-

Pakistan inflict more T20 misery on West Indies

Pakistan inflict more T20 misery on West Indies

-

South Korea's Yoon resists questioning by lying in underwear

-

Stocks drop as Trump's new tariff sweep offsets earnings

Stocks drop as Trump's new tariff sweep offsets earnings

-

El Salvador abolishes presidential term limits, allowing another Bukele run

-

Nintendo quarterly revenue surges thanks to Switch 2

Nintendo quarterly revenue surges thanks to Switch 2

-

Swiss to try to negotiate way out of stiff US tariffs

-

British Airways owner sees profit jump on 'strong' demand

British Airways owner sees profit jump on 'strong' demand

-

Sand and dust storm sweeps across southern Peru

-

Battered Wallabies determined to deny Lions a whitewash

Battered Wallabies determined to deny Lions a whitewash

-

'Wednesday' returns with Jenna Ortega, and a Lady Gaga cameo

-

Trump unveils slew of new tariffs, punishes Canada

Trump unveils slew of new tariffs, punishes Canada

-

McIntosh, Ledecky set up 800m world title showdown

-

'Emotional' Yu, 12, celebrates historic world swimming medal

'Emotional' Yu, 12, celebrates historic world swimming medal

-

Stocks struggle as Trump's new tariff sweep offsets earnings

-

Stocks struggle as Trump unveils new tariff sweep offsets earnings

Stocks struggle as Trump unveils new tariff sweep offsets earnings

-

Landslide-prone Nepal tests AI-powered warning system

-

El Salvador parliament adopts reform to allow Bukele to run indefinitely

El Salvador parliament adopts reform to allow Bukele to run indefinitely

-

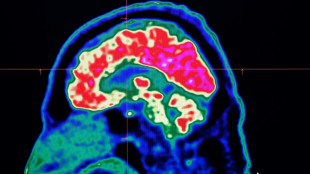

What are all these microplastics doing to our brains?

-

Zverev rallies in Toronto to claim milestone 500th ATP match win

Zverev rallies in Toronto to claim milestone 500th ATP match win

-

Farrell says debate over Australia as Lions destination 'insulting'

-

After stadium delays, African Nations Championship kicks off

After stadium delays, African Nations Championship kicks off

-

US tech titan earnings rise on AI as economy roils

-

Nvidia says no 'backdoors' in chips as China questions security

Nvidia says no 'backdoors' in chips as China questions security

-

Wallabies' Tizzano absent from third Lions Test after online abuse

-

Famed union leader Dolores Huerta urges US to mobilize against Trump

Famed union leader Dolores Huerta urges US to mobilize against Trump

-

Richardson, Lyles ease through 100m heats at US trials

-

Correa returning to Astros in blockbuster MLB trade from Twins

Correa returning to Astros in blockbuster MLB trade from Twins

-

Trump orders tariffs on dozens of countries in push to reshape global trade

-

Trump to build huge $200mn ballroom at White House

Trump to build huge $200mn ballroom at White House

-

Heathrow unveils £49 bn expansion plan for third runway

-

'Peaky Blinders' creator to pen new James Bond movie: studio

'Peaky Blinders' creator to pen new James Bond movie: studio

-

Top seed Gauff rallies to reach WTA Montreal fourth round

-

Amazon profits surge 35% but forecast sinks share price

Amazon profits surge 35% but forecast sinks share price

-

Gas workers uncover 1,000-year-old mummy in Peru

-

Brazil vows to fight Trump tariff 'injustice'

Brazil vows to fight Trump tariff 'injustice'

