-

Australian medal hope latest swimmer hit by tummy trouble at worlds

Australian medal hope latest swimmer hit by tummy trouble at worlds

-

England captain Stokes out of India series decider

-

HSBC banks lower profits on higher costs

HSBC banks lower profits on higher costs

-

Shanghai police bust gang selling counterfeit Labubu toys

-

Eurozone economy expands but tariff impact looms

Eurozone economy expands but tariff impact looms

-

Shanghai evacuates 283,000 people as typhoon hits

-

Ryanair says dropping three French airports over 'harmful' tax

Ryanair says dropping three French airports over 'harmful' tax

-

China says childcare subsidies to 'add new impetus' to economy

-

Mercedes-Benz welcomes EU-US deal after profits plunge on tariff woes

Mercedes-Benz welcomes EU-US deal after profits plunge on tariff woes

-

Bayern Munich sign Luis Diaz from Liverpool

-

Adidas reports hit from US tariffs

Adidas reports hit from US tariffs

-

Italy opens probe into Meta over AI tool in WhatsApp

-

Russian TV shows buildings swept away as tsunami hits coast

Russian TV shows buildings swept away as tsunami hits coast

-

Japan sees new record high temperature of 41.2C

-

Mercedes-Benz profit plunges on tariff, China woes

Mercedes-Benz profit plunges on tariff, China woes

-

Climbers attempt rescue of German biathlete injured on Pakistan mountain

-

Life after cod: Latvia reinvents its coastal communities

Life after cod: Latvia reinvents its coastal communities

-

Kyrgyzstan struggles with deadly shortages of medicine

-

Canada project reclaims 'foul' industrial area to contain floods

Canada project reclaims 'foul' industrial area to contain floods

-

Toxic Balkan wildfires ignite in poorly managed dumps

-

Intimate no more? Japan clamps down on 'host clubs'

Intimate no more? Japan clamps down on 'host clubs'

-

Could copper tariff hurt US more than Chile?

