-

Sabalenka cruises on Wimbledon's hottest opening day as Alcaraz launches title bid

Sabalenka cruises on Wimbledon's hottest opening day as Alcaraz launches title bid

-

Bosch breaks through as South Africa set Zimbabwe huge target

-

S.Africa's ex-transport bosses charged over Zuma-era graft case

S.Africa's ex-transport bosses charged over Zuma-era graft case

-

'No panic' says Medvedev after shock Wimbledon exit

-

Rescuers evacuate 50,000 as Turkey battles wildfires

Rescuers evacuate 50,000 as Turkey battles wildfires

-

ADB acting on US concerns over China, bank chief tells AFP

-

Archer misses out as England unchanged for second India Test

Archer misses out as England unchanged for second India Test

-

US Senate begins nail-biting vote on Trump spending bill

-

Top seed Sabalenka cruises into Wimbledon second round

Top seed Sabalenka cruises into Wimbledon second round

-

Medvedev suffers shock early Wimbledon exit

-

Wall Street stocks rally further on trade deal optimism

Wall Street stocks rally further on trade deal optimism

-

Britain's Tarvet says 'not here for the money' after landmark Wimbledon win

-

Tennis fans sizzle as heatwave hits Wimbledon

Tennis fans sizzle as heatwave hits Wimbledon

-

Tearful Jabeur forced to retire from Wimbledon first-round clash

-

No relief for Southern Europe as punishing heatwave persists

No relief for Southern Europe as punishing heatwave persists

-

PKK disarmament process to begin early July: report

-

Alcaraz, Sabalenka in action on day one at sizzling Wimbledon

Alcaraz, Sabalenka in action on day one at sizzling Wimbledon

-

France court jails migrant smugglers over 2022 Channel deaths

-

Stocks muted as investors eye US trade talks

Stocks muted as investors eye US trade talks

-

China says aircraft carriers conduct combat training in Pacific

-

NGO loses bid to block UK export of military equipment to Israel

NGO loses bid to block UK export of military equipment to Israel

-

Three talking points from Austrian Grand Prix

-

Wimbledon 'ready' for soaring temperatures

Wimbledon 'ready' for soaring temperatures

-

UN chief urges aid surge in world of 'climate chaos, raging conflicts'