-

Michelsen stuns Musetti as Ruud rallies in Toronto

-

Oscars group picks 'A Star is Born' producer as new president

Oscars group picks 'A Star is Born' producer as new president

-

Global stocks mostly fall ahead of big Trump tariff deadline

-

Apple profit beats forecasts on strong iPhone sales

Apple profit beats forecasts on strong iPhone sales

-

Michelsen stuns Musetti at ATP Toronto Masters

-

Peru's president rejects court order on police amnesty

Peru's president rejects court order on police amnesty

-

Google must open Android to rival app stores: US court

-

Amazon profits surge 35% as AI investments drive growth

Amazon profits surge 35% as AI investments drive growth

-

Zelensky urges allies to seek 'regime change' in Russia

-

Trump envoy to inspect Gaza aid as pressure mounts on Israel

Trump envoy to inspect Gaza aid as pressure mounts on Israel

-

US theater and opera legend Robert Wilson dead at 83

-

EA shooter 'Battlefield 6' to appear in October

EA shooter 'Battlefield 6' to appear in October

-

Heavyweight shooter 'Battlefield 6' to appear in October

-

Justin Timberlake says he has Lyme disease

Justin Timberlake says he has Lyme disease

-

Atkinson and Tongue strike as India struggle in England decider

| RIO | 0.47% | 59.77 | $ | |

| CMSC | 1.09% | 22.85 | $ | |

| SCU | 0% | 12.72 | $ | |

| BTI | 0.97% | 53.68 | $ | |

| NGG | 0.28% | 70.39 | $ | |

| RYCEF | 7.62% | 14.18 | $ | |

| BCC | -1.29% | 83.81 | $ | |

| SCS | 0% | 10.33 | $ | |

| AZN | -4.79% | 73.09 | $ | |

| JRI | 0.15% | 13.13 | $ | |

| RBGPF | 0.69% | 74.94 | $ | |

| GSK | -4.9% | 37.15 | $ | |

| CMSD | 0.9% | 23.27 | $ | |

| BCE | -0.86% | 23.33 | $ | |

| BP | -0.31% | 32.15 | $ | |

| VOD | -2.31% | 10.81 | $ | |

| RELX | 0.21% | 51.89 | $ |

Stocks, dollar mixed tracking Fed, tariffs, results

Major stock markets and the dollar traded mixed Thursday as traders weighed a cautious Federal Reserve, strong tech earnings and new US tariffs.

The US central bank held interest rates steady Wednesday and refrained from suggesting it would cut them any time soon as inflation stays stubbornly high in the world's biggest economy.

Ahead of US jobs data Friday, focus was on company earnings, with energy giant Shell plus automakers Renault and BMW reporting profit slumps after Microsoft and Facebook owner Meta posted better-than-expected earnings.

The two American giants saw their share prices soar in futures trading ahead of Wall Street's reopening Thursday and results from Amazon and Apple.

"US markets are expected to enjoy a buoyant open thanks in no small part to the bumper earnings seen from Meta and Microsoft," noted Joshua Mahony, chief market analyst at trading group Rostro.

The latest developments on the tariffs front saw Trump announce a deal that sees 15 percent levies on South Korean goods and a commitment from Seoul to invest $350 billion in the United States.

The president Thursday said his sweeping tariffs were making the US "great & rich again".

It came after he revealed that India would face 25 percent tolls, coupled with an unspecified penalty over New Delhi's purchases of Russian weapons and energy.

Trump has also signed an executive order implementing an additional tax on Brazilian products, as he lambasts what he calls Brazil's "witch hunt" against his far-right ally, former president Jair Bolsonaro, on coup charges.

Traders are keeping tabs on talks with other countries that are yet to sign deals with Washington ahead of Trump's self-imposed Friday deadline.

After a broadly negative session Wednesday on Wall Street, Asian markets struggled.

Hong Kong, Shanghai, Sydney, Singapore, Seoul, Manila, Wellington and Jakarta closed lower, while Tokyo, Taipei, Mumbai and Bangkok climbed.

London was higher around midday in the UK, while eurozone indices Paris and Frankfurt steadied.

The yen retreated against the dollar after the Bank of Japan decided against hiking interest rates, while lifting economic growth and inflation costs.

The BoJ cautiously welcomed the country's trade deal with the United States.

- Key figures at around 1045 GMT -

London - FTSE 100: UP 0.6 percent at 9,189.22 points

Paris - CAC 40: DOWN 0.1 percent at 7,852.55

Frankfurt - DAX: FLAT at 24,261.38

Tokyo - Nikkei 225: UP 1.0 percent at 41,069.82 (close)

Hong Kong - Hang Seng Index: DOWN 1.6 percent at 24,773.33 (close)

Shanghai - Composite: DOWN 1.2 percent at 3,573.21 (close)

New York - Dow: DOWN 0.5 percent at 44,632.99 (close)

Euro/dollar: UP at $1.1434 from $1.1409 on Wednesday

Pound/dollar: DOWN at $1.3220 from $1.3239

Dollar/yen: UP at 149.98 yen from 149.50 yen

Euro/pound: UP at 86.50 pence from 86.15 pence

West Texas Intermediate: DOWN 0.5 percent at $69.67 per barrel

Brent North Sea Crude: DOWN 0.6 percent at $72.05

burs-bcp/ajb/rl

U.Shaheen--SF-PST