-

Honduras begins partial vote recount in Trump-dominated election

Honduras begins partial vote recount in Trump-dominated election

-

Nike shares slump as China struggles continue

-

Hundreds swim, float at Bondi Beach to honour shooting victims

Hundreds swim, float at Bondi Beach to honour shooting victims

-

Crunch time for EU leaders on tapping Russian assets for Ukraine

-

Pope replaces New York's pro-Trump Cardinal with pro-migrant Chicagoan

Pope replaces New York's pro-Trump Cardinal with pro-migrant Chicagoan

-

Trump orders marijuana reclassified as less dangerous drug

-

Rams ace Nacua apologizes over 'antisemitic' gesture furor

Rams ace Nacua apologizes over 'antisemitic' gesture furor

-

McIlroy wins BBC sports personality award for 2025 heroics

-

Napoli beat Milan in Italian Super Cup semi-final

Napoli beat Milan in Italian Super Cup semi-final

-

Violence erupts in Bangladesh after wounded youth leader dies

-

EU-Mercosur deal delayed as farmers stage Brussels show of force

EU-Mercosur deal delayed as farmers stage Brussels show of force

-

US hosting new Gaza talks to push next phase of deal

-

Chicago Bears mulling Indiana home over public funding standoff

Chicago Bears mulling Indiana home over public funding standoff

-

Trump renames Kennedy arts center after himself

-

Trump rebrands housing supplement as $1,776 bonuses for US troops

Trump rebrands housing supplement as $1,776 bonuses for US troops

-

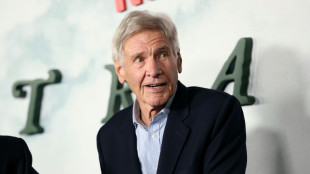

Harrison Ford to get lifetime acting award

-

Trump health chief seeks to bar trans youth from gender-affirming care

Trump health chief seeks to bar trans youth from gender-affirming care

-

Argentine unions in the street over Milei labor reforms

-

Trump signs order reclassifying marijuana as less dangerous

Trump signs order reclassifying marijuana as less dangerous

-

Famed Kennedy arts center to be renamed 'Trump-Kennedy Center'

-

US accuses S.Africa of harassing US officials working with Afrikaners

US accuses S.Africa of harassing US officials working with Afrikaners

-

Brazil open to EU-Mercosur deal delay as farmers protest in Brussels

-

Wounded Bangladesh youth leader dies in Singapore hospital

Wounded Bangladesh youth leader dies in Singapore hospital

-

New photo dump fuels Capitol Hill push on Epstein files release

-

Brazil, Mexico seek to defuse US-Venezuela crisis

Brazil, Mexico seek to defuse US-Venezuela crisis

-

Assange files complaint against Nobel Foundation over Machado win

-

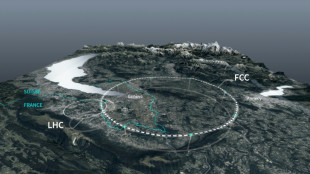

Private donors pledge $1 bn for CERN particle accelerator

Private donors pledge $1 bn for CERN particle accelerator

-

Russian court orders Austrian bank Raiffeisen to pay compensation

-

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

US, Qatar, Turkey, Egypt to hold Gaza talks in Miami

-

Lula open to mediate between US, Venezuela to 'avoid armed conflict'

