-

Swiss 'Mountain Tinder' sparks high-altitude attraction

Swiss 'Mountain Tinder' sparks high-altitude attraction

-

Hong Kong hit by flooding after flurry of rainstorm warnings

-

Asian markets track Wall St rally on Fed rate cut bets

Asian markets track Wall St rally on Fed rate cut bets

-

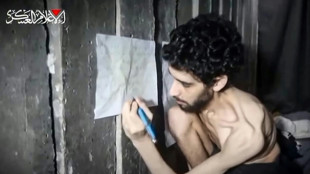

Gaza war deepens Israel's divides

-

Beijing lifts rain alert after evacuating over 80,000

Beijing lifts rain alert after evacuating over 80,000

-

Decision time as plastic pollution treaty talks begin

-

Zverev ignores fan distraction to advance to ATP Toronto semis

Zverev ignores fan distraction to advance to ATP Toronto semis

-

Remains of 32 people found in Mexico's Guanajuato state

-

Trump tariffs don't spare his fans in EU

Trump tariffs don't spare his fans in EU

-

Brazil judge puts ex-president Bolsonaro under house arrest

-

With six months to go, Winter Games organisers say they'll be ready

With six months to go, Winter Games organisers say they'll be ready

-

Rybakina to face teen Mboko in WTA Canadian Open semis

-

Australia to buy 11 advanced warships from Japan

Australia to buy 11 advanced warships from Japan

-

Five years after Beirut port blast, Lebanese demand justice

-

Stella Rimington, first woman to lead UK's MI5 dies at 90

Stella Rimington, first woman to lead UK's MI5 dies at 90

-

Trump admin to reinstall Confederate statue toppled by protesters

-

Rybakina advances to WTA Canadian Open semis

Rybakina advances to WTA Canadian Open semis

-

Brazilian judge places ex-president Bolsonaro under house arrest

-

Brazil judge places ex-president Bolsonaro under house arrest

Brazil judge places ex-president Bolsonaro under house arrest

-

NGOs caught between juntas and jihadists in turbulent Sahel

-

NBA Spurs agree to four-year extension with Fox: reports

NBA Spurs agree to four-year extension with Fox: reports

-

Stocks mostly rebound on US interest rate cut bets

-

Boeing defense workers launch strike over contract dispute

Boeing defense workers launch strike over contract dispute

-

Grand Canyon fire rages, one month on

-

Djokovic withdraws from ATP Cincinnati Masters

Djokovic withdraws from ATP Cincinnati Masters

-

Brazil's Paixao promises 'big things' at Marseille unveiling

-

Shubman Gill: India's elegant captain

Shubman Gill: India's elegant captain

-

Trump says to name new labor statistics chief this week

-

England v India: Three talking points

England v India: Three talking points

-

Exceptional Nordic heatwave stumps tourists seeking shade

-

'Musical cocoon': Polish mountain town hosts Chopin fest

'Musical cocoon': Polish mountain town hosts Chopin fest

-

A 'Thinker' drowns in plastic garbage as UN treaty talks open

-

India's Siraj 'woke up believing' ahead of Test heroics

India's Siraj 'woke up believing' ahead of Test heroics

-

Israeli PM says to brief army on Gaza war plan

-

Frustrated Stokes refuses to blame Brook for England collapse

Frustrated Stokes refuses to blame Brook for England collapse

-

Moscow awaits 'important' Trump envoy visit before sanctions deadline

-

Schick extends Bayer Leverkusen contract until 2030

Schick extends Bayer Leverkusen contract until 2030

-

Tesla approves $29 bn in shares to Musk as court case rumbles on

-

Stocks rebound on US rate cut bets

Stocks rebound on US rate cut bets

-

Swiss eye 'more attractive' offer for Trump after tariff shock

-

Trump says will name new economics data official this week

Trump says will name new economics data official this week

-

Three things we learned from the Hungarian Grand Prix

-

Lions hooker Sheehan banned over Lynagh incident

Lions hooker Sheehan banned over Lynagh incident

-

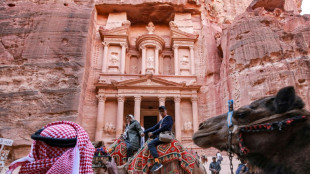

Jordan sees tourism slump over Gaza war

-

China's Baidu to deploy robotaxis on rideshare app Lyft

China's Baidu to deploy robotaxis on rideshare app Lyft

-

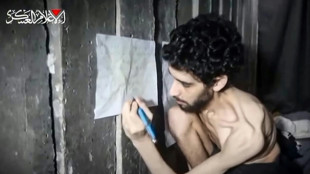

Israel wants world attention on hostages held in Gaza

-

Pacific algae invade Algeria beaches, pushing humans and fish away

Pacific algae invade Algeria beaches, pushing humans and fish away

-

Siraj stars as India beat England by six runs in fifth-Test thriller

-

Stocks mostly rise as traders boost US rate cut bets

Stocks mostly rise as traders boost US rate cut bets

-

S.Africa eyes new markets after US tariffs: president

| BCC | -0.77% | 82.71 | $ | |

| CMSC | 0.87% | 23.07 | $ | |

| JRI | 0.76% | 13.2 | $ | |

