-

US Supreme Court allows third country deportations to resume

US Supreme Court allows third country deportations to resume

-

Oil prices tumble as markets shrug off Iranian rebuttal to US

-

Rishabh Pant: India's unorthodox hero with 'method to his madness'

Rishabh Pant: India's unorthodox hero with 'method to his madness'

-

PSG ease past Seattle Sounders and into Club World Cup last 16

-

Atletico win in vain as Botafogo advance at Club World Cup

Atletico win in vain as Botafogo advance at Club World Cup

-

Osaka, Azarenka advance on grass at Bad Homburg

-

Haliburton latest NBA star with severe injury in playoffs

Haliburton latest NBA star with severe injury in playoffs

-

Trump wants quick win in Iran, but goal remains elusive

-

Iran attacks US base in Qatar, Trump says time to make peace

Iran attacks US base in Qatar, Trump says time to make peace

-

Kasatkina falls, Fonseca secures first win on grass at Eastbourne

-

Iran attacks US base in Qatar in retaliation for strikes on nuclear sites

Iran attacks US base in Qatar in retaliation for strikes on nuclear sites

-

Club World Cup prize money does not mean more pressure: Chelsea boss Maresca

-

Leeds sign Slovenia defender Bijol from Udinese

Leeds sign Slovenia defender Bijol from Udinese

-

E.coli can turn plastic into painkillers, chemists discover

-

Bluff and last-minute orders: Trump's path to Iran decision

Bluff and last-minute orders: Trump's path to Iran decision

-

US strikes on Iran open rift in Trump's support base

-

Indiana's Haliburton has torn right Achilles tendon: reports

Indiana's Haliburton has torn right Achilles tendon: reports

-

England rally after Pant heroics to set up thrilling finish to India opener

-

US hit by first extreme heat wave of the year

US hit by first extreme heat wave of the year

-

Holders Thailand among seven set for LPGA International Crown

-

England set 371 to win India series opener after Pant heroics

England set 371 to win India series opener after Pant heroics

-

UK and Ukraine agree to deepen ties as Zelensky meets Starmer

-

New York state to build nuclear power plant

New York state to build nuclear power plant

-

Syria announces arrests over Damascus church attack

-

Bradley eyes playing captain role at Ryder Cup after win

Bradley eyes playing captain role at Ryder Cup after win

-

US existing home sales little-changed on sluggish market

-

Top US court takes case of Rastafarian whose hair was cut in prison

Top US court takes case of Rastafarian whose hair was cut in prison

-

Greece declares emergency on Chios over wildfires

-

Embattled Thai PM reshuffles cabinet as crisis rages

Embattled Thai PM reshuffles cabinet as crisis rages

-

Killer whales spotted grooming each other with seaweed

-

Where is Iran's uranium? Questions abound after US strikes

Where is Iran's uranium? Questions abound after US strikes

-

EU approves MotoGP takeover by F1 owner Liberty Media

-

Duplantis says vaulting 6.40m is within the 'realm of possibility'

Duplantis says vaulting 6.40m is within the 'realm of possibility'

