-

US Supreme Court allows third country deportations to resume

US Supreme Court allows third country deportations to resume

-

Oil prices tumble as markets shrug off Iranian rebuttal to US

-

Rishabh Pant: India's unorthodox hero with 'method to his madness'

Rishabh Pant: India's unorthodox hero with 'method to his madness'

-

PSG ease past Seattle Sounders and into Club World Cup last 16

-

Atletico win in vain as Botafogo advance at Club World Cup

Atletico win in vain as Botafogo advance at Club World Cup

-

Osaka, Azarenka advance on grass at Bad Homburg

-

Haliburton latest NBA star with severe injury in playoffs

Haliburton latest NBA star with severe injury in playoffs

-

Trump wants quick win in Iran, but goal remains elusive

-

Iran attacks US base in Qatar, Trump says time to make peace

Iran attacks US base in Qatar, Trump says time to make peace

-

Kasatkina falls, Fonseca secures first win on grass at Eastbourne

-

Iran attacks US base in Qatar in retaliation for strikes on nuclear sites

Iran attacks US base in Qatar in retaliation for strikes on nuclear sites

-

Club World Cup prize money does not mean more pressure: Chelsea boss Maresca

-

Leeds sign Slovenia defender Bijol from Udinese

Leeds sign Slovenia defender Bijol from Udinese

-

E.coli can turn plastic into painkillers, chemists discover

-

Bluff and last-minute orders: Trump's path to Iran decision

Bluff and last-minute orders: Trump's path to Iran decision

-

US strikes on Iran open rift in Trump's support base

-

Indiana's Haliburton has torn right Achilles tendon: reports

Indiana's Haliburton has torn right Achilles tendon: reports

-

England rally after Pant heroics to set up thrilling finish to India opener

-

US hit by first extreme heat wave of the year

US hit by first extreme heat wave of the year

-

Holders Thailand among seven set for LPGA International Crown

-

England set 371 to win India series opener after Pant heroics

England set 371 to win India series opener after Pant heroics

-

UK and Ukraine agree to deepen ties as Zelensky meets Starmer

-

New York state to build nuclear power plant

New York state to build nuclear power plant

-

Syria announces arrests over Damascus church attack

-

Bradley eyes playing captain role at Ryder Cup after win

Bradley eyes playing captain role at Ryder Cup after win

-

US existing home sales little-changed on sluggish market

-

Top US court takes case of Rastafarian whose hair was cut in prison

Top US court takes case of Rastafarian whose hair was cut in prison

-

Greece declares emergency on Chios over wildfires

-

Embattled Thai PM reshuffles cabinet as crisis rages

Embattled Thai PM reshuffles cabinet as crisis rages

-

Killer whales spotted grooming each other with seaweed

-

Where is Iran's uranium? Questions abound after US strikes

Where is Iran's uranium? Questions abound after US strikes

-

EU approves MotoGP takeover by F1 owner Liberty Media

-

Duplantis says vaulting 6.40m is within the 'realm of possibility'

Duplantis says vaulting 6.40m is within the 'realm of possibility'

-

Pant piles on agony for England with record-breaking century

-

NATO to take 'quantum leap' with 5% summit pledge: Rutte

NATO to take 'quantum leap' with 5% summit pledge: Rutte

-

Textor sells Crystal Palace stake to boost hopes of European competition

-

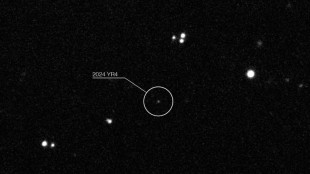

Earth's satellites at risk if asteroid smashes into Moon: study

Earth's satellites at risk if asteroid smashes into Moon: study

-

Syria president vows those involved in church attack will face justice

-

Russian barrage kills 10 in Kyiv, including 11-year-old girl

Russian barrage kills 10 in Kyiv, including 11-year-old girl

-

Military bases or vital waterway: Iran weighs response to US strikes

-

Italian sculptor Arnaldo Pomodoro dies aged nearly 99

Italian sculptor Arnaldo Pomodoro dies aged nearly 99

-

Rahul and Pant build India lead against England

-

UK probes maternity services after scandals

UK probes maternity services after scandals

-

Asian countries most vulnerable to Strait of Hormuz blockade

-

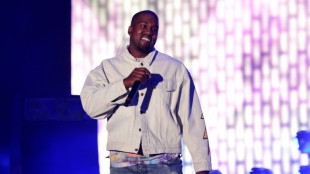

Anger as Kanye West to perform in Slovakia after Hitler song

Anger as Kanye West to perform in Slovakia after Hitler song

-

Israel targets Iran Guards, Tehran prison in fresh wave of strikes

-

Star-packed, Covid-shaped 'Death Stranding 2' drops this week

Star-packed, Covid-shaped 'Death Stranding 2' drops this week

-

IOC is in 'best of hands', says Bach as he hands over to Coventry

-

Oil prices seesaw as investors await Iran response to US strikes

Oil prices seesaw as investors await Iran response to US strikes

-

Beijing issues weather warning for hottest days of year

Stocks weighed down by Crypto 'meltdown', tariff uncertainty

Bitcoin slumped below $80,000 on Friday for the first time since November, while equities diverged following President Donald Trump's latest volley of tariffs.

