-

Bradley hones Ryder Cup strategy as US team bonds in California

Bradley hones Ryder Cup strategy as US team bonds in California

-

Victims buried after IS-linked attack in DR Congo

-

Prince Harry meets King Charles for first time since 2024

Prince Harry meets King Charles for first time since 2024

-

Veteran Vardy ready to silence doubters in Cremonese adventure

-

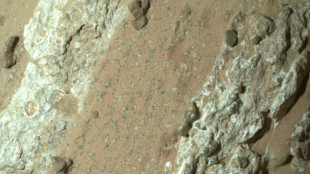

Speckled Martian rocks 'clearest sign' yet of ancient life

Speckled Martian rocks 'clearest sign' yet of ancient life

-

Ex-France goalkeeper Mandanda calls time on club career

-

'Anguish' as Cuba plunges into new electricity blackout

'Anguish' as Cuba plunges into new electricity blackout

-

Martian rocks offer clues that might indicate ancient life

-

Kuldeep stars as 'clinical' India crush UAE in Asia Cup T20

Kuldeep stars as 'clinical' India crush UAE in Asia Cup T20

-

Musk's title of richest person challenged by Oracle's Ellison

-

New French PM vows 'profound break' with past as protests flare

New French PM vows 'profound break' with past as protests flare

-

Three migrants dead, three missing in Channel crossing attempts

-

Kuldeep stars as India crush UAE in Asia Cup T20

Kuldeep stars as India crush UAE in Asia Cup T20

-

Bolsonaro judge criticizes trial, warns of 'political' verdict

-

Italy's Pellizzari scorches to Vuelta stage 17 honours

Italy's Pellizzari scorches to Vuelta stage 17 honours

-

Nine dead in Israeli strikes on rebel-held Yemen

-

Italy to remain top wine producer in world: 2025 estimates

Italy to remain top wine producer in world: 2025 estimates

-

400-year-old Rubens found in Paris mansion

-

Pellizzari takes Vuelta stage 17 honours

Pellizzari takes Vuelta stage 17 honours

-

Deadly floods inundate Indonesia's Bali and Flores islands

-

Syrian jailed for life over Islamist knife attack at German festival

Syrian jailed for life over Islamist knife attack at German festival

-

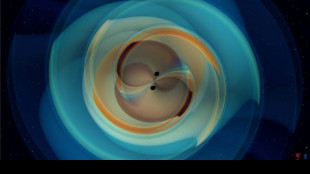

Gravitational waves from black hole smash confirm Hawking theory

-

Israel launches deadly strike on Yemen rebel media arm

Israel launches deadly strike on Yemen rebel media arm

-

Fossil energy 'significant' driver of climate-fuelled heatwaves: study

-

Oldest known lizard ancestor discovered in England

Oldest known lizard ancestor discovered in England

-

Smoke from 2023 Canada fires linked to thousands of deaths: study

-

Software company Oracle shares surge more than 35% on huge AI deals

Software company Oracle shares surge more than 35% on huge AI deals

-

UK aims to transform Alzheimer's diagnosis with blood test trial

-

US Senate panel advances nomination of Trump's Fed governor pick

US Senate panel advances nomination of Trump's Fed governor pick

-

Israeli strikes shake quiet Qatar, strain US ties

-

Russian drones in Poland put NATO to the test

Russian drones in Poland put NATO to the test

-

Emotional Axelsen well beaten on return from six months out

-

US producer inflation unexpectedly falls in first drop since April

US producer inflation unexpectedly falls in first drop since April

-

Viking ships make final high-risk voyage to new Oslo home

-

UK PM expresses 'confidence' in ambassador to US after Epstein letter

UK PM expresses 'confidence' in ambassador to US after Epstein letter

-

Belgium seeks US help in drug trafficking fight

-

Spain PM's wife denies embezzlement in fresh court hearing

Spain PM's wife denies embezzlement in fresh court hearing

-

Stock markets strike records despite geopolitical unrest

-

Spain to deploy 'extraordinary' security for Vuelta finale

Spain to deploy 'extraordinary' security for Vuelta finale

-

Ex-Premier League referee Coote charged with making indecent child image

-

Ryder Cup pairings not 'set in stone', says Europe captain Donald

Ryder Cup pairings not 'set in stone', says Europe captain Donald

-

What we know about Israel's attack on Hamas in Qatar

-

Poland warns of escalation, holds NATO talks after Russian drone intrusion

Poland warns of escalation, holds NATO talks after Russian drone intrusion

-

Australia Davis Cup captain Hewitt handed ban for pushing anti-doping official

-

