-

From 'Derry Girls' to 'heaven', Irish writer airs new comedy

From 'Derry Girls' to 'heaven', Irish writer airs new comedy

-

Asia markets mixed as stong US jobs data temper rate expectations

-

Shanaka fireworks as Sri Lanka pile up 225-5 against Oman

Shanaka fireworks as Sri Lanka pile up 225-5 against Oman

-

Samsung starts mass production of next-gen AI memory chip

-

Benin's lovers less row-mantic as apps replace waterway rendezvous

Benin's lovers less row-mantic as apps replace waterway rendezvous

-

Geneva opera house selling off thousands of extravagant costumes

-

Non-alcoholic wine: a booming business searching for quality

Non-alcoholic wine: a booming business searching for quality

-

Greece's Cycladic islands swept up in concrete fever

-

Grieving Canada town holds vigil for school shooting victims

Grieving Canada town holds vigil for school shooting victims

-

Israel president says at end of visit antisemitism in Australia 'frightening'

-

Cunningham on target as depleted Pistons down Raptors

Cunningham on target as depleted Pistons down Raptors

-

Canada probes mass shooter's past interactions with police, health system

-

Dutch speed skater Jutta Leerdam combines Olympic gold and influencer attitude

Dutch speed skater Jutta Leerdam combines Olympic gold and influencer attitude

-

Scotland coach Townsend under pressure as England await

-

Canadian ice dancers put 'dark times' behind with Olympic medal

Canadian ice dancers put 'dark times' behind with Olympic medal

-

'Exhausting' off-field issues hang over Wales before France clash

-

Crusaders target another title as Super Rugby aims to speed up

Crusaders target another title as Super Rugby aims to speed up

-

Chinese Olympic snowboarder avoids serious injury after nasty crash

-

China carbon emissions 'flat or falling' in 2025: analysis

China carbon emissions 'flat or falling' in 2025: analysis

-

'China shock': Germany struggles as key market turns business rival

-

French ice dancer Cizeron's 'quest for perfection' reaps second Olympic gold

French ice dancer Cizeron's 'quest for perfection' reaps second Olympic gold

-

Most Asia markets rise as traders welcome US jobs

-

EU leaders push to rescue European economy challenged by China, US

EU leaders push to rescue European economy challenged by China, US

-

Plenty of peaks, but skiing yet to take off in Central Asia

-

UN aid relief a potential opening for Trump-Kim talks, say analysts

UN aid relief a potential opening for Trump-Kim talks, say analysts

-

Berlin Film Festival to open with a rallying cry 'to defend artistic freedom'

-

Taiwan leader wants greater defence cooperation with Europe: AFP interview

Taiwan leader wants greater defence cooperation with Europe: AFP interview

-

Taiwan leader warns countries in region 'next' in case of China attack: AFP interview

-

World Cup ticket prices skyrocket on FIFA re-sale site

World Cup ticket prices skyrocket on FIFA re-sale site

-

'No one to back us': Arab bus drivers in Israel grapple with racist attacks

-

Venezuelan AG wants amnesty for toppled leader Maduro

Venezuelan AG wants amnesty for toppled leader Maduro

-

Scrutiny over US claim that Mexican drone invasion prompted airport closure

-

Trump to undo legal basis for US climate rules

Trump to undo legal basis for US climate rules

-

Protesters, police clash at protest over Milei labor reform

-

Dyche sacked by Forest after dismal Wolves draw

Dyche sacked by Forest after dismal Wolves draw

-

France seeks probe after diplomat cited in Epstein files

-

Rivers among 2026 finalists for Basketball Hall of Fame

Rivers among 2026 finalists for Basketball Hall of Fame

-

Israel president says antisemitism in Australia 'frightening'

-

Trump orders Pentagon to buy coal-fired electricity

Trump orders Pentagon to buy coal-fired electricity

-

Slot hails 'unbelievable' Salah after matching Liverpool assist record

-

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

Von Allmen joins Olympic ski greats, French couple win remarkable ice dance

-

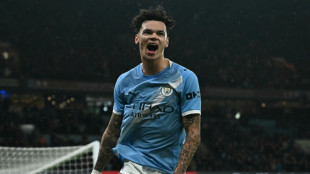

Guardiola eyes rest for 'exhausted' City stars

-

US pushes for 'dramatic increase' in Venezuela oil output

US pushes for 'dramatic increase' in Venezuela oil output

-

France's Cizeron and Fournier Beaudry snatch Olympic ice dancing gold

-

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

Man City close on Arsenal, Liverpool end Sunderland's unbeaten home run

-

Van Dijk sinks Sunderland to boost Liverpool's bid for Champions League

-

Messi out with hamstring strain as Puerto Rico match delayed

Messi out with hamstring strain as Puerto Rico match delayed

-

Kane helps Bayern past Leipzig into German Cup semis

-

Matarazzo's Real Sociedad beat Athletic in Copa semi first leg

Matarazzo's Real Sociedad beat Athletic in Copa semi first leg

-

Arsenal stroll in Women's Champions League play-offs

EU battles in court to overturn Apple tax bill ruling

Apple and Brussels butted heads in a top EU court on Tuesday as the bloc battled to overturn a ruling against its whopping 13-billion euro order on the iPhone-maker to pay Ireland in back taxes.

The landmark case remains one of the most bitter between the European Commission and a big tech firm, dating back to 2016 when the EU's executive arm accused Ireland of allowing Apple to escape 13 billion euros ($14 billion) in taxes between 2003 and 2014.

The EU alleged that Apple parked untaxed revenue earned in Europe, Africa, the Middle East and India in Ireland, which is a European hub for US-based big tech.

Brussels claims this amounted to illegal "state aid" by Ireland.

On Tuesday, the bloc's highest court heard the commission's appeal against a 2020 decision by the EU's lower General Court to annul its order that Apple repay the money.

The commission's lawyer, Paul-John Loewenthal, told the European Court of Justice (ECJ) that there had been a "breach of procedure" and "numerous other legal errors" when the lower court heard the case.

He also said the "tax breaks" resulted in Apple's Irish subsidiary "paying an effective tax rate on its European profits starting at one percent in 2003 down to 0.005 percent in 2014".

"Tax breaks which Apple itself described (to the US Senate) as investment incentives amounting to state aid," Loewenthal said.

Apple's lawyer Daniel Beard pushed back against Loewenthal's claims.

"Apple has paid the taxes that were due under the Irish tax code," Beard said.

"Taking quotes to the US Senate completely out of context doesn't change that."

The lawyer dismissed Brussels' accusations of illegal support from Ireland, insisting "there was no special treatment, there was no state aid".

Apple has been present in Ireland since the 1980s and employs more than 6,000 people in Cork, the country's second-largest city.

The ECJ's top legal advisor will issue an opinion on November 9, with a final ruling expected a few months later by judges that are not bound by the advice.

The EU has faced difficulty justifying its tax decisions in recent years with previous court losses against Amazon and Starbucks.

B.AbuZeid--SF-PST