-

Asian stocks wobble as US shutdown rally loses steam

Asian stocks wobble as US shutdown rally loses steam

-

UK unemployment jumps to 5% before key govt budget

-

Japanese 'Ran' actor Tatsuya Nakadai dies at 92

Japanese 'Ran' actor Tatsuya Nakadai dies at 92

-

AI stock boom delivers bumper quarter for Japan's SoftBank

-

Asian stocks struggle as US shutdown rally loses steam

Asian stocks struggle as US shutdown rally loses steam

-

India probes deadly Delhi blast, vows those responsible will face justice

-

Pistons win streak hits seven on night of NBA thrillers

Pistons win streak hits seven on night of NBA thrillers

-

US state leaders take stage at UN climate summit -- without Trump

-

Burger King to enter China joint venture, plans to double stores

Burger King to enter China joint venture, plans to double stores

-

Iraqis vote in general election in rare moment of calm

-

Philippines digs out from Typhoon Fung-wong as death toll climbs to 18

Philippines digs out from Typhoon Fung-wong as death toll climbs to 18

-

'Demon Slayer' helps Sony hike profit forecasts

-

Who can qualify for 2026 World Cup in next round of European qualifiers

Who can qualify for 2026 World Cup in next round of European qualifiers

-

Ireland's climate battle is being fought in its fields

-

Sony hikes profit forecasts on strong gaming, anime sales

Sony hikes profit forecasts on strong gaming, anime sales

-

End to US government shutdown in sight as stopgap bill advances to House

-

'Western tech dominance fading' at Lisbon's Web Summit

'Western tech dominance fading' at Lisbon's Web Summit

-

Asian stocks rise as record US shutdown nears end

-

'Joy to beloved motherland': N.Korea football glory fuels propaganda

'Joy to beloved motherland': N.Korea football glory fuels propaganda

-

Taiwan coastguard faces China's might near frontline islands

-

Concentration of corporate power a 'huge' concern: UN rights chief

Concentration of corporate power a 'huge' concern: UN rights chief

-

Indian forensic teams scour deadly Delhi car explosion

-

Trump says firebrand ally Greene has 'lost her way' after criticism

Trump says firebrand ally Greene has 'lost her way' after criticism

-

Show shines light on Mormons' unique place in US culture

-

Ukraine, China's critical mineral dominance, on agenda as G7 meets

Ukraine, China's critical mineral dominance, on agenda as G7 meets

-

AI agents open door to new hacking threats

-

Syria joins alliance against Islamic State after White House talks

Syria joins alliance against Islamic State after White House talks

-

As COP30 opens, urban Amazon residents swelter

-

NHL unveils new Zurich office as part of global push

NHL unveils new Zurich office as part of global push

-

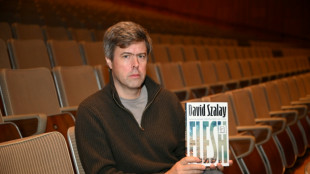

Szalay wins Booker Prize for tortured tale of masculinity

-

'Netflix House' marks streaming giant's first theme park

'Netflix House' marks streaming giant's first theme park

-

UN warns of rough winter ahead for refugees

-

Brazil's 'action agenda' at COP30 takes shape

Brazil's 'action agenda' at COP30 takes shape

-

Trump threatens $1 billion action as BBC apologises for edit error

-

Sinner dominates injury-hit Auger-Aliassime in ATP Finals opener

Sinner dominates injury-hit Auger-Aliassime in ATP Finals opener

-

Trump hails Syria's 'tough' ex-jihadist president after historic talks

-

Syria's ex-jihadist president meets Trump for historic talks

Syria's ex-jihadist president meets Trump for historic talks

-

Top US court hears case of Rastafarian whose hair was cut in prison

-

US mediator Kushner and Netanyahu discuss phase two of Gaza truce

US mediator Kushner and Netanyahu discuss phase two of Gaza truce

-

End to US government shutdown in sight as Democrats quarrel

-

Trump threatens air traffic controllers over shutdown absences

Trump threatens air traffic controllers over shutdown absences

-

US to remove warnings from menopause hormone therapy

-

UK water firm says 'highly likely' behind plastic pellet pollution incident

UK water firm says 'highly likely' behind plastic pellet pollution incident

-

Syria's ex-jihadist president holds historic Trump talks

-

End to record-long US government shutdown in sight

End to record-long US government shutdown in sight

-

France's ex-leader Sarkozy says after jail release 'truth will prevail'

-

Atalanta sack coach Juric after poor start to season

Atalanta sack coach Juric after poor start to season

-

Trump threatens $1 billion action as BBC apologises for speech edit

-

Gattuso wants 'maximum commitment' as Italy's World Cup bid on the line

Gattuso wants 'maximum commitment' as Italy's World Cup bid on the line

-

Indian capital car blast kills at least eight

AI stock boom delivers bumper quarter for Japan's SoftBank

Japan's SoftBank Group reported Tuesday that net profit more than doubled in the second quarter thanks to a boom in AI-related share prices that has fuelled fears of a market bubble.

The tech investment giant -- a major backer of ChatGPT-maker OpenAI -- logged a net profit of 2.5 trillion yen ($16.2 billion) in July-September, up from 1.2 trillion yen in the same period last year.

SoftBank also announced it sold $5.8 billion worth of shares in US chip giant Nvidia last month, after the quarter had ended.

The group's earnings often swing dramatically because it invests heavily in tech start-ups and semiconductor firms, whose stocks are volatile.

In recent months optimism over the promise of AI technology has sparked a rush of multi-billion-dollar deals -- sending tech shares soaring worldwide.

Wall Street's tech-rich Nasdaq index has surged 25 percent since May.

But that has fed concerns of a market bubble that could eventually burst, like the dot-com boom that imploded at the turn of the millennium.

Fears that AI stock valuations are too high sparked a market sell-off last week.

Nvidia, whose chips are used to train and power generative AI systems, recently became the world's first company valued above $5 trillion, though its market cap has since receded to around $4.8 trillion.

SoftBank did not give a reason for the Nvidia stock sale in its earnings statement.

But Bloomberg News said it could reflect plans by the Japanese company's flamboyant founder Masayoshi Son to boost his own influence in the AI field.

Son, 68, believes "artificial superintelligence" is on the horizon, which will herald a technological revolution with new inventions and medicine.

He appeared alongside US President Donald Trump at the White House in January when SoftBank teamed up with OpenAI and cloud giant Oracle to lead the $500 billion Stargate project to build AI infrastructure in the United States.

By some estimates, OpenAI has signed approximately $1 trillion worth of infrastructure deals in 2025, including a $300 billion Oracle agreement.

SoftBank stock has "had a strong run" itself, said a Jefferies equity research published last month.

"The recent surge appears to be driven by excitement around its exposure to OpenAI," it said.

The firm has soared more than 140 percent so far in 2025.

But Jefferies also listed some reasons for caution.

"While OpenAI has strong consumer visibility, its share in (the) enterprise market is tiny. Its transition from non-profit to for-profit remains unresolved, and its relationship with Microsoft is still evolving," the note said.

And "the competitive landscape is intense, with Google, Anthropic, Grok, and others investing heavily".

SoftBank said last month it would buy Swiss-Swedish firm ABB Robotics for nearly $5.4 billion as part of its plans to develop so-called physical AI.

I.Yassin--SF-PST