-

US strikes on Iran open rift in Trump's support base

US strikes on Iran open rift in Trump's support base

-

Indiana's Haliburton has torn right Achilles tendon: reports

-

England rally after Pant heroics to set up thrilling finish to India opener

England rally after Pant heroics to set up thrilling finish to India opener

-

US hit by first extreme heat wave of the year

-

Holders Thailand among seven set for LPGA International Crown

Holders Thailand among seven set for LPGA International Crown

-

England set 371 to win India series opener after Pant heroics

-

UK and Ukraine agree to deepen ties as Zelensky meets Starmer

UK and Ukraine agree to deepen ties as Zelensky meets Starmer

-

New York state to build nuclear power plant

-

Syria announces arrests over Damascus church attack

Syria announces arrests over Damascus church attack

-

Bradley eyes playing captain role at Ryder Cup after win

-

US existing home sales little-changed on sluggish market

US existing home sales little-changed on sluggish market

-

Top US court takes case of Rastafarian whose hair was cut in prison

-

Greece declares emergency on Chios over wildfires

Greece declares emergency on Chios over wildfires

-

Embattled Thai PM reshuffles cabinet as crisis rages

-

Killer whales spotted grooming each other with seaweed

Killer whales spotted grooming each other with seaweed

-

Where is Iran's uranium? Questions abound after US strikes

-

EU approves MotoGP takeover by F1 owner Liberty Media

EU approves MotoGP takeover by F1 owner Liberty Media

-

Duplantis says vaulting 6.40m is within the 'realm of possibility'

