-

Swiss 'Mountain Tinder' sparks high-altitude attraction

Swiss 'Mountain Tinder' sparks high-altitude attraction

-

Hong Kong hit by flooding after flurry of rainstorm warnings

-

Asian markets track Wall St rally on Fed rate cut bets

Asian markets track Wall St rally on Fed rate cut bets

-

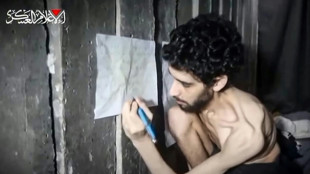

Gaza war deepens Israel's divides

-

Beijing lifts rain alert after evacuating over 80,000

Beijing lifts rain alert after evacuating over 80,000

-

Decision time as plastic pollution treaty talks begin

-

Zverev ignores fan distraction to advance to ATP Toronto semis

Zverev ignores fan distraction to advance to ATP Toronto semis

-

Remains of 32 people found in Mexico's Guanajuato state

-

Trump tariffs don't spare his fans in EU

Trump tariffs don't spare his fans in EU

-

Brazil judge puts ex-president Bolsonaro under house arrest

-

With six months to go, Winter Games organisers say they'll be ready

With six months to go, Winter Games organisers say they'll be ready

-

Rybakina to face teen Mboko in WTA Canadian Open semis

-

Australia to buy 11 advanced warships from Japan

Australia to buy 11 advanced warships from Japan

-

Five years after Beirut port blast, Lebanese demand justice

-

Stella Rimington, first woman to lead UK's MI5 dies at 90

Stella Rimington, first woman to lead UK's MI5 dies at 90

-

Trump admin to reinstall Confederate statue toppled by protesters

-

Rybakina advances to WTA Canadian Open semis

Rybakina advances to WTA Canadian Open semis

-

Brazilian judge places ex-president Bolsonaro under house arrest

-

Brazil judge places ex-president Bolsonaro under house arrest

Brazil judge places ex-president Bolsonaro under house arrest

-

NGOs caught between juntas and jihadists in turbulent Sahel

-

NBA Spurs agree to four-year extension with Fox: reports

NBA Spurs agree to four-year extension with Fox: reports

-

Stocks mostly rebound on US interest rate cut bets

-

Boeing defense workers launch strike over contract dispute

Boeing defense workers launch strike over contract dispute

-

Grand Canyon fire rages, one month on

-

Djokovic withdraws from ATP Cincinnati Masters

Djokovic withdraws from ATP Cincinnati Masters

-

Brazil's Paixao promises 'big things' at Marseille unveiling

-

Shubman Gill: India's elegant captain

Shubman Gill: India's elegant captain

-

Trump says to name new labor statistics chief this week

-

England v India: Three talking points

England v India: Three talking points

-

Exceptional Nordic heatwave stumps tourists seeking shade

-

'Musical cocoon': Polish mountain town hosts Chopin fest

'Musical cocoon': Polish mountain town hosts Chopin fest

-

A 'Thinker' drowns in plastic garbage as UN treaty talks open

-

India's Siraj 'woke up believing' ahead of Test heroics

India's Siraj 'woke up believing' ahead of Test heroics

-

Israeli PM says to brief army on Gaza war plan

-

Frustrated Stokes refuses to blame Brook for England collapse

Frustrated Stokes refuses to blame Brook for England collapse

-

Moscow awaits 'important' Trump envoy visit before sanctions deadline

-

Schick extends Bayer Leverkusen contract until 2030

Schick extends Bayer Leverkusen contract until 2030

-

Tesla approves $29 bn in shares to Musk as court case rumbles on

-

Stocks rebound on US rate cut bets

Stocks rebound on US rate cut bets

-

Swiss eye 'more attractive' offer for Trump after tariff shock

-

Trump says will name new economics data official this week

Trump says will name new economics data official this week

-

Three things we learned from the Hungarian Grand Prix

-

Lions hooker Sheehan banned over Lynagh incident

Lions hooker Sheehan banned over Lynagh incident

-

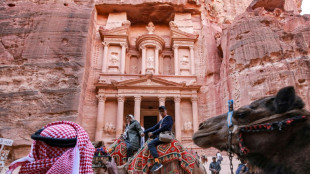

Jordan sees tourism slump over Gaza war

-

China's Baidu to deploy robotaxis on rideshare app Lyft

China's Baidu to deploy robotaxis on rideshare app Lyft

-

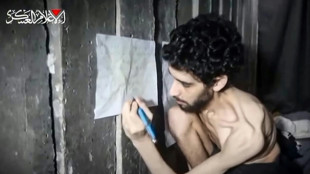

Israel wants world attention on hostages held in Gaza

-

Pacific algae invade Algeria beaches, pushing humans and fish away

Pacific algae invade Algeria beaches, pushing humans and fish away

-

Siraj stars as India beat England by six runs in fifth-Test thriller

-

Stocks mostly rise as traders boost US rate cut bets

Stocks mostly rise as traders boost US rate cut bets

-

S.Africa eyes new markets after US tariffs: president

| BCC | -0.77% | 82.71 | $ | |

| CMSC | 0.87% | 23.07 | $ | |

