-

India accused of illegal deportations targeting Muslims

India accused of illegal deportations targeting Muslims

-

Australia and Lions yet to resolve tour sticking point

-

Green bonds offer hope, and risk, in Africa's climate fight

Green bonds offer hope, and risk, in Africa's climate fight

-

Game 'reloots' African artefacts from Western museums

-

Renters struggle to survive in Portugal housing crisis

Renters struggle to survive in Portugal housing crisis

-

Western Japan sees earliest end to rainy season on record

-

Ketamine 'epidemic' among UK youth raises alarm

Ketamine 'epidemic' among UK youth raises alarm

-

'Shocking' COP30 lodging costs heap pressure on Brazil

-

India investigates 'unnatural' death of five tigers

India investigates 'unnatural' death of five tigers

-

Anderson teases Dior debut with Mbappe, Basquiet and Marie Antoinette

-

Bangladesh pushes solar to tackle energy woes

Bangladesh pushes solar to tackle energy woes

-

Wallabies veteran White relishing 'unreal' Lions opportunity

-

Hong Kong's dragnet widens 5 years after national security law

Hong Kong's dragnet widens 5 years after national security law

-

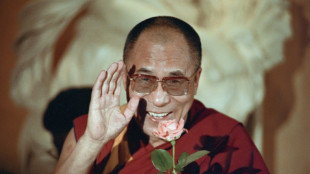

Tibetans face up to uncertain future as Dalai Lama turns 90

-

'Simple monk': the Dalai Lama, in his translator's words

'Simple monk': the Dalai Lama, in his translator's words

-

Man City crush Juventus, Real Madrid reach Club World Cup last 16

-

Stocks climb, dollar holds on trade hopes and rate bets

Stocks climb, dollar holds on trade hopes and rate bets

-

Bezos, Sanchez to say 'I do' in Venice

-

Vinicius stars as Real Madrid ease into Club World Cup last 16

Vinicius stars as Real Madrid ease into Club World Cup last 16

-

New-look Wimbledon prepares for life without line judges

-

Japan executes 'Twitter killer' who murdered nine

Japan executes 'Twitter killer' who murdered nine

-

UN conference seeks foreign aid rally as Trump cuts bite

-

Dying breed: Tunisian dog lovers push to save age-old desert hound

Dying breed: Tunisian dog lovers push to save age-old desert hound

-

Springboks launch 'really tough season' against Barbarians

-

Syria's wheat war: drought fuels food crisis for 16 million

Syria's wheat war: drought fuels food crisis for 16 million

-

Ex-All Black Kaino's Toulouse not expecting 'walkover' in Top 14 final

-

Rwanda, DRC to ink peace deal in US but questions remain

Rwanda, DRC to ink peace deal in US but questions remain

-

Combs defense team set to take the floor in trial's closing arguments

-

Fraser-Pryce eases through in Jamaica trials farewell

Fraser-Pryce eases through in Jamaica trials farewell

-

US Treasury signals G7 deal excluding US firms from some taxes

-

Combs created 'climate of fear' as head of criminal ring: prosecutors

Combs created 'climate of fear' as head of criminal ring: prosecutors

-

Chelsea's Fernandez flying ahead of Benfica reunion at Club World Cup

-

Potgieter and Roy share PGA lead in Detroit with course record 62s

Potgieter and Roy share PGA lead in Detroit with course record 62s

-

City skipper Bernardo hails Guardiola's new generation

-

Nike profits sink but company says it is turning a corner

Nike profits sink but company says it is turning a corner

-

'Mission: Impossible' composer Lalo Schifrin dies aged 93

-

Ex-Ravens ace Tucker suspended 10 games over masseuse allegations

Ex-Ravens ace Tucker suspended 10 games over masseuse allegations

-

Australia lead by 82 runs as West Indies' Test on a knife edge

-

Snow cloaks Atacama, the world's driest desert

Snow cloaks Atacama, the world's driest desert

-

Man City crush Juve as Real Madrid aim to avoid them

-

Dryburgh and Porter grab lead at LPGA pairs event

Dryburgh and Porter grab lead at LPGA pairs event

-

Iran says no plan for new US nuclear talks, plays down impact of strikes

-

City thrash Juventus to maintain 100% record at Club World Cup

City thrash Juventus to maintain 100% record at Club World Cup

-

Brazil prodigy Estevao has unfinished business ahead of Chelsea move

-

Mexican lawmakers vote to ban dolphin shows

Mexican lawmakers vote to ban dolphin shows

-

Trump admin insists Iran strikes success, attacks media

-

Anna Wintour steps down as US Vogue editor after nearly 40 years

Anna Wintour steps down as US Vogue editor after nearly 40 years

-

How Trump finally learned to love NATO -- for now

-

Faith Kipyegon misses out on bid for first female sub-4 minute mile

Faith Kipyegon misses out on bid for first female sub-4 minute mile

-

Spain PM alleges 'genocide' in Gaza as rescuers say 65 killed

Glenmorgan Investments Partners with Major Global Financial Institutions

Glenmorgan Investments expands access to their private funds through global partnerships with major investment banks and trading platforms in the UK, Europe and the Middle East.

LONDON, UNITED KINGDOM / ACCESS Newswire / January 30, 2025 / Glenmorgan Investments is excited to announce a series of strategic partnerships with several leading investment banks and trading platforms across the UK, Europe, and the Middle East. This collaboration will enable investors to seamlessly access and invest in Glenmorgan's diverse range of privately managed funds directly through their existing brokerage accounts, starting from Q3 2025.

The new initiative will significantly simplify the investment process for institutional and individual investors alike. By leveraging the trusted platforms of leading financial institutions, investors will now be able to buy and sell units in Glenmorgan's high-performing private funds directly through their brokerage accounts, without the need to establish a separate Glenmorgan investment account. This will provide investors with a straightforward, user-friendly way to access Glenmorgan's portfolio of innovative and strategically diversified funds.

Glenmorgan expects these partnerships to dramatically increase its assets under management (AUM), from its current level of $6 billion to well over $20 billion in the coming years. The ability to offer traditional investors direct access to alternative asset funds is expected to drive significant growth, unlocking new opportunities and offering substantial exposure to a wider investor base.

"This partnership marks a transformative step forward for Glenmorgan as we continue to enhance accessibility to our investment products," said Mr. David Walsh, Chief Operating Officer of Glenmorgan Investments. "Opening the door for traditional investors to access alternative assets through their existing brokerage accounts not only broadens our market reach but also positions us for sustained growth in the future. We're excited about the impact this will have on our business and the value it will bring to our clients."

In addition to this major milestone, Glenmorgan is currently in negotiations with several prominent investment banks as it prepares for a potential IPO in 2026. The company is exploring the opportunity to list on the London Stock Exchange, a move that would further enhance its position in the global financial market and provide investors with additional avenues for engagement and participation.

Mrs. Susan Harper

Media and Public Relations Manager

Email: [email protected]

Tel: +44(0)20 3355 9612

Web: www.glenmorganinvestments.com

Address: City Reach, 5-6 Greenwich View Place, London E14 9NN, United Kingdom

SOURCE: Glenmorgan Investments Limited

View the original press release on ACCESS Newswire

N.AbuHussein--SF-PST