-

Five years after Beirut port blast, Lebanese demand justice

Five years after Beirut port blast, Lebanese demand justice

-

Stella Rimington, first woman to lead UK's MI5 dies at 90

-

Trump admin to reinstall Confederate statue toppled by protesters

Trump admin to reinstall Confederate statue toppled by protesters

-

Rybakina advances to WTA Canadian Open semis

-

Brazilian judge places ex-president Bolsonaro under house arrest

Brazilian judge places ex-president Bolsonaro under house arrest

-

Brazil judge places ex-president Bolsonaro under house arrest

-

NGOs caught between juntas and jihadists in turbulent Sahel

NGOs caught between juntas and jihadists in turbulent Sahel

-

NBA Spurs agree to four-year extension with Fox: reports

-

Stocks mostly rebound on US interest rate cut bets

Stocks mostly rebound on US interest rate cut bets

-

Boeing defense workers launch strike over contract dispute

-

Grand Canyon fire rages, one month on

Grand Canyon fire rages, one month on

-

Djokovic withdraws from ATP Cincinnati Masters

-

Brazil's Paixao promises 'big things' at Marseille unveiling

Brazil's Paixao promises 'big things' at Marseille unveiling

-

Shubman Gill: India's elegant captain

-

Trump says to name new labor statistics chief this week

Trump says to name new labor statistics chief this week

-

England v India: Three talking points

-

Exceptional Nordic heatwave stumps tourists seeking shade

Exceptional Nordic heatwave stumps tourists seeking shade

-

'Musical cocoon': Polish mountain town hosts Chopin fest

-

A 'Thinker' drowns in plastic garbage as UN treaty talks open

A 'Thinker' drowns in plastic garbage as UN treaty talks open

-

India's Siraj 'woke up believing' ahead of Test heroics

-

Israeli PM says to brief army on Gaza war plan

Israeli PM says to brief army on Gaza war plan

-

Frustrated Stokes refuses to blame Brook for England collapse

-

Moscow awaits 'important' Trump envoy visit before sanctions deadline

Moscow awaits 'important' Trump envoy visit before sanctions deadline

-

Schick extends Bayer Leverkusen contract until 2030

-

Tesla approves $29 bn in shares to Musk as court case rumbles on

Tesla approves $29 bn in shares to Musk as court case rumbles on

-

Stocks rebound on US rate cut bets

-

Swiss eye 'more attractive' offer for Trump after tariff shock

Swiss eye 'more attractive' offer for Trump after tariff shock

-

Trump says will name new economics data official this week

-

Three things we learned from the Hungarian Grand Prix

Three things we learned from the Hungarian Grand Prix

-

Lions hooker Sheehan banned over Lynagh incident

-

Jordan sees tourism slump over Gaza war

Jordan sees tourism slump over Gaza war

-

China's Baidu to deploy robotaxis on rideshare app Lyft

-

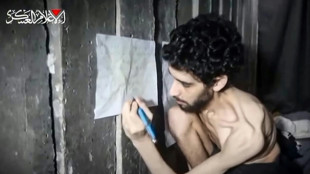

Israel wants world attention on hostages held in Gaza

Israel wants world attention on hostages held in Gaza

-

Pacific algae invade Algeria beaches, pushing humans and fish away

-

Siraj stars as India beat England by six runs in fifth-Test thriller

Siraj stars as India beat England by six runs in fifth-Test thriller

-

Stocks mostly rise as traders boost US rate cut bets

-

S.Africa eyes new markets after US tariffs: president

S.Africa eyes new markets after US tariffs: president

-

Trump envoy's visit will be 'important', Moscow says

-

BP makes largest oil, gas discovery in 25 years off Brazil

BP makes largest oil, gas discovery in 25 years off Brazil

-

South Korea removing loudspeakers on border with North

-

Italy fines fast-fashion giant Shein for 'green' claims

Italy fines fast-fashion giant Shein for 'green' claims

-

Shares in UK banks jump after car loan court ruling

-

Beijing issues new storm warning after deadly floods

Beijing issues new storm warning after deadly floods

-

Most markets rise as traders US data boosts rate cut bets

-

17 heat records broken in Japan

17 heat records broken in Japan

-

Most markets rise as traders weigh tariffs, US jobs

-

Tycoon who brought F1 to Singapore pleads guilty in graft case

Tycoon who brought F1 to Singapore pleads guilty in graft case

-

Australian police charge Chinese national with 'foreign interference'