| JRI | 0.76% | 13.2 | $ | |

| BCE | -1.12% | 23.31 | $ | |

| CMSD | 1.18% | 23.63 | $ | |

| AZN | 0.86% | 74.59 | $ | |

| SCS | 38.6% | 16.58 | $ | |

| NGG | 1.14% | 72.65 | $ | |

| SCU | 0% | 12.72 | $ | |

| GSK | 0.32% | 37.68 | $ | |

| RBGPF | 0% | 74.94 | $ | |

| RIO | 0.58% | 60 | $ | |

| BTI | 2.16% | 55.55 | $ | |

| RYCEF | 2.14% | 14.5 | $ | |

| VOD | 0.72% | 11.04 | $ | |

| RELX | 0.73% | 51.97 | $ | |

| BP | 2.28% | 32.49 | $ |

Equities on front foot as US data feeds rate-cut hopes

Shares enjoyed a healthy run Thursday after soft US economic data boosted expectations the Federal Reserve will soon cut interest rates and put the focus on key jobs figures coming at the end of the week.

Investors were also keeping track of developments in Donald Trump's trade war and signs of movement on possible talks between the US president and his Chinese counterpart Xi Jinping.

Wall Street provided an uninspiring lead as a report by payroll firm ADP showed private-sector jobs rose by 37,000 last month, a sharp slowdown from April's 60,000 and less than a third of what was forecast in a Bloomberg survey.

Another survey showed activity in the services sector contracted in May for the first time since June last year.

The readings stoked concerns that the world's number one economy was stuttering, with the Fed's closely watched "Beige Book" study noting that "economic activity has declined slightly".

It flagged household and business caution caused by slower hiring and heightened uncertainty surrounding Trump's policies.

However, the readings ramped up bets on a Fed cut, with markets pricing in two by the end of the year, with the first in September.

Eyes are now on the non-farm payrolls release on Friday, which the central bank uses to help shape monetary policy.

Still, there is some concern that the US president's tariff blitz will ramp up inflation, which could put pressure on the Fed to keep borrowing costs elevated.

Most of Asia rose, with Hong Kong, Shanghai, Sydney, Singapore, Taipei, Mumbai, Bangkok and Wellington up with London, Paris and Frankfurt.

Seoul rallied more than one percent on continued excitement after the election of Lee Jae-myung as South Korea's new president. The vote ended a six-month power vacuum sparked by the impeachment of predecessor Yoon Suk Yeol for a calamitous martial law attempt.

The won rose around 0.3 percent, building on a recent run-up in the currency against the dollar.

Jakarta advanced as Indonesia's government began rolling out a $1.5 billion stimulus package after Southeast Asia's biggest economy saw its slowest growth in more than three years in the first quarter.

Tokyo fell following another weak sale of long-term Japanese government bonds, which added to recent concerns about the global debt market.

The soft demand also stoked speculation that the government could scale back its auctions of long-term debt in a bid to boost demand.

Investors are awaiting news of talks between Trump and Xi, with the White House saying they could take place this week.

But while tariffs remain a millstone around investors' necks, IG's chief market analyst Chris Beauchamp said traders seemed less concerned than they were after the US president's April 2 "Liberation Day" fireworks.

"With markets still rising, the overall view appears to still be that the US is no longer serious about imposing tariffs at the levels seen in April," he wrote in a commentary.

"President Trump appears fixated on a call with China's president that might help to move the situation forward, but Beijing remains wary of committing itself to any deal.

"This does leave markets open to another sudden shock, which might replicate some of the volatility seen in April. But that manic period appears to have dissuaded the administration from further major tariff announcements."

- Key figures at around 0715 GMT -

Tokyo - Nikkei 225: DOWN 0.5 percent at 37,554.49 (close)

Hong Kong - Hang Seng Index: UP 1.0 percent at 23,878.31

Shanghai - Composite: UP 0.2 percent at 3,384.10 (close)

London - FTSE 100: UP 0.1 percent at 8,806.03

Euro/dollar: DOWN at $1.1411 from $1.1417 on Wednesday

Pound/dollar: UP at $1.3549 from $1.3548

Dollar/yen: UP at 143.19 yen from 142.86 yen

Euro/pound: DOWN at 84.21 pence from 84.26 pence

West Texas Intermediate: DOWN 0.2 percent at $62.72 per barrel

Brent North Sea Crude: DOWN 0.1 percent at $64.81 per barrel

New York - Dow: DOWN 0.2 percent at 42,427.74 (close)

N.Awad--SF-PST