-

AI videos push Combs trial misinformation, researchers say

AI videos push Combs trial misinformation, researchers say

-

UK govt guts key welfare reforms to win vote after internal rebellion

-

Polish supreme court ratifies nationalist's presidential vote win

Polish supreme court ratifies nationalist's presidential vote win

-

Macron, Putin discuss Iran, Ukraine in first talks since 2022

-

French league launches own channel to broadcast Ligue 1

French league launches own channel to broadcast Ligue 1

-

Man City left to reflect on Club World Cup exit as tournament opens up

-

Shock study: Mild electric stimulation boosts math ability

Shock study: Mild electric stimulation boosts math ability

-

Europe swelters as surprise early summer heatwave spreads

-

Third seed Zverev stunned at Wimbledon

Third seed Zverev stunned at Wimbledon

-

Israel expands Gaza campaign ahead of Netanyahu's US visit

-

Gaza mourns those killed in Israeli strike on seafront cafe

Gaza mourns those killed in Israeli strike on seafront cafe

-

Rubio hails end of USAID as Bush, Obama deplore cost in lives

-

Berlusconi family sell Monza football club to US investment fund

Berlusconi family sell Monza football club to US investment fund

-

UN aid meeting seeks end to Global South debt crisis

-

Trump ramps up Musk feud with deportation threat

Trump ramps up Musk feud with deportation threat

-

French paparazzi boss handed 18-month suspended sentence for blackmail

-

Gilgeous-Alexander agrees record $285 mln extension: reports

Gilgeous-Alexander agrees record $285 mln extension: reports

-

Tearful former champion Kvitova loses on Wimbledon farewell

-

IMF urges Swiss to strengthen bank resilience

IMF urges Swiss to strengthen bank resilience

-

Sri Lanka eye top-three spot in ODI rankings

-

Trump hails new 'Alligator Alcatraz' migrant detention center

Trump hails new 'Alligator Alcatraz' migrant detention center

-

US Senate approves divisive Trump spending bill

-

Krejcikova toughs it out in Wimbledon opener, Sinner cruises

Krejcikova toughs it out in Wimbledon opener, Sinner cruises

-

UK govt braces for crunch welfare reforms vote amid major rebellion

-

Shifting to Asia, Rubio meets Quad and talks minerals

Shifting to Asia, Rubio meets Quad and talks minerals

-

Stocks diverge while tracking US trade deal prospects

-

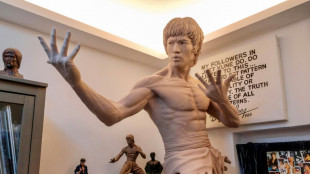

Bruce Lee Club closes archive doors citing operating costs

Bruce Lee Club closes archive doors citing operating costs

-

Trump ramps up Musk feud with deportation, DOGE threats

-

BTS announces comeback for spring 2026

BTS announces comeback for spring 2026

-

Beating England without Bumrah 'not impossible' for India captain Gill

-

Krejcikova battles back against rising star Eala to win Wimbledon opener

Krejcikova battles back against rising star Eala to win Wimbledon opener

-

US Republicans close in on make-or-break Trump mega-bill vote

-

Arsenal sign goalkeeper Kepa from Chelsea

Arsenal sign goalkeeper Kepa from Chelsea

-

Olympic champion Zheng knocked out of Wimbledon

-

Line judges missed at Wimbledon as AI takes their jobs

Line judges missed at Wimbledon as AI takes their jobs

-

Tshituka to make Test debut as Springboks change five

-

'Remember Charlie Hebdo!' Protesters seethe at Istanbul magazine

'Remember Charlie Hebdo!' Protesters seethe at Istanbul magazine

-

Top seed Sinner eases into Wimbledon second round

-

Stocks retreat as profit-taking follows Wall Street records

Stocks retreat as profit-taking follows Wall Street records

-

Israel expands campaign in Gaza ahead of Netanyahu's US visit

-

Barcelona's Ansu Fati aims to kick-start career in Monaco

Barcelona's Ansu Fati aims to kick-start career in Monaco

-

Bordeaux-Begles drawn with Northampton in Champions Cup final repeat

-

Sean Combs trial: jurors seek verdict for a second day

Sean Combs trial: jurors seek verdict for a second day

-

Trump says will 'take a look' at deporting Musk

-

Greece starts charging tourist tax on cruises

Greece starts charging tourist tax on cruises

-

Trump heads for 'Alligator Alcatraz' migrant detention center

