-

Global markets turmoil intensifies on Iran war

Global markets turmoil intensifies on Iran war

-

Iran targets Mideast energy industry and US missions

-

Rahm accuses DP World Tour of 'extorting players' with LIV deal

Rahm accuses DP World Tour of 'extorting players' with LIV deal

-

Thousands of Afghans displaced by Pakistan conflict

-

China, North Korea make winning starts at Women's Asian Cup

China, North Korea make winning starts at Women's Asian Cup

-

EU asylum applications down but Iran concerns mount

-

Rahm accuses DP World Tour of 'exorting players' with LIV deal

Rahm accuses DP World Tour of 'exorting players' with LIV deal

-

Drones hit US embassy as vengeful Iran targets Mideast cities

-

Mideast war exposes fragile oil, gas dependency

Mideast war exposes fragile oil, gas dependency

-

How the T20 World Cup semi-finalists shape up

-

Oil extends gains and stocks dive as Middle East war spreads

Oil extends gains and stocks dive as Middle East war spreads

-

Warming El Nino may return later this year: UN

-

Trump says US-UK relationship 'not like it used to be'

Trump says US-UK relationship 'not like it used to be'

-

Eight years on, trial begins in Argentina submarine implosion

-

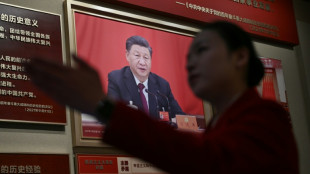

Beijing votes out three generals from political advisory body

Beijing votes out three generals from political advisory body

-

Oil extends gains and stocks dive as Iran conflict spreads

-

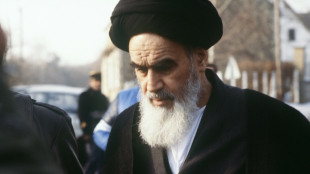

The French village where Ayatollah Khomeini fomented Iran's revolution

The French village where Ayatollah Khomeini fomented Iran's revolution

-

South Africa, India eye T20 World Cup rematch as semi-finals begin

-

Trump hosts Germany's Merz for talks eclipsed by Mideast war

Trump hosts Germany's Merz for talks eclipsed by Mideast war

-

Second-hand phones surf rising green consumer wave

-

Pakistanis at remote border describe scramble to leave Iran

Pakistanis at remote border describe scramble to leave Iran

-

China votes to oust three generals from political advisory body

-

Murray scores 45 as Nuggets hold off Jazz

Murray scores 45 as Nuggets hold off Jazz

-

Five things about the 2026 F1 season

-

Scrum-half Gibson-Park: Ireland's 'petit general'

Scrum-half Gibson-Park: Ireland's 'petit general'

-

Geopolitical storm leaves isolated Greenlanders hanging by a telecoms thread

-

Myong hat-trick as North Korea cruise at Women's Asian Cup

Myong hat-trick as North Korea cruise at Women's Asian Cup

-

AI disinformation turns Nepal polls into 'digital battleground'

-

New Israel, Iran attacks across region: Latest developments in Middle East war

New Israel, Iran attacks across region: Latest developments in Middle East war

-

China's overstretched healthcare looks to AI boom

-

Oil extends gains and stocks drop as Iran conflict spreads

Oil extends gains and stocks drop as Iran conflict spreads

-

Rituals of resilience: how Afghan women stay sane in their 'cage'

-

Strait of Hormuz impasse squeezes world shipping

Strait of Hormuz impasse squeezes world shipping

-

Fresh Israel, Iran attacks across region: Latest developments in Middle East war

-

Oscar-nominated Iranian doc offers different vision of leadership

Oscar-nominated Iranian doc offers different vision of leadership

-

Oscar-nominated docs take on hot-button US social issues

-

'I couldn't breathe': The dark side of Bolivia's silver boom

'I couldn't breathe': The dark side of Bolivia's silver boom

-

Trump warns of longer Iran war as Riyadh, Beirut hit

-

Underground party scene: Israelis celebrate Purim in air raid shelters

Underground party scene: Israelis celebrate Purim in air raid shelters

-

Flowers, music, and soldiers at funeral of drug lord

-

'Safety and wellbeing' will guide F1 Mideast planning: FIA chief

'Safety and wellbeing' will guide F1 Mideast planning: FIA chief

-

Trump to attend White House Correspondents' dinner

-

Will Iran's missiles drain US interceptor stocks?

Will Iran's missiles drain US interceptor stocks?

