-

Brazil's Lula urges Trump to treat all countries equally

Brazil's Lula urges Trump to treat all countries equally

-

Knicks rally to down Rockets as Pistons, Spurs roll on

-

Brumbies end 26-year jinx with thrashing of Crusaders

Brumbies end 26-year jinx with thrashing of Crusaders

-

Pakistan launches deadly strikes in Afghanistan

-

Son's LAFC defeats Messi and Miami in MLS season opener

Son's LAFC defeats Messi and Miami in MLS season opener

-

Korda to face Paul in all-American Delray Beach final

-

Vikings receiver Rondale Moore dies at 25

Vikings receiver Rondale Moore dies at 25

-

Copper, a coveted metal boosting miners

-

Indigenous protesters occupy Cargill port terminal in Brazil

Indigenous protesters occupy Cargill port terminal in Brazil

-

Four lives changed by four years of Russia-Ukraine war

-

AI agent invasion has people trying to pick winners

AI agent invasion has people trying to pick winners

-

'Hamnet' eyes BAFTAs glory over 'One Battle', 'Sinners'

-

Cron laments errors after Force crash to Blues in Super Rugby

Cron laments errors after Force crash to Blues in Super Rugby

-

The Japanese snowball fight game vying to be an Olympic sport

-

'Solar sheep' help rural Australia go green, one panel at a time

'Solar sheep' help rural Australia go green, one panel at a time

-

Cuban Americans keep sending help to the island, but some cry foul

-

As US pressures Nigeria over Christians, what does Washington want?

As US pressures Nigeria over Christians, what does Washington want?

-

Dark times under Syria's Assad hit Arab screens for Ramadan

-

Bridgeman powers to six-shot lead over McIlroy at Riviera

Bridgeman powers to six-shot lead over McIlroy at Riviera

-

Artist creates 'Latin American Mona Lisa' with plastic bottle caps

-

Malinin highlights mental health as Shaidorov wears panda suit at Olympic skating gala

Malinin highlights mental health as Shaidorov wears panda suit at Olympic skating gala

-

Timberwolves center Gobert suspended after another flagrant foul

-

Guardiola hails Man City's 'massive' win over Newcastle

Guardiola hails Man City's 'massive' win over Newcastle

-

Leaders Real Madrid stung at Osasuna, Atletico back on track

-

PSG win to reclaim Ligue 1 lead after Lens lose to Monaco

PSG win to reclaim Ligue 1 lead after Lens lose to Monaco

-

Man City down Newcastle to pile pressure on Arsenal, Chelsea held

-

Man City close gap on Arsenal after O'Reilly sinks Newcastle

Man City close gap on Arsenal after O'Reilly sinks Newcastle

-

Finland down Slovakia to claim bronze in men's ice hockey

-

More than 1,500 request amnesty under new Venezuela law

More than 1,500 request amnesty under new Venezuela law

-

US salsa legend Willie Colon dead at 75

-

Canada beat Britain to win fourth Olympic men's curling gold

Canada beat Britain to win fourth Olympic men's curling gold

-

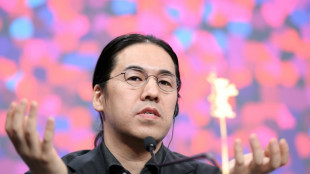

Political drama 'Yellow Letters' wins Berlin's Golden Bear

-

Fly-half Jalibert ruled out of France side to face Italy

Fly-half Jalibert ruled out of France side to face Italy

-

Russell restart try 'big moment' in Scotland win, says Townsend

-

Kane helps Bayern extend Bundesliga lead as Dortmund held by Leipzig

Kane helps Bayern extend Bundesliga lead as Dortmund held by Leipzig

-

Liga leaders Real Madrid stung by late Osasuna winner

-

Ilker Catak's 'Yellow Letters' wins Golden Bear at Berlin film festival

Ilker Catak's 'Yellow Letters' wins Golden Bear at Berlin film festival

-

England's Genge says thumping Six Nations loss to Ireland exposes 'scar tissue'

