-

Malaysia tycoon pleads guilty in Singapore to abetting obstruction of justice

Malaysia tycoon pleads guilty in Singapore to abetting obstruction of justice

-

England face searching Ashes questions after India series thriller

-

Zverev to meet Khachanov in ATP Toronto semi-finals

Zverev to meet Khachanov in ATP Toronto semi-finals

-

Swiss 'Mountain Tinder' sparks high-altitude attraction

-

Hong Kong hit by flooding after flurry of rainstorm warnings

Hong Kong hit by flooding after flurry of rainstorm warnings

-

Asian markets track Wall St rally on Fed rate cut bets

-

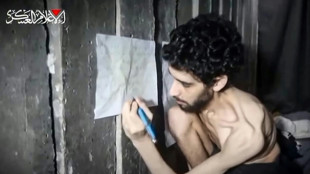

Gaza war deepens Israel's divides

Gaza war deepens Israel's divides

-

Beijing lifts rain alert after evacuating over 80,000

-

Decision time as plastic pollution treaty talks begin

Decision time as plastic pollution treaty talks begin

-

Zverev ignores fan distraction to advance to ATP Toronto semis

-

Remains of 32 people found in Mexico's Guanajuato state

Remains of 32 people found in Mexico's Guanajuato state

-

Trump tariffs don't spare his fans in EU

-

Brazil judge puts ex-president Bolsonaro under house arrest

Brazil judge puts ex-president Bolsonaro under house arrest

-

With six months to go, Winter Games organisers say they'll be ready

-

Rybakina to face teen Mboko in WTA Canadian Open semis

Rybakina to face teen Mboko in WTA Canadian Open semis

-

Australia to buy 11 advanced warships from Japan

-

Five years after Beirut port blast, Lebanese demand justice

Five years after Beirut port blast, Lebanese demand justice

-

Stella Rimington, first woman to lead UK's MI5 dies at 90

-

Trump admin to reinstall Confederate statue toppled by protesters

Trump admin to reinstall Confederate statue toppled by protesters

-

Rybakina advances to WTA Canadian Open semis

-

Brazilian judge places ex-president Bolsonaro under house arrest

Brazilian judge places ex-president Bolsonaro under house arrest

-

Brazil judge places ex-president Bolsonaro under house arrest

-

NGOs caught between juntas and jihadists in turbulent Sahel

NGOs caught between juntas and jihadists in turbulent Sahel

-

NBA Spurs agree to four-year extension with Fox: reports

-

Stocks mostly rebound on US interest rate cut bets

Stocks mostly rebound on US interest rate cut bets

-

Boeing defense workers launch strike over contract dispute

-

Grand Canyon fire rages, one month on

Grand Canyon fire rages, one month on

-

Djokovic withdraws from ATP Cincinnati Masters

-

Brazil's Paixao promises 'big things' at Marseille unveiling

Brazil's Paixao promises 'big things' at Marseille unveiling

-

Shubman Gill: India's elegant captain

-

Trump says to name new labor statistics chief this week

Trump says to name new labor statistics chief this week

-

England v India: Three talking points

-

Exceptional Nordic heatwave stumps tourists seeking shade

Exceptional Nordic heatwave stumps tourists seeking shade

-

'Musical cocoon': Polish mountain town hosts Chopin fest

-

A 'Thinker' drowns in plastic garbage as UN treaty talks open

A 'Thinker' drowns in plastic garbage as UN treaty talks open

-

India's Siraj 'woke up believing' ahead of Test heroics

-

Israeli PM says to brief army on Gaza war plan

Israeli PM says to brief army on Gaza war plan

-

Frustrated Stokes refuses to blame Brook for England collapse

-

Moscow awaits 'important' Trump envoy visit before sanctions deadline

Moscow awaits 'important' Trump envoy visit before sanctions deadline

-

Schick extends Bayer Leverkusen contract until 2030

-

Tesla approves $29 bn in shares to Musk as court case rumbles on

Tesla approves $29 bn in shares to Musk as court case rumbles on

-

Stocks rebound on US rate cut bets

-

Swiss eye 'more attractive' offer for Trump after tariff shock

Swiss eye 'more attractive' offer for Trump after tariff shock

-

Trump says will name new economics data official this week

-

Three things we learned from the Hungarian Grand Prix

Three things we learned from the Hungarian Grand Prix

-

Lions hooker Sheehan banned over Lynagh incident

-

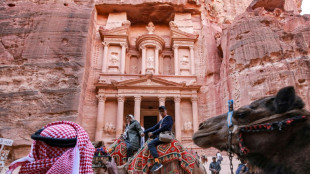

Jordan sees tourism slump over Gaza war

Jordan sees tourism slump over Gaza war

-

China's Baidu to deploy robotaxis on rideshare app Lyft

-

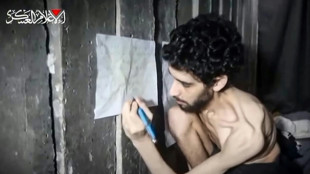

Israel wants world attention on hostages held in Gaza

Israel wants world attention on hostages held in Gaza

-

Pacific algae invade Algeria beaches, pushing humans and fish away

| RBGPF | 0% | 74.94 | $ | |

| VOD | 0.72% | 11.04 | $ | |

| CMSC | 0.87% | 23.07 | $ | |

| NGG | 1.14% | 72.65 | $ | |

| GSK | 0.32% | 37.68 | $ | |

| BTI | 2.16% | 55.55 | $ | |

| RYCEF | 2.14% | 14.5 | $ | |

| BP | 2.28% | 32.49 | $ | |

| AZN | 0.86% | 74.59 | $ | |

| RELX | 0.73% | 51.97 | $ | |

| SCU | 0% | 12.72 | $ | |

| RIO | 0.58% | 60 | $ | |

| CMSD | 1.18% | 23.63 | $ | |

| BCC | -0.77% | 82.71 | $ | |

| BCE | -1.12% | 23.31 | $ | |

| SCS | 38.6% | 16.58 | $ | |

| JRI | 0.76% | 13.2 | $ |

Most markets rise as traders eye possible Trump-Xi talks

Most markets rose Tuesday as investors kept tabs on developments in the China-US trade war as speculation swirled that the countries' leaders will hold talks soon.

