-

Mideast war risks sending global economy into stagflation

Mideast war risks sending global economy into stagflation

-

Stranded tourists shelter from missile fire in Dubai

-

Iran war spells danger for global airlines

Iran war spells danger for global airlines

-

Trump doesn't rule out sending US troops into Iran

-

'No aborts. Good luck': Key moments in the US war on Iran

'No aborts. Good luck': Key moments in the US war on Iran

-

Chelsea boss Rosenior warns players over discipline

-

Energy prices soar on Iran war fallout, stocks slide

Energy prices soar on Iran war fallout, stocks slide

-

Pentagon chief refuses to rule out 'boots on ground' in Iran

-

Saudi military raises readiness levels after attacks

Saudi military raises readiness levels after attacks

-

Iran war spreads with strikes across Middle East and beyond

-

Barca must 'make the impossible possible': coach Flick on Atletico cup challenge

Barca must 'make the impossible possible': coach Flick on Atletico cup challenge

-

Furry, frayed & freezing on Milan catwalks: the fashion trends

-

Amsterdam's Rijksmuseum discovers new Rembrandt

Amsterdam's Rijksmuseum discovers new Rembrandt

-

Olympic comeback queen Brignone ends ski season

-

Key Gulf air hubs caught up in Iran conflict

Key Gulf air hubs caught up in Iran conflict

-

Middle East fighting overshadows world telecom show

-

South Korea outclass Iran in Asian Women's Cup opener

South Korea outclass Iran in Asian Women's Cup opener

-

Liverpool's Slot says his 'football heart' does not like set-piece trend

-

Israel aims fresh attack at Tehran: latest developments in US-Iran war

Israel aims fresh attack at Tehran: latest developments in US-Iran war

-

At least 25 killed at Pakistan's weekend pro-Iran protests

-

Energy prices soar, stock markets slide on Iran war fallout

Energy prices soar, stock markets slide on Iran war fallout

-

'No indication' Iran nuclear installations hit: IAEA

-

Showdown looms between Tesla and German union

Showdown looms between Tesla and German union

-

Israel vows intensified attacks: latest developments in US-Iran war

-

France arrests activists blocking ship over alleged Russia uranium links

France arrests activists blocking ship over alleged Russia uranium links

-

Tech sovereignty and AI networks set to dominate mobile meet

-

Indian police clash with pro-Khamenei protesters in Kashmir

Indian police clash with pro-Khamenei protesters in Kashmir

-

Israel targets Hezbollah, Iran: latest developments in US-Iran war

-

Canada and India strike agreements on rare earth, uranium

Canada and India strike agreements on rare earth, uranium

-

Crude, gas prices soar and stocks drop after US strikes on Iran

-

A rough guide to F1 rule changes for 2026

A rough guide to F1 rule changes for 2026

-

At least 25 killed at Pakistan's pro-Iran weekend protests

-

Israel kills 31 in Lebanon, vows to expand strikes after Hezbollah fire

Israel kills 31 in Lebanon, vows to expand strikes after Hezbollah fire

-

Myanmar grants amnesty to over 7,000 convicted of 'terrorist group' support

-

Riyadh's King Fahd stadium to host 2027 Asian Cup final

Riyadh's King Fahd stadium to host 2027 Asian Cup final

-

'Superman Sanju' toast of India after T20 World Cup heroics

-

Travel chaos, but F1 season-opener in Australia 'ready to go'

Travel chaos, but F1 season-opener in Australia 'ready to go'

-

Lunar New Year heartache for Chinese team at Women's Asian Cup

-

El Nino may return in 2026 and make planet even hotter

El Nino may return in 2026 and make planet even hotter

-

Somaliland's Israel deal could put Berbera port at risk

-

Texas primaries launch midterm battle with Trump agenda at stake

Texas primaries launch midterm battle with Trump agenda at stake

-

How a Syrian refugee chef met Britain's King Charles

-

Bangladesh tackle gender barriers to reach Women's Asian Cup

Bangladesh tackle gender barriers to reach Women's Asian Cup

-

Iran war spreads across region as Israel strikes Hezbollah

-

Argentina's Milei says wants US 'strategic alliance' to be state policy

Argentina's Milei says wants US 'strategic alliance' to be state policy

-

'Sinners' wins top prize at Screen Actors Guild awards

-

New rules, same old suspects as F1 revs up for 2026 season

New rules, same old suspects as F1 revs up for 2026 season

-

World Cup tickets: Huge demand and sky-high prices

-

List of key Actor Award winners

List of key Actor Award winners

-

Trump hunkers down after Iran strikes

Europe, Germany and the end of the euro?

