-

PlayStation prices rise as US tariffs bite

PlayStation prices rise as US tariffs bite

-

Games publisher kepler on cloud nine after smash hits

-

Thirteen arrested over murders of Mexico City officials

Thirteen arrested over murders of Mexico City officials

-

Seville storms past Lyles for Lausanne 100m win

-

India test-fires nuclear-capable ballistic missile

India test-fires nuclear-capable ballistic missile

-

Google unveils latest Pixel phones packed with AI

-

Brazil records 65 percent drop in Amazon area burned by fire

Brazil records 65 percent drop in Amazon area burned by fire

-

Threat from massive western Canada wildfire eases

-

England women's rugby coach Mitchell says World Cup favourites' tag 'irrelevant'

England women's rugby coach Mitchell says World Cup favourites' tag 'irrelevant'

-

US ramps up attack on international court over Israel

-

Palace transfer targets Eze and Guehi to start in European tie

Palace transfer targets Eze and Guehi to start in European tie

-

North Carolina coasts prepare for flooding as Erin churns offshore

-

India test-fires ballistic missile ahead of US tariff hike

India test-fires ballistic missile ahead of US tariff hike

-

Antarctic climate shifts threaten 'catastrophic' impacts globally

-

Tall ships sail into Amsterdam for giant maritime festival

Tall ships sail into Amsterdam for giant maritime festival

-

Trump raises pressure on central bank, calls for Fed governor to resign

-

Woods to head PGA Tour committee to overhaul golf

Woods to head PGA Tour committee to overhaul golf

-

Google packs new Pixel phones with AI

-

How Europe tried to speak Trump

How Europe tried to speak Trump

-

Stock markets diverge awaiting Fed signals as tech sell-off deepens

-

Ombudsman gives Gosden another International, Derby hero Lambourn loses

Ombudsman gives Gosden another International, Derby hero Lambourn loses

-

Eurovision returns to Vienna, 11 years after Conchita Wurst triumph

-

England expects at Women's Rugby World Cup as hosts name strong side for opener

England expects at Women's Rugby World Cup as hosts name strong side for opener

-

Marseille's Rabiot, Rowe up for sale after 'extremely violent' bust-up: club president

-

Shearer accuses Isak of pouring 'flames on fire' of Newcastle row

Shearer accuses Isak of pouring 'flames on fire' of Newcastle row

-

French champagne harvest begins with 'promising' outlook

-

England unchanged for Women's Rugby World Cup opener against the USA

England unchanged for Women's Rugby World Cup opener against the USA

-

Stock markets diverge as traders eye US rate signals

-

Russia says must be part of Ukraine security guarantees talks

Russia says must be part of Ukraine security guarantees talks

-

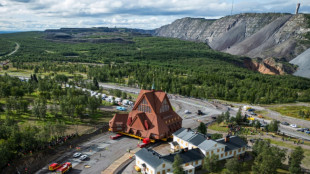

Historic Swedish church arrives at new home after two-day journey

-

Winds complicate wildfire battle in Spain

Winds complicate wildfire battle in Spain

-

Nestle unveils method to boost cocoa yields as climate change hits

-

UK set for more legal challenges over migrant hotels

UK set for more legal challenges over migrant hotels

-

Russia says discussing Ukraine security guarantees without Moscow 'road to nowhere'

-

Torrential Pakistan monsoon rains kill more than 20

Torrential Pakistan monsoon rains kill more than 20

-

Record number of mosquito-borne disease outbreaks in Europe: health agency

-

Stock markets diverge after Wall Street tech sell-off

Stock markets diverge after Wall Street tech sell-off

-

Chinese troops swelter through rehearsal for major military parade

-

Defence begins closing arguments in Hong Kong trial of Jimmy Lai

Defence begins closing arguments in Hong Kong trial of Jimmy Lai

-

World champions Springboks to play Japan at Wembley

-

Kneecap rapper in court on terrorism charge over Hezbollah flag

Kneecap rapper in court on terrorism charge over Hezbollah flag

-

Israel approves plan to conquer Gaza City, calls up reservists

-

Oasis star Noel Gallagher piles praise on 'amazing' brother Liam

Oasis star Noel Gallagher piles praise on 'amazing' brother Liam

-

German minister says China's 'assertiveness' threatens European interests

-

Markets waver as Japan exports show tariff strain

Markets waver as Japan exports show tariff strain

-

Afghanistan bus crash death toll rises to 78

-

Historic Swedish church inches closer to new home

Historic Swedish church inches closer to new home

-

Asian markets waver as Japan exports show tariff strain

-

Israel defence minister approves plan to conquer Gaza City

Israel defence minister approves plan to conquer Gaza City

-

More than 20 dead in fresh Pakistan monsoon rains

IMF urges Swiss to strengthen bank resilience

The International Monetary Fund on Tuesday urged Switzerland to strengthen the resilience of its banks and address the flaws exposed by the collapse of Credit Suisse.

The IMF said the Swiss Financial Market Supervisory Authority (FINMA) ought to be able to intervene early to detect and address bank failures, including having the power to impose fines, conduct on-site inspections, or intervene to improve risk management.

"Enhanced legal powers and resources for FINMA are critical to strengthening the effectiveness of supervision," the IMF said as it presented the findings of an analysis of the Swiss financial sector.

Credit Suisse, Switzerland's second-biggest bank, was among 30 international banks deemed too big to fail due to their importance in the global banking architecture.

But it imploded in March 2023, with the Swiss government, the central bank and FINMA strongarming the country's biggest bank UBS into a quickfire $3.25-billion takeover.

The government feared Credit Suisse would have rapidly defaulted and triggered a global banking crisis that would also have shredded Switzerland's valuable reputation for sound banking.

The government set about tightening regulations in the banking sector -- in particular to ensure that UBS can withstand a crisis, given the size of the megabank now, in relation to the Swiss economy.

Last month it unveiled its proposals, which included strengthening FINMA's powers and significantly increasing the capital that UBS will have to set aside for its foreign subsidiaries -- much to the bank's displeasure.

This could amount to nearly $18 billion of additional capital.

However, UBS argued that these requirements -- which are much more onerous than those in other countries -- risked putting it at a disadvantage compared to its competitors abroad.

The reforms, aimed at reducing the risks for the state, taxpayers and the economy, "would further strengthen the long-term stability of the Swiss financial centre", the IMF said.

The IMF found the Swiss financial sector would be broadly resilient in the event of a severe shock, but nonetheless needed strengthening given the current climate of high uncertainty in the global economy.

"Switzerland continues to benefit from strong fundamentals, highly credible institutions, and a skilled labour force, positioning it among the world’s most competitive, resilient, and innovative economies," the IMF said in a statement.

Nonetheless, it faces challenges from "persistent safe-haven pressures" and the appreciation of the Swiss franc currency, it said.

V.AbuAwwad--SF-PST