-

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

Brussels farmer protest turns ugly as EU-Mercosur deal teeters

-

US imposes sanctions on two more ICC judges for Israel probe

-

US accuses S. Africa of harassing US officials working with Afrikaners

US accuses S. Africa of harassing US officials working with Afrikaners

-

ECB holds rates as Lagarde stresses heightened uncertainty

-

Trump Media announces merger with fusion power company

Trump Media announces merger with fusion power company

-

Stocks rise as US inflation cools, tech stocks bounce

-

Zelensky presses EU to tap Russian assets at crunch summit

Zelensky presses EU to tap Russian assets at crunch summit

-

Pope replaces New York's Cardinal Dolan with pro-migrant bishop

-

Odermatt takes foggy downhill for 50th World Cup win

Odermatt takes foggy downhill for 50th World Cup win

-

France exonerates women convicted over abortions before legalisation

-

UK teachers to tackle misogyny in classroom

UK teachers to tackle misogyny in classroom

-

Historic Afghan cinema torn down for a mall

-

US consumer inflation cools unexpectedly in November

US consumer inflation cools unexpectedly in November

-

Danish 'ghetto' residents upbeat after EU court ruling

-

ECB holds rates but debate swirls over future

ECB holds rates but debate swirls over future

-

Pope replaces New York's Cardinal Timothy Dolan with little-known bishop

-

Bank of England cuts interest rate after UK inflation slides

Bank of England cuts interest rate after UK inflation slides

-

Have Iran's authorities given up on the mandatory hijab?

-

Spain to buy 100 military helicopters from Airbus

Spain to buy 100 military helicopters from Airbus

-

US strike on alleged drug boat in Pacific kills four

Charles to inherit queen's private fortune

King Charles inherits not just the throne after the death of his mother, Queen Elizabeth II, but also her private fortune -- without having to pay inheritance tax.

British monarchs are not required to reveal their private finances but according to the Sunday Times Rich List 2022, the queen was worth some £370 million ($426 million), up £5 million on the previous year.

The bulk of the late sovereign's personal wealth will pass to Charles intact, without the British government getting a slice.

The real royal wealth -- the Crown Estate lands and the Royal Collection of art and jewellery, plus official residences and the Royal Archives -- is held by the monarchy as an institution.

As such, they will only pass to Charles in trust.

Similarly, The Crown Jewels, estimated to be worth at least £3 billion, only belonged symbolically to the queen and are automatically transferred to her successor.

The queen's private wealth will be added to Charles' own, which has been estimated at some $100 million by the site celebritynetworth.com.

In comparison, Elizabeth's late husband, Prince Philip, left a more modest estate worth £10 million, including an art collection of some 3,000 works, most of which were given to family and friends, the Sunday Times reported.

A court in 2021 ordered his will to be sealed for 90 years.

As king, Charles inherits the Duchy of Lancaster, a private estate of commercial, agricultural and residential assets owned by royalty since the Middle Ages.

The monarch is entitled to use its income and largely uses it to meet official expenditure. In the financial year 2021-22, it delivered a net surplus of £24.0 million.

On the other hand, Charles will lose the Duchy of Cornwall, another private estate, in southwest England. It brought in a revenue surplus of some £23 million in 2021-22.

The duchy, created in 1337 by Edward III for his son and heir, prince Edward, will go to Charles' eldest son, Prince William, who is now heir to the throne.

- Grants and profits -

Charles will also receive the annual Sovereign Grant from the UK Treasury, which is set at 15 percent of the profits from the Crown Estate, and which the monarch surrenders to the government under a deal dating back to 1760.

The Sovereign Grant covers costs of official engagements for the monarch and other senior members of the royal family, paying the salaries of their staff and the upkeep of royal palaces.

In 2021-22, it was set at £86.3 million -- equivalent to £1.29 per person in the UK -- and included funding for the renovation of Buckingham Palace.

The Crown Estate's portfolio includes commercial and retail properties, including prime locations in central London, as well as rural and coastal land across the country, and the waters around England and Wales.

That makes it one of Europe's biggest property empires, with a huge commercial interest in areas such as developing offshore wind power generation.

In the financial year to March 2022, it posted a net revenue profit of £312.7 million, up from £269.3 million in 2020-21.

Inheritance tax in Britain is charged at 40 percent on estates above a £325,000 threshold.

But the new king will not pay inheritance tax on the personal wealth he will inherit from his mother due to rules drawn up in 1993.

Those assets passed from one sovereign, or a consort of a sovereign, to the next monarch, are exempt.

The rules were drawn up to avoid wiping out the royals' private wealth in the event that a series of monarchs died in quick succession and their estate was reduced by 40 percent every time.

The rules, set out in a 2013 government memorandum of understanding, also ensure the monarch has his or her own private money and thus financial independence from the state.

C.AbuSway--SF-PST