-

US Fed holds firm against Trump pressure as divisions emerge

US Fed holds firm against Trump pressure as divisions emerge

-

Michael Jackson's dirty sock sells for over $8,000 in France

-

Turkish city calls for help after heat tops 50C

Turkish city calls for help after heat tops 50C

-

Renault names Provost CEO after De Meo exit

-

Le Court makes history for Africa at women's Tour de France

Le Court makes history for Africa at women's Tour de France

-

Canada central bank holds rate steady citing US tariff 'threats'

-

Henry puts New Zealand in control of 1st Test against Zimbabwe

Henry puts New Zealand in control of 1st Test against Zimbabwe

-

Stocks edge higher, dollar gains before tech earnings, Fed decision

-

Palestine Action wins bid to challenge terror ban in London court

Palestine Action wins bid to challenge terror ban in London court

-

EU urged to act on forests' faltering absorption of carbon

-

India secures return of ancient Buddhist gems

India secures return of ancient Buddhist gems

-

Stokes braced for 'emotional' tribute to late England batsman Thorpe

-

France's Luc Besson resurrects new 'romantic' Dracula

France's Luc Besson resurrects new 'romantic' Dracula

-

Trump hits India with 25% tariff and 'penalty' over Russia ties

-

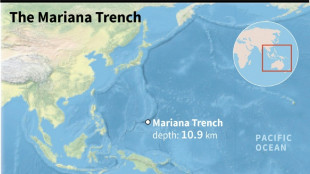

Chinese sub discovers deepest-ever creatures 10 km undersea

Chinese sub discovers deepest-ever creatures 10 km undersea

-

Kingscote revels in being the 'villain' of Sussex Stakes shock

-

English cricket chiefs confirm sale of six Hundred franchises

English cricket chiefs confirm sale of six Hundred franchises

-

Wirtz opens Liverpool account in friendly win in Japan

-

Marchand shatters record as US, Australia win more world gold

Marchand shatters record as US, Australia win more world gold

-

Thousands honour Ozzy Osbourne at UK hometown funeral procession

-

WHO chief says continuous medical aid into Gaza 'critical'

WHO chief says continuous medical aid into Gaza 'critical'

