-

Bradley hones Ryder Cup strategy as US team bonds in California

Bradley hones Ryder Cup strategy as US team bonds in California

-

Victims buried after IS-linked attack in DR Congo

-

Prince Harry meets King Charles for first time since 2024

Prince Harry meets King Charles for first time since 2024

-

Veteran Vardy ready to silence doubters in Cremonese adventure

-

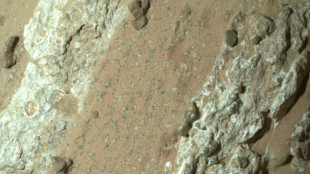

Speckled Martian rocks 'clearest sign' yet of ancient life

Speckled Martian rocks 'clearest sign' yet of ancient life

-

Ex-France goalkeeper Mandanda calls time on club career

-

'Anguish' as Cuba plunges into new electricity blackout

'Anguish' as Cuba plunges into new electricity blackout

-

Martian rocks offer clues that might indicate ancient life

-

Kuldeep stars as 'clinical' India crush UAE in Asia Cup T20

Kuldeep stars as 'clinical' India crush UAE in Asia Cup T20

-

Musk's title of richest person challenged by Oracle's Ellison

-

New French PM vows 'profound break' with past as protests flare

New French PM vows 'profound break' with past as protests flare

-

Three migrants dead, three missing in Channel crossing attempts

-

Kuldeep stars as India crush UAE in Asia Cup T20

Kuldeep stars as India crush UAE in Asia Cup T20

-

Bolsonaro judge criticizes trial, warns of 'political' verdict

-

Italy's Pellizzari scorches to Vuelta stage 17 honours

Italy's Pellizzari scorches to Vuelta stage 17 honours

-

Nine dead in Israeli strikes on rebel-held Yemen

-

Italy to remain top wine producer in world: 2025 estimates

Italy to remain top wine producer in world: 2025 estimates

-

400-year-old Rubens found in Paris mansion

-

Pellizzari takes Vuelta stage 17 honours

Pellizzari takes Vuelta stage 17 honours

-

Deadly floods inundate Indonesia's Bali and Flores islands

-

Syrian jailed for life over Islamist knife attack at German festival

Syrian jailed for life over Islamist knife attack at German festival

-

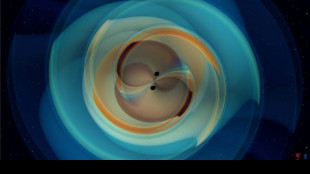

Gravitational waves from black hole smash confirm Hawking theory

-

Israel launches deadly strike on Yemen rebel media arm

Israel launches deadly strike on Yemen rebel media arm

-

Fossil energy 'significant' driver of climate-fuelled heatwaves: study

-

Oldest known lizard ancestor discovered in England

Oldest known lizard ancestor discovered in England

-

Smoke from 2023 Canada fires linked to thousands of deaths: study

-

Software company Oracle shares surge more than 35% on huge AI deals

Software company Oracle shares surge more than 35% on huge AI deals

-

UK aims to transform Alzheimer's diagnosis with blood test trial

-

US Senate panel advances nomination of Trump's Fed governor pick

US Senate panel advances nomination of Trump's Fed governor pick

-

Israeli strikes shake quiet Qatar, strain US ties

-

Russian drones in Poland put NATO to the test

Russian drones in Poland put NATO to the test

-

Emotional Axelsen well beaten on return from six months out

-

US producer inflation unexpectedly falls in first drop since April

US producer inflation unexpectedly falls in first drop since April

-

Viking ships make final high-risk voyage to new Oslo home

-

UK PM expresses 'confidence' in ambassador to US after Epstein letter

UK PM expresses 'confidence' in ambassador to US after Epstein letter

-

Belgium seeks US help in drug trafficking fight

-

Spain PM's wife denies embezzlement in fresh court hearing

Spain PM's wife denies embezzlement in fresh court hearing

-

Stock markets strike records despite geopolitical unrest

-

Spain to deploy 'extraordinary' security for Vuelta finale

Spain to deploy 'extraordinary' security for Vuelta finale

-

Ex-Premier League referee Coote charged with making indecent child image

-

Ryder Cup pairings not 'set in stone', says Europe captain Donald

Ryder Cup pairings not 'set in stone', says Europe captain Donald

-

What we know about Israel's attack on Hamas in Qatar

-

Poland warns of escalation, holds NATO talks after Russian drone intrusion

Poland warns of escalation, holds NATO talks after Russian drone intrusion

-

Australia Davis Cup captain Hewitt handed ban for pushing anti-doping official

-

New French PM vows 'profound break' with past to exit crisis

New French PM vows 'profound break' with past to exit crisis

-

Israel vows to strike foes anywhere after Qatar attack

-