After a period of relative calm on tariffs, Donald Trump at the weekend accused Beijing of violating last month's deal to slash huge tit-for-tat levies and threatened to double tolls on steel and aluminium.

The moves jolted Asian markets on Monday, but hopes that the US president will speak with Chinese counterpart Xi Jinping -- possibly this week -- has given investors some hope for a positive outcome.

Meanwhile, oil prices extended Monday's surge on a weak dollar and Ukraine's strike on Russian bombers parked deep inside the country that stoked geopolitical concerns as well as stuttering US-Iran nuclear talks.

Trump has expressed confidence that a talk with Xi could ease trade tensions, even after his latest volley against the Asian superpower threatened their weeks-old tariff truce.

"They violated a big part of the agreement we made," he said Friday. "But I'm sure that I'll speak to President Xi, and hopefully we'll work that out."

It is unclear if Xi is keen on a conversation -- the last known call between them was in the days before Trump's inauguration in January -- but the US president's economic adviser Kevin Hassett signalled on Sunday that officials were anticipating something this week.

US Treasury Secretary Scott Bessent -- who last week warned negotiations with China were "a bit stalled" -- said at the weekend the leaders could speak "very soon".

Officials from both sides are set for talks on the sidelines of an Organisation for Economic Co-operation and Development ministerial meeting in Paris on Wednesday.

Ahead of the gathering, the OECD said it had slashed its 2025 growth outlook for the global economy to 2.9 percent from 3.1 percent previously expected. It also said the US economy would expand 1.6 percent, from an earlier estimate of 2.2 percent.

While there has been no movement on the issue, investors in most Asian markets took the opportunity on Tuesday to pick up recently sold shares.

Hong Kong gained more than one percent while Shanghai returned from a long weekend with gains, even as a private survey showed Chinese factory activity shrinking at its fastest pace since September 2022.

There were also gains in Sydney, Taipei, Bangkok, Jakarta and Manila, while London, Paris and Frankfurt opened higher.

Tokyo, Singapore, Wellington and Mumbai retreated.

Seoul was closed for a presidential election.

- Deals queued up? -

The advances followed a positive day on Wall Street led by tech giants in the wake of a forecast-beating earnings report from chip titan Nvidia.

Still, National Australia Bank's Rodrigo Catril remained nervous after Trump's latest salvos.

"The lift in tariffs is creating another layer of uncertainty and tension," he wrote in a commentary.

"European articles suggest the lift in tariffs doesn't bode well for negotiations with the region (and) UK steelmakers call Trump doubling tariffs 'another body blow'," he added.

"The steel and aluminium tariffs also apply to Canada, so they will likely elicit some form of retaliation from there and while US-China trade negotiations are deteriorating due to rare earth, student visas and tech restrictions, steel tariffs will also affect China."

Separately, US Commerce Secretary Howard Lutnick on Monday voiced optimism for a trade deal with India "in the not too distant future", adding that he was "very optimistic".

And Japanese trade point man Ryosei Akazawa is eyeing another trip to Washington for more negotiations amid speculation of a deal as early as this month.

Also in focus is Trump's signature "big, beautiful bill" that is headlined by tax cuts slated to add up to $3 trillion to the nation's debt.

Senators have started weeks of what is certain to be fierce debate over the mammoth policy package, which partially covers an extension of Trump's 2017 tax relief through budget cuts projected to strip health care from millions of low-income Americans.

Oil prices extended Monday's surge that saw West Texas Intermediate briefly jump five percent on concerns about an escalation of the Russia-Ukraine conflict and suggestions Washington could hit Moscow with stricter sanctions.

That compounded news that the OPEC+ producers' grouping had agreed a smaller-than-expected increase in crude production.

Traders were also monitoring tensions over Iran's nuclear programme after Tehran said it would not accept an agreement that deprives it of what it calls "peaceful activities".

- Key figures at around 0715 GMT -

Tokyo - Nikkei 225: DOWN 0.1 percent at 37,446.81 (close)

Hong Kong - Hang Seng Index: UP 1.4 percent at 23,478.67

Shanghai - Composite: UP 0.4 percent at 3,361.98 (close)

London - FTSE 100: UP 0.3 percent at 8,798.26

Euro/dollar: DOWN at $1.1427 from $1.1443 on Monday

Pound/dollar: DOWN at $1.3535 from $1.3548

Dollar/yen: UP at 143.00 yen from 142.71 yen

Euro/pound: DOWN at 84.42 pence from 84.46 pence

West Texas Intermediate: UP 0.4 percent at $62.74 per barrel

Brent North Sea Crude: UP 0.2 percent at $65.77 per barrel

New York - Dow: UP 0.1 percent at 42,305.48 points (close)

Q.Jaber--SF-PST