| BCE | -1.12% | 23.31 | $ | |

| CMSD | 1.18% | 23.63 | $ | |

| AZN | 0.86% | 74.59 | $ | |

| SCS | 38.6% | 16.58 | $ | |

| NGG | 1.14% | 72.65 | $ | |

| SCU | 0% | 12.72 | $ | |

| GSK | 0.32% | 37.68 | $ | |

| RBGPF | 0% | 74.94 | $ | |

| RIO | 0.58% | 60 | $ | |

| BTI | 2.16% | 55.55 | $ | |

| RYCEF | 2.14% | 14.5 | $ | |

| VOD | 0.72% | 11.04 | $ | |

| RELX | 0.73% | 51.97 | $ | |

| BP | 2.28% | 32.49 | $ |

Trump-Xi call fuels market optimism but US stocks slip on Musk row

Wall Street closed lower Thursday as a spat between President Donald Trump and his billionaire former aide Elon Musk spilled into the public eye, but global markets were mixed while investors assessed trade talks between Washington and Beijing.

Major US indexes fell, with shares in Musk's electric vehicle company Tesla tanking more than 14 percent as the US leader threatened to tear up the tycoon's government contracts.

Trump expressed disappointment Thursday with his top donor's criticisms of a "big, beautiful" spending bill before Congress, prompting Musk to hit back in real time.

But markets were "holding up reasonably well" otherwise, said Patrick O'Hare of Briefing.com.

Earlier Thursday, Trump and Chinese President Xi Jinping held a long-awaited call focused almost entirely on trade.

"The call lasted approximately one and a half hours, and resulted in a very positive conclusion for both Countries," Trump said on his Truth Social platform. He added that US and Chinese teams would hold a new meeting "shortly."

The market "initially took a positive view of that call," O'Hare said. This was "largely because it seemed that the tone of the call was more conciliatory than combative."

Previously, the world's two biggest economies blamed each other for jeopardizing a temporary truce in their escalating tariffs war.

City Index and FOREX.com analyst Fawad Razaqzada said markets hoped the direct line between Washington and Beijing could ease trade tensions, even if momentarily.

But he added: "It is super important that the Trump-Xi call now leads to some concrete movement."

Since his return to the White House, Trump has launched wide-ranging tariffs including a 10 percent levy on most US trading partners, while subjecting goods from China to elevated rates.

- Euro boost -

Meanwhile, the euro got a boost from the European Central Bank signaling an end to its rate-cut cycle.

European stock markets closed mixed even though the ECB cut its key deposit rate a quarter point to two percent, as expected.

It was its eighth reduction since June last year when it began lowering borrowing costs.

But ECB President Christine Lagarde stated the central bank is "getting to the end" of the rate-cutting cycle.

That sent the euro surging against the dollar and European stocks gave up earlier gains.

The ECB's series of cuts stands in contrast to the US Federal Reserve, which has kept rates on hold recently amid fears that Trump's levies could stoke inflation in the world's top economy.

Investors are now looking to the release on Friday of US payrolls data, which could have a bearing on monetary policy.

Other data has been mixed. April jobs openings data beat expectations but according to payroll firm ADP, private sector jobs rose by only 37,000 last month, slowing from April.

Another survey showed activity in the US services sector contracted in May for the first time since June last year.

The readings stoked concerns that the US economy was stuttering.

The readings ramped up bets on a Fed cut, with markets pricing in two by the end of the year, starting in September.

- Key figures at around 2100 GMT -

New York - Dow: DOWN 0.3 percent at 42,319.74 points (close)

New York - S&P 500: DOWN 0.5 percent at 5,939.30 (close)

New York - Nasdaq Composite: DOWN 0.8 percent at 19,298.45 (close)

Paris - CAC 40: DOWN 0.2 percent at 7,790.27 (close)

Frankfurt - DAX: UP 0.2 percent at 24,323.58 (close)

London - FTSE 100: UP 0.1 percent at 8,811.04 (close)

Tokyo - Nikkei 225: DOWN 0.5 percent at 37,554.49 (close)

Hong Kong - Hang Seng Index: UP 1.1 percent at 23,906.97 (close)

Shanghai - Composite: UP 0.2 percent at 3,384.10 (close)

Euro/dollar: UP at $1.1444 from $1.1417 on Wednesday

Pound/dollar: UP at $1.3571 from $1.3548

Dollar/yen: UP at 143.58 yen from 142.86 yen

Euro/pound: UP at 84.31 pence from 84.26 pence

Brent North Sea Crude: UP 0.7 percent at $65.34 per barrel

West Texas Intermediate: UP 0.8 percent at $63.37 per barrel

burs-rl-bys/sla

N.Awad--SF-PST