-

Canada's Carney to mend rift, boost trade as he meets India's Modi

Canada's Carney to mend rift, boost trade as he meets India's Modi

-

Crude soars, stocks drop after US strikes on Iran

-

Iran war spreads across region as US, Israel suffer losses

Iran war spreads across region as US, Israel suffer losses

-

Miriam Margolyes tackles aging in Oscar-nominated short

-

Recognition, not competition, for Oscar-nominated foreign filmmakers

Recognition, not competition, for Oscar-nominated foreign filmmakers

-

Israel, Hezbollah trade fire: latest developments in Iran war

-

Israel strikes Tehran: latest developments in Iran war

Israel strikes Tehran: latest developments in Iran war

-

Trump vows to avenge first US deaths as Iran war intensifies

-

Lowry collapses late again, Echavarria snatches victory in Cognizant Classic

Lowry collapses late again, Echavarria snatches victory in Cognizant Classic

-

Aubameyang strikes twice as Marseille edge Lyon in Ligue 1

-

Infantino says players who cover mouths when speaking could be sent off

Infantino says players who cover mouths when speaking could be sent off

-

Bolsonaro son rallies the right as thousands protest Brazil government

-

Juve stay in Champions League hunt with last-gasp Roma draw

Juve stay in Champions League hunt with last-gasp Roma draw

-

Maersk suspends vessel transit through Strait of Hormuz

-

France, Germany, UK ready to take 'defensive action' against Iran

France, Germany, UK ready to take 'defensive action' against Iran

-

Trump vows to avenge deaths of US troops: latest Iran developments

-

Knicks halt Spurs' 11-game NBA winning streak

Knicks halt Spurs' 11-game NBA winning streak

-

EU warns against long war, urges 'credible transition' in Iran

-

'Severe blow' dealt to Iran command centres: latest developments

'Severe blow' dealt to Iran command centres: latest developments

-

Bored of peace? Trump keeps choosing war

-

Arteta embraces Arsenal's 'Set-Piece FC' label after corners sink Chelsea

Arteta embraces Arsenal's 'Set-Piece FC' label after corners sink Chelsea

-

Sevilla rescue derby draw to deal Betis top four setback

-

India need 'special effort' to beat England in semi-final: Gambhir

India need 'special effort' to beat England in semi-final: Gambhir

-

'A terrible day,' says Israel community shaken by deadly Iranian strike

-

Arsenal corner Chelsea into submission, Man Utd climb to third

Arsenal corner Chelsea into submission, Man Utd climb to third

-

Arsenal win set-piece battle to sink Chelsea in title boost

-

What future for Iranian leadership after Khamenei's death?

What future for Iranian leadership after Khamenei's death?

-

'Scream 7' makes a killing at N. America box office

-

Thousands stranded as Iran conflict shuts Mideast hubs

Thousands stranded as Iran conflict shuts Mideast hubs

-

Samson's 97 puts India into T20 World Cup semi-final against England

-

Latest developments as Iran retaliates to US-Israel strikes that killed Khamenei

Latest developments as Iran retaliates to US-Israel strikes that killed Khamenei

-

Spurs have 'big problems' says Tudor as relegation risk persists

-

Dortmund captain Can out for season with ACL tear

Dortmund captain Can out for season with ACL tear

-

Leweling doubles up as Stuttgart sink sorry Wolfsburg

-

Man Utd climb to third, Fulham sink sorry Spurs

Man Utd climb to third, Fulham sink sorry Spurs

-

Iran strikes send VIP Dubai influencers 'back to reality'

