-

Sinner caps eventful year with ATP Finals triumph over great rival Alcaraz

Sinner caps eventful year with ATP Finals triumph over great rival Alcaraz

-

Portugal book spot at 2026 World Cup as England stay perfect

-

Hakimi, Osimhen, Salah shortlisted for top African award

Hakimi, Osimhen, Salah shortlisted for top African award

-

Sinner beats great rival Alcaraz to retain ATP Finals title

-

Schenk wins windy Bermuda Championship for first PGA title

Schenk wins windy Bermuda Championship for first PGA title

-

Crime, immigration dominate as Chile votes for president

-

Kane double gives England record-setting finish on road to World Cup

Kane double gives England record-setting finish on road to World Cup

-

World champions South Africa add Mbonambi, Mchunu to squad

-

Greenpeace says French uranium being sent to Russia

Greenpeace says French uranium being sent to Russia

-

'Now You See Me' sequel steals N. American box office win

-

Argentina beat Scotland after frenzied fightback

Argentina beat Scotland after frenzied fightback

-

Argentina beat Scotland after stunning fightback

-

Pope urges leaders not to leave poor behind

Pope urges leaders not to leave poor behind

-

Pressure will boost Germany in 'knockout' Slovakia clash, says Nagelsmann

-

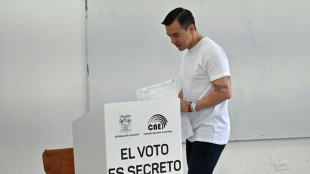

Ecuador votes on hosting foreign bases as Noboa eyes more powers

Ecuador votes on hosting foreign bases as Noboa eyes more powers

-

Portugal qualify for 2026 World Cup by thrashing Armenia

-

Greece to supply winter gas to war battered Ukraine

Greece to supply winter gas to war battered Ukraine

-

India and Pakistan blind women show spirit of cricket with handshakes

-

Ukraine signs deal with Greece for winter deliveries of US gas

Ukraine signs deal with Greece for winter deliveries of US gas

-

George glad England backed-up haka response with New Zealand win

-

McIlroy loses playoff but clinches seventh Race to Dubai title

McIlroy loses playoff but clinches seventh Race to Dubai title

-

Ecuador votes on reforms as Noboa eyes anti-crime ramp-up

-

Chileans vote in elections dominated by crime, immigration

Chileans vote in elections dominated by crime, immigration

-

Turkey seeks to host next COP as co-presidency plans falter

-

Bezzecchi claims Valencia MotoGP victory in season-ender

Bezzecchi claims Valencia MotoGP victory in season-ender

-

Wasim leads as Pakistan dismiss Sri Lanka for 211 in third ODI

-

Serbia avoiding 'confiscation' of Russian shares in oil firm NIS

Serbia avoiding 'confiscation' of Russian shares in oil firm NIS

-

Coach Gambhir questions 'technique and temperament' of Indian batters

-

Braathen wins Levi slalom for first Brazilian World Cup victory

Braathen wins Levi slalom for first Brazilian World Cup victory

-

Rory McIlroy wins seventh Race to Dubai title

-

Samsung plans $310 bn investment to power AI expansion

Samsung plans $310 bn investment to power AI expansion

-

Harmer stars as South Africa stun India in low-scoring Test

-

Mitchell ton steers New Zealand to seven-run win in first Windies ODI

Mitchell ton steers New Zealand to seven-run win in first Windies ODI

-

Harmer stars as South Africa bowl out India for 93 to win Test

-

China authorities approve arrest of ex-abbot of Shaolin Temple

China authorities approve arrest of ex-abbot of Shaolin Temple

-

Clashes erupt in Mexico City anti-crime protests, injuring 120

-

India, without Gill, 10-2 at lunch chasing 124 to beat S.Africa

India, without Gill, 10-2 at lunch chasing 124 to beat S.Africa

-

Bavuma fifty makes India chase 124 in first Test

-

Mitchell ton lifts New Zealand to 269-7 in first Windies ODI

Mitchell ton lifts New Zealand to 269-7 in first Windies ODI

-

Ex-abbot of China's Shaolin Temple arrested for embezzlement

-

Doncic scores 41 to propel Lakers to NBA win over Bucks

Doncic scores 41 to propel Lakers to NBA win over Bucks

