-

White and Tupou to start for Wallabies in third Lions Test

White and Tupou to start for Wallabies in third Lions Test

-

Fritz beats rain, Carballes Baena, to advance in Toronto

-

Laos braced for blow of Trump tariff threat

Laos braced for blow of Trump tariff threat

-

United cruise over Bournemouth in Premier League US friendly

-

Most markets down as Fed holds and Trump announces fresh tariffs

Most markets down as Fed holds and Trump announces fresh tariffs

-

McLaughlin-Levrone, Lyles headline US championships

-

Too much too young?: Swimming's dilemma over 12-year-old schoolgirl

Too much too young?: Swimming's dilemma over 12-year-old schoolgirl

-

Swiatek cruises, Osaka battles, Bouchard says goodbye in Montreal

-

China manufacturing sinks again in July as US trade talks stall

China manufacturing sinks again in July as US trade talks stall

-

Vatican embraces social media 'digital missionaries'

-

'Silent killer': the science of tracing climate deaths in heatwaves

'Silent killer': the science of tracing climate deaths in heatwaves

-

Seoul breaks century-long record with 22 'tropical nights' in July

-

Wallabies scrum-half Nic White calls time on career

Wallabies scrum-half Nic White calls time on career

-

Terrified by Trump raids, LA's undocument migrants hide at home

-

Tale of love, passion behind Mexico's 'boundary-pushing' Quintonil

Tale of love, passion behind Mexico's 'boundary-pushing' Quintonil

-

Clock ticks on US tariff hikes as Trump broadens blitz

-

England and India set for final push in gripping Test series

England and India set for final push in gripping Test series

-

Canada intends to recognize Palestinian state at UN General Assembly: Carney

-

Trump says US to impose 15% tariff on South Korean goods

Trump says US to impose 15% tariff on South Korean goods

-

Brazil Central Bank holds interest rate as tariffs loom

-

Ex-NBA star Arenas arrested on charges of hosting illegal poker games

Ex-NBA star Arenas arrested on charges of hosting illegal poker games

-

Brazil Central Bank holds interest rate after seven straight hikes

-

Shelton ends Mannarino jinx in Toronto

Shelton ends Mannarino jinx in Toronto

-

Swiatek cruises, Osaka battles through in Montreal

-

Meta beats expectations sending share price soaring

Meta beats expectations sending share price soaring

-

Gaza civil defence says 30 killed in food queue by Israeli fire

-

Microsoft quarterly profits soar on AI and cloud growth

Microsoft quarterly profits soar on AI and cloud growth

-

Airbus first-half profit climbs 85% to $1.7 bn

-

TikTok launches crowd-sourced debunking tool in US

TikTok launches crowd-sourced debunking tool in US

-

'Ours forever': would-be Israeli settlers march on Gaza

-

Trump punishes Brazil with tariffs, sanctions over trial of ally Bolsonaro

Trump punishes Brazil with tariffs, sanctions over trial of ally Bolsonaro

-

US sprinter Kerley out of US trials

-

Ukraine will fix anti-graft law, minister tells AFP ahead of crucial vote

Ukraine will fix anti-graft law, minister tells AFP ahead of crucial vote

-

Tata Motors to buy Italy's Iveco for $4.4 bn

-

From skies over Gaza, Jordanian crew drops lifeline to civilians

From skies over Gaza, Jordanian crew drops lifeline to civilians

-

US Fed holds firm against Trump pressure as divisions emerge

-

Michael Jackson's dirty sock sells for over $8,000 in France

Michael Jackson's dirty sock sells for over $8,000 in France

-

Turkish city calls for help after heat tops 50C

-

Renault names Provost CEO after De Meo exit

Renault names Provost CEO after De Meo exit

-

Le Court makes history for Africa at women's Tour de France

-

Canada central bank holds rate steady citing US tariff 'threats'

Canada central bank holds rate steady citing US tariff 'threats'