-

Pant piles on agony for England with record-breaking century

Pant piles on agony for England with record-breaking century

-

NATO to take 'quantum leap' with 5% summit pledge: Rutte

-

Textor sells Crystal Palace stake to boost hopes of European competition

Textor sells Crystal Palace stake to boost hopes of European competition

-

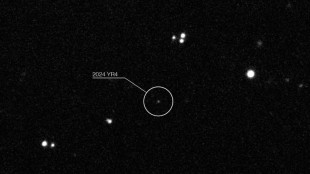

Earth's satellites at risk if asteroid smashes into Moon: study

-

Syria president vows those involved in church attack will face justice

Syria president vows those involved in church attack will face justice

-

Russian barrage kills 10 in Kyiv, including 11-year-old girl

-

Military bases or vital waterway: Iran weighs response to US strikes

Military bases or vital waterway: Iran weighs response to US strikes

-

Italian sculptor Arnaldo Pomodoro dies aged nearly 99

-

Rahul and Pant build India lead against England

Rahul and Pant build India lead against England

-

UK probes maternity services after scandals

-

Asian countries most vulnerable to Strait of Hormuz blockade

Asian countries most vulnerable to Strait of Hormuz blockade

-

Anger as Kanye West to perform in Slovakia after Hitler song

-

Israel targets Iran Guards, Tehran prison in fresh wave of strikes

Israel targets Iran Guards, Tehran prison in fresh wave of strikes

-

Star-packed, Covid-shaped 'Death Stranding 2' drops this week

-

IOC is in 'best of hands', says Bach as he hands over to Coventry

IOC is in 'best of hands', says Bach as he hands over to Coventry

-

Oil prices seesaw as investors await Iran response to US strikes

-

Beijing issues weather warning for hottest days of year

Beijing issues weather warning for hottest days of year

-

Tehran hit by Israeli attacks, vows response to US strikes

-

New CEO of Jeep owner Stellantis starts with leadership shake-up

New CEO of Jeep owner Stellantis starts with leadership shake-up

-

Russian drone and missile barrage kills eight in Kyiv

-

Oil dips, dollar firms after US strikes in Iran

Oil dips, dollar firms after US strikes in Iran

-

Paris Olympics and Paralympics cost taxpayer nearly 6 bn euros: state body

-

Eurozone business activity almost flat again in June

Eurozone business activity almost flat again in June

-

In Norway's Arctic, meteorologists have a first-row seat to climate change

-

Iran vows retaliation for US strikes as Israel keeps up attacks

Iran vows retaliation for US strikes as Israel keeps up attacks

-

Russian drone and missile barrage on Kyiv kills seven

-

Oil rises, dollar firms after US strikes in Iran

Oil rises, dollar firms after US strikes in Iran

-

'Noble to attend': Budapest prepares for 'banned' Pride march

-

Art market banking on new generation of collectors

Art market banking on new generation of collectors

-

Turning 80, UN faces fresh storm of doubts

-

'A great start': NBA crown just the beginning for Shai

'A great start': NBA crown just the beginning for Shai

-

Man City hit six to reach Club World Cup last 16, Real Madrid win with 10 men

Markets fall on trade war fears after US, China tariffs

Markets fell in volatile trade Tuesday on fears of a trade war after China announced fresh tariffs on US imports in retaliation for President Donald Trump's latest levies.

China said it would impose levies of 10 and 15 percent on a range of US agricultural imports in response to Trump's tariffs.

The US president signed an executive order to increase a previously imposed 10 percent tariff on Chinese goods to 20 percent, the White House said on Monday.

US tariffs also came into effect on imports from major trading partners Canada and Mexico after a deadline to avert the levies passed without a deal being struck.

Canada said it would respond in kind, with 25 percent tariffs on $155 billion worth of US goods taking effect after the deadline.

Fears of a full-blown trade war increased volatility with Asian markets mostly lower.

Tokyo recovered some of its early losses to end down 1.2 percent after China announced its retaliatory tariffs.

Japanese automakers with Mexican factories in their supply chains suffered the biggest hit, with Nissan, Toyota and Honda among the major losers.

Hong Kong closed in the red after a volatile session with Singapore, Bangkok, Sydney, Wellington, Taipei, Jakarta, Kuala Lumpur and Seoul also down. Manila and Shanghai were the only gainers.

Concerns over the impact of a tariff war spread to European markets, with London, Paris and Frankfurt all opening lower.

"The spectre of a full-blown trade war is once again looming, threatening to choke global economic growth just as investors were starting to regain confidence," said Stephen Innes of SPI Asset Management.

Investors are hoping that China will announce a huge economic stimulus package at its key parliamentary meeting, the National People's Congress, which opens Wednesday.

"In the upcoming National People's Congress, Chinese policymakers could provide more pro-growth measures including announcing a larger budget deficit target and maintaining a five percent growth target for this year," said MUFG Bank's Lloyd Chan.

Both the Mexican peso and Canadian dollar have dropped against the greenback over the past few days.

Trump expressed outrage on Monday over the weakening of certain currencies, accusing Beijing and Tokyo of using it as a trade strategy, although the Japanese government fiercely refuted the claim.

The oil market also saw sharp declines, with West Texas Intermediate crude falling to $67.60 per barrel and Brent crude dropping to $70.66 per barrel.

Bitcoin's price plunged nearly 10 percent on Monday as concerns of an escalating trade war pushed investors to seek safer investments.

Bitcoin and similar digital assets had surged at the weekend after Trump suggested creating a national cryptocurrency reserve.

"Everything is getting sold," Forexlive manager Adam Button said. "There's a de-risking that's unfolding" among crypto investors, he said.

- Key figures around 0815 GMT -

Tokyo - Nikkei 225: DOWN 1.2 percent at 37,331.18 (close)

Hong Kong - Hang Seng Index: DOWN 0.3 percent at 22,941.77 (close)

Shanghai - Composite: UP 0.2 percent at 3,324.21 (close)

London - FTSE 100: DOWN 0.5 percent at 8,821.65

Euro/dollar: UP at 1.0517 from $1.0419 on Monday

Pound/dollar: UP at $1.2719 from $1.2612

Dollar/yen: DOWN 149.16 from 150.28 yen

Euro/pound: UP at 82.69 pence from 82.62 pence

West Texas Intermediate: DOWN 1.13 percent at $67.60 per barrel

Brent North Sea Crude: DOWN 1.34 percent at $70.66 per barrel

New York - Dow: DOWN 1.5 percent at 43,191.24 (close)

G.AbuOdeh--SF-PST