-

US strikes on Iran open rift in Trump's support base

US strikes on Iran open rift in Trump's support base

-

Indiana's Haliburton has torn right Achilles tendon: reports

-

England rally after Pant heroics to set up thrilling finish to India opener

England rally after Pant heroics to set up thrilling finish to India opener

-

US hit by first extreme heat wave of the year

-

Holders Thailand among seven set for LPGA International Crown

Holders Thailand among seven set for LPGA International Crown

-

England set 371 to win India series opener after Pant heroics

-

UK and Ukraine agree to deepen ties as Zelensky meets Starmer

UK and Ukraine agree to deepen ties as Zelensky meets Starmer

-

New York state to build nuclear power plant

-

Syria announces arrests over Damascus church attack

Syria announces arrests over Damascus church attack

-

Bradley eyes playing captain role at Ryder Cup after win

-

US existing home sales little-changed on sluggish market

US existing home sales little-changed on sluggish market

-

Top US court takes case of Rastafarian whose hair was cut in prison

-

Greece declares emergency on Chios over wildfires

Greece declares emergency on Chios over wildfires

-

Embattled Thai PM reshuffles cabinet as crisis rages

-

Killer whales spotted grooming each other with seaweed

Killer whales spotted grooming each other with seaweed

-

Where is Iran's uranium? Questions abound after US strikes

-

EU approves MotoGP takeover by F1 owner Liberty Media

EU approves MotoGP takeover by F1 owner Liberty Media

-

Duplantis says vaulting 6.40m is within the 'realm of possibility'

-

Pant piles on agony for England with record-breaking century

Pant piles on agony for England with record-breaking century

-

NATO to take 'quantum leap' with 5% summit pledge: Rutte

-

Textor sells Crystal Palace stake to boost hopes of European competition

Textor sells Crystal Palace stake to boost hopes of European competition

-

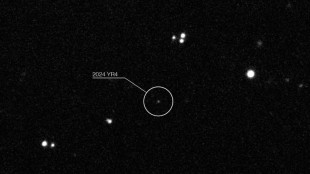

Earth's satellites at risk if asteroid smashes into Moon: study

-

Syria president vows those involved in church attack will face justice

Syria president vows those involved in church attack will face justice

-

Russian barrage kills 10 in Kyiv, including 11-year-old girl

-

Military bases or vital waterway: Iran weighs response to US strikes

Military bases or vital waterway: Iran weighs response to US strikes

-

Italian sculptor Arnaldo Pomodoro dies aged nearly 99

-

Rahul and Pant build India lead against England

Rahul and Pant build India lead against England

-

UK probes maternity services after scandals

-

Asian countries most vulnerable to Strait of Hormuz blockade

Asian countries most vulnerable to Strait of Hormuz blockade

-

Anger as Kanye West to perform in Slovakia after Hitler song

-

Israel targets Iran Guards, Tehran prison in fresh wave of strikes

Israel targets Iran Guards, Tehran prison in fresh wave of strikes

-

Star-packed, Covid-shaped 'Death Stranding 2' drops this week

-

IOC is in 'best of hands', says Bach as he hands over to Coventry

IOC is in 'best of hands', says Bach as he hands over to Coventry

-

Oil prices seesaw as investors await Iran response to US strikes

-

Beijing issues weather warning for hottest days of year

Beijing issues weather warning for hottest days of year

-

Tehran hit by Israeli attacks, vows response to US strikes

-

New CEO of Jeep owner Stellantis starts with leadership shake-up

New CEO of Jeep owner Stellantis starts with leadership shake-up

-

Russian drone and missile barrage kills eight in Kyiv

-

Oil dips, dollar firms after US strikes in Iran

Oil dips, dollar firms after US strikes in Iran

-

Paris Olympics and Paralympics cost taxpayer nearly 6 bn euros: state body

-

Eurozone business activity almost flat again in June

Eurozone business activity almost flat again in June

-

In Norway's Arctic, meteorologists have a first-row seat to climate change

-

Iran vows retaliation for US strikes as Israel keeps up attacks

Iran vows retaliation for US strikes as Israel keeps up attacks

-

Russian drone and missile barrage on Kyiv kills seven

-

Oil rises, dollar firms after US strikes in Iran

Oil rises, dollar firms after US strikes in Iran

-

'Noble to attend': Budapest prepares for 'banned' Pride march

-

Art market banking on new generation of collectors

Art market banking on new generation of collectors

-

Turning 80, UN faces fresh storm of doubts

-

'A great start': NBA crown just the beginning for Shai

'A great start': NBA crown just the beginning for Shai

-

Man City hit six to reach Club World Cup last 16, Real Madrid win with 10 men

Stock markets, oil slide on trade war fears as US tariffs bite

Stock markets were in gloomy mode Tuesday as China, Mexico and Canada hit back at US tariffs and fears grew that Europe could be President Donald Trump's next target in the growing global trade war.