-

Henry puts New Zealand in control of 1st Test against Zimbabwe

-

Stocks edge higher, dollar gains before tech earnings, Fed decision

Stocks edge higher, dollar gains before tech earnings, Fed decision

-

Palestine Action wins bid to challenge terror ban in London court

-

EU urged to act on forests' faltering absorption of carbon

EU urged to act on forests' faltering absorption of carbon

-

India secures return of ancient Buddhist gems

-

Stokes braced for 'emotional' tribute to late England batsman Thorpe

Stokes braced for 'emotional' tribute to late England batsman Thorpe

-

France's Luc Besson resurrects new 'romantic' Dracula

-

Trump hits India with 25% tariff and 'penalty' over Russia ties

Trump hits India with 25% tariff and 'penalty' over Russia ties

-

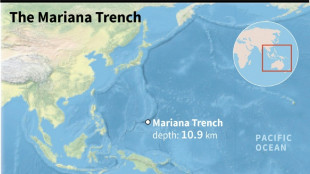

Chinese sub discovers deepest-ever creatures 10 km undersea

| RBGPF | 0.52% | 74.42 | $ | |

| VOD | -0.45% | 11.06 | $ | |

| CMSC | -0.04% | 22.6 | $ | |

| BTI | 0.73% | 53.16 | $ | |

| NGG | -0.47% | 70.19 | $ | |

| RYCEF | -3.05% | 13.1 | $ | |

| GSK | 3.34% | 38.97 | $ | |

| RIO | -4.67% | 59.49 | $ | |

| SCS | -1.74% | 10.33 | $ | |

| RELX | -0.27% | 51.78 | $ | |

| SCU | 0% | 12.72 | $ | |

| AZN | 3.41% | 76.59 | $ | |

| CMSD | -0.26% | 23.06 | $ | |

| BCC | -1.47% | 84.89 | $ | |

| JRI | 0.38% | 13.11 | $ | |

| BCE | -0.55% | 23.53 | $ | |

| BP | -2.2% | 32.25 | $ |

HSBC banks lower profits on higher costs

Bank giant HSBC said Wednesday that group profits fell in the first half on higher costs but noted that it was "well positioned" to deal with the effects of US tariffs.

Profit after tax dropped by one third to $12.4 billion compared with the first six months of 2024, hit by restructuring costs and an impairment on its stake in a Chinese lender.

The London-headquartered bank is months into a shakeup aimed at simplifying the group's structure and delivering $1.5 billion in annual cost savings in 2027.

It comes as the bank sector faces volatile trading as a result of US President Donald Trump's tariffs onslaught.

"We have delivered these results in an ongoing period of uncertainty," chief executive Georges Elhedery said in call with reporters Wednesday.

"It has become increasingly important to simplify the organisation and make it more agile for further growth," he added.

The bank recorded a $2.1 billion impairment linked to its stake in China's Bank of Communications, which was recapitalised by the country's finance ministry this year.

Elhedery said that HSBC is "making positive progress" in its structural overhaul, which began in October, shortly after he became chief executive.

Operating expenses increased four percent, which the bank partly attributed to restructuring and related costs.

The bank generates most of its revenue in Asia and has spent several years pivoting to the region, vowing to develop its wealth business and target fast-growing markets.

HSBC shares fell around 2.5 percent in morning deals on London's top-tier FTSE 100 index despite a dividend payment and plans to repurchase up to $3 billion of shares.

- Missed expectations -

Elhedery said HSBC is "well positioned to manage the changes and uncertainties prevalent within the global environment in which we operate, including in relation to tariffs".

He noted that a "broader macroeconomic deterioration" could impact returns in future years.

Profit before tax fell more than 26 percent to $15.8 billion, falling short of analyst expectations.

First-half revenue declined nine percent to $34.1 billion.

"Repositioning HSBC is not a simple task given its size and scale," said Russ Mould, investment director at AJ Bell.

"There are also challenges in its priority regions such as property market weakness in Hong Kong and mainland China.

"It means investors must continue to brace themselves for setbacks in its results well into 2026," he added.

In Hong Kong, HSBC shares in were down 3.8 percent at the close.

Morningstar senior equity analyst Michael Makdad said the bank "needs to make sure that shareholders in Asia remain on board with the strategic direction... centred on simplification and intensive cost-cutting, but without a radical overhaul of the entire business model".

Makdad added that its immediate challenge is to find a replacement for board chairman Mark Tucker, who will retire by the end of 2025 after eight years helping to steer Europe's largest bank.

O.Mousa--SF-PST