-

Canada's Carney to mend rift, boost trade as he meets India's Modi

Canada's Carney to mend rift, boost trade as he meets India's Modi

-

Crude soars, stocks drop after US strikes on Iran

-

Iran war spreads across region as US, Israel suffer losses

Iran war spreads across region as US, Israel suffer losses

-

Miriam Margolyes tackles aging in Oscar-nominated short

-

Recognition, not competition, for Oscar-nominated foreign filmmakers

Recognition, not competition, for Oscar-nominated foreign filmmakers

-

Israel, Hezbollah trade fire: latest developments in Iran war

-

Israel strikes Tehran: latest developments in Iran war

Israel strikes Tehran: latest developments in Iran war

-

Trump vows to avenge first US deaths as Iran war intensifies

-

Lowry collapses late again, Echavarria snatches victory in Cognizant Classic

Lowry collapses late again, Echavarria snatches victory in Cognizant Classic

-

Aubameyang strikes twice as Marseille edge Lyon in Ligue 1

-

Infantino says players who cover mouths when speaking could be sent off

Infantino says players who cover mouths when speaking could be sent off

-

Bolsonaro son rallies the right as thousands protest Brazil government

-

Juve stay in Champions League hunt with last-gasp Roma draw

Juve stay in Champions League hunt with last-gasp Roma draw

-

Maersk suspends vessel transit through Strait of Hormuz

-

France, Germany, UK ready to take 'defensive action' against Iran

France, Germany, UK ready to take 'defensive action' against Iran

-

Trump vows to avenge deaths of US troops: latest Iran developments

-

Knicks halt Spurs' 11-game NBA winning streak

Knicks halt Spurs' 11-game NBA winning streak

-

EU warns against long war, urges 'credible transition' in Iran

-

'Severe blow' dealt to Iran command centres: latest developments

'Severe blow' dealt to Iran command centres: latest developments

-

Bored of peace? Trump keeps choosing war

-

Arteta embraces Arsenal's 'Set-Piece FC' label after corners sink Chelsea

Arteta embraces Arsenal's 'Set-Piece FC' label after corners sink Chelsea

-

Sevilla rescue derby draw to deal Betis top four setback

-

India need 'special effort' to beat England in semi-final: Gambhir

India need 'special effort' to beat England in semi-final: Gambhir

-

'A terrible day,' says Israel community shaken by deadly Iranian strike

-

Arsenal corner Chelsea into submission, Man Utd climb to third

Arsenal corner Chelsea into submission, Man Utd climb to third

-

Arsenal win set-piece battle to sink Chelsea in title boost

-

What future for Iranian leadership after Khamenei's death?

What future for Iranian leadership after Khamenei's death?

-

'Scream 7' makes a killing at N. America box office

-

Thousands stranded as Iran conflict shuts Mideast hubs

Thousands stranded as Iran conflict shuts Mideast hubs

-

Samson's 97 puts India into T20 World Cup semi-final against England

-

Latest developments as Iran retaliates to US-Israel strikes that killed Khamenei

Latest developments as Iran retaliates to US-Israel strikes that killed Khamenei

-

Spurs have 'big problems' says Tudor as relegation risk persists

-

Dortmund captain Can out for season with ACL tear

Dortmund captain Can out for season with ACL tear

-

Leweling doubles up as Stuttgart sink sorry Wolfsburg

-

Man Utd climb to third, Fulham sink sorry Spurs

Man Utd climb to third, Fulham sink sorry Spurs

-

Iran strikes send VIP Dubai influencers 'back to reality'

-

Briton Brennan bursts to Kuurne-Bruxelles-Kuurne triumph

Briton Brennan bursts to Kuurne-Bruxelles-Kuurne triumph

-

Activists pressure Milan Fashion Week to go fully fur-free

-

First US service members killed in operation against Iran

First US service members killed in operation against Iran

-

Blasts in Kabul as Afghan govt says responding to Pakistan attacks

-

Iranians grieve, celebrate, worry after Khamenei's killing

Iranians grieve, celebrate, worry after Khamenei's killing

-

Latest developments as Iran lashes out after US-Israel strikes kill Khamenei

-

First US soldiers killed in operation against Iran

First US soldiers killed in operation against Iran

-

West Indies post 195-4 against India in T20 World Cup do-or-die clash

-

South Africa 'embrace pressure' and favourites tag, says coach

South Africa 'embrace pressure' and favourites tag, says coach

-

Tel Aviv residents say ready to withstand more Iranian attacks

-

Russia loses key ally leader as Putin slams Khamenei 'cynical' killing

Russia loses key ally leader as Putin slams Khamenei 'cynical' killing

-

AC Milan consolidate top-four credentials with win at Cremonese

-

Flights of fancy at Bottega Veneta, atmospheric mood at Armani in Milan

Flights of fancy at Bottega Veneta, atmospheric mood at Armani in Milan

-

South Africa beat plucky Zimbabwe ahead of New Zealand semi-final

Trump vs Intel: Chip endgame?