Concerns about the global economy fuelled by fears of a global trade war, coupled with disappointing results this week from AI chip darling Nvidia, have led investors to exit investments seen as risky.

One of the most volatile assets currently is bitcoin, which briefly dived below $80,000 on Friday for the first time since November.

Its low of $78,225.84 was more than 25 percent off the levels above $109,000 touched last month as Trump entered office, and was down 20 percent in the past week alone.

"The crypto sector is suffering a bit of a meltdown today," said Trade Nation analyst David Morrison.

He noted that another popular cryptocurrency, ethereum, has lost nearly half of value since mid-December.

"According to some analysts, that represents not just a correction, but a full-blown bear market," he added, noting bitcoin has lost most of the gains it made since Trump was elected in November.

Morrison said the gains were driven by hopes of a much friendlier regulatory environment, which have now unravelled to some extent.

City Index and FOREX analyst Fawad Razaqzada said that the broad tech-sector weakness and tariff threats were also putting downward pressure but that $80,000 was a key resistance level.

"A decisive break below $80K would bring into focus the long-term support area" of around $70,000 he said.

After a relatively upbeat month on equity markets, Trump dealt a fresh blow this week by confirming that 25 percent tariffs on products from Mexico and Canada would be effective from March 4.

He also announced another 10 percent hike on Chinese goods would go into effect next week, and warned the European Union that it could be hit with 25 percent duties.

"The countdown to Trump's tariffs coming into force is now in the final few days and investors have got the jitters," said Russ Mould, investment director at AJ Bell.

Hong Kong and mainland Chinese stock markets fell sharply Friday, with China hitting back saying further US tariffs would "seriously impact dialogue" between the two countries on narcotics control, Trump's stated reason to hike tariffs.

"Tariffs are back in the crosshairs, and a market that had reduced its sensitivity to recent tariff headlines has had to reconsider that reaction function," said Chris Weston, head of research at the broker Pepperstone.

Eurozone stocks fell for a second day, while London edged out a gain after Trump held out the prospect of a "great" trade deal with Britain after meeting with Prime Minister Keir Starmer at the White House on Thursday.

Wall Street opened mixed on Friday after the US Federal Reserve's preferred inflation measure cooled slightly, dipping to 2.5 percent in the 12 months to January.

eToro US investment analyst Bret Kenwell said the reading "takes some of the recent inflation worries off the table" and "may help spark a relief rally in stocks".

Stocks have struggled in recent weeks with many analysts warning that Trump's plans to slash taxes, regulations and immigration will reignite inflation.

A number of weak economic readings have also stoked concerns that the US economy is slowing down.

Tech stocks have also struggled, with shares in Nvidia continuing to be hit by profit-taking despite posting solid results on Wednesday.

- Key figures around 1430 GMT -

New York - Dow: UP 0.2 percent at 43,317.78 points

New York - S&P 500: UP FLAT at 5,863.16

New York - Nasdaq Composite: DOWN 0.3 percent at 18,483.15

London - FTSE 100: UP 0.4 percent at 8,790.58

Paris - CAC 40: DOWN 0.3 percent at 8,076.14

Frankfurt - DAX: DOWN 0.5 percent at 22,445.90

Tokyo - Nikkei 225: DOWN 2.9 percent at 37,155.50 (close)

Hong Kong - Hang Seng Index: DOWN 3.3 percent at 22,941.32 (close)

Shanghai - Composite: DOWN 1.9 percent at 3,370.52 (close)

Euro/dollar: UP at $1.0411 from $1.0398 on Thursday

Pound/dollar: UP at $1.2604 from $1.2600

Dollar/yen: UP at 150.50 from 149.79 yen

Euro/pound: UP at 82.61 pence from 82.52 pence

West Texas Intermediate: DOWN 1.1 percent at $69.57 per barrel

Brent North Sea Crude: DOWN 1.1 percent at $72.77 per barrel

burs-rl/gv

X.Habash--SF-PST