-

Briton Brennan bursts to Kuurne-Bruxelles-Kuurne triumph

Briton Brennan bursts to Kuurne-Bruxelles-Kuurne triumph

-

Activists pressure Milan Fashion Week to go fully fur-free

-

First US service members killed in operation against Iran

First US service members killed in operation against Iran

-

Blasts in Kabul as Afghan govt says responding to Pakistan attacks

-

Iranians grieve, celebrate, worry after Khamenei's killing

Iranians grieve, celebrate, worry after Khamenei's killing

-

Latest developments as Iran lashes out after US-Israel strikes kill Khamenei

-

First US soldiers killed in operation against Iran

First US soldiers killed in operation against Iran

-

West Indies post 195-4 against India in T20 World Cup do-or-die clash

-

South Africa 'embrace pressure' and favourites tag, says coach

South Africa 'embrace pressure' and favourites tag, says coach

-

Tel Aviv residents say ready to withstand more Iranian attacks

-

Russia loses key ally leader as Putin slams Khamenei 'cynical' killing

Russia loses key ally leader as Putin slams Khamenei 'cynical' killing

-

AC Milan consolidate top-four credentials with win at Cremonese

-

Flights of fancy at Bottega Veneta, atmospheric mood at Armani in Milan

Flights of fancy at Bottega Veneta, atmospheric mood at Armani in Milan

-

South Africa beat plucky Zimbabwe ahead of New Zealand semi-final

China’s profitless push

Can we keep up? Chinese companies are sacrificing margins—sometimes incurring outright losses—to win global market share in strategic industries from electric vehicles and batteries to solar and consumer tech. The tactic is turbocharging exports, pressuring Western competitors and forcing policymakers in Europe and the United States to erect new defenses while they scramble to lower costs at home.

Electric vehicles: a race to the bottom on price. In late spring 2025, China’s largest carmakers unleashed another round of steep price cuts, with entry-level models reduced to mass-market price points. Regulators in Beijing have since urged manufacturers to rein in the bruising price war, citing risks to industry health and employment. Yet the incentives keep coming as dozens of brands fight for share in the world’s most competitive EV market. The financial fallout is visible: leading pure-play EV makers continue to post substantial quarterly losses, while ambitious new entrants have acknowledged that their car divisions remain in the red even as sales surge.

Green tech: overcapacity meets collapsing margins. China’s build-out in solar has morphed from a growth engine into a profitability trap. Module and polysilicon prices have fallen so far that key manufacturers forecast sizeable half-year losses, and producers are now discussing a coordinated effort to shutter older capacity. Industry reports describe spot prices for feedstocks dipping below production costs, a hallmark of cut-throat competition that spills over into export markets and undercuts rivals globally.

Trade blowback intensifies. The U.S. has moved to quadruple tariffs on Chinese-made EVs and lift duties on batteries, chips and solar cells. The European Union has imposed definitive countervailing duties on Chinese battery-electric cars and opened additional probes across green-tech supply chains. Brussels and Beijing have even explored minimum export prices to reduce undercutting—an extraordinary step that underscores how acute the pricing pressure has become.

Deflation at the factory gate. China’s factory-gate prices remain in negative territory year on year, reflecting slack domestic demand and excess capacity. That weakness transmits abroad via cheaper exports, squeezing margins for manufacturers elsewhere and complicating central banks’ inflation-fighting calculus. Beijing has rolled out an “anti-involution” campaign to curb ruinous discounting and steer investment toward “high-quality growth,” but implementation is uneven and local governments still depend on industrial output to stabilize employment.

Scale, speed—and logistics. Chinese champions are not only cutting prices; they are redesigning logistics to keep them low. One leading EV maker has built its own fleet of car carriers and is localizing production via overseas factories to sidestep tariffs and port bottlenecks. Such vertical integration magnifies the advantage from sprawling domestic supply chains in batteries, motors and power electronics.

What this means for Western competitors. The immediate effect is a margin squeeze across autos, solar and adjacent sectors. The strategic response taking shape in Europe and the U.S. is three-pronged: (1) trade defense to buy time; (2) industrial policy to catalyze domestic gigafactories and clean-tech manufacturing; and (3) consolidation to rebuild pricing power. Companies that cannot match China’s cost curve will need to differentiate—through software, design, brand and service—or partner to gain scale. Even in China, the current “profitless prosperity” looks unsustainable: consolidation is inevitable, and state guidance now favors capacity rationalization over raw volume.

