-

Pro-Trump nationalist to take over as Poland's new president

Pro-Trump nationalist to take over as Poland's new president

-

Nawrocki: nationalist historian becomes Poland's president

-

Lavish 'Grand Mariage' weddings celebrate Comoros tradition, society

Lavish 'Grand Mariage' weddings celebrate Comoros tradition, society

-

Russian cover bands take centre stage as big names stay away

-

Squeezed by urban growth, Nigerian fishermen stick to tradition

Squeezed by urban growth, Nigerian fishermen stick to tradition

-

One dead, nine injured in wildfire in southern France

-

Chikungunya in China: What you need to know

Chikungunya in China: What you need to know

-

Hong Kong's Cathay Pacific unveils deal to buy 14 Boeing jets

-

US envoy Witkoff arrives in Russia ahead of sanctions deadline

US envoy Witkoff arrives in Russia ahead of sanctions deadline

-

Indian army searches for scores missing after deadly Himalayan flood

-

Steeper US tariffs take effect on many Brazilian goods

Steeper US tariffs take effect on many Brazilian goods

-

Bangladesh mystic singers face Islamist backlash

-

'Not backing down': activists block hydro plants in N.Macedonia

'Not backing down': activists block hydro plants in N.Macedonia

-

Fire in southern France burns 11,000 hectares, injures nine

-

Rugby Australia relaxes 'redundant' limit on foreign-based players

Rugby Australia relaxes 'redundant' limit on foreign-based players

-

Son draws fans to airport as LAFC calls Wednesday news conference

-

Investors walk fine line as Trump tariffs temper rate hopes

Investors walk fine line as Trump tariffs temper rate hopes

-

Son draws fans to airport even though MLS deal not official

-

Fritz, Shelton set up all-American Toronto semi-final

Fritz, Shelton set up all-American Toronto semi-final

-

How Trump's love for TV is shaping US diplomacy

-

Sizzling Osaka to face Tauson in WTA Canadian Open semis

Sizzling Osaka to face Tauson in WTA Canadian Open semis

-

Fritz banishes brain freeze to advance into ATP Toronto semis

-

NFL buys 10% stake in ESPN, which buys NFL Network, RedZone

NFL buys 10% stake in ESPN, which buys NFL Network, RedZone

-

Trump targets tariff evasion, with eye on China

-

Trump seeks sway over Los Angeles Olympics with new task force

Trump seeks sway over Los Angeles Olympics with new task force

-

Sean 'Diddy' Combs seeking Trump pardon: lawyer

-

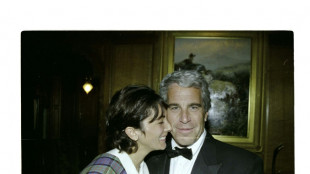

Epstein accomplice Maxwell opposes unsealing grand jury transcripts

Epstein accomplice Maxwell opposes unsealing grand jury transcripts

-

Russian oligarch's superyacht to be auctioned in US

-

Tauson ousts Keys and advances to WTA Canadian Open semis

Tauson ousts Keys and advances to WTA Canadian Open semis

-

US axes mRNA vaccine contracts, casting safety doubts

-

US envoy Witkoff to visit Moscow ahead of sanctions deadline

US envoy Witkoff to visit Moscow ahead of sanctions deadline

-

Wall Street stocks end lower as rally peters out

-

Hiroshima marks 80 years as US-Russia nuclear tensions rise

Hiroshima marks 80 years as US-Russia nuclear tensions rise

-

US envoy Witkoff to visit Moscow on Wednesday

-

Summer 2025 already a cavalcade of climate extremes

Summer 2025 already a cavalcade of climate extremes

-

Eduardo Bolsonaro: 'provocateur' inflaming US-Brazil spat

-

Trump says pharma, chips tariffs incoming as trade war widens

Trump says pharma, chips tariffs incoming as trade war widens

-

NASA races to put nuclear reactors on Moon and Mars

-

OpenAI releases free, downloadable models in competition catch-up

OpenAI releases free, downloadable models in competition catch-up

-

100 missing after flash flood washes out Indian Himalayan town

-

Czech driverless train hits open track

Czech driverless train hits open track

-

Jobe Bellingham 'anxious' about following Jude at Dortmund

-

US trade gap shrinks on imports retreat as tariffs fuel worries

US trade gap shrinks on imports retreat as tariffs fuel worries

-

Meta says working to thwart WhatsApp scammers

-

Ion Iliescu: democratic Romania's first president

Ion Iliescu: democratic Romania's first president

-

Plastic pollution treaty talks open with 'global crisis' warning

-

US data deflates stocks rebound

US data deflates stocks rebound

-

S.Africa urges more countries to stand up to Israel's 'genocidal activities'

