-

Trump has options on Iran, but first must define goal

Trump has options on Iran, but first must define goal

-

Paris FC's Ikone stuns PSG to knock out former club from French Cup

-

Australia's ambassador to US leaving post, marked by Trump rift

Australia's ambassador to US leaving post, marked by Trump rift

-

Slot angered by 'weird' Szoboszlai error in Liverpool FA Cup win

-

Szoboszlai plays hero and villain in Liverpool's FA Cup win

Szoboszlai plays hero and villain in Liverpool's FA Cup win

-

Hawaii's Kilauea volcano puts on spectacular lava display

-

US stocks at records despite early losses on Fed independence angst

US stocks at records despite early losses on Fed independence angst

-

Koepka rejoins PGA Tour under new rules for LIV players

-

Ex-France, Liverpool defender Sakho announces retirement

Ex-France, Liverpool defender Sakho announces retirement

-

Jerome Powell: The careful Fed chair standing firm against Trump

-

France scrum-half Le Garrec likely to miss start of Six Nations

France scrum-half Le Garrec likely to miss start of Six Nations

-

AI helps fuel new era of medical self-testing

-

Leaders of Japan and South Korea meet as China flexes muscles

Leaders of Japan and South Korea meet as China flexes muscles

-

Trump sets meeting with Venezuelan opposition leader, Caracas under pressure

-

Australia captain Alyssa Healy to retire from cricket

Australia captain Alyssa Healy to retire from cricket

-

US 'screwed' if Supreme Court rules against tariffs: Trump

-

NATO, Greenland vow to boost Arctic security after Trump threats

NATO, Greenland vow to boost Arctic security after Trump threats

-

Israel to take part in first Eurovision semi-final on May 12

-

How Alonso's dream Real Madrid return crumbled so quickly

How Alonso's dream Real Madrid return crumbled so quickly

-

Ex-Fed chiefs, lawmakers slam US probe into Jerome Powell

-

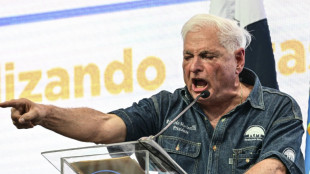

Former Panama leader on trial over mega Latin America corruption scandal

Former Panama leader on trial over mega Latin America corruption scandal

-

Trump keeping Iran air strikes on the table: White House

-

Paramount sues in hostile bid to buy Warner Bros Discover

Paramount sues in hostile bid to buy Warner Bros Discover

-

Ugandan opposition leader Bobi Wine warns of protests if polls rigged

-

Airbus delivers more planes in 2025

Airbus delivers more planes in 2025

-

Alonso leaves Real Madrid, Arbeloa appointed as coach

-

UK pays 'substantial' compensation to Guantanamo inmate: lawyer

UK pays 'substantial' compensation to Guantanamo inmate: lawyer

-

Iran protest toll mounts as government stages mass rallies

-

Gold hits record high, dollar slides as US targets Fed

Gold hits record high, dollar slides as US targets Fed

-

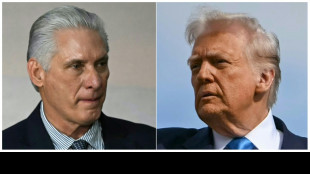

Cuba denies being in talks with Trump on potential deal

-

Scientists reveal what drives homosexual behaviour in primates

Scientists reveal what drives homosexual behaviour in primates

-

Venezuela releases more political prisoners as pressure builds

-

15,000 NY nurses stage largest-ever strike over conditions

15,000 NY nurses stage largest-ever strike over conditions

-

Rosenior plots long Chelsea stay as Arsenal loom

-

Zuckerberg names banker, ex-Trump advisor as Meta president

Zuckerberg names banker, ex-Trump advisor as Meta president

-

Reza Pahlavi: Iran's ex-crown prince dreaming of homecoming

-

Venezuela releases more political prisoners

Venezuela releases more political prisoners

-

Kenya's NY marathon champ Albert Korir gets drug suspension

-

US prosecutors open probe of Fed chief, escalating Trump-Powell clash

US prosecutors open probe of Fed chief, escalating Trump-Powell clash

-

Russian captain in fiery North Sea crash faces UK trial

-

Carrick is frontrunner for interim Man Utd job: reports

Carrick is frontrunner for interim Man Utd job: reports

-

Iran government stages mass rallies as alarm grows over protest toll

-

Variawa leads South African charge over Dakar dunes

Variawa leads South African charge over Dakar dunes

-

Swiss inferno bar owner detained for three months

-

Heathrow airport sees record high annual passenger numbers

