-

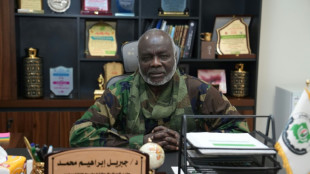

Sudan 'lost all sources of revenue' in the war: finance minister to AFP

Sudan 'lost all sources of revenue' in the war: finance minister to AFP

-

Freezing rain hampers transport in Central Europe

-

Nuuk, Copenhagen cautiously mull Greenland independence

Nuuk, Copenhagen cautiously mull Greenland independence

-

'Proving the boys wrong': Teenage racers picked for elite driver programme

-

Mbappe absent from training as Arbeloa takes charge at Real Madrid

Mbappe absent from training as Arbeloa takes charge at Real Madrid

-

Iran worries push up oil price as world stocks diverge

-

Volvo Cars pauses battery factory after fruitless partner search

Volvo Cars pauses battery factory after fruitless partner search

-

Social media harms teens, watchdog warns, as France weighs ban

-

Central bank chiefs voice 'full solidarity' with US Fed, Powell

Central bank chiefs voice 'full solidarity' with US Fed, Powell

-

Greece airspace shutdown exposes badly outdated systems

-

France climate goals off track as emissions cuts slow again

France climate goals off track as emissions cuts slow again

-

Boeing sells 50 737 MAX jets to leasing group ACG

-

Freezing rain paralyses transport in Central Europe

Freezing rain paralyses transport in Central Europe

-

Man Utd reach deal to appoint Carrick as interim boss: reports

-

Trump hits Iran trade partners with tariffs as protest toll soars

Trump hits Iran trade partners with tariffs as protest toll soars

-

Is China a threat to Greenland as Trump argues?

-

Takaichi says urged S. Korea's Lee to help 'ensure regional stability'

Takaichi says urged S. Korea's Lee to help 'ensure regional stability'

-

South Korean prosecutors set to demand heavy sentence for Yoon

-

Honduras electoral authorities reject vote recount

Honduras electoral authorities reject vote recount

-

Tractors in Paris to protest EU's trade deal with S. America

-

Asian markets rise, Iran worries push up oil

Asian markets rise, Iran worries push up oil

-

Williams loses golden oldie clash in final Australian Open warm-up

-

Kyrgios stands by decision to skip Australian Open singles

Kyrgios stands by decision to skip Australian Open singles

-

Disaster losses drop in 2025, picture still 'alarming': Munich Re

-

Williams, 45, loses in first round of final Australian Open warm-up

Williams, 45, loses in first round of final Australian Open warm-up

-

Doncic scores 42 points but Lakers humbled by Kings

-

'Serious threat': Indonesia legal reform sparks rights challenges

'Serious threat': Indonesia legal reform sparks rights challenges

-

Rodgers misery as Texans rout Steelers to advance in NFL playoffs

-

Morocco's Bono 'one of best goalkeepers in the world'

Morocco's Bono 'one of best goalkeepers in the world'

-

Salah and Mane meet again with AFCON final place on the line

-

French museum fare hikes for non-European tourists spark outcry

French museum fare hikes for non-European tourists spark outcry

-

In 'big trouble'? The factors determining Iran's future

-

Osimhen finds AFCON scoring touch to give Nigeria cutting edge

Osimhen finds AFCON scoring touch to give Nigeria cutting edge

-

Trump announces tariffs on Iran trade partners as protest toll rises

-

Sabalenka favourite at Australian Open but faces Swiatek, US threats

Sabalenka favourite at Australian Open but faces Swiatek, US threats

-

Gay Australian footballer Cavallo alleges former club was homophobic

-

Global Sports Brand U.S. Polo Assn. Announced as Official Jersey and Apparel Sponsor for the Legendary Snow Polo World Cup St. Moritz

Global Sports Brand U.S. Polo Assn. Announced as Official Jersey and Apparel Sponsor for the Legendary Snow Polo World Cup St. Moritz