-

Marchand gears up for 200m IM world record bid

Marchand gears up for 200m IM world record bid

-

Thousands of carpets sunbathe at Turkish resort

-

'I didn't feel safe': Banned Canada coach explains move to New Zealand

'I didn't feel safe': Banned Canada coach explains move to New Zealand

-

Norwegian cousins battle over oil, climate policy

-

Zverev makes winning Toronto return after a month off court

Zverev makes winning Toronto return after a month off court

-

Thailand accuses Cambodia of 'flagrant violation' of truce

-

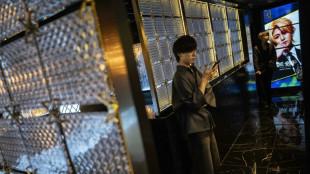

'Marathon at F1 speed': China bids to lap US in AI leadership

'Marathon at F1 speed': China bids to lap US in AI leadership

-

Stablecoins inspire hope, and hype, in Hong Kong

-

Markets mixed as China-US talks end, eyes on tech earnings

Markets mixed as China-US talks end, eyes on tech earnings

-

Huge quake off Russia sparks Pacific tsunami warnings

-

Top seed Gauff outlasts Collins to advance at Montreal

Top seed Gauff outlasts Collins to advance at Montreal

-

Ukraine says Russian strike on training camp kills 3 soldiers

-

Trump's MAGA base defies conservative pro-Israel doctrine

Trump's MAGA base defies conservative pro-Israel doctrine

-

US Fed set to hold firm against Trump pressure

-

Five products to be hit by Trump's incoming tariffs

Five products to be hit by Trump's incoming tariffs

-

US second quarter GDP growth to reflect tariff turbulence

-

US, India to launch powerful Earth-monitoring satellite

US, India to launch powerful Earth-monitoring satellite

-

Australia to ban under-16s from YouTube

-

England and India fight fatigue as gripping Test series goes to the wire

England and India fight fatigue as gripping Test series goes to the wire

-

American Eagle 'jeans' campaign that stars Sydney Sweeney under fire

-

Portugal battles to contain wildfires

Portugal battles to contain wildfires

-

FIFA World Cup draw in Vegas on December 5: reports

-

Japanese qualifier Ito ousts seventh seed Paolini in Montreal

Japanese qualifier Ito ousts seventh seed Paolini in Montreal

-

New Athletic captain Williams 'lucky' to represent migrants in Spain

-

Musetti, Rune set winning pace for ATP seeds in Toronto

Musetti, Rune set winning pace for ATP seeds in Toronto

-

Venus Williams gets US Open mixed doubles wild card spot

-

Global stocks mixed as market focus shifts to earnings deluge

Global stocks mixed as market focus shifts to earnings deluge

-

Tens of thousands of Catholics head to Vatican's Jubilee of Youth

| RBGPF | -4.75% | 74.03 | $ | |

| RYCEF | 2.59% | 13.5 | $ | |

| CMSC | 0.49% | 22.61 | $ | |

| NGG | 0.28% | 70.52 | $ | |

| GSK | 0.58% | 37.67 | $ | |

| SCU | 0% | 12.72 | $ | |

| BP | 0.88% | 32.96 | $ | |

| RIO | 0.13% | 62.27 | $ | |

| BTI | 1.88% | 52.77 | $ | |

| RELX | 0.29% | 51.92 | $ | |

| SCS | -3.24% | 10.51 | $ | |

| AZN | 2.91% | 73.98 | $ | |

| VOD | -0.45% | 11.11 | $ | |

| JRI | 0.23% | 13.06 | $ | |

| CMSD | 0.95% | 23.12 | $ | |

| BCC | -0.7% | 86.14 | $ | |

| BCE | -0.72% | 23.66 | $ |

Stock market attention shifts from trade deals to company results

Stock markets were mixed on Tuesday as investors started turning their attention from trade deals to a slew of company results falling this week.

New York struggled, while in Europe, London, Paris and Frankfurt all closed higher.

In Asia, Shanghai ended higher but Hong Kong and Tokyo lost ground.

The muddled picture came as investors continue to digest the implications of a US-EU trade deal announced on the weekend that many European capitals viewed as lopsided in Washington's favour.

Tuesday also saw Chinese and US officials huddle in Sweden for a second day of talks aimed at extending a trade truce to avoid the return of triple-digit tariffs on each of their countries from August 12.

"The latest surveys point to further weakness to come" in global trade, said Ariane Curtis, a senior analyst at Capital Economics.

The dollar continued its advance, especially against the euro, while oil prices kept rising strongly.

The euro has "suffered a nasty battering... as investors questioned just how positive the US-EU trade deal was for the European Union", said David Morrison, senior market analyst at Trade Nation.

For many investors, though, the focus this week was now more on company earning reports.

Tech heavyweights are stealing the spotlight, with Meta and Microsoft to give results on Wednesday, followed by Amazon and Apple on Thursday.

Their massive -- and extremely costly -- investment race in artificial intelligence underpinned much of the action.

Bloomberg News reported that Microsoft was in talks to keep access to OpenAI technology, even if the ChatGPT maker achieves AI that goes beyond human intelligence.

Thomas Mathews, a markets analyst at Capital Economics, said: "With the worst of the risks around trade seemingly fading, we suspect there are fewer remaining obstacles to further investor enthusiasm for AI and its implications for US companies."

European carmakers -- especially those in Germany -- pursued their drop from Monday as investors balked at the US tariffs they face.

Stellantis, owner of brands including Jeep, Fiat and Peugeot, ended 0.6 percent lower as it said it expected profits to rebound later this year, despite taking a a 1.5-billion-euro ($1.7-billion) hit from the US tariffs.

It was mixed fortunes for pharmaceutical stocks.

AstraZeneca, up more than three percent, helped buoy London's FTSE after posting strong earnings.

But Denmark's Novo Nordisk, known for its blockbuster diabetes and weight-loss treatments Ozempic and Wegovy, shed 23 percent on lowered forecasts.

It has been fighting US authorisation allowing pharmacies to create "compound" copycat versions of its drugs because of shortages due to high demand.

Merck, the US pharma company, pared a drop in its shares but was still down four percent after saying it would axe jobs under a restructuring aimed at cutting $3 billion in costs a year by 2027.

Swedish music streamer Spotify's shares slid 11 percent after it reported an operating profit that far missed its target.

The US Federal Reserve, meanwhile, was to begin Tuesday its two-day policy meeting under increasing pressure from President Donald Trump to slash rates, despite stubbornly high inflation.

- Key figures at around 1545 GMT -

New York - Dow: DOWN 0.4 percent at 44,642.36 points

New York - S&P 500: DOWN 0.2 percent at 6,374.57

New York - Nasdaq Composite: DOWN 0.3 percent at 21,113.42

London - FTSE 100: UP 0.6 percent at 9,138.85 (close)

Paris - CAC 40: UP 0.7 percent at 7,851.54 (close)

Frankfurt - DAX: UP 1.0 percent at 24,198.28 (close)

Tokyo - Nikkei 225: DOWN 0.8 percent at 40,674.55 (close)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 25,524.45 (close)

Shanghai - Composite: UP 0.3 percent at 3,609.71 (close)

Euro/dollar: DOWN at $1.1532 from $1.1597 on Monday

Pound/dollar: DOWN at $1.3333 from $1.3356

Dollar/yen: DOWN at 148.41 yen from 148.52 yen

Euro/pound: DOWN at 86.49 pence from 86.80 pence

Brent North Sea Crude: UP 1.2 percent at $70.17 per barrel

West Texas Intermediate: UP 1.4 percent at $67.62 per barrel

S.AbuJamous--SF-PST