-

Colombia beats New Zealand 2-1 in friendly clash

-

France's Aymoz wins Skate America men's gold as Tomono falters

France's Aymoz wins Skate America men's gold as Tomono falters

-

Gambling ads target Indonesian Meta users despite ban

-

Joe Root: England great chases elusive century in Australia

Joe Root: England great chases elusive century in Australia

-

England's Archer in 'happy place', Wood 'full of energy' ahead of Ashes

-

Luxury houses eye India, but barriers remain

Luxury houses eye India, but barriers remain

-

Budget coffee start-up leaves bitter taste in Berlin

-

Reyna, Balogun on target for USA in 2-1 win over Paraguay

Reyna, Balogun on target for USA in 2-1 win over Paraguay

-

Japa's Miura and Kihara capture Skate America pairs gold

ExxonMobil to buy Texas shale producer Pioneer for about $60 bn

ExxonMobil sealed a megadeal to acquire Pioneer Natural Resources for about $60 billion, bolstering its holdings in the Permian Basin, a key US petroleum region, the companies announced Wednesday.

Under the all-stock transaction, ExxonMobil will buy Texas-based Pioneer for $59.5 billion based on ExxonMobil's closing price on October 5. The overall transaction, including debt, is valued at around $64.5 billion, the companies said.

ExxonMobil said the takeover, the company's biggest since the late 1990s acquisition of Mobil by Exxon, will enable greater economies of scale, permitting it to deploy drilling and operating technologies over a bigger region.

"The combined capabilities of our two companies will provide long-term value creation well in excess of what either company is capable of doing on a standalone basis," said ExxonMobil Chief Executive Darren Woods.

The "highly contiguous" drilling acreage of the two companies will allow "for greater opportunities to deploy our technologies, delivering operating and capital efficiency as well as significantly increasing production," Woods said.

Production in the Permian Basin, located in western Texas and eastern New Mexico, accounts for a whopping 5.8 million barrels of oil per day, or about 45 percent of US output.

- Shale revival -

The region has a long and storied history, with the first wells dating to 1920. The basin soared during the energy boom of the 1970s before experiencing a steady decline in subsequent decades.

The US shale boom of the 2010s revived the area, with fracking and new drilling techniques that make development more affordable.

Both ExxonMobil and fellow US petroleum behemoth Chevron have invested heavily in the region in recent years.

With the Pioneer acreage, ExxonMobil will be able to drill some wells as long as four miles, boosting efficiency the oil giant said would enable it to produce the acquired acreage for less the $35 a barrel.

The takeover comes as oil currently trades at more than $85 a barrel, a relatively high historical benchmark.

ExxonMobil vowed that it would employ best practices on the environment, accelerating Pioneer's plan to reach "net zero" emissions by 15 years to 2035 and employing technology to limit methane emissions.

But as a longterm bet on oil and gas, the merger is unlikely to please climate activists.

ExxonMobil has long faced criticism that it intentionally fueled doubts about climate change science in order to protect its core business.

Under Woods, the company has established a low-carbon business, having acquired Denbury Inc., a specialist in enhanced oil recovery and carbon sequestration, for $4.9 billion earlier this year.

While ExxonMobil usually avoids big deals under a high price scenario, analysts noted that Pioneer's shares had retreated prior to speculation of the deal.

Another factor favoring a deal was the impending retirement of Pioneer CEO Scott Sheffield, who has planned to step down at the end of 2023.

Shares of Pioneer jumped 2.0 percent in pre-market trading, while ExxonMobil dropped 2.5 percent.

F.AbuShamala--SF-PST