-

Myong hat-trick as North Korea cruise at Women's Asian Cup

Myong hat-trick as North Korea cruise at Women's Asian Cup

-

AI disinformation turns Nepal polls into 'digital battleground'

-

New Israel, Iran attacks across region: Latest developments in Middle East war

New Israel, Iran attacks across region: Latest developments in Middle East war

-

China's overstretched healthcare looks to AI boom

-

Oil extends gains and stocks drop as Iran conflict spreads

Oil extends gains and stocks drop as Iran conflict spreads

-

Rituals of resilience: how Afghan women stay sane in their 'cage'

-

Strait of Hormuz impasse squeezes world shipping

Strait of Hormuz impasse squeezes world shipping

-

Fresh Israel, Iran attacks across region: Latest developments in Middle East war

-

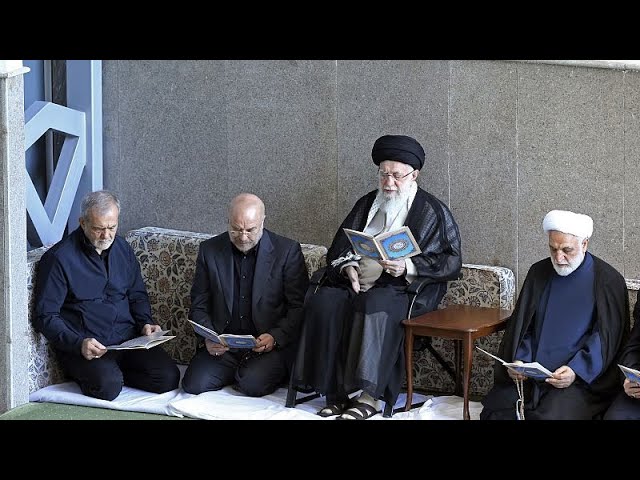

Oscar-nominated Iranian doc offers different vision of leadership

Oscar-nominated Iranian doc offers different vision of leadership

-

Oscar-nominated docs take on hot-button US social issues

-

'I couldn't breathe': The dark side of Bolivia's silver boom

'I couldn't breathe': The dark side of Bolivia's silver boom

-

Trump warns of longer Iran war as Riyadh, Beirut hit

-

Underground party scene: Israelis celebrate Purim in air raid shelters

Underground party scene: Israelis celebrate Purim in air raid shelters

-

Flowers, music, and soldiers at funeral of drug lord

-

'Safety and wellbeing' will guide F1 Mideast planning: FIA chief

'Safety and wellbeing' will guide F1 Mideast planning: FIA chief

-

Trump to attend White House Correspondents' dinner

-

Will Iran's missiles drain US interceptor stocks?

Will Iran's missiles drain US interceptor stocks?

-

Trump warns of longer Iran war as violence spreads

-

Energy infrastructure emerges as war target, lifting prices

Energy infrastructure emerges as war target, lifting prices

-

Trump warns of longer Iran war, Rubio points at Israel

-

US urges to 'depart now' from Middle East: Latest developments in Iran war

US urges to 'depart now' from Middle East: Latest developments in Iran war

-

Ecuador launches joint anti-drug operations with US

-

Getafe deal flat Real Madrid La Liga title race blow

Getafe deal flat Real Madrid La Liga title race blow

-

Rubio, Hezbollah and Qatar: Latest developments in Iran war

-

Rubio says Israel's strike plan triggered US attack on Iran

Rubio says Israel's strike plan triggered US attack on Iran

-

'Thank you, madam president': Melania Trump leads UN Security Council as Iran war rages

-

Bombing Iran, Trump has 'epic fury' but endgame undefined

Bombing Iran, Trump has 'epic fury' but endgame undefined

-

US slaps sanctions on Rwanda military over DR Congo 'violation'

-

US Congress to debate Trump's war powers

US Congress to debate Trump's war powers

-

US appeals court denies Trump bid to delay tariff refund lawsuits

-

Trump warns of longer Iran war

Trump warns of longer Iran war

-

Fire-damaged Six nations trophy to be replaced

-

Trump mulls ground troops: latest developments in US-Iran war

Trump mulls ground troops: latest developments in US-Iran war

-

Middle East war puts shipping firms in tight insurance spot

-

Qatar downs Iran jets as Tehran targets oil and gas in spiralling Gulf crisis

Qatar downs Iran jets as Tehran targets oil and gas in spiralling Gulf crisis

-

UK PM says US will not use British bases in Cyprus

-

Can Anthropic survive taking on Trump's Pentagon?

Can Anthropic survive taking on Trump's Pentagon?

-

Real Madrid superstar Mbappe in Paris for treatment on knee injury

-

Mideast war risks sending global economy into stagflation

Mideast war risks sending global economy into stagflation

-

Stranded tourists shelter from missile fire in Dubai

-

Iran war spells danger for global airlines

Iran war spells danger for global airlines

-

Trump doesn't rule out sending US troops into Iran

-

'No aborts. Good luck': Key moments in the US war on Iran

'No aborts. Good luck': Key moments in the US war on Iran

-

Chelsea boss Rosenior warns players over discipline

-

Energy prices soar on Iran war fallout, stocks slide

Energy prices soar on Iran war fallout, stocks slide

-

Pentagon chief refuses to rule out 'boots on ground' in Iran

-

Saudi military raises readiness levels after attacks

Saudi military raises readiness levels after attacks

-

Iran war spreads with strikes across Middle East and beyond

-

Barca must 'make the impossible possible': coach Flick on Atletico cup challenge

Barca must 'make the impossible possible': coach Flick on Atletico cup challenge

-

Furry, frayed & freezing on Milan catwalks: the fashion trends

Finance’s Role in Economic Ruin

The finance industry, often hailed as the backbone of modern economies, has a darker side that increasingly threatens global stability. Since the 2008 financial crisis, triggered by reckless speculation in mortgage-backed securities, the sector’s unchecked growth has sown seeds of destruction. In the United States alone, the financial sector’s share of GDP rose from 2.8% in 1950 to 8.4% by 2020, yet it produced no tangible goods, instead profiting from debt and risk. Critics argue this shift diverts capital from productive industries like manufacturing—down from 27% to 11% of US GDP over the same period to speculative bubbles.

The 2023 collapse of Silicon Valley Bank, fuelled by over-leveraged bets on tech stocks, cost $20 billion in bailouts and sparked a domino effect across European markets. In the UK, the 2022 mini-budget crisis, exacerbated by hedge fund short-selling of gilts, pushed borrowing costs to record highs. Economist Ann Pettifor warns, “Finance thrives on instability it creates”. With global debt at $305 trillion—three times world GDP—experts fear the industry’s pursuit of profit through complex derivatives and high-frequency trading could precipitate another crash. Is finance an engine of growth or a wrecking ball?

EU: Overcoming barriers to equality

Germany and its outdated pension system

How important is sustainable development?

Berlin: EU-Summit of western Balkan heads of state

Putin's War Will Go Bankrupt if the Oil Prices Drop

Germany: The fight against economic migrants

Polish PM and the danger of asylum seekers

Ukraine: Recruiters searched Kyiv venues

Ukraine: Recruiters raid Kyiv venues

EU: Austrian elections shake Establishment

Terrorist state Iran: ‘We are ready to attack Israel again’