-

French injury worries mount ahead of first All Blacks Test

French injury worries mount ahead of first All Blacks Test

-

India coach Gambhir faces growing pressure ahead of second England Test

-

Oasis ride Britpop revival as 90s make nostalgic comeback in UK

Oasis ride Britpop revival as 90s make nostalgic comeback in UK

-

'Embracing AI': TomTom cuts 300 jobs

-

'We have nothing': Afghans driven out of Iran return to uncertain future

'We have nothing': Afghans driven out of Iran return to uncertain future

-

Bangladesh's biggest port resumes operations as strike ends

-

Havili, Frizell among All Blacks in Australia-NZ XV to face Lions

Havili, Frizell among All Blacks in Australia-NZ XV to face Lions

-

Southern Europe roasts as temperatures soar

-

Kenyan women jockey for place at DJ turntables

Kenyan women jockey for place at DJ turntables

-

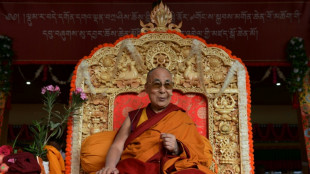

Dalai Lama suggests institution to continue at 90th birthday launch

-

Late fashion icon Lagerfeld's discreet villa near Paris goes under hammer

Late fashion icon Lagerfeld's discreet villa near Paris goes under hammer

-

Tougher Singapore crypto regulations kick in

-

Russia bets on patriotism to address demographic crisis

Russia bets on patriotism to address demographic crisis

-

Dalai Lama prays at landmark 90th birthday launch

-

India-Pakistan conflict hits shared love of film, music

India-Pakistan conflict hits shared love of film, music

-

China's top diplomat visits Europe pitching closer ties in 'volatile' world

-

Kiss urges under-strength Reds to 'rip in' against Lions

Kiss urges under-strength Reds to 'rip in' against Lions

-

Canada rescinds tax on US tech firms in hopes of Trump trade deal

-

Most Asian stocks rise as investors eye US trade talks

Most Asian stocks rise as investors eye US trade talks

-

Jury retires to decide verdict in Australia's mushroom murder trial

-

Farrell expects Reds to be 'big step up' for Lions

Farrell expects Reds to be 'big step up' for Lions

-

UN conference seeks boost for aid as US cuts bite

-

Sweet-smelling fungi at centre of Australian triple-murder trial

Sweet-smelling fungi at centre of Australian triple-murder trial

-

All Blacks lose injured prop Williams for France series

-

The players to watch at women's Euro 2025

The players to watch at women's Euro 2025

-

England's nemesis Spain bid to add Euro title to world crown

Stocks muted as investors eye US trade talks

Global equities steadied Monday as investors kept tabs on countries' efforts to strike trade deals with the United States before a key deadline next week.

Canada said Sunday it will restart trade negotiations with the United States after it rescinded a tax impacting US tech firms that had prompted US President Donald Trump to call off talks.

That boosted optimism for other governments to make deals with Trump to avoid his steep levies, as the July 9 cut-off for tariff reprieve looms.

"Investors seem confident trade deals will be struck, geopolitical tensions ease, and a major economic slump is avoided," said Dan Coatsworth, investment analyst at AJ Bell.

"The big unknown is whether investors are correct or are simply being too complacent," he added.

Officials from Japan and India have extended their stays in Washington to continue talks, raising hopes for agreements with two of the world's biggest economies.

Trade optimism helped boost most Asian stocks and US futures.

Meanwhile European equities were mixed in more tentative trade, with Paris ticking higher, London flat and Frankfurt edging lower.

Over the last month, US indices have notably outperformed European ones, explained Kathleen Brooks, research director at trading group XTB.

She attributed this to a "slowdown in the defence sector."

The dollar extended losses against its peers on Monday as traders ramped up bets for at least two rate cuts this year following Trump's indication he could choose a successor to Federal Reserve boss Jerome Powell within months.

A key US jobs report on Thursday will also be pored over for signs of the pace of interest-rate cuts.

Eyes were also on Trump's signature tax-cutting bill -- now inching towards a Senate vote -- that would add trillions of dollars to the national debt.

The "One Big Beautiful Bill" extends Trump's expiring first-term tax cuts at a cost of $4.5 trillion and beefs up border security.

The Republican president has ramped up pressure to get the package to his desk by July 4, and called out wavering lawmakers from his party.

However, there are worries about the impact on the economy, with the nonpartisan Congressional Budget Office estimating the measure would add nearly $3.3 trillion to US deficits over a decade.

The S&P 500 and Nasdaq finished at all-time peaks Friday amid optimism governments will be able to avoid swingeing US tariffs.

There was little major reaction on Monday to data showing the contraction in Chinese factory activity eased further in June after a China-US trade truce.

- Key figures at around 1050 GMT -

London - FTSE 100: FLAT at 8,799.59 points

Paris - CAC 40: UP 0.1 percent at 7,698.59

Frankfurt - DAX: DOWN 0.1 percent at 23,998.68

Tokyo - Nikkei 225: UP 0.8 percent at 40,487.39 (close)

Hong Kong - Hang Seng Index: DOWN 0.9 percent at 24,072.28 (close)

Shanghai - Composite: UP 0.6 percent at 3,444.43 (close)

New York - Dow: UP 1.0 percent at 43,819.27 (close)

Euro/dollar: UP at $1.1723 from $1.1718 on Friday

Pound/dollar: DOWN at $1.3698 from $1.3715

Dollar/yen: DOWN at 144.20 yen from 144.68 yen

Euro/pound: UP at 85.59 pence from 85.43 pence

West Texas Intermediate: DOWN 0.4 percent at $65.25 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $66.61 per barrel

C.AbuSway--SF-PST