Wall Street had retreated almost 2 percent mid-session following steep losses the previous day while European stock markets closed down sharply and oil prices slumped, the price of Brent Crude plunging 2.4 percent to a five-month low of $69.94 amid worries a prolonged trade spat may knock the world economy out of kilter.

European equities took a similar buffeting as Frankfurt lost more than 3.5 percent for its worst session in almost three years. London shed 1.3 percent and Paris gave up 1.9 percent.

"The headlines surrounding an impending global trade war have become too loud to ignore on the once-booming trading floor of Frankfurt," noted Konstantin Oldenburger, analyst at CMC Markets.

"The sounds of trade disruptions are growing louder and are becoming increasingly difficult to ignore, even though Trump has yet to impose any direct tariffs against Germany or the European Union."

The main US oil contract, West Texas Intermediate, fell almost two percent to $69.04 a day after OPEC+ confirmed plans to hike oil output from April, amid pressure from Trump to lower prices.

"Investors don't like tariffs, and they are deeply uncomfortable with President Trump’s new world order, which is weighing on market sentiment," said Kathleen Brooks, research director at XTB trading platform.

US tariffs of 25 percent for Canadian and Mexican goods came into effect on Tuesday along with the doubling of levies on Chinese imports to 20 percent. The three countries announced retaliatory moves.

"The US administration is continuing to cause even more global upheaval and overnight by far the broadest set of tariffs yet has come into effect," said Deutsche Bank analyst Jim Reid.

But Reid added "there is still some market doubt as to whether all these tariffs will persist for a prolonged period of time."

The European Union warned that the tariffs on Canada and Mexico risk "disrupting global trade", urging Washington to reverse course.

"These tariffs threaten deeply integrated supply chains, investment flows, and economic stability across the Atlantic," said EU trade spokesman Olof Gill.

Amid fears the EU will be the next target, French Economy Minister Eric Lombard insisted that the bloc would be tough in negotiations.

"We have negotiators who are playing hardball, we will play hardball but... we need to reach a balanced deal to protect our economies," Lombard said.

- China congress and eurozone rates -

Bitcoin continued its recent nosedive as it dropped below $83,000 while the dollar came under pressure.

Traders have their eyes on other major economic events this week.

Investors hope China will announce a huge economic stimulus package at its annual parliamentary meeting, the National People's Congress.

On Thursday, the European Central Bank is expected to cut interest rates again to try to boost a floundering eurozone economy.

The key scheduled economic event Friday will be US jobs data.

- Key figures around 1640 GMT -

New York - Dow: DOWN 1.7 percent at 42,439.97 points

New York - S&P 500: DOWN 1.7 percent at 5,799.25

New York - Nasdaq Composite: DOWN 1.5 percent at 18,090.25

London - FTSE 100: DOWN 1.3 percent at 8,759.00 (close)

Paris - CAC 40: DOWN 1.9 percent at 8,047.92 (close)

Frankfurt - DAX: DOWN 3.5 percent at 22,326.81 (close)

Tokyo - Nikkei 225: DOWN 1.2 percent at 37,331.18 (close)

Hong Kong - Hang Seng Index: DOWN 0.3 percent at 22,941.77 (close)

Shanghai - Composite: UP 0.2 percent at 3,324.21 (close)

Euro/dollar: UP at 1.0535 from $1.0419 on Monday

Pound/dollar: UP at $1.2730 from $1.2612

Dollar/yen: DOWN 148.75 from 150.28 yen

Euro/pound: UP at 82.76 pence from 82.62 pence

West Texas Intermediate: DOWN 1.0 percent at $67.67 per barrel

Brent North Sea Crude: DOWN 1.6 percent at $70.29 per barrel

U.Shaheen--SF-PST