-

US Senate push to pass Trump's unpopular spending bill enters second day

US Senate push to pass Trump's unpopular spending bill enters second day

-

England captain Stokes relishing Pant battle in India series

-

Ukraine hits Russian city deep behind front line, leaves three dead

Ukraine hits Russian city deep behind front line, leaves three dead

-

Hinault backs 'complete rider' Pogacar for Tour de France glory

Stocks retreat as profit-taking follows Wall Street records

US and European stocks were mostly lower on Tuesday after Wall Street indexes closed the second quarter at record highs, with investors locking in gains while weighing up the prospects for US trade deals ahead of President Donald Trump's July 9 tariff deadline.

Asian markets ended mixed after both the S&P 500 and the Nasdaq hit records, with Shanghai rising but Tokyo sinking more than one percent after Trump threatened more tariffs on Japan in a row over rice and autos.

"The next few days are going to be testing times for governments in many parts of the world as they try to hammer out trade deals with the US," said Dan Coatsworth, an investment analyst at AJ Bell.

While few trade agreements have been reached so far, the week began with some optimism as Canada and the United States agreed to restart trade talks after Ottawa scrapped a digital services tax contested by US tech giants.

Comments from Trump and some of his top officials also suggested the deadline was flexible, and that several pacts were nearly completed.

"We expect risk sentiment to remain shaky until a deal is agreed... investors are on pause for now and are waiting for concrete news before making their next move," said Kathleen Brooks, research director at trading group XTB.

The dollar remained under pressure after its worst start to the year since 1973, with confidence deteriorating amongst many foreign investors since Trump returned to the White House.

The Dollar Index, which compares the greenback to a basket of major currencies, fell 10.8 percent in the first half of the year, its steepest decline since the dollar became the global benchmark currency.

Investors increasingly expect the Federal Reserve to cut rates at least twice this year -- with Trump having loudly criticised Fed chief Jerome Powell for not doing so sooner -- and all eyes will be on US jobs data due this week.

Investors are also keeping an eye on Trump's multitrillion-dollar tax-cutting bill, which is being debated in the Senate.

Trump has urged lawmakers to pass the bill by July 4 -- when Wall Street will be closed for Independence Day -- but its passage remains uncertain over concerns that it will add $3 trillion to US deficits.

For David Morrison at Trade Nation, the dollar's weakness reflects "ongoing concerns over trade, tariffs, national debt and central bank independence".

The Tokyo market drop came after Trump threatened to impose a fresh levy on Japan over a row about the country not buying US rice.

Japan has seen rice prices double over the past year owing to supply issues caused by various factors, piling pressure on Prime Minister Shigeru Ishiba ahead of elections this month.

Trump also hit out at what he considered an unfair balance in the trade in cars between the two countries, and floated the idea of keeping a 25-percent tariff on autos in place.

- Key figures at around 1340 GMT -

New York - Dow: FLAT at 44,109.67

New York - S&P 500: DOWN 0.2 percent at 6,190.18

New York - Nasdaq: DOWN 0.4 percent at 20,280.15

London - FTSE 100: FLAT at 8,759.34 points

Paris - CAC 40: DOWN 0.5 percent at 7,625.88

Frankfurt - DAX: DOWN 0.8 percent at 23,722.89

Tokyo - Nikkei 225: DOWN 1.2 percent at 39,986.33 (close)

Shanghai - Composite: UP 0.4 percent at 3,457.75 (close)

Hong Kong - Hang Seng Index: Closed for holiday

Euro/dollar: UP at $1.1800 from $1.1785 on Monday

Pound/dollar: DOWN at $1.3730 from $1.3732

Dollar/yen: DOWN at 143.24 yen from 143.98 yen

Euro/pound: UP at 85.94 pence from 85.82 pence

Brent North Sea Crude: UP 0.5 percent at $67.04 per barrel

West Texas Intermediate: UP 0.6 percent at $65.47 per barrel

E.AbuRizq--SF-PST