-

Thousands march in France for slain far-right activist

Thousands march in France for slain far-right activist

-

Imperious Alcaraz storms to Qatar Open title

-

Klaebo makes Olympic history as Gu forced to wait

Klaebo makes Olympic history as Gu forced to wait

-

Late Scotland try breaks Welsh hearts in Six Nations

-

Lens lose, giving PSG chance to reclaim Ligue 1 lead

Lens lose, giving PSG chance to reclaim Ligue 1 lead

-

FIFA's Gaza support 'in keeping' with international federation - IOC

-

First all-Pakistani production makes history at Berlin film fest

First all-Pakistani production makes history at Berlin film fest

-

Gu forced to wait as heavy snow postpones Olympic halfpipe final

-

NASA chief rules out March launch of Moon mission over technical issues

NASA chief rules out March launch of Moon mission over technical issues

-

Dutch double as Bergsma and Groenewoud win Olympic speed skating gold

-

At least three dead as migrant boat capsizes off Greek island

At least three dead as migrant boat capsizes off Greek island

-

Fears of renewed conflict haunt Tehran as US issues threats

Copper, a coveted metal boosting miners

BHP, Glencore and Teck Resources -- three mining giants whose annual results have revealed significantly increased profits thanks in large part to soaring copper prices.

AFP explores the reasons behind the gains.

- Profits boost -

Australian resources group BHP saw net profit surge almost 28 percent to US$5.64 billion in the final six months of last year, the group's fiscal first half.

Alongside the recent earnings, BHP stated that it was the world's largest copper producer after raising output by about 30 percent in the past four years, including from its vast Escondida mine in Chile.

In the same week, Swiss miner Glencore announced a return to profit last year and plans to double its copper production within a decade.

Canadian miner Teck Resources, in talks over a multi-billion-dollar merger with Anglo American to forge a copper giant, noted that its profits have been driven by "significantly higher copper prices".

Resources groups that have not fared so well in 2025 -- iron ore behemoth Rio Tinto and Anglo American -- are ramping up production of copper to help offset sagging demand for steel and diamonds.

- Why copper? -

Copper demand has exploded in recent years, with the metal needed for solar panels, wind turbines and also military hardware.

The coveted metal is also used in electric vehicle batteries and data centres for artificial intelligence.

Surging demand caused the price of copper to soar 40 percent on the London Metal Exchange (LME) last year, and in January this year it reached a record high.

This was fuelled by supply disruptions at major copper mines in Chile, Indonesia and the Democratic Republic of Congo.

Demand has been boosted additionally "by Donald Trump's decisions", said Benjamin Louvet, head of commodities management at Ofi Invest AM.

Elaborating further to AFP, he pointed to the US president's tariff threats, which saw companies build copper stocks, and heightened tensions between the United States and China, the world's dominant player in metals markets.

- Copper supply risks -

Many copper experts agree that the industrial metal could reach a supply deficit this year.

"A structural deficit appears almost inevitable," Philippe Chalmin, a commodities professor at Paris-Dauphine University, told AFP.

The poor anticipation of current needs is partly explained by the fact that "the energy transition happened quite quickly", he added.

Developing a new mine takes time.

According to a study by the International Energy Agency, an average of 16 years is required -- although the duration varies depending on the ore and location.

This timeframe and the enormous associated costs are deterring financiers, "who are turning to investments with much faster returns", said Louvet.

Against this backdrop, the sector is seeking to consolidate, although a bid by BHP to buy Anglo American, disrupting the latter's planned tie-up with Teck, recently collapsed.

- Commodities versus stocks -

Unlike shares in companies, which rise in anticipation of increased revenue, commodity prices are determined by the current supply versus demand.

The price of copper "does not factor in future scarcity", said Louvet.

This means new mining projects are launched only once there is a need for increased production.

Louvet explained that copper would have to reach $15,000 per tonne for miners to begin new projects as, despite soaring profits, the financial risk is too high.

Copper is trading at below $13,000 per tonne on the LME, compared with its all-time high of $14,527.50 last month.

Even the creation or expansion of strategic stockpiles by the United States and other countries will not "fundamentally change the situation", Louvet added.

burs-pml/bcp/rmb/rh/abs

F.AbuShamala--SF-PST