New French PM vows 'profound break' with past to exit crisis

New French PM vows 'profound break' with past to exit crisis

-

Israel vows to strike foes anywhere after Qatar attack

-

Kony defence urges ICC judges to halt case

Kony defence urges ICC judges to halt case

-

British horse racing strikes over proposed tax rise on betting

-

Zara owner Inditex shares soar as sales growth revives

Zara owner Inditex shares soar as sales growth revives

-

Stock markets rise amid geopolitical unrest

European stocks close higher as Wall Street dips

European and Asian stocks closed higher on Tuesday while Wall Street was trading slightly lower, without any major economic data to set a firm direction.

The dip of the main US indices came as the market digested a Moody's credit rating downgrade from last Friday. It also followed a recent weeklong US market rally, with analysts suggesting a likely consolidation of gains.

In Europe, London and Paris finished higher and Frankfurt's DAX gained 0.4 percent to go past 24,000 points for the first time.

Some of the rise stemmed from hopes of a European Central Bank interest rate cut next month, said Philippe Cohen, portfolio manager at Kiplink.

Luxury clothing company Chanel waited until after Paris's close to report a 28-percent drop in 2024 net profit.

Asian stocks closed moslty higher, with Hong Kong rising more than one percent, buoyed by China cutting its interest rates to historic lows, and Tokyo also up.

The Chinese central bank move, which had been expected, comes as officials battle to kickstart the economy amid trade tensions with the United States and a persistent domestic spending slump.

Elsewhere, the Australian central bank cut its key interest rate to its lowest level in two years, citing steady progress in bringing inflation under control.

The dollar weakened against major currencies as G7 finance ministers met in Canada to discuss global economic conditions, as well as seeking a common position on Ukraine.

David Morrison, senior market analyst at Trade Nation, said investors did not seem overly alarmed by the Moody's downgrade, even though it was weighing on the dollar and US bonds.

"It looks as if sentiment is sufficiently resilient to take this punch on the nose in its stride," he said.

Instead, attention was focused more on the fate of US President Donald Trump's giant tax cut proposal, which he was to discuss in a closed-door meeting with House Republicans. The legislation is expected to face a close vote later this week.

Patrick J O'Hare, analyst at Briefing.com, said investors were "waiting to see if the Treasury market can keep its cool" as the bill is debated, given it "is expected to add trillions to the budget deficit".

In corporate news, billionaire Elon Musk said he was pulling back from spending his fortune on politics, and asserted the Tesla electric car company he runs was doing well despite blowback over his support of Trump.

Aside from a Tesla sales decline in Europe, "we're strong everywhere else," Musk said.

Chinese battery giant CATL ended its first day on the Hong Kong Stock Exchange more than 16 percent higher, having raised $4.6 billion in the world's biggest initial public offering this year.

A global leader in the sector, CATL produces more than a third of all electric vehicle batteries sold worldwide.

- Key figures at around 1615 GMT -

New York - Dow: DOWN 0.1 percent at 42,735.06 points

New York - S&P 500: DOWN 0.3 percent at 5,947.91

New York - Nasdaq Composite: DOWN 0.4 percent at 19,143.42

London - FTSE 100: UP 0.9 percent at 8,781.12 (close)

Paris - CAC 40: UP 0.8 percent at 7,942.42 (close)

Frankfurt - DAX: UP 0.4 percent at 24,036.11 (close)

Tokyo - Nikkei 225: UP 0.1 percent at 37,529.49 (close)

Hong Kong - Hang Seng Index: UP 1.5 percent at 23,681.48 (close)

Shanghai - Composite: UP 0.4 percent at 3,380.48 (close)

Euro/dollar: UP at $1.1252 from $1.1244 on Monday

Pound/dollar: UP at $1.3368 from $1.3360

Dollar/yen: DOWN at 144.72 yen from 144.87 yen

Euro/pound: UP at 84.16 pence from 84.14 pence

West Texas Intermediate: DOWN 0.7 percent at $61.68 per barrel

Brent North Sea Crude: DOWN 0.8 percent at $65.04 per barrel

X.AbuJaber--SF-PST