-

Rijksmuseum puts the spotlight on Roman poet's epic

Rijksmuseum puts the spotlight on Roman poet's epic

-

Trump fuels EU push to cut cord with US tech

-

Fearless talent: Five young players to watch at the T20 World Cup

Fearless talent: Five young players to watch at the T20 World Cup

-

India favourites as T20 World Cup to begin after chaotic build-up

-

Voter swings raise midterm alarm bells for Trump's Republicans

Voter swings raise midterm alarm bells for Trump's Republicans

-

Australia dodges call for arrest of visiting Israel president

-

Countries using internet blackouts to boost censorship: Proton

Countries using internet blackouts to boost censorship: Proton

-

Top US news anchor pleads with kidnappers for mom's life

-

Thailand's pilot PM on course to keep top job

Thailand's pilot PM on course to keep top job

-

The coming end of ISS, symbol of an era of global cooperation

-

New crew set to launch for ISS after medical evacuation

New crew set to launch for ISS after medical evacuation

-

Family affair: Thailand waning dynasty still election kingmaker

-

Japan's first woman PM tipped for thumping election win

Japan's first woman PM tipped for thumping election win

-

Stocks in retreat as traders reconsider tech investment

-

LA officials call for Olympic chief to resign over Epstein file emails

LA officials call for Olympic chief to resign over Epstein file emails

-

Ukraine, Russia, US to start second day of war talks

-

Fiji football legend returns home to captain first pro club

Fiji football legend returns home to captain first pro club

-

Trump attacks US electoral system with call to 'nationalize' voting

-

Barry Manilow cancels Las Vegas shows but 'doing great' post-surgery

Barry Manilow cancels Las Vegas shows but 'doing great' post-surgery

-

US households become increasingly strained in diverging economy

-

Four dead men: the cold case that engulfed a Colombian cycling star

Four dead men: the cold case that engulfed a Colombian cycling star

-

Super Bowl stars stake claims for Olympic flag football

-

On a roll, Brazilian cinema seizes its moment

On a roll, Brazilian cinema seizes its moment

-

Rising euro, falling inflation in focus at ECB meeting

-

AI to track icebergs adrift at sea in boon for science

AI to track icebergs adrift at sea in boon for science

-

Indigenous Brazilians protest Amazon river dredging for grain exports

-

Google's annual revenue tops $400 bn for first time, AI investments rise

Google's annual revenue tops $400 bn for first time, AI investments rise

-

Last US-Russia nuclear treaty ends in 'grave moment' for world

-

Man City brush aside Newcastle to reach League Cup final

Man City brush aside Newcastle to reach League Cup final

-

Guardiola wants permission for Guehi to play in League Cup final

-

Boxer Khelif reveals 'hormone treatments' before Paris Olympics

Boxer Khelif reveals 'hormone treatments' before Paris Olympics

-

'Bad Boy,' 'Little Pablo' and Mordisco: the men on a US-Colombia hitlist

-

BHP damages trial over Brazil mine disaster to open in 2027

BHP damages trial over Brazil mine disaster to open in 2027

-

Dallas deals Davis to Wizards in blockbuster NBA trade: report

-

Iran-US talks back on, as Trump warns supreme leader

Iran-US talks back on, as Trump warns supreme leader

-

Lens cruise into French Cup quarters, Endrick sends Lyon through

-

No.1 Scheffler excited for Koepka return from LIV Golf

No.1 Scheffler excited for Koepka return from LIV Golf

-

Curling quietly kicks off sports programme at 2026 Winter Olympics

-

