-

India accused of illegal deportations targeting Muslims

India accused of illegal deportations targeting Muslims

-

Australia and Lions yet to resolve tour sticking point

-

Green bonds offer hope, and risk, in Africa's climate fight

Green bonds offer hope, and risk, in Africa's climate fight

-

Game 'reloots' African artefacts from Western museums

-

Renters struggle to survive in Portugal housing crisis

Renters struggle to survive in Portugal housing crisis

-

Western Japan sees earliest end to rainy season on record

-

Ketamine 'epidemic' among UK youth raises alarm

Ketamine 'epidemic' among UK youth raises alarm

-

'Shocking' COP30 lodging costs heap pressure on Brazil

-

India investigates 'unnatural' death of five tigers

India investigates 'unnatural' death of five tigers

-

Anderson teases Dior debut with Mbappe, Basquiet and Marie Antoinette

-

Bangladesh pushes solar to tackle energy woes

Bangladesh pushes solar to tackle energy woes

-

Wallabies veteran White relishing 'unreal' Lions opportunity

-

Hong Kong's dragnet widens 5 years after national security law

Hong Kong's dragnet widens 5 years after national security law

-

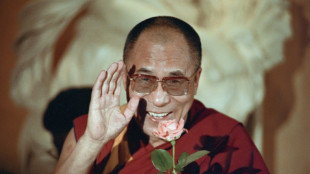

Tibetans face up to uncertain future as Dalai Lama turns 90

-

'Simple monk': the Dalai Lama, in his translator's words

'Simple monk': the Dalai Lama, in his translator's words

-

Man City crush Juventus, Real Madrid reach Club World Cup last 16

-

Stocks climb, dollar holds on trade hopes and rate bets

Stocks climb, dollar holds on trade hopes and rate bets

-

Bezos, Sanchez to say 'I do' in Venice

-

Vinicius stars as Real Madrid ease into Club World Cup last 16

Vinicius stars as Real Madrid ease into Club World Cup last 16

-

New-look Wimbledon prepares for life without line judges

-

Japan executes 'Twitter killer' who murdered nine

Japan executes 'Twitter killer' who murdered nine

-

UN conference seeks foreign aid rally as Trump cuts bite

-

Dying breed: Tunisian dog lovers push to save age-old desert hound

Dying breed: Tunisian dog lovers push to save age-old desert hound

-

Springboks launch 'really tough season' against Barbarians

-

Syria's wheat war: drought fuels food crisis for 16 million

Syria's wheat war: drought fuels food crisis for 16 million

-

Ex-All Black Kaino's Toulouse not expecting 'walkover' in Top 14 final

-

Rwanda, DRC to ink peace deal in US but questions remain

Rwanda, DRC to ink peace deal in US but questions remain

-

Combs defense team set to take the floor in trial's closing arguments

-

Fraser-Pryce eases through in Jamaica trials farewell

Fraser-Pryce eases through in Jamaica trials farewell

-

US Treasury signals G7 deal excluding US firms from some taxes

-

Combs created 'climate of fear' as head of criminal ring: prosecutors

Combs created 'climate of fear' as head of criminal ring: prosecutors

-

Chelsea's Fernandez flying ahead of Benfica reunion at Club World Cup

-

Potgieter and Roy share PGA lead in Detroit with course record 62s

Potgieter and Roy share PGA lead in Detroit with course record 62s

-

City skipper Bernardo hails Guardiola's new generation

-

Nike profits sink but company says it is turning a corner

Nike profits sink but company says it is turning a corner

-

'Mission: Impossible' composer Lalo Schifrin dies aged 93

-

Ex-Ravens ace Tucker suspended 10 games over masseuse allegations

Ex-Ravens ace Tucker suspended 10 games over masseuse allegations

-

Australia lead by 82 runs as West Indies' Test on a knife edge

-

Snow cloaks Atacama, the world's driest desert

Snow cloaks Atacama, the world's driest desert

-

Man City crush Juve as Real Madrid aim to avoid them

-

Dryburgh and Porter grab lead at LPGA pairs event

Dryburgh and Porter grab lead at LPGA pairs event

-

Iran says no plan for new US nuclear talks, plays down impact of strikes

-

City thrash Juventus to maintain 100% record at Club World Cup

City thrash Juventus to maintain 100% record at Club World Cup

-

Brazil prodigy Estevao has unfinished business ahead of Chelsea move

-

Mexican lawmakers vote to ban dolphin shows

Mexican lawmakers vote to ban dolphin shows

-

Trump admin insists Iran strikes success, attacks media

-

Anna Wintour steps down as US Vogue editor after nearly 40 years

Anna Wintour steps down as US Vogue editor after nearly 40 years

