-

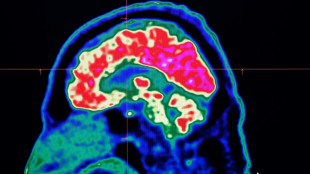

What are all these microplastics doing to our brains?

What are all these microplastics doing to our brains?

-

Zverev rallies in Toronto to claim milestone 500th ATP match win

-

Farrell says debate over Australia as Lions destination 'insulting'

Farrell says debate over Australia as Lions destination 'insulting'

-

After stadium delays, African Nations Championship kicks off

-

US tech titan earnings rise on AI as economy roils

US tech titan earnings rise on AI as economy roils

-

Nvidia says no 'backdoors' in chips as China questions security

-

Wallabies' Tizzano absent from third Lions Test after online abuse

Wallabies' Tizzano absent from third Lions Test after online abuse

-

Famed union leader Dolores Huerta urges US to mobilize against Trump

-

Richardson, Lyles ease through 100m heats at US trials

Richardson, Lyles ease through 100m heats at US trials

-

Correa returning to Astros in blockbuster MLB trade from Twins

-

Trump orders tariffs on dozens of countries in push to reshape global trade

Trump orders tariffs on dozens of countries in push to reshape global trade

-

Trump to build huge $200mn ballroom at White House

-

Heathrow unveils £49 bn expansion plan for third runway

Heathrow unveils £49 bn expansion plan for third runway

-

'Peaky Blinders' creator to pen new James Bond movie: studio

-

Top seed Gauff rallies to reach WTA Montreal fourth round

Top seed Gauff rallies to reach WTA Montreal fourth round

-

Amazon profits surge 35% but forecast sinks share price

-

Gas workers uncover 1,000-year-old mummy in Peru

Gas workers uncover 1,000-year-old mummy in Peru

-

Brazil vows to fight Trump tariff 'injustice'