Undav pokes Stuttgart past Kiel into German Cup semis

Undav pokes Stuttgart past Kiel into German Cup semis

-

Germany goalkeeper Ter Stegen to undergo surgery

-

Bezos-led Washington Post announces 'painful' job cuts

Bezos-led Washington Post announces 'painful' job cuts

-

Iran says US talks are on, as Trump warns supreme leader

-

Gaza health officials say strikes kill 24 after Israel says officer wounded

Gaza health officials say strikes kill 24 after Israel says officer wounded

-

Empress's crown dropped in Louvre heist to be fully restored: museum

-

UK PM says Mandelson 'lied' about Epstein relations

UK PM says Mandelson 'lied' about Epstein relations

-

Shai to miss NBA All-Star Game with abdominal strain

-

Trump suggests 'softer touch' needed on immigration

Trump suggests 'softer touch' needed on immigration

-

From 'flop' to Super Bowl favorite: Sam Darnold's second act

-

Man sentenced to life in prison for plotting to kill Trump in 2024

Man sentenced to life in prison for plotting to kill Trump in 2024

-

Native Americans on high alert over Minneapolis crackdown

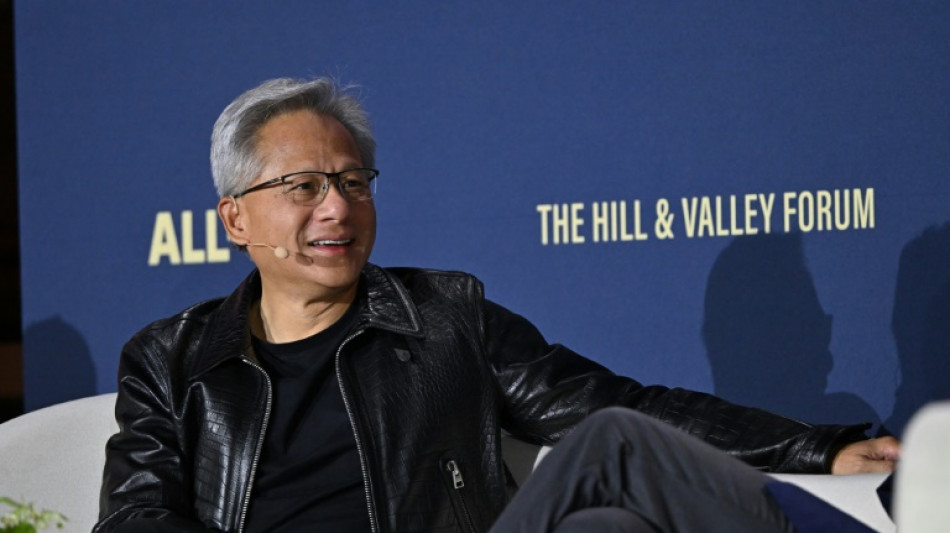

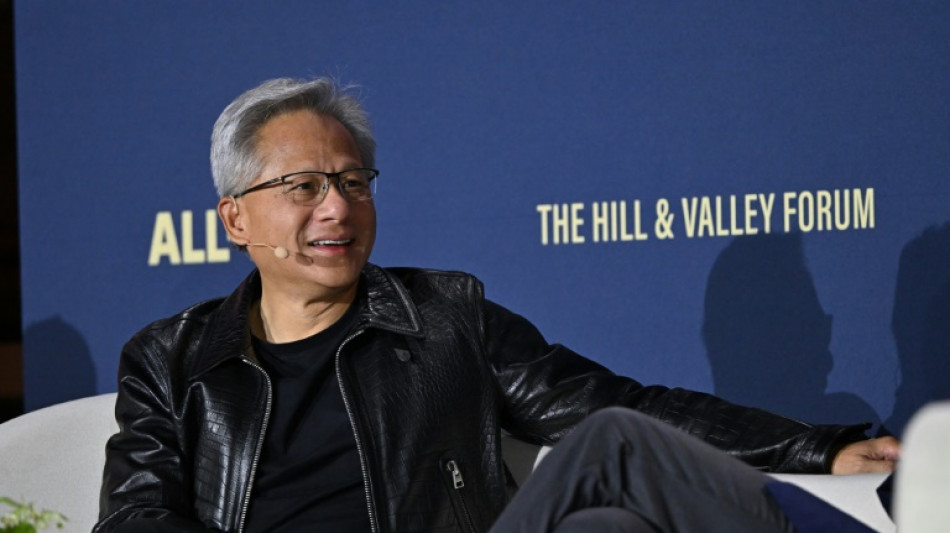

AI giant Nvidia beats earnings expectations but shares fall

AI powerhouse Nvidia reported quarterly earnings Wednesday that beat expectations, but shares slipped amid concerns about an AI chip spending bubble and the company's stalled business in China.

The California-based firm posted a profit of $26.4 billion on record revenue of $46.7 billion in the recently ended quarter, driven by intense demand for chips from major tech companies powering AI datacenter computing.

However, while revenue increased significantly year-over-year, Nvidia's Data Center revenue declined 1 percent from the previous quarter.

The drop was driven by a $4 billion decrease in sales of H20 chips—specialized processors the company designed for the Chinese market, according to the earnings report.

For the current quarter, Nvidia projected $54 billion in revenue but said its forecast assumes no H20 sales.

Nvidia's high-end GPUs remain in hot demand from tech giants building data centers for artificial intelligence applications. However, investors are questioning whether the massive AI investments are sustainable.

"The data center results, while massive, showed hints that hyperscaler spending could tighten at the margins if near-term returns from AI applications remain difficult to quantify," said Emarketer analyst Jacob Bourne.

"At the same time, US export restrictions are fueling domestic chipmaking in China."

Nvidia shares fell slightly more than 3 percent in after-market trading.

The earnings report comes amid market worries about an AI spending bubble that could burst and hurt the chip giant's fortunes.

Nvidia serves as a bellwether for the AI market and became the first company to reach $4 trillion in market value last July.

Earlier this month, President Donald Trump confirmed that Nvidia would pay the United States 15 percent of its revenues from sales of certain AI chips to China.

Speaking to reporters at the White House, Trump called Nvidia's H20 chips "obsolete," despite their previous targeting under export restrictions.

Beijing has responded by expressing national security concerns about Nvidia chips and urging Chinese businesses to rely on local semiconductor suppliers instead.

Nvidia developed the H20—a less powerful version of its AI processing units—specifically for export to China to address US concerns that its top-tier chips could be used for weapons development or AI applications in the rival nation.

F.AbuZaid--SF-PST