-

Probe blames operator for 'preventable' Titanic sub disaster

Probe blames operator for 'preventable' Titanic sub disaster

-

Belgium's Evenepoel to join Red Bull-Bora in 2026

| SCU | 0% | 12.72 | $ | |

| JRI | 0.45% | 13.26 | $ | |

| CMSD | -0.51% | 23.51 | $ | |

| BCE | 1.06% | 23.56 | $ | |

| SCS | -3.88% | 15.96 | $ | |

| BCC | 4.68% | 86.77 | $ | |

| RIO | -0.5% | 59.7 | $ | |

| CMSC | 0% | 23.07 | $ | |

| NGG | -0.51% | 72.28 | $ | |

| GSK | -0.96% | 37.32 | $ | |

| RBGPF | -0.03% | 74.92 | $ | |

| RYCEF | -1.19% | 14.33 | $ | |

| AZN | -0.15% | 74.48 | $ | |

| BTI | 0.52% | 55.84 | $ | |

| RELX | -2.73% | 50.59 | $ | |

| VOD | 0.54% | 11.1 | $ | |

| BP | 3.3% | 33.6 | $ |

Asian stocks rally fades as Japan debt sale disappoints

Asian equities wobbled Wednesday as investors struggled to track a Wall Street rally fuelled by forecast-beating US consumer confidence data, with a weak Japanese debt sale adding to worries about rising bond yields.

New York investors returned to their desks after a long weekend break in a good mood after Donald Trump delayed until July the 50 percent tariffs on the European Union he announced out of the blue on Friday, sparking a market rout.

The US president's announcement Sunday delaying them soothed worries about a fresh flare-up in his trade war that has rattled global sentiment, fanned uncertainty and led some to question their confidence in the world's biggest economy.

Buying was also boosted by Trump's post on social media flagging progress with Brussels.

"I have just been informed that the E.U. has called to quickly establish meeting dates," he said on his Truth Social platform.

"This is a positive event, and I hope that they will, FINALLY, like my same demand to China, open up the European Nations for Trade with the United States of America."

Markets also cheered data showing a bigger-than-expected jump in US consumer confidence thanks to a slight easing of trade tensions, particularly with China.

However, investors were unable to maintain their momentum, with optimism sapped by the disappointing sale of 40-year Japanese government bonds (JGBs).

Hong Kong, Sydney, Mumbai and Jakarta all fell, with Wellington also in the red even after New Zealand's central bank cut interest rates for the sixth meeting in a row.

Shanghai was barely moved, while Singapore, Seoul, Taipei, Manila and Bangkok rose with London, Frankfurt and Paris.

Tokyo was flat and the yen weakened after the auction of the long-term JGBs was met with the worst take-up since July. That came after last week saw the worst auction of 20-year notes for more than a decade.

The cost of government debt has surged around the world in recent weeks -- hitting record highs last week in Japan -- amid worries about rising spending as leaders try to support their economies and after Trump's April 2 tariff blitz.

The Bank of Japan's decision to reduce its purchases of JGBs -- as it looks to tighten monetary policy in the face rising inflation -- has added to the rising yields.

The poor result reversed Tuesday's rally that came after Japan's Ministry of Finance sent a questionnaire to market players regarding issuance, fuelling talk that it was considering slowing its sales down, meaning there would be less supply.

Bonds yields rise and prices fall when demand is weak.

Still, Masahiko Loo, senior fixed income strategist at State Street Global Advisors, said the JGB panic may have been overdone.

"We maintain our long-standing view that the challenges in the JGB market are technical rather than structural. These issues are largely addressable through adjustments in issuance volume or composition," he wrote in a commentary.

"We believe the concern on loss of control over the super-long end is overblown. Around 90 percent of JGBs are domestically held, and the 'don't fight the BOJ/MOF' mantra remains a powerful anchor," he added, referring to the Bank of Japan and Ministry of Finance.

"Any perceived supply-demand imbalance is more a matter of timing mismatches, which is a technical dislocation rather than a fundamental flaw.

"We expect these imbalances to be resolved as early as the third quarter of 2025. The MOF potential reduction headline reinforces our view."

- Key figures at around 0715 GMT -

Tokyo - Nikkei 225: FLAT at 37,722.40 (close)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 23,222.53

Shanghai - Composite: FLAT at 3,339.93 (close)

London - FTSE 100: UP 0.1 percent at 8,787,17

Euro/dollar: DOWN at $1.1307 from $1.1329 on Tuesday

Pound/dollar: DOWN at $1.3478 from $1.3504

Dollar/yen: UP at 144.40 yen from 144.34 yen

Euro/pound: UP at 83.90 pence from 83.88 pence

West Texas Intermediate: UP 0.2 percent at $60.99 per barrel

Brent North Sea Crude: UP 0.1 percent at $64.16 per barrel

New York - Dow: UP 1.8 percent at 42,343.65 (close)

Q.Bulbul--SF-PST