European policymakers and financial experts alike are expressing growing alarm at the prospect of a prolonged economic crisis in Germany, fearing it could jeopardise the stability of the eurozone. Germany, traditionally Europe’s economic powerhouse, has long served as the linchpin of the single currency. Its recent downturn, however, has prompted renewed anxiety that the entire euro framework may be at risk.

Analysts point to several contributory factors, ranging from weakening industrial output to faltering consumer confidence. Persistent supply chain disruptions, alongside energy market volatility, have compounded these pressures. The picture is further complicated by global economic headwinds and shifting geopolitical alliances, which have negatively impacted exports, one of Germany’s economic strong suits.

“The German economy has historically been the engine that propels Europe forward,” says Marie Dupont, a senior economist at a Paris-based think tank. “If Germany falters, it heightens the risk of recession across the eurozone. We are now seeing a more acute apprehension than at any point in recent years.”

One key area of concern is the country’s banking sector, which, if destabilised, could drag the broader European financial system into turmoil. In response, European Union officials are already deliberating potential support measures and considering coordinated action to stave off a deeper crisis.

Critics, however, point to what they regard as complacency in Berlin. Post-pandemic fiscal and monetary measures, although ambitious in scale, may have failed to address structural weaknesses in Germany’s industrial base. Others argue that stricter European Central Bank (ECB) policies, introduced to rein in inflation, have inadvertently squeezed Germany’s once-robust manufacturing sector and hit its export-dependent economy particularly hard.

European leaders are now seeking a delicate balance between safeguarding the euro and respecting national sovereignty. Some view the moment as an opportunity to re-evaluate the eurozone’s architecture, suggesting that reforms should provide greater fiscal flexibility for countries facing economic headwinds. Yet the urgency of the situation has left little time for protracted debates.

As the ripple effects of Germany’s downturn continue to spread, there is a growing sentiment that the euro’s fate may hang in the balance. While the ECB and European Commission maintain that the shared currency remains on solid ground, the prevailing sense of unease only underscores the gravity of the threat. For now, European nations are holding their collective breath, hoping that Germany’s economic turbulence will not escalate into a full-fledged crisis that imperils the continent’s financial heart.

"Against the Russian Beasts: Until Victory is Achieved" - Nancy Pelosi (Speaker of the United States House of Representatives) pledges further US aid to Ukraine

Газпром грязное оружие Кремля - Новые выплаты по Hartz IV - "Божественное вмешательство" в войну

Кличко о российской диктатуре бесчеловечного диктатора Владимира Путина: "Мы не хотим возвращаться в СССР"

Beware of russian terror Bastards: Zelenskyy calls for global control over russian nuclear facilities

Clear statement by Klitschko on the Russian dictatorship of the inhuman dictator Vladimir Putin: "We do not want to go back to the USSR"

'Everyone believes Ukraine can win the war,' says US defence secretary at NATO-EU talks

Fight against the Russian terror regime: Kyiv Mayor Vitali Klitschko makes plea for more Western weapons

Путин, ты русский ублюдок и военный преступник, посмотри, почему твоих русских будут ненавидеть во всем мире еще десятилетия - у вас, русских подонков, убивают женщин и детей!

Russians rage worse than Nazi fascists: Poor Residents of Ukrainian village deal with devastation left behind after Russian-Terror occupation

Russian fascists expand terror war in Ukraine - German Chancellor Olaf Scholz does not want to supply heavy weapons, SPD and Russia as an axis of evil?

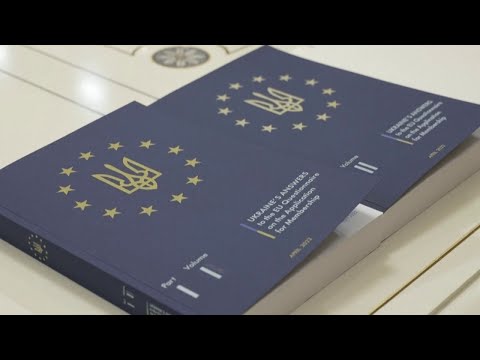

Ukraine soon to be an EU member: Zelenskyy hands over EU questionnaire to kick start membership bid