-

London court rules oligarch liable in $1.9 bn Ukraine loan scheme

-

England's Stokes out of India series decider with shoulder injury

England's Stokes out of India series decider with shoulder injury

-

Stocks diverge, dollar gains before tech earnings, Fed decision

-

India's Gill says Oval groundsman caused 'unnecessary' row

India's Gill says Oval groundsman caused 'unnecessary' row

-

Physicists still divided about quantum world, 100 years on

-

Russia relieved as tsunami spares far east from major damage

Russia relieved as tsunami spares far east from major damage

-

'Can't believe it': Marchand shatters long-standing world record

-

French govt prepares new law to return colonial-era art

French govt prepares new law to return colonial-era art

-

London court rules oligarch liable over $1.9 bn Ukraine loan scheme

-

Olympic biathlon champion confirmed dead after Pakistan mountaineering accident

Olympic biathlon champion confirmed dead after Pakistan mountaineering accident

-

German biathlete confirmed dead after accident on Pakistan mountain

-

Marchand smashes long-standing 200m medley world record

Marchand smashes long-standing 200m medley world record

-

US economy returns to growth in second quarter on tariff turbulence

-

'All gone': Beijing villagers left with nothing after deadly floods

'All gone': Beijing villagers left with nothing after deadly floods

-

Aston Martin pares outlook as US tariffs weigh

-

Adidas says may hike US prices after tariff cost warning

Adidas says may hike US prices after tariff cost warning

-

GSK reports improved outlook despite US drug tariffs

-

Olympic champ Pan crashes out again in second worlds flop

Olympic champ Pan crashes out again in second worlds flop

-

US, India launch powerful Earth-monitoring satellite

-

Thailand and Cambodia trade allegations of truce breaking

Thailand and Cambodia trade allegations of truce breaking

-

Thai family mourns soldier son killed just before truce

-

Zimbabwe's Taylor to return after corruption and drugs ban

Zimbabwe's Taylor to return after corruption and drugs ban

-

'Whirlwind' as Australia's O'Callaghan romps to 200m world gold

-

Portugal gains control of some wildfires

Portugal gains control of some wildfires

-

Bayern Munich boost firepower with Diaz signing

-

Tunisia's Jaouadi wins 800m freestyle gold for first major title

Tunisia's Jaouadi wins 800m freestyle gold for first major title

-

Hermes confirms outlook for rising sales in 2025

-

Stocks diverge, dollar slips before tech earnings, Fed decision

Stocks diverge, dollar slips before tech earnings, Fed decision

-

Australian medal hope latest swimmer hit by tummy trouble at worlds

| RYCEF | -1.36% | 13.2 | $ | |

| CMSD | -0.17% | 23.08 | $ | |

| CMSC | 0.18% | 22.65 | $ | |

| BCC | -0.16% | 86 | $ | |

| RIO | -3.73% | 60.03 | $ | |

| SCS | 0.38% | 10.55 | $ | |

| SCU | 0% | 12.72 | $ | |

| RELX | -0.16% | 51.835 | $ | |

| BCE | -0.55% | 23.53 | $ | |

| RBGPF | -4.75% | 74.03 | $ | |

| VOD | -0.05% | 11.105 | $ | |

| GSK | 3.5% | 39.035 | $ | |

| NGG | 0.25% | 70.7 | $ | |

| JRI | 0.61% | 13.14 | $ | |

| BP | -2.12% | 32.275 | $ | |

| AZN | 3.45% | 76.62 | $ | |

| BTI | 1.17% | 53.394 | $ |

US Fed set to hold firm against Trump pressure

The US central bank is expected to defy political pressure and keep interest rates unchanged Wednesday at the end of a two-day policy meeting, as the effects of President Donald Trump's tariffs emerge.

The Federal Reserve's decision, due to be announced at 2:00 pm US eastern time (1800 GMT), comes amid a flurry of data releases this week, including an early estimate of second quarter economic growth.

"It's a high-wire act for the Fed, because they're balancing a lot of risks without a net," KPMG chief economist Diane Swonk told AFP.

"Some of the most tariff-sensitive sectors have begun to show price increases, but the bulk of any inflation bump due to tariffs is still ahead of us," Swonk added in a recent note.

Meanwhile, there are cracks in the foundation when it comes to the labor market, she said, adding that "it doesn't take much of a pick-up in layoffs to have a bigger effect on demand."

Analysts broadly expect the Fed to hold interest rates steady at a range between 4.25 percent and 4.50 percent. Its last reduction was in December.

The outcome could vex Trump, who has lashed out repeatedly at independent Fed Chair Jerome Powell for not lowering rates sooner -- calling him "too late," a "numbskull" and "moron."

JP Morgan chief US economist Michael Feroli said in a note that Powell will likely sidestep questions at a press conference Wednesday on issues like Trump's threats to fire him or speculation over a possible early retirement.

Powell's term as Fed Chair ends in May 2026.

- 'Hyper-politicized' -

But the central bank could well see renewed criticism from Trump after unveiling its decision, particularly as the outcome may show internal disagreements.

Economists anticipate potentially two dissents among Fed policymakers, given that a couple of officials have signaled willingness to reduce rates as soon as in July.

This month, Fed governor Christopher Waller flagged that indicators do not point to a particularly healthy private sector jobs market.

While he did not commit to a decision, he has made the case for a July rate cut and stressed that policymakers need to respond to real-time data.

Analysts said it is not too unusual to see a couple of dissents when the Fed unveils its decision, and financial markets would already have braced for this possibility given officials' recent remarks.

But Swonk warned: "What I worry about is how, in this hyper-politicized environment, that's perceived."

"Multiple dissents by governors, who are closest to the Chair, could signal an unintended view that they have lost confidence in the chairman," Swonk noted.

Already, Trump has called for interest rates to be dropped by as much as three percentage points.

- Cruel summer -

Swonk of KPMG said: "it's going to get tougher over the summer."

"Tariff-induced price pressures are starting to filter through the economy," said EY chief economist Gregory Daco in a note.

Companies are citing weaker earnings and higher input costs, while elevated consumer prices are beginning to weigh on retail sales.

"More demand erosion is likely in the months ahead," Daco said.

He expects Powell to "strike a tone of cautious patience" in his press conference after the rate decision.

Powell would likely reiterate that policy remains data-dependent, and that the Fed can adjust this as conditions evolve, Daco added.

Looking ahead, Swonk said, "the real issue will be, what does he say at Jackson Hole now?"

Powell typically addresses an annual central banking conference in Jackson Hole, Wyoming, and it takes place this year in late August.

"The next shoe to drop is: Will there be enough data by the time we get to Jackson Hole to open the door to a September rate cut?" Swonk said.

J.AbuHassan--SF-PST