-

How Trump finally learned to love NATO -- for now

-

Faith Kipyegon misses out on bid for first female sub-4 minute mile

Faith Kipyegon misses out on bid for first female sub-4 minute mile

-

Spain PM alleges 'genocide' in Gaza as rescuers say 65 killed

Stocks firm after tech rout; dollar steady before Fed rate call

Stock markets mostly rose Wednesday, tracking a rally on Wall Street, where tech titans led by Nvidia recovered some of their hefty losses thanks to easing worries over Chinese artificial intelligence startup DeepSeek.

Investors were awaiting the conclusion of the Federal Reserve's interest-rate policy meeting later in the day as well as major earnings, including from Meta, Microsoft and Tesla.

"Calm has descended on financial markets after the AI upheaval, which triggered a wave of selling (this week), with investors seeing sharp falls as a buying opportunity," noted Susannah Streeter, head of money and markets at Hargreaves Lansdown.

DeepSeek's unveiling of its R1 chatbot has apparently shown the ability to match the capacity of US AI pace-setters for a fraction of the investments made by American companies.

The news hammered tech firms Monday, with US chip giant and market darling Nvidia collapsing almost 17 percent and wiping almost $600 billion from its market capitalisation -- a record single-day loss for a publicly traded company.

Tuesday saw a tech rebound, with Nvidia surging 8.8 percent, as some analysts voiced doubts over whether DeepSeek's AI was developed as cheaply as it claims.

Shares in Dutch tech giant ASML, which sells cutting-edge machines to make semiconductors, soared more than 11 percent on Wednesday after it reported solid orders in the fourth quarter.

DeepSeek's arrival raised questions about whether the vast sums of cash invested in AI in the past few years may have been overdone, but observers said the industry could benefit in the long term from competition pushing down costs.

All three main Wall Street indices rose Tuesday, with the Nasdaq putting on two percent and the S&P 500 almost one percent -- both clawing back most of Monday's losses.

Tokyo followed suit Wednesday, having taken a heavy hit over the previous two days as its chip companies tanked.

There were gains also in Sydney, Wellington and Mumbai, though Bangkok dipped. Chinese indices were closed for holidays.

European stock markets mostly rose in morning deals, though Paris was dragged lower by heavy falls to shares of luxury companies.

It comes one day after LVMH, Europe's largest company by market value, said its net profit slid 17 percent last year to 12.6 billion euros ($13 billion) on falling sales.

- Fed decision -

The Fed is set to stand pat on interest rates Wednesday despite calls by President Donald Trump for the central bank to lower them.

Its post-meeting statement, and comments by boss Jerome Powell, will be pored over for clues over the outlook.

There are worries Trump's plans to slash taxes, regulations and immigration -- as well as impose tariffs on imports -- will reignite inflation and therefore keep borrowing costs higher for longer.

The prospect of rates staying elevated boosted the dollar, which is being lifted also by Trump wanting universal tariffs "much bigger" than the 2.5 percent suggested by Treasury Secretary Scott Bessent.

Elsewhere, the European Central Bank is expected to cut eurozone interest rates on Thursday.

On the eve of the decision, eurozone member Spain said its economy expanded 3.2 percent last year on buoyant exports and consumption that have made it one of the fastest-growing developed countries.

- Key figures around 0915 GMT -

London - FTSE 100: UP 0.1 percent at 8,541.10 points

Paris - CAC 40: DOWN 0.3 percent at 7,875.79

Frankfurt - DAX: UP 0.4 percent at 21,509.19

Tokyo - Nikkei 225: UP 1.0 percent at 39,414.78 (close)

Hong Kong - Hang Seng Index: Closed for a holiday

Shanghai - Composite: Closed for a holiday

New York - Dow: UP 0.3 percent at 44,850.35 (close)

Euro/dollar: DOWN at $1.0414 from $1.0433 on Tuesday

Pound/dollar: DOWN at $1.2434 from $1.2440

Dollar/yen: DOWN at 155.24 yen from 155.53 yen

Euro/pound: DOWN at 83.77 pence from 83.84 pence

West Texas Intermediate: DOWN 0.6 percent at $73.33 per barrel

Brent North Sea Crude: DOWN 0.6 percent at $76.02 per barrel

G.AbuOdeh--SF-PST