-

India accused of illegal deportations targeting Muslims

India accused of illegal deportations targeting Muslims

-

Australia and Lions yet to resolve tour sticking point

-

Green bonds offer hope, and risk, in Africa's climate fight

Green bonds offer hope, and risk, in Africa's climate fight

-

Game 'reloots' African artefacts from Western museums

-

Renters struggle to survive in Portugal housing crisis

Renters struggle to survive in Portugal housing crisis

-

Western Japan sees earliest end to rainy season on record

-

Ketamine 'epidemic' among UK youth raises alarm

Ketamine 'epidemic' among UK youth raises alarm

-

'Shocking' COP30 lodging costs heap pressure on Brazil

-

India investigates 'unnatural' death of five tigers

India investigates 'unnatural' death of five tigers

-

Anderson teases Dior debut with Mbappe, Basquiet and Marie Antoinette

-

Bangladesh pushes solar to tackle energy woes

Bangladesh pushes solar to tackle energy woes

-

Wallabies veteran White relishing 'unreal' Lions opportunity

-

Hong Kong's dragnet widens 5 years after national security law

Hong Kong's dragnet widens 5 years after national security law

-

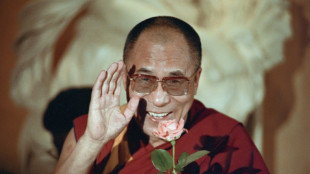

Tibetans face up to uncertain future as Dalai Lama turns 90

-

'Simple monk': the Dalai Lama, in his translator's words

'Simple monk': the Dalai Lama, in his translator's words

-

Man City crush Juventus, Real Madrid reach Club World Cup last 16

-

Stocks climb, dollar holds on trade hopes and rate bets

Stocks climb, dollar holds on trade hopes and rate bets

-

Bezos, Sanchez to say 'I do' in Venice

-

Vinicius stars as Real Madrid ease into Club World Cup last 16

Vinicius stars as Real Madrid ease into Club World Cup last 16

-

New-look Wimbledon prepares for life without line judges

-

Japan executes 'Twitter killer' who murdered nine

Japan executes 'Twitter killer' who murdered nine

-

UN conference seeks foreign aid rally as Trump cuts bite

-

Dying breed: Tunisian dog lovers push to save age-old desert hound

Dying breed: Tunisian dog lovers push to save age-old desert hound

-

Springboks launch 'really tough season' against Barbarians

-

Syria's wheat war: drought fuels food crisis for 16 million

Syria's wheat war: drought fuels food crisis for 16 million

-

Ex-All Black Kaino's Toulouse not expecting 'walkover' in Top 14 final

-

Rwanda, DRC to ink peace deal in US but questions remain

Rwanda, DRC to ink peace deal in US but questions remain

-

Combs defense team set to take the floor in trial's closing arguments

-

Fraser-Pryce eases through in Jamaica trials farewell

Fraser-Pryce eases through in Jamaica trials farewell

-

US Treasury signals G7 deal excluding US firms from some taxes

-

Combs created 'climate of fear' as head of criminal ring: prosecutors

Combs created 'climate of fear' as head of criminal ring: prosecutors

-

Chelsea's Fernandez flying ahead of Benfica reunion at Club World Cup

-

Potgieter and Roy share PGA lead in Detroit with course record 62s

Potgieter and Roy share PGA lead in Detroit with course record 62s

-

City skipper Bernardo hails Guardiola's new generation

-

Nike profits sink but company says it is turning a corner

Nike profits sink but company says it is turning a corner

-

'Mission: Impossible' composer Lalo Schifrin dies aged 93

-

Ex-Ravens ace Tucker suspended 10 games over masseuse allegations

Ex-Ravens ace Tucker suspended 10 games over masseuse allegations

-

Australia lead by 82 runs as West Indies' Test on a knife edge

-

Snow cloaks Atacama, the world's driest desert

Snow cloaks Atacama, the world's driest desert

-

Man City crush Juve as Real Madrid aim to avoid them

-

Dryburgh and Porter grab lead at LPGA pairs event

Dryburgh and Porter grab lead at LPGA pairs event

-

Iran says no plan for new US nuclear talks, plays down impact of strikes

-

City thrash Juventus to maintain 100% record at Club World Cup

City thrash Juventus to maintain 100% record at Club World Cup

-

Brazil prodigy Estevao has unfinished business ahead of Chelsea move

-

Mexican lawmakers vote to ban dolphin shows

Mexican lawmakers vote to ban dolphin shows

-

Trump admin insists Iran strikes success, attacks media

-

Anna Wintour steps down as US Vogue editor after nearly 40 years

Anna Wintour steps down as US Vogue editor after nearly 40 years

-

How Trump finally learned to love NATO -- for now