-

Torrential rain in Taiwan kills four over past week

Torrential rain in Taiwan kills four over past week

-

Rwanda bees being wiped out by pesticides

| RBGPF | 0.08% | 75 | $ | |

| SCU | 0% | 12.72 | $ | |

| CMSD | 1.18% | 23.63 | $ | |

| CMSC | 0.87% | 23.07 | $ | |

| JRI | 0.76% | 13.2 | $ | |

| NGG | 1.14% | 72.65 | $ | |

| BCE | -1.12% | 23.31 | $ | |

| BCC | -0.77% | 82.71 | $ | |

| SCS | 38.6% | 16.58 | $ | |

| RIO | 0.58% | 60 | $ | |

| RELX | 0.73% | 51.97 | $ | |

| RYCEF | 2.07% | 14.5 | $ | |

| GSK | 0.32% | 37.68 | $ | |

| AZN | 0.86% | 74.59 | $ | |

| VOD | 0.72% | 11.04 | $ | |

| BTI | 2.16% | 55.55 | $ | |

| BP | 2.28% | 32.49 | $ |

China exports slow as trade war takes toll

Chinese exports grew slower than expected in May, according to official data Monday, as shipments to the United States tumbled amid global trade turmoil triggered by Donald Trump's tariff blitz.

The figures also showed imports suffered a forecast-beating drop, with weak domestic consumption in the world's number two economy highlighted by data earlier in the day revealing another month of falling prices.

The 4.8 percent year-on-year drop in overseas shipments last month was an improvement on April but bigger than the 6.0 percent forecast in a survey of economists by Bloomberg.

The reading included a 12.7 percent plunge in exports to the United States compared with April, when Trump unveiled his eye-watering tariffs on China. Imports from the US tanked 17.9 percent after Beijing imposed tit-for-tat measures.

Exports tumbled by a third year-on-year in May.

In contrast, the data showed shipments to Vietnam increased from the previous month. Those to other Southeast Asian countries including Malaysia, Thailand, Singapore and Indonesia all declined slightly after soaring in April, the figures indicated.

"The trade war between China and the US led to sharply lower exports to the US, but the damage was offset by stronger exports to other countries," Zhiwei Zhang, resident and Chief Economist at Pinpoint Asset Management, said in a note.

"The trade outlook remains highly uncertain at this stage," he added, pointing to the impact of "frontloading", when overseas buyers increase shipments ahead of potentially higher tariffs.

Monday's readings added to concerns about the Chinese economy, with a report from the National Bureau of Statistics (NBS) showing the consumer price index -- a key measure of inflation -- dropped 0.1 percent year on year in May.

The reading, which was slightly better than expected but marks the fourth straight month of falling prices, comes as Beijing struggles to boost the sluggish domestic consumption seen since the end of the pandemic.

Leaders' failure to kickstart demand threatens their official growth targets and complicates their ability to shield its economy from Trump's tariff blitz.

While deflation suggests the cost of goods is falling, it poses a threat to the broader economy as consumers tend to postpone purchases under such conditions, hoping for further reductions.

A lack of demand can then force companies to cut production, freeze hiring or lay off workers, while potentially also having to discount existing stocks -- dampening profitability even as costs remain the same.

Deepening a slump that has now lasted more than two years, factory gate prices also dropped in May, the NBS said Monday.

The producer price index decline of 3.3 percent -- accelerating from a 2.7 percent drop in April -- was faster than the 3.2 percent estimated in the Bloomberg survey.

Representatives from China and the United States are expected to meet on Monday in London for another round of high-stakes trade talks markets hope will ease tensions between the economic superpowers.

A key issue in the negotiations will be Beijing's shipments of rare earths, crucial to a range of goods including electric vehicle batteries and which have been a bone of contention between the two for some time.

Figures Monday showed Chinese exports of 17 minerals rose last month to 5,865 from 4,785 tons in April.

The London talks will be the second set of formal negotiations between the two since Trump launched his global trade blitz on April 2.

They were announced after a phone call last week between Trump and Chinese President Xi Jinping, which the US president described as "very good".

The first round, held in mid-May in Geneva, saw the two pause sky-high tariffs but fail to reach a sweeping trade deal.

Z.AlNajjar--SF-PST