Heathrow airport sees record high annual passenger numbers

-

Georgia jails ex-PM for five years amid ruling party oustings

-

Kyiv buries medic killed in Russian drone strike

Kyiv buries medic killed in Russian drone strike

-

Israel revokes French researcher's travel permit

-

India and Germany seek to boost defence industry ties

India and Germany seek to boost defence industry ties

-

French coach and football pundit Rolland Courbis dies at 72

Climate finance can be hard sell, says aide to banks and PMs

Trillions of dollars are needed to make poorer nations more resilient to climate change, and studies have estimated that every $1 invested today will save at least $4 in future.

So why is it so hard to raise this money, and what are some of the innovative ways of going about it?

- Wind over walls -

Developing countries, excluding China, will need $1 trillion a year by 2030 in outside help to reduce their carbon footprint and adapt to a warming planet, according to UN-commissioned experts.

This money could come from foreign governments, big lending institutions like the World Bank, or the private sector.

But some projects attract money more easily than others, said Avinash Persaud, special climate adviser to the president of the Inter-American Development Bank, a lender for Latin American and Caribbean nations.

For example, the private sector likes building solar farms and wind turbines because there's a return on investment when people buy the electricity.

But investors are much less interested in building defensive sea walls that generate no revenue, said Persaud, who hails from Barbados, and once advised the Caribbean nation's Prime Minister Mia Mottley.

"Unfortunately, there's no magic in finance. And so that does require a lot of public money," he told AFP on the sidelines of the UN COP29 climate summit in Azerbaijan.

- Political jitters -

But governments are limited in the amount they can borrow, he said, and reluctant to dip into their budgets for climate adaptation in poorer nations.

In the European Union, which is the largest contributor to international climate finance, major donors face political and economic pressures at home.

Meanwhile, newly-elected Donald Trump has threatened to pull the US, the world's largest economy, out of global cooperation on climate action.

This has posed enormous challenges at COP29, where nations are no closer to striking a long-sought deal to raise more money for developing countries.

"You're seeing the political landscape -- governments are not getting elected to raise their aid budgets and send more money abroad," said Persaud.

- Close the gap -

A defensive sea wall, for example, might not pay off for decades, making it difficult for debt-strapped countries to borrow enough money at reasonable rates to build it in the first place.

Persaud said development banks could help bring down the cost of borrowing, while new taxes on polluting industries like global shipping and coal, oil and gas could raise new money.

Such "innovative" schemes already exist, he said: in the United States, $0.09 of every barrel of oil goes into a fund to cover the cost of cleaning up a spill.

"Well, we're seeing a spill in the atmosphere... and maybe if we spread these things, make them global across fossil fuels, we could raise the money we need."

This could help poorer nations recover from disaster -- known in UN parlance as "loss and damage" -- something few investors go near, he said.

"If we can raise these levees -- the solidarity levees -- here and there, for those things that can't be funded any other way, then we can close that gap," he said.

- 'Science into finance' -

Persaud conceded "none of this is easy".

"Raising the money is hard. Spending it well is hard. Getting it to the the people who need it most is hard," he said.

But $1 trillion was a realistic ask if underpinned by $300 billion in public finance -- three times the existing pledge, he said.

Without "translating the science into finance", developing countries could not take the action necessary to help curb rises in global temperatures.

"If we don't get one, we don't get the other," he said.

V.AbuAwwad--SF-PST