-

Faith Kipyegon misses out on bid for first female sub-4 minute mile

Faith Kipyegon misses out on bid for first female sub-4 minute mile

-

Spain PM alleges 'genocide' in Gaza as rescuers say 65 killed

US Fed pauses rate cuts, will 'wait and see' on Trump policies

The US Federal Reserve left its key lending rate unchanged Wednesday and adopted a patient "wait and see" approach to Donald Trump's economic policies, in the first decision since his return to the White House.

Policymakers voted unanimously to keep the Fed's benchmark lending rate at between 4.25 percent and 4.50 percent, the Fed announced in a statement.

"With our policy stance significantly less restrictive than it had been, and the economy remaining strong, we do not need to be in a hurry to adjust our policy stance," Chair Jerome Powell told reporters after the decision.

The Fed's pause follows three consecutive rate reductions which together lowered its key rate by a full percentage point.

In its statement, the Fed said the "unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid."

Inflation however "remains somewhat elevated," it said, while removing a reference in earlier statements to inflation making progress towards the bank's long-term target of two percent.

The US central bank has a dual mandate from Congress to act independently to tackle inflation and unemployment.

It does so primarily by raising or lowering its key short-term lending rate, which influences borrowing costs for consumers and businesses.

Most analysts agree that the US economy is going fairly well, with robust growth, a largely healthy labor market, and relatively low inflation which nevertheless remains stuck above the Fed's target.

Futures traders see a probability of close to 80 percent that the Fed will extend its pause at the next rate meeting in March, according to data from CME Group.

- 'Wait and see' -

Since returning to office on January 20, Trump has revived his threats to impose sweeping tariffs on US trading partners as soon as this weekend and to deport millions of undocumented workers.

He has also said he wants to extend expiring tax cuts and slash red tape on energy production.

Last week, Trump also revived his criticism of the independent Fed and Powell, whom he first appointed to run the US central bank.

"I'll demand that interest rates drop immediately," he said, later adding that he would "put in a strong statement" if the Fed did not take his views on board.

Speaking to reporters Wednesday, Powell said it was "not appropriate" for him to respond to Trump's comments, adding he had not spoken to the president since his return to the White House.

Most -- though not all -- economists expect Trump's tariff and immigration policies to be at least mildly inflationary, raising the cost of goods faced by consumers.

"I think those policies are definitively inflationary, it's just a question of what degree," Zandi from Moody's Analytics told AFP ahead of the rate decision.

"A big part of (the Fed's) job in calibrating monetary policy is responding to what lawmakers are doing, and if they can't get a fix on what they're doing, then that just argues for no change in policy, either higher or lower rates," he added.

Asked about the likely impact of Trump's proposals -- including tariffs -- Powell said the Fed would "wait and see" how they affected the economy.

- 'Meaningful odds' -

At the Fed's previous meeting, policymakers dialed back the number of rate cuts they expect this year to a median of just two, with some incorporating assumptions about Trump's likely economic policies into their forecasts, according to minutes of the meeting.

Given the uncertainty about the effect of Trump's policies on the US economy, analysts are now divided over how many rate cuts they expect the Fed to make this year.

In a recent investor note, economists at Goldman Sachs said their baseline forecast was for two quarter-point cuts, assuming a mild, one-time effect on inflation.

"We retain our baseline that the FOMC will cut rates 25bp (basis points) this year, in June," economists at Barclays wrote, pointing to the underlying strength of the economy.

Zandi from Moody's Analytics said he also expects two rate cuts later in the year.

But, he added, "there are meaningful odds that the next move by the Fed may not be a rate cut, it might be a rate increase."

N.Awad--SF-PST