Kony defence urges ICC judges to halt case

Kony defence urges ICC judges to halt case

-

British horse racing strikes over proposed tax rise on betting

-

Zara owner Inditex shares soar as sales growth revives

Zara owner Inditex shares soar as sales growth revives

-

Stock markets rise amid geopolitical unrest

Asian markets rebound to track Wall St up as China cuts rates

Asian markets rose Tuesday as investor sentiment returned following the previous day's US rating-fuelled losses, with sentiment also boosted after China cut interest rates to historic lows.

The rally tracked advances on Wall Street, where the initial selloff sparked by Moody's removal of Washington's triple-A grade soon gave way to a push back into beaten-down equities amid hopes about US trade talks.

After Donald Trump's April 2 tariff blitz sowed global turmoil, the deal between China and the United States last week -- which slashed eye-watering tit-for-tat levies -- has re-energised dealers and pushed most markets back to levels before the US president's "Liberation Day" duties.

Trump suspended his harshest measures for 90 days until mid-July, and while few solid agreements have been reached so far there is optimism that the worst of the crisis has passed.

Traders are also hoping the Federal Reserve will cut interest rates this year, with two reductions expected, according to Bloomberg News.

However, two central bank officials remained cautious about when to resume their monetary easing, amid worries that the tariffs and possible tax cuts will reignite inflation.

New York Fed boss John Williams indicated decision-makers might not be able to move before September, while the central bank's vice chairman Philip Jefferson urged patience, adding that it was crucial to make sure any price increases do not become entrenched.

In early trade, Hong Kong, Shanghai, Tokyo, Sydney, Seoul, Singapore, Taipei, Wellington and Jakarta were all up.

The gains came as China's central bank cut two key interest rates as officials battle to kickstart the economy, which faces persistent headwinds from a long-term domestic spending slump, a protracted debt crisis in the property sector and high youth unemployment.

The People's Bank of China lowered its one-year Loan Prime Rate (LPR), the benchmark for the most advantageous rates lenders can offer to businesses and households, to 3.0 percent from 3.1 percent.

The five-year LPR, the benchmark for mortgage loans, was cut to 3.5 percent to 3.6 percent.

Both rates were last cut in October to what were then record lows.

"The rate cuts will reduce interest payments on existing loans, taking some pressure off indebted firms. It will also reduce the price of new loans," Zichun Huang, China economist at Capital Economics, said in a note.

However, she added that "modest rate cuts alone are unlikely to meaningfully boost loan demand or wider economic activity".

The "reductions... probably won't be the last this year", she said.

The move came a day after data showed Chinese retail sales came in below expectations in April, highlighting a continued lack of confidence among consumers.

In Hong Kong, Chinese battery giant CATL soared more than 13 percent on its debut, having raised US$4.6 billion in the world's biggest initial public offering this year.

The firm, which produces more than a third of all electric vehicle batteries sold worldwide, saw strong demand even after it was designated as a "Chinese military company" on a US list in January.

The US House Select Committee on the Chinese Communist Party even highlighted this inclusion in letters to two US banks in April, urging them to withdraw from the IPO deal with the "Chinese military-linked company".

But the two banks -- JPMorgan and Bank of America -- are still onboard.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 0.5 percent at 37,691.56 (break)

Hong Kong - Hang Seng Index: UP 1.0 percent at 23,568.99

Shanghai - Composite: UP 0.2 percent at 3,373.52

Euro/dollar: DOWN at $1.1243 from $1.1244 on Monday

Pound/dollar: UP at $1.3363 from $1.3360

Dollar/yen: DOWN at 144.84 yen from 144.87 yen

Euro/pound: UP at 84.15 pence from 84.14 pence

West Texas Intermediate: UP 0.2 percent at $62.82 per barrel

Brent North Sea Crude: DOWN 0.1 percent at $65.46 per barrel

New York - Dow: UP 0.3 percent at 42,792.07 (close)

London - FTSE 100: UP 0.2 percent at 8,699.31 (close)

V.Said--SF-PST