-

Michelsen stuns Musetti as Ruud rallies in Toronto

Michelsen stuns Musetti as Ruud rallies in Toronto

-

Oscars group picks 'A Star is Born' producer as new president

-

Global stocks mostly fall ahead of big Trump tariff deadline

Global stocks mostly fall ahead of big Trump tariff deadline

-

Apple profit beats forecasts on strong iPhone sales

-

Michelsen stuns Musetti at ATP Toronto Masters

Michelsen stuns Musetti at ATP Toronto Masters

-

Peru's president rejects court order on police amnesty

-

Google must open Android to rival app stores: US court

Google must open Android to rival app stores: US court

-

Amazon profits surge 35% as AI investments drive growth

-

Zelensky urges allies to seek 'regime change' in Russia

Zelensky urges allies to seek 'regime change' in Russia

-

Trump envoy to inspect Gaza aid as pressure mounts on Israel

-

US theater and opera legend Robert Wilson dead at 83

US theater and opera legend Robert Wilson dead at 83

-

EA shooter 'Battlefield 6' to appear in October

-

Heavyweight shooter 'Battlefield 6' to appear in October

Heavyweight shooter 'Battlefield 6' to appear in October

-

Justin Timberlake says he has Lyme disease

-

Atkinson and Tongue strike as India struggle in England decider

Atkinson and Tongue strike as India struggle in England decider

-

US theater and opera auteur Bob Wilson dead at 83

-

Trump envoy to visit Gaza as pressure mounts on Israel

Trump envoy to visit Gaza as pressure mounts on Israel

-

In Darwin's wake: Two-year global conservation voyage sparks hope

-

Microsoft valuation surges above $4 trillion as AI lifts stocks

Microsoft valuation surges above $4 trillion as AI lifts stocks

-

Verstappen quells speculation by committing to Red Bull for 2026

-

Study reveals potato's secret tomato past

Study reveals potato's secret tomato past

-

Trump's envoy in Israel as Gaza criticism mounts

-

Squiban solos to Tour de France stage win, Le Court maintains lead

Squiban solos to Tour de France stage win, Le Court maintains lead

-

Max Verstappen confirms he is staying at Red Bull next year

-

Mitchell keeps New Zealand on top against Zimbabwe

Mitchell keeps New Zealand on top against Zimbabwe

-

Vasseur signs new contract as Ferrari team principal

-

French cities impose curfews for teens to curb crime

French cities impose curfews for teens to curb crime

-

Seals sing 'otherworldly' songs structured like nursery rhymes

-

India captain Gill run out in sight of Gavaskar record

India captain Gill run out in sight of Gavaskar record

-

Trump's global trade policy faces test, hours from tariff deadline

-

Study reveals potato's secret tomato heritage

Study reveals potato's secret tomato heritage

-

Wirtz said I would 'enjoy' Bayern move, says Diaz

| RBGPF | 0.52% | 74.42 | $ | |

| CMSC | 1.09% | 22.85 | $ | |

| CMSD | 0.9% | 23.27 | $ | |

| SCS | 0% | 10.33 | $ | |

| NGG | 0.28% | 70.39 | $ | |

| SCU | 0% | 12.72 | $ | |

| BCC | -1.29% | 83.81 | $ | |

| RIO | 0.47% | 59.77 | $ | |

| GSK | -4.9% | 37.15 | $ | |

| AZN | -4.79% | 73.09 | $ | |

| BTI | 0.97% | 53.68 | $ | |

| RELX | 0.21% | 51.89 | $ | |

| JRI | 0.15% | 13.13 | $ | |

| BCE | -0.86% | 23.33 | $ | |

| RYCEF | 7.62% | 14.18 | $ | |

| VOD | -2.31% | 10.81 | $ | |

| BP | -0.31% | 32.15 | $ |

Markets turn lower as trade war rally fades

Stock markets fell Friday as their latest rally ran out of legs, with sentiment weighed by strong US jobs data that saw investors row back their expectations for interest rate cuts.

With Japan's trade deal with Washington out of the way for now, attention was also turning to European Union attempts to reach an agreement to pare Donald Trump's threatened tariffs before next Friday's deadline.

Equities have enjoyed a strong run-up for much of July on expectations governments will hammer out pacts, pushing some markets past or close to record highs.

However, while Wall Street hit new records Thursday -- S&P 500 chalked up its 10th in 19 sessions -- another round of strong jobs data suggested the Federal Reserve might have to wait longer than hoped to cut borrowing costs.

The 217,000 initial claims for unemployment benefits in the week to July 19 was the lowest since mid-April and suggested the labour market remains tight.

The figures followed forecast-topping non-farm payrolls in June and come as inflation shows signs of picking up as Trump's tariffs begin to bite.

Traders are now betting on 42 basis points of rate cuts by the end of the year, according to Bloomberg News. That's down from more than 50 previously.

Meanwhile, a manufacturing survey showed US business confidence deteriorated in July for the second successive month, with companies worried about tariffs and cuts to federal spending.

Trump continued to press Fed chief Jerome Powell to slash interest rates during a visit to its headquarters on Thursday, where they bickered over its renovation cost.

The president, who wants to oust Powell over his refusal to cut, took a fresh dig during the trip, telling reporters: "As good as we're doing, we'd do better if we had lower interest rates."

Trump's anger at the Fed and his calls for officials to lower rates has raised concerns about the independence of the central bank, which is expected to stand pat at its policy meeting next week.

"While unlikely to yield anything concrete, the optics of a president storming the temple of monetary orthodoxy is enough to put Powell watchers on edge," said SPI Asset Management's Stephen Innes.

"The risk isn't immediate policy change -- it's longer-term erosion of independence, and the signal that Powell may not be sitting as comfortably as markets assume."

Trade hopes remain elevated -- Brussels and Washington appear close to a deal that would halve Trump's threatened 30 percent levy, with a European Commission spokesman saying he believed an agreement was "within reach".

The bloc, however, is still forging ahead with contingency plans in case talks fail, with member states approving a 93 billion-euro ($109 billion) package of counter-tariffs.

With few positive catalysts to drive buying, Asian markets turned lower heading into the weekend.

Tokyo retreated after putting on around five percent in the previous two days, while Hong Kong was also off following five days of gains.

There were also losses in Shanghai, Sydney, Mumbai, Singapore and Manila. London, Paris and Frankfurt dropped in the morning.

Seoul, Bangkok, Jakarta and Wellington edged up.

The dollar extended gains against its peers as investors pared their rate forecasts.

- Key figures at around 0810 GMT -

Tokyo - Nikkei 225: DOWN 0.9 percent at 41,456.23 (close)

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 25,388.35 (close)

Shanghai - Composite: DOWN 0.3 percent at 3,593.66 (close)

London - FTSE 100: DOWN 0.4 percent at 9,103.42

Dollar/yen: UP at 147.40 yen from 146.94 yen on Thursday

Euro/dollar: DOWN at $1.1751 from $1.1756

Pound/dollar: DOWN at $1.3469 from $1.3507

Euro/pound: UP at 87.28 pence from 87.01 pence

West Texas Intermediate: UP 0.4 percent at $66.33 per barrel

Brent North Sea Crude: UP 0.5 percent at $69.53 per barrel

New York - Dow: DOWN 0.7 percent at 44,693.91 (close)

I.Matar--SF-PST