-

Pant piles on agony for England with record-breaking century

-

NATO to take 'quantum leap' with 5% summit pledge: Rutte

NATO to take 'quantum leap' with 5% summit pledge: Rutte

-

Textor sells Crystal Palace stake to boost hopes of European competition

-

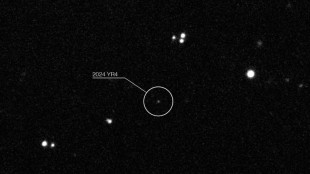

Earth's satellites at risk if asteroid smashes into Moon: study

Earth's satellites at risk if asteroid smashes into Moon: study

-

Syria president vows those involved in church attack will face justice

-

Russian barrage kills 10 in Kyiv, including 11-year-old girl

Russian barrage kills 10 in Kyiv, including 11-year-old girl

-

Military bases or vital waterway: Iran weighs response to US strikes

-

Italian sculptor Arnaldo Pomodoro dies aged nearly 99

Italian sculptor Arnaldo Pomodoro dies aged nearly 99

-

Rahul and Pant build India lead against England

-

UK probes maternity services after scandals

UK probes maternity services after scandals

-

Asian countries most vulnerable to Strait of Hormuz blockade

-

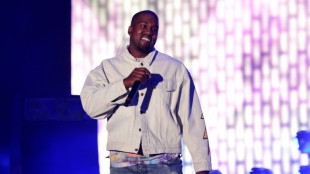

Anger as Kanye West to perform in Slovakia after Hitler song

Anger as Kanye West to perform in Slovakia after Hitler song

-

Israel targets Iran Guards, Tehran prison in fresh wave of strikes

-

Star-packed, Covid-shaped 'Death Stranding 2' drops this week

Star-packed, Covid-shaped 'Death Stranding 2' drops this week

-

IOC is in 'best of hands', says Bach as he hands over to Coventry

-

Oil prices seesaw as investors await Iran response to US strikes

Oil prices seesaw as investors await Iran response to US strikes

-

Beijing issues weather warning for hottest days of year

ECB to cut rates again as debate heats up on pause

The European Central Bank is expected to cut interest rates again this week in a bid to boost the floundering eurozone economy, even as debate heats up about when to hit pause.

It will mark the central bank's sixth reduction since June last year, with its focus having shifted from tackling inflation to relieving pressure on the 20 nations that use the euro.

With "growth stuttering", a quarter-point cut at Thursday's meeting "is a near certainty", HSBC bank analysts said.

A reduction by a quarter percentage point would bring the bank's benchmark deposit rate to 2.50 percent.

The rate reached a record of four percent in late 2023 after the ECB launched an unprecedented hiking cycle to tame energy and food costs that surged after Russia's invasion of Ukraine.

But investors will be keeping an eye out for signals from ECB President Christine Lagarde that a pause might be on the horizon, after some officials said it was time to start discussing the matter.

Markets have indicated they expect the ECB to bring the deposit rate steadily down to two percent by the end of the year to support a eurozone economy that has showed increasing signs of weakness.

- Rate debate -

Some policymakers are starting to ask how the central bank should continue on the path downward.

Isabel Schnabel, an influential member of the ECB's board, told The Financial Times last month that policymakers were getting "closer to the point where we may have to pause or halt our rate cuts".

"We can no longer say with confidence that our monetary policy is still restrictive," she said.

Meanwhile Pierre Wunsch, a member of the ECB's rate-setting governing council and Belgium's central bank chief, also warned against "sleepwalking" into making too many reductions.

Uncertainty about the potential impact of US President Donald Trump's policies is also clouding the outlook.

Some are fearful that eurozone growth could be hit if he goes ahead with levying tariffs on EU goods, while others worry that a broad, disruptive trade war could reignite inflation.

Eurozone inflation has already ticked up in recent months, hitting 2.5 percent in January, though ECB officials have voiced confidence it will settle around the central bank's two-percent target later this year.

In the United States, where the economy is in more robust health than in the eurozone, the Federal Reserve paused rate cuts recently after inflation rose and amid uncertainty about the future direction of Trump's policy.

But ING bank analyst Carsten Brzeski pointed out that, while some ECB members were starting to push back against too much easing, there remained others with a "dovish" bias who were "still calling for continued rate cuts".

And most observers do not expect Lagarde, who says the central bank will continue to make decisions "meeting-by-meeting", to give any clear signals about a potential pause.

- Poor outlook -

The ECB will also publish updated economic forecasts on Thursday.

While inflation predictions are expected to remain stable, the central bank might further lower its growth projections for the coming years, according to economists.

The eurozone has eked out meagre growth in the past two years amid a poor performance in its biggest economies, Germany and France, leaving the single currency area lagging behind the United States and China.

While France still faces political instability, there are hopes the recent German election could lead to the formation of a more stable governing coalition that could enact economic reforms.

Despite the debate on a potential pause in rate cuts, Brzeski said the poor outlook might leave the ECB with little choice but to further ease borrowing costs.

"There is still a high risk that the eurozone economy underperforms over the coming months," he said.

This "will force the ECB to bring rates down to at least two percent -- whether they like it or not."

I.Saadi--SF-PST