When the White House converted previously pledged chip subsidies into a near-10% equity stake in Intel, it did more than jolt markets. It marked a break with decades of hands-off policy toward private industry and thrust the United States government directly into the strategy of a struggling national champion at the center of the global semiconductor race. Coming just days after the president publicly demanded the resignation of Intel’s chief executive, the move has raised urgent questions: Can state-backed Intel credibly become America’s comeback vehicle in advanced manufacturing—or does politicized ownership risk slowing the very turnaround it seeks to accelerate?

The deal gives Washington a formidable position in one of the world’s most strategically important companies without taking board seats or formal control. For Intel, the cash and imprimatur of national backing arrive amid a high-stakes transformation of its manufacturing arm and an intensifying contest with Asian foundry leaders. For the administration, it signals a willingness to intervene decisively where markets have been reluctant to finance multiyear, cap-ex-heavy bets with uncertain payoffs.

The optics were dramatic. On August 7, the president blasted Intel’s new CEO, alleging conflicts over historic business ties and calling for his immediate resignation. Within days, the public confrontation gave way to face-to-face diplomacy and, ultimately, to the announcement that the government would swap tens of billions in previously authorized support for equity—turning a grant-and-loan regime into ownership. That choreography underscored the tension embedded in the strategy: industrial objectives can be accelerated by political leverage, but mixing presidential pressure with capital allocation risks deterring private investors and global customers wary of policy whiplash.

Intel’s operational backdrop remains demanding. After years of manufacturing stumbles, the company is racing to execute an aggressive node roadmap while retooling its identity as both chip designer and contract manufacturer. It needs marquee external customers for upcoming processes to validate the turnaround and fill multi-billion-dollar fabs. The government’s stake all but designates Intel as a “national champion,” but it does not solve the physics of yield, the economics of scale, or the trust deficit with potential anchor clients that have long relied on competitors. Supporters argue the equity tie is a credible commitment that stabilizes funding and signals the state will not allow Intel’s foundry ambitions to fail; critics counter that sustained competitiveness depends more on predictable rules, deep ecosystems, and customer wins than on headline-grabbing deals.

The domestic manufacturing picture is mixed. Flagship U.S. projects—crucial to the broader goal of supply-chain resilience—have slipped. Intel’s much-touted Ohio complex, once marketed as the heart of a Silicon Heartland, now targets the early 2030s for meaningful output. Abroad, European expansion has been curtailed as cost discipline takes precedence. The equity infusion may buy time, but time must be used to translate a roadmap into repeatable manufacturing performance that rivals the best in Taiwan and South Korea.

Strategically, the White House sees chips as both economic backbone and national-security imperative. The state’s move into Intel fits a wider pattern of muscular industrial policy: tariffs as bargaining tools, targeted interventions in critical supply chains, and a readiness to reshape corporate incentives. Inside the tech sector, that posture is reverberating. Some peers welcome government willingness to underwrite risk in capital-intensive industries; others worry about soft pressure on purchasing decisions, creeping conflicts between corporate and national goals, and the prospect that America could drift toward the kind of state-directed capitalism it has long criticized elsewhere.

Markets are split. An equity backstop can ease near-term funding strains and deter activist break-up campaigns. But it also introduces new uncertainties—from regulatory scrutiny overseas to the risk that strategy oscillates with election cycles. Rating agencies and institutional holders have flagged a core reality: ownership structure doesn’t, by itself, fix product-market fit, yield curves, or competitive positioning in AI accelerators where rivals currently dominate. Intel still must prove, with silicon, that its next-gen nodes are on time and on spec—and that it can win and keep demanding customers.