The bottom line. China’s price-first strategy is remaking global competition. Whether others can keep up will hinge on how quickly they can de-risk supply chains, compress costs and innovate without hollowing out profitability. For now, the contest is being fought as much on balance sheets as it is on assembly lines.

Cuba's golden Goose dies

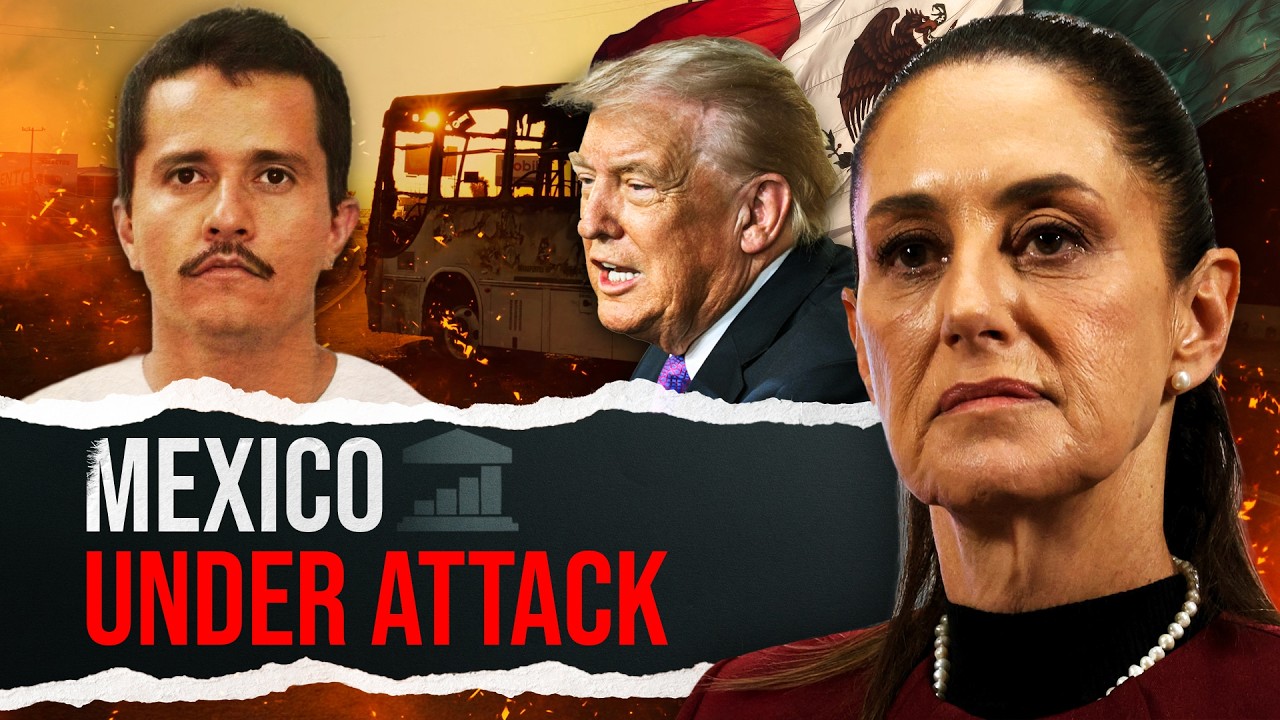

Mexico after El Mencho falls

Nicaragua on the brink?

Cuba: The Regime's last Card

Strike fears rise over Iran

U.S. Jobs stall, gdp slows

Japan’s right‑turn triumph

EU India deal gains unveiled

AI sparks Wall Street panic

India defies U.S. tariffs

EU misstep on mercosur Deal