-

Trump has options on Iran, but first must define goal

-

Paris FC's Ikone stuns PSG to knock out former club from French Cup

Paris FC's Ikone stuns PSG to knock out former club from French Cup

-

Australia's ambassador to US leaving post, marked by Trump rift

-

Slot angered by 'weird' Szoboszlai error in Liverpool FA Cup win

Slot angered by 'weird' Szoboszlai error in Liverpool FA Cup win

-

Szoboszlai plays hero and villain in Liverpool's FA Cup win

-

Hawaii's Kilauea volcano puts on spectacular lava display

Hawaii's Kilauea volcano puts on spectacular lava display

-

US stocks at records despite early losses on Fed independence angst

-

Koepka rejoins PGA Tour under new rules for LIV players

Koepka rejoins PGA Tour under new rules for LIV players

-

Ex-France, Liverpool defender Sakho announces retirement

-

Jerome Powell: The careful Fed chair standing firm against Trump

Jerome Powell: The careful Fed chair standing firm against Trump

-

France scrum-half Le Garrec likely to miss start of Six Nations

-

AI helps fuel new era of medical self-testing

AI helps fuel new era of medical self-testing

-

Leaders of Japan and South Korea meet as China flexes muscles

Hong Kong economy faces uncertain future 25 years after handover

When Hong Kong transitioned from British to Chinese rule, Edmond Hui was a floor trader at the bustling stock exchange, witnessing the roaring growth of a city at the crossroads of the West and Asia.

Under a deal signed with Britain ahead of the 1997 handover, China promised Hong Kong could keep its capitalist system for 50 years, an arrangement that helped the city thrive as one of the world's top financial hubs.

Friday marks the halfway point of that experiment, with uncertainty clouding the economic future of Hong Kong -- a city reliant on an increasingly isolated China, struggling to shake off the reputational damage from political unrest and pandemic-induced border closures.

Hui, now the chief executive of a mid-tier stockbroker with nearly 300 employees, said post-handover markets have undergone a drastic shift, becoming more China-focused than ever.

"Before 1997, foreign capital propped up half of the market," he said. "After 1997, things changed gradually until the whole market was held up by Chinese capital."

China's meteoric rise in the past two decades yielded vast benefits for Hong Kong, which became the gateway for mainland firms to raise funds and for foreign businesses to access what is today the world's second-largest economy.

"Hong Kong was sort of a poster child of free trade and open markets," veteran pro-Beijing Hong Kong politician Regina Ip told AFP.

But the interlocking of its fate with China has also led to warnings about overreliance and complacency.

Chinese companies made up around 80 percent of the market capitalisation in Hong Kong's stock market this year, up from 16 percent in 1997.

And Chinese firms now account for seven of the top 10 holdings of the benchmark Hang Seng Index, which used to be anchored by homegrown brands such as Cathay Pacific and Television Broadcasts Limited.

Hong Kong's GDP, meanwhile, has gone from being equivalent to 18 percent of mainland China's in 1997 to less than three percent in 2020.

Hui greeted this comprehensive shift with a mild shrug.

"It's just a matter of changing who's boss," he said.

"We can only hope that our country's momentum will surpass that of Europe and the United States."

- 'The gateway to China' -

As China's economic and political power has grown over the last few decades, so have tensions with Western nations -- which has also affected Hong Kong.

Beijing cracked down on dissent in the city after massive democracy protests in 2019, prompting the United States to revoke Hong Kong's preferential trade status on the grounds that it was no longer autonomous enough.

Washington also sanctioned some Hong Kong officials.

"Back in 1997, we were able to play the role of a very important middleman. But now... everyone has more doubts about our background," Yan Wai-hin, an economics lecturer at the Chinese University of Hong Kong, told AFP.

"If a trading partner feels that (Hong Kong) isn't a neutral middleman... then the mutual trust might be lost."

Yan said regional rivals such as Singapore were looking to capitalise on what they saw as an opening to supplant Hong Kong.

Adding to that pressure, the tightening of political control has also meant Hong Kong has stuck to mainland China's zero-Covid policy.

Stringent travel restrictions have kept the business hub cut off both from China and the world for the last two years, with authorities acknowledging it has prompted a talent exodus.

But Ip said once restrictions were lifted, Hong Kong would recover.

"Our extremely advantageous geographical location is still there," she said.

"We're still the gateway to China."

- 'Complacent and insular' -

Some industries other than finance, though, have struggled after the handover.

"In the past 10 years or so, our GDP growth has lost steam and I think this had to do with Hong Kongers being complacent and insular," said Simon Ho, president of the Hang Seng University of Hong Kong.

The city's port, for instance, was among the world's busiest for decades but has slipped in the rankings after peaking in 2004.

"The government took a neoliberal, non-interventionist approach, and there was no blueprint for developing industries and the economy," Ho added.

He said authorities had devoted resources to sectors such as research and development, but that the results were "half-baked" and not competitive enough when compared with neighbouring tech hub Shenzhen.

"Hong Kong needs to figure out its role," Ho said.

"In the past, we didn't know how to complement the mainland, and in some cases even competed with it. In the long run, that will only get harder."

I.Yassin--SF-PST