implied Fed rate cuts to be repriced -- perhaps with growth data in Europe and China also slowing," said Pepperstone's Chris Weston.

"That doesn’t seem likely in the near term, and as such, rallies in the dollar are likely to be quickly sold off, with the downtrend set to continue."

All three main equity indexes on Wall Street rallied, with the Nasdaq hitting a record high and the S&P 500 within a whisker of a new closing peak.

In Asia, Tokyo rallied more than one percent to break 40,000 for the first time since January, while Singapore, Wellington, Taipei, Manila and Mumbai were also up, along with London, Paris and Frankfurt.

Hong Kong, Shanghai, Sydney, Seoul and Bangkok fell.

Trade war worries were tempered slightly Thursday after the White House said Trump could extend his deadline for agreeing deals to avert painful tariffs.

The president announced a swathe of levies on trading partners at the start of April but quickly said he would pause them until July 9 to allow for talks but few agreements have been reached so far.

When asked if there would be another delay, press secretary Karoline Leavitt told reporters: "Perhaps it could be extended, but that's a decision for the president to make.

"The deadline is not critical.

"The president can simply provide these countries with a deal if they refuse to make us one by the deadline."

This means Trump can "pick a reciprocal tariff rate that he believes is advantageous for the United States", she added.

The administration also signalled progress on trade with China, with US Commerce Secretary Howard Lutnick saying they had "signed and sealed" an understanding reached in Geneva last month.

Those talks saw the two slash eye-watering tit-for-tat tariffs and address other key issues including China's export of rare earths used in smartphones and electric vehicles, while Beijing was keen to see an easing of restrictions on its access to tech goods.

Beijing "confirmed details" of the deal on Friday, adding that Washington would lift "restrictive measures" while Beijing would "review and approve" items under export controls.

In company news, Chinese smartphone maker Xiaomi soared eight percent to a record high in Hong Kong as it enjoyed strong early orders for its YU7 sports utility vehicle, its second foray into the competitive electric vehicle market.

- Key figures at around 0715 GMT -

Tokyo - Nikkei 225: UP 1.4 percent at 40,150.79 (close)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 24,274.08

Shanghai - Composite: DOWN 0.7 percent at 3,424.23 (close)

London - FTSE 100: UP 0.3 percent at 8,763.22

Euro/dollar: UP at $1.1714 from $1.1701 on Thursday

Pound/dollar: UP at $1.3744 from $1.3725

Dollar/yen: DOWN at 144.26 yen from 144.44 yen

Euro/pound: UP at 85.23 pence from 85.22 pence

West Texas Intermediate: UP 0.6 percent at $65.62 per barrel

Brent North Sea Crude: UP 0.5 percent at $68.08 per barrel

New York - Dow: UP 0.9 percent at 43,386.84 (close)

R.Halabi--SF-PST