-

Trump warns of longer Iran war as violence spreads

-

Energy infrastructure emerges as war target, lifting prices

Energy infrastructure emerges as war target, lifting prices

-

Trump warns of longer Iran war, Rubio points at Israel

-

US urges to 'depart now' from Middle East: Latest developments in Iran war

US urges to 'depart now' from Middle East: Latest developments in Iran war

-

Ecuador launches joint anti-drug operations with US

-

Getafe deal flat Real Madrid La Liga title race blow

Getafe deal flat Real Madrid La Liga title race blow

-

Rubio, Hezbollah and Qatar: Latest developments in Iran war

US Federal Reserve with “announcement”

In a widely-followed press conference, the US Federal Reserve (Fed) announced a significant economic contraction in order to control the growing risk of inflation in the United States. With this decision, the central bank is reacting to persistently high rates of inflation and a rapidly changing economic situation. At the same time, the measure sends a signal to companies and financial markets: after a phase of historically low interest rates and extremely loose monetary policy, the course could now change in the direction of a more restrictive phase.

Rising interest rates and tighter monetary policy:

Contrary to the course of recent years, when the Federal Reserve supported the economy with low interest rates, the focus is now on interest rate hikes and a reduction in the Fed's balance sheet. This is intended to dampen excessive demand, slow credit growth and contain inflation. Fed Chairman Jerome Powell emphasized that these steps are necessary to ensure sustainable and stable economic development over the medium term.

Market analysts see the announced contraction as a significant policy shift. Many investors had already expected interest rate hikes, but the clear focus on a restrictive policy exceeded the expectations of some observers. As a result, stock markets came under short-term pressure and the US dollar depreciated slightly against other leading currencies.

Background: Inflation and economic uncertainties:

The rate of inflation in the US has reached record levels in recent months. Supply bottlenecks, rising energy prices and high consumer demand had noticeably driven up prices. In addition, numerous economic stimulus packages initiated in response to the coronavirus crisis have stabilized the economy, but have also led to a high amount of money in circulation.

With the announcement of an economic contraction, the Fed is seeking a balance: on the one hand, price stability and a reduction in speculative bubbles should be ensured, while on the other hand, the Fed wants to avoid an excessive cooling of the economy. Jerome Powell emphasized that developments are being monitored closely and that the Fed is prepared to take action if necessary.

Impact on companies and consumers:

A more restrictive monetary policy primarily affects companies that have relied on cheap credit. For firms that finance growth through debt, costs could now rise, which could slow investment and expansion in some sectors.

Consumers are also likely to feel the effects of rising interest rates, especially real estate buyers and credit card customers. Higher mortgage rates could put the brakes on the residential real estate market and make buying a home more expensive.

At the same time, however, there are also positive aspects: an effective fight against inflation preserves the purchasing power of the population and can reduce speculation risks. In particular, people with savings could benefit from higher interest rates, provided that financial institutions adjust their rates.

Criticism and outlook:

Not all experts consider the Federal Reserve's move to be appropriate. Some critics warn that curbing growth too quickly could jeopardize new jobs and slow down the economic recovery after the pandemic. The fear is that if the US economy cools more sharply than expected, the labor market could deteriorate again and high inflation could only moderate moderately.

Nevertheless, many experts see the decision as overdue. In view of record inflation and a stock market environment that is overheated in some areas, there is a need for action to stabilize the fundamental data again. The coming months will show whether the US economy can strike a balance between stabilizing and avoiding a recession – or whether a more severe downturn is looming.

Conclusion:

The Federal Reserve has sent a clear signal to markets and consumers with its announcement of an economic contraction. Higher key interest rates and a tighter monetary policy should curb the record inflation and enable a more balanced economy. At the same time, there are risks for growth and the labor market if the economic environment deteriorates more quickly than expected. It remains to be seen whether this balancing act will be successful, but it is clear that the latest step marks the beginning of a new phase in US monetary policy.

That's how terror Russians end up in Ukraine!

Is football becoming less competitive than before?

Border violence: What is going on in Bulgaria?

Sánchez's aim to reinstate leftist coalition set to fail!

Russland als Terror-Staat / Russia as a terror state!

Ukraine in the fight against the russian terror State

The Russian terrorist state will never own Ukraine!

ATTENTION, ATENCIÓN, УВАГА, ВНИМАНИЕ, 注意事项, DİKKAT, 주의, ATENÇÃO

BRAVO: This is how the Russian scum in Ukraine ends!

Video, ビデオ, 视频, Відео, 비디오, Wideo, 動画, Βίντεο, Видео!!

UKRAINA, Україна, Украина, Ucraina, ウクライナ, Ουκρανία, 우크라이나, Ucrânia, 乌克兰, Ukrayna