The politics of the deal may matter as much as the financials. Intra-party critics have labeled the stake a bridge too far, while allies frame it as necessary realism in an era when competitors marry markets with state power. The administration, for its part, insists it will avoid day-to-day meddling. Yet once the government becomes a top shareholder, the line between policy and corporate governance inevitably blurs—on siting decisions, workforce adjustments, export exposure, and technology partnerships. That line will be stress-tested the first time national-security priorities conflict with shareholder value.

What would success look like? Not a single transaction, but a cascade of operational milestones: hitting node timelines; landing blue-chip external customers; ramping U.S. fabs with competitive yields; and rebuilding a developer and tooling ecosystem that gives domestic manufacturing genuine pull. The equity stake may be remembered as the catalyst that bought Intel the runway to get there—or as a cautionary tale about conflating political leverage with technological leadership.

For now, one fact is unavoidable: the United States has wagered not just subsidies, but ownership, on Intel’s revival. Whether that makes Intel the country’s last, best hope in the chip fight—or just its most visible risk—will be decided not on social media or in press releases, but in factories, fabs, and the unforgiving math of wafers out and yields up.

Cuba's golden Goose dies

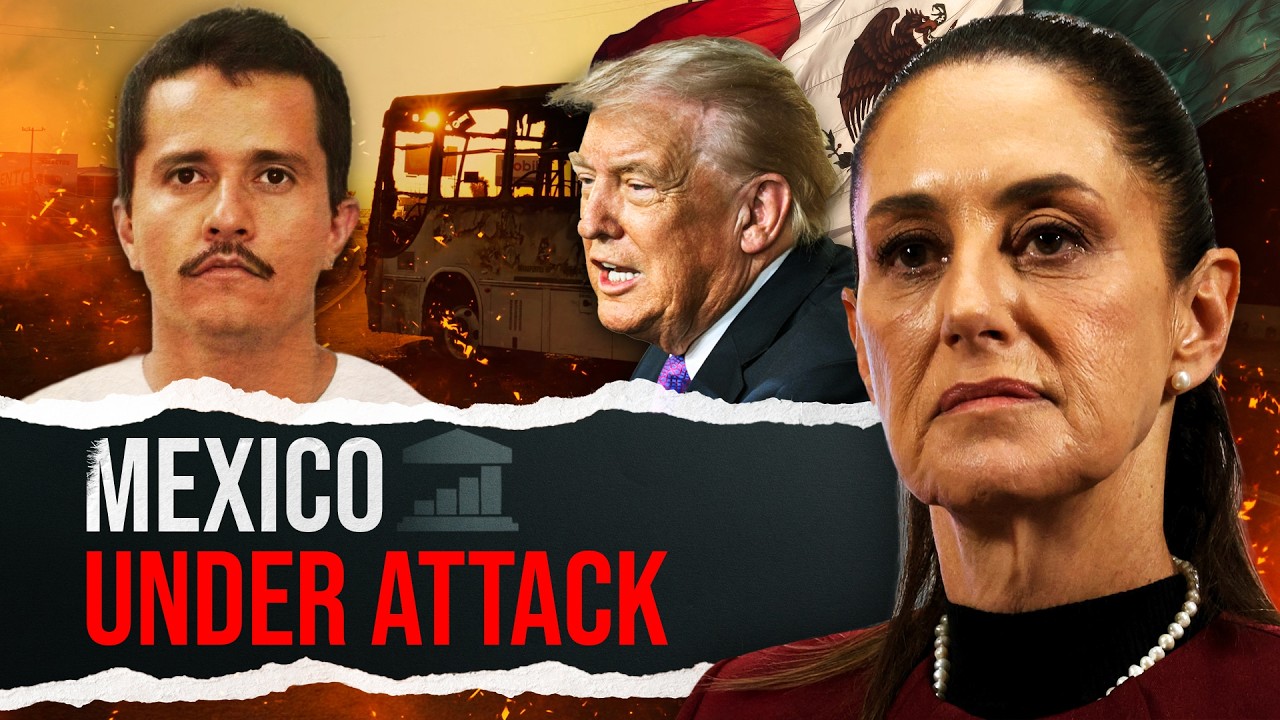

Mexico after El Mencho falls

Nicaragua on the brink?

Cuba: The Regime's last Card

Strike fears rise over Iran

U.S. Jobs stall, gdp slows

Japan’s right‑turn triumph

EU India deal gains unveiled

AI sparks Wall Street panic

India defies